Will Inflation Surprises Upset The Apple Cart?

Breadth is fine, but excessive optimism and unmet expectations threaten to trip up the market

Portfolio Applications Subscribers: Click here to review the latest updates to our Blue Heron Systematic Portfolios or review the latest asset allocation summary at the bottom of this report.

Now on to inflation, sentiment and expectations for rate cuts. . .

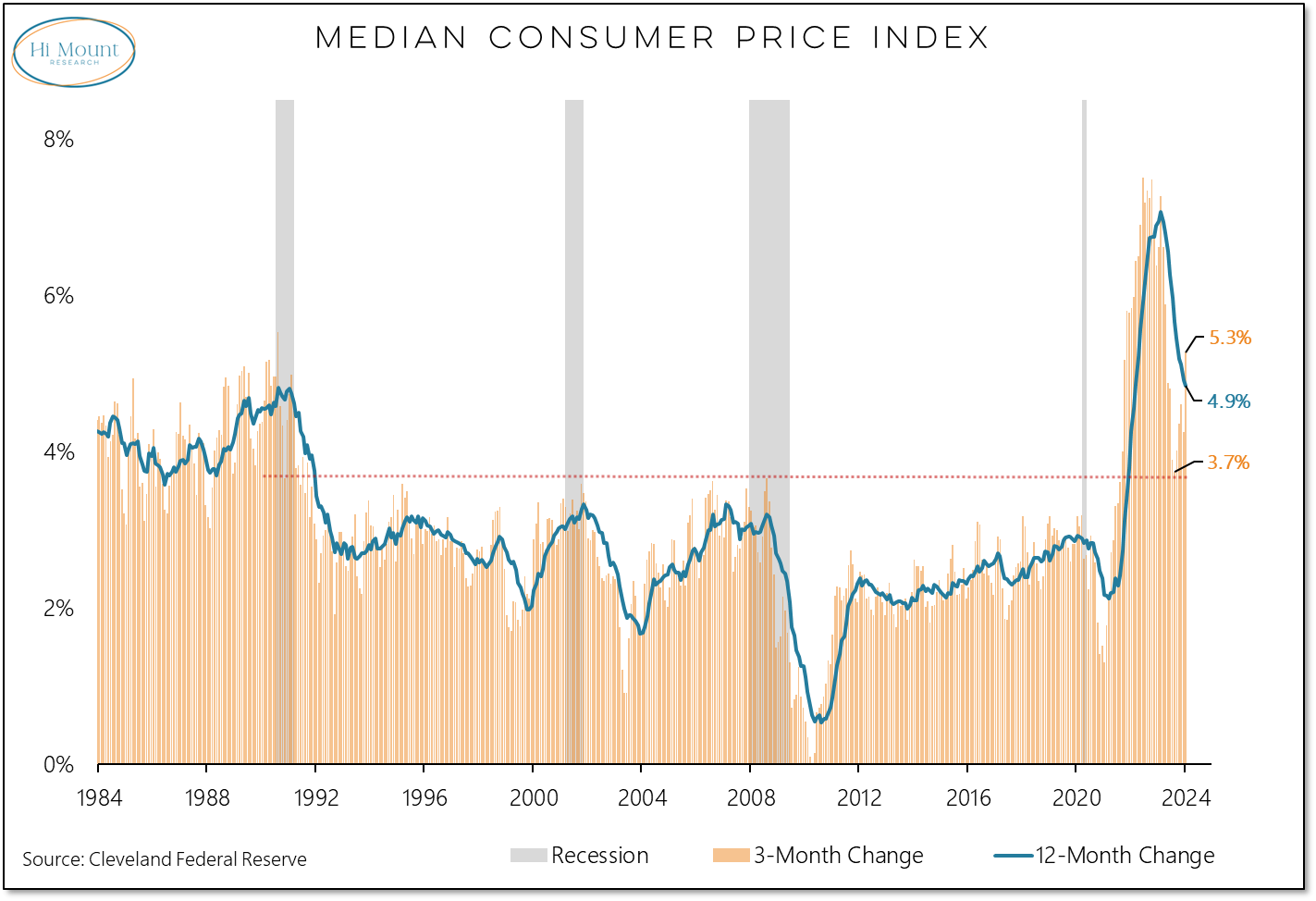

What: Yesterday’s hotter than expected inflation report produced a broad wave of selling yesterday. Downside volume exceed upside volume by more than 9:1 as the latest inflation data showed the 3-month change in the median CPI rising above the 12-month change for the first time in nearly a year. Dis-inflation appears to have been transitory.

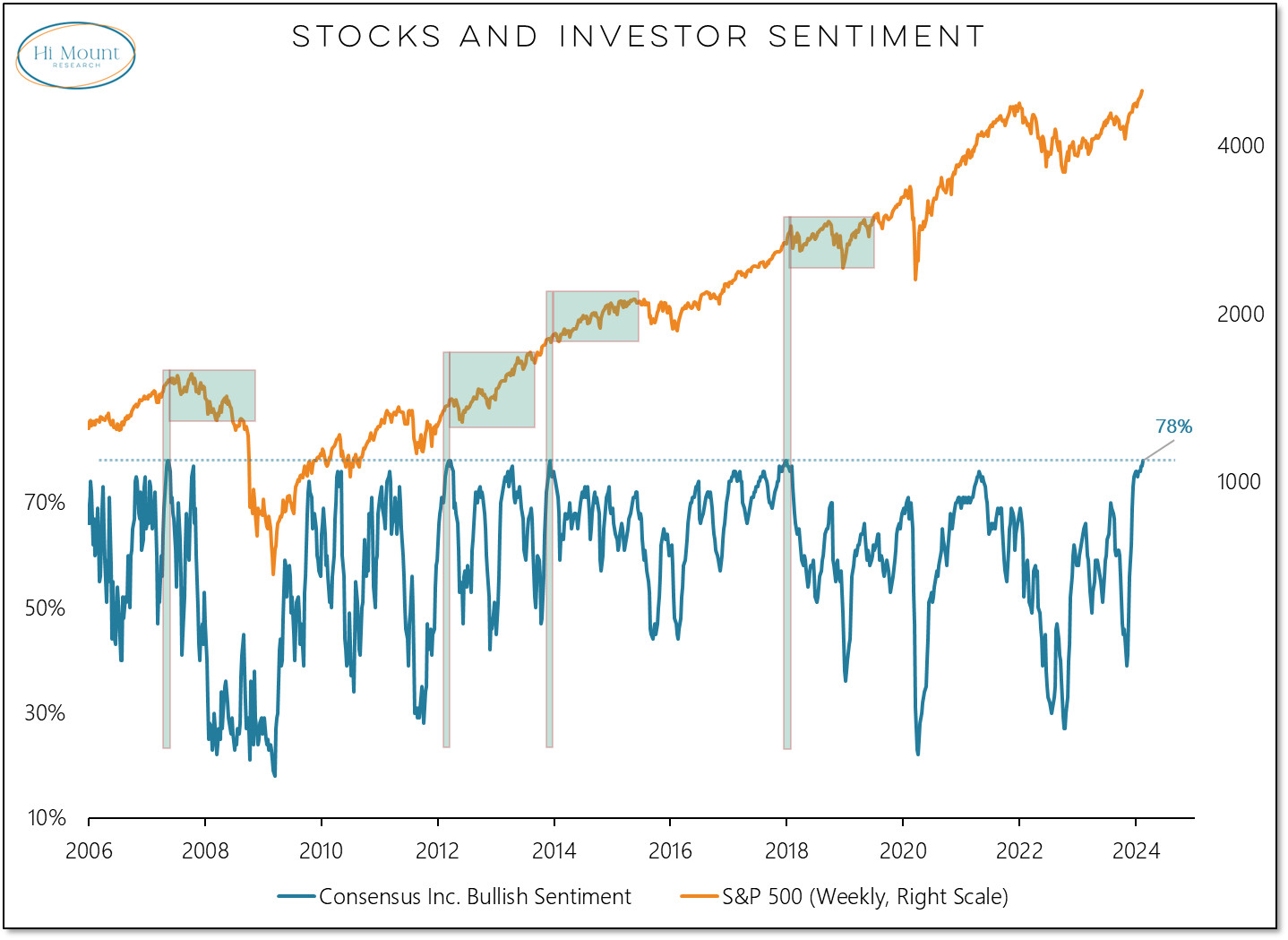

So What: The market’s reaction to the inflation data was a reflection of the excessive optimism that has been building for sometime. Consensus Bulls now match their highest level in 20 years and across the board optimism ranges between elevated and extreme. Even with price trends strong and rally participation robust, one-sided sentiment leaves the market vulnerable to disappointment (Market Insights subscribers can click here to read our latest Sentiment Report and/or review the Sentiment Summary at the bottom of this report). Bull markets have plenty of bad days, but in bear markets those bad days stretch into bad weeks and bad months.

Now What: The resiliency of the stock market’s rally as the bond market began to anticipate rate cuts will now be tested. Already, the yield on the 2-year T-Note has already given back nearly half of its decline associated with expectations of a Fed pivot this year. If equities are going to continue to rally, they may have to do so without help from bonds.

Our latest Sentiment Summary table and Systematic Asset Allocation updates are below the break:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.