Bull Market Behavior Persists

New highs exceeding new lows creates a favorable risk/reward environment and other takeaways from the week

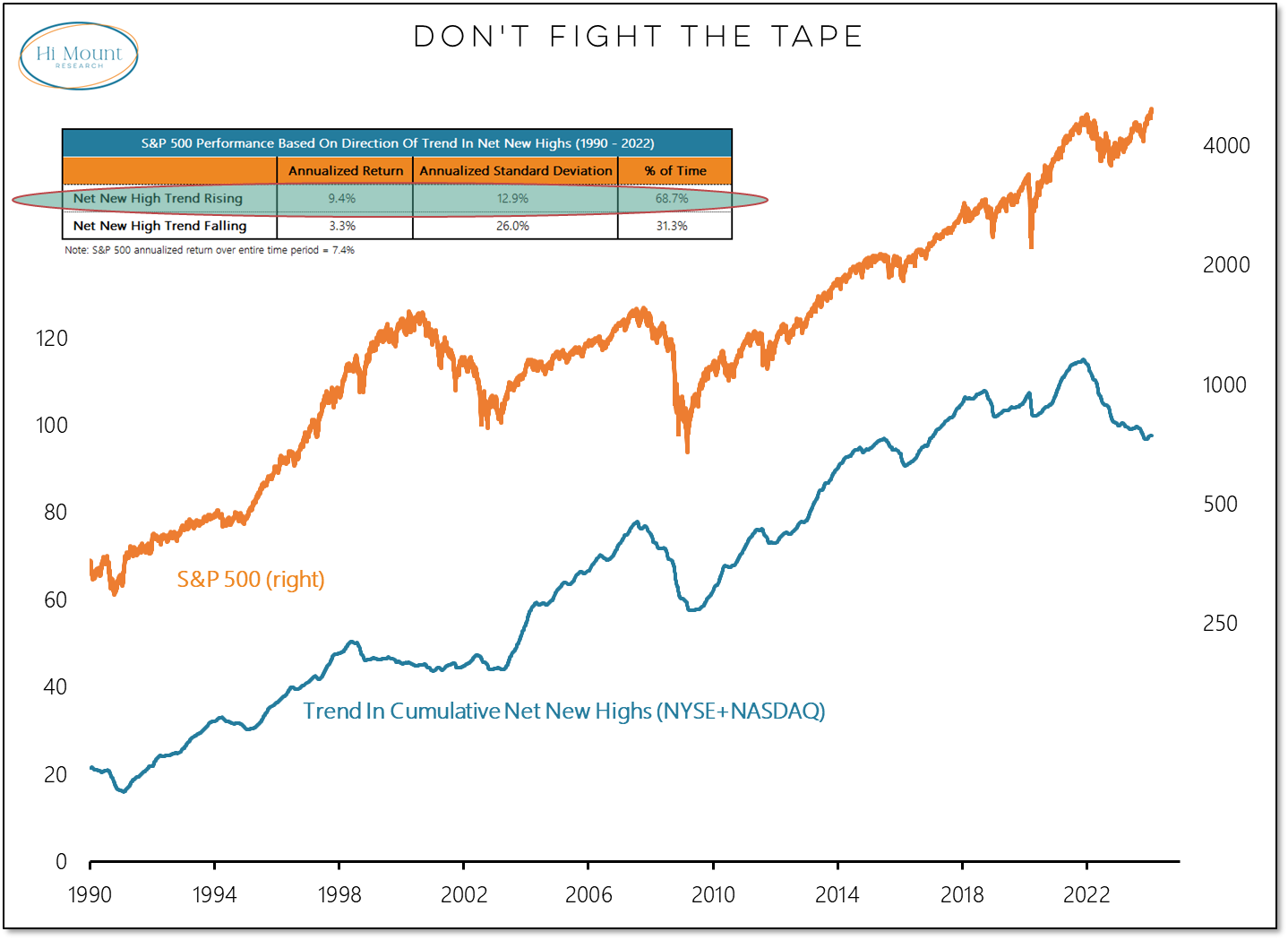

Key Takeaway: The new highs list has expanded every day so far this week and, more importantly, the trend in net new highs (new highs less new lows) has continued to rise.

That tilts the odds in favor of further strength (when the net ew high trend is rising, we see 3x the annualized returns and only ½ the volatility versus when the net new high trend is falling).

Rather than being overly concerned about breadth weakening, our work indicates that bull market behavior is persisting. In such an environment it makes sense to see the Dow Transports (and the Transportation ETF) breaking through resistance and RSP (the equal-weight S&P 500 ETF) moving to a new all-time high.

While the week is not in the books just year, we are on the cusp of five consecutive weekly gains of 1% or more for the S&P 500. This has only happened 11 times in the past three-quarters of a century (most recently in late-2016 and mid-2009).

I had a chance to chat about this and more when I checked in with Oliver Renick on the Schwab Network earlier this week. Oliver is one of the best in the business and I always enjoy our conversations Give it a listen and let me know what you think.

You can also download the chart pack I shared Oliver before we went on air.

If you are a Hi Mount Research subscriber, be sure to check out the February update to the Weight of the Evidence. Price trends and market breadth are strong, but there are risks to consider.

If you are not yet a subscriber, click here to learn more about our services and how we can help you help your clients.