Weighing Risks & Opportunities As We Head Toward 2026

Leadership trends from 2025 are carrying into the New Year

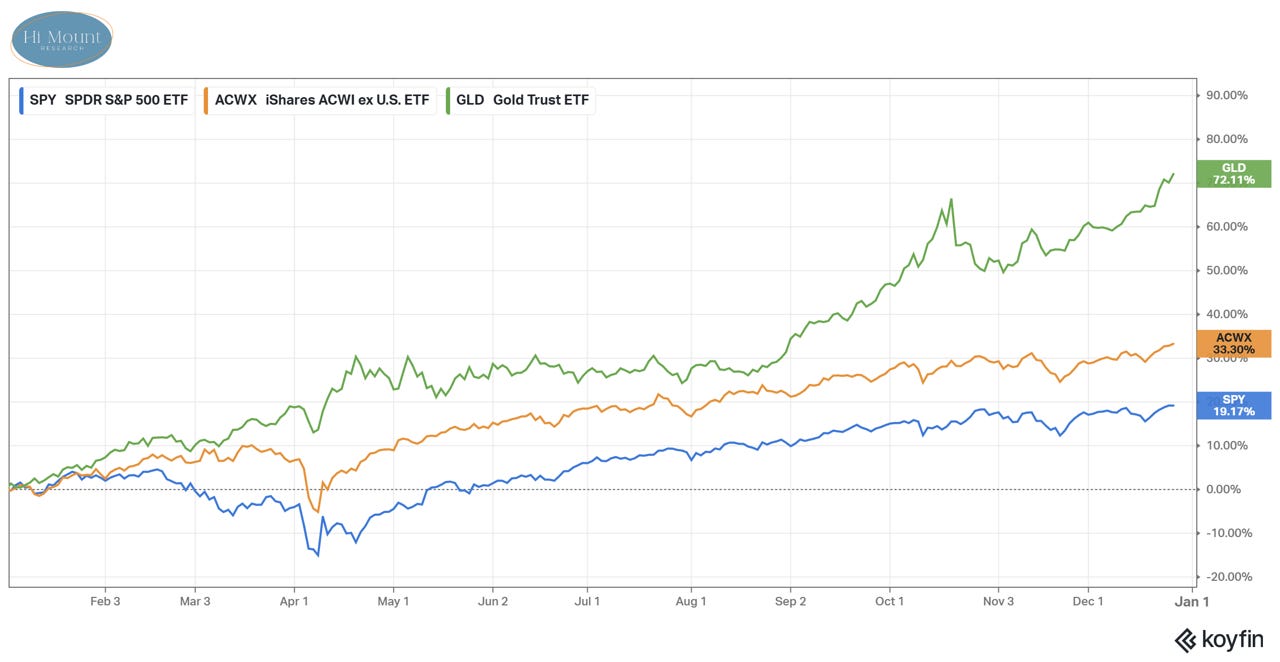

With a little help from Santa, the S&P 500 could finish 2025 with a 20% gain. While that is certainly not disappointing on an absolute basis, it does represent significant underperformance relative to stocks around the world and other asset classes. The opportunity cost for investors with over-exposure to the US is the 33% gain from non-US equities and the 72% gain from gold in 2025.

The US has been in the bottom of the global equity relative strength rankings we publish on a weekly basis for most of the year (you can access the latest report here). US stocks are experiencing their longest period of cyclical trend weakness versus the rest of the world in a decade and a half. Gold is in its longest sustained period of strength versus US stocks since prior to the Great Financial Crisis. Data-driven investors were able to capitalize on the shifts in these trends and the data suggests these trends have not yet run their course.

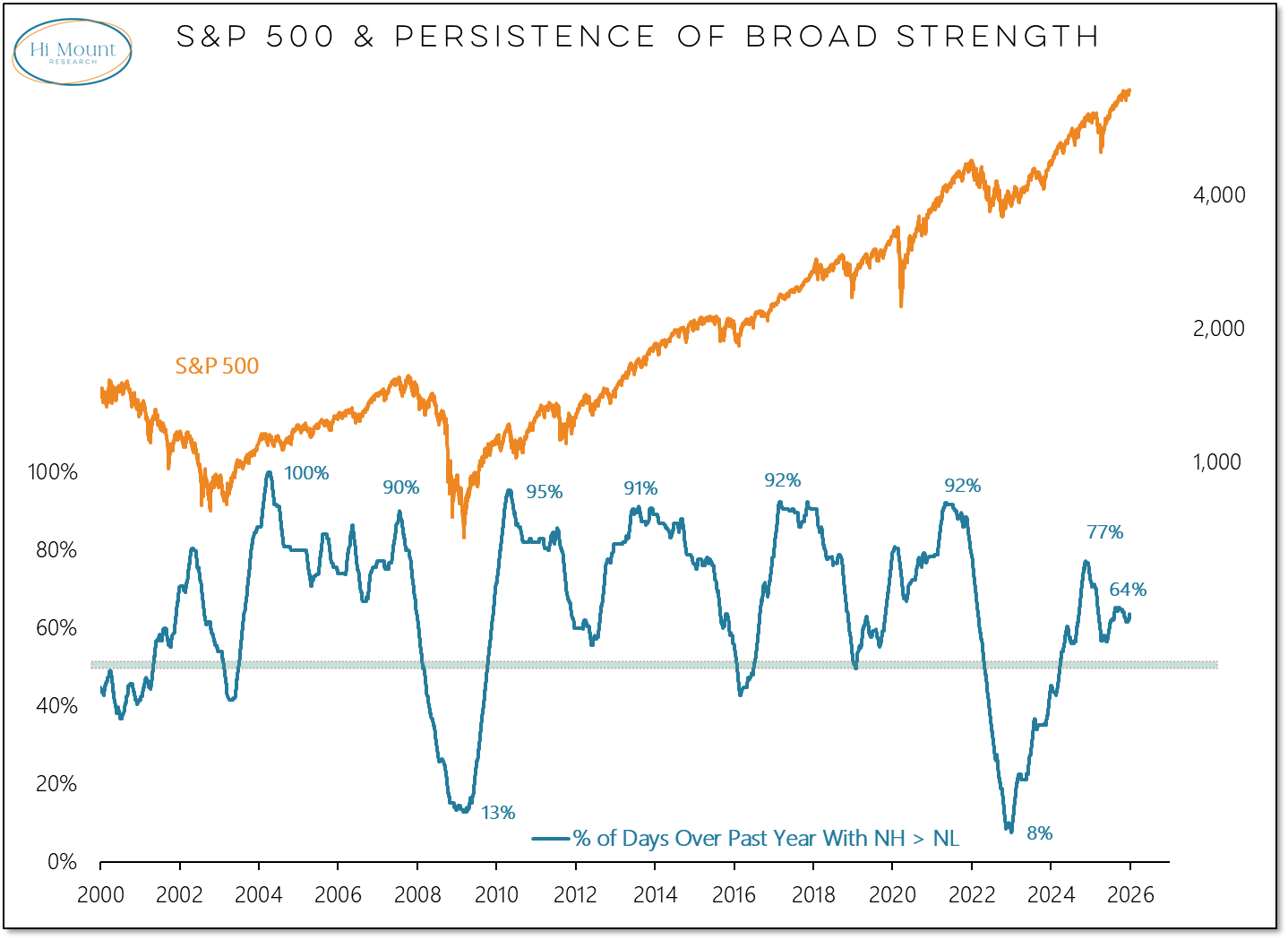

Only a handful of stocks in the US joined the S&P 500 in making a new high last week. That is the opposite of what we saw earlier in the month and without better domestic participation, it may be difficult for the S&P 500 to continue to climb higher. The inconsistency of more stocks making new highs than new lows has been a recurring theme in 2025. The strongest markets of the past have come with new highs exceeding new lows on 90%+ of all trading days. In 2025, new highs have exceeded new lows on fewer than 2/3 of the trading days.

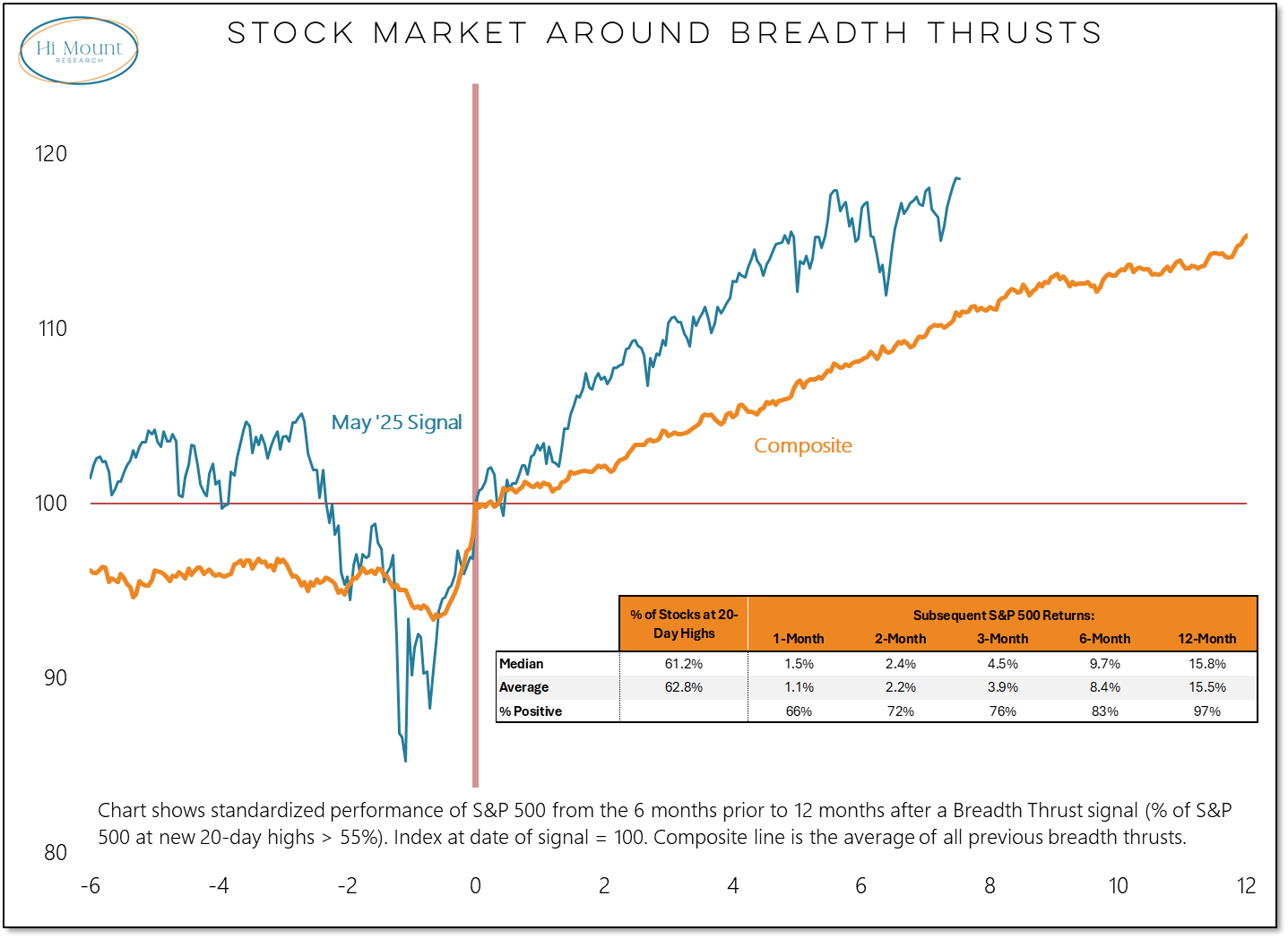

The breadth thrust that emerged off of the Tariff-related lows earlier this year have helped buoy US stocks even with the uneven participation beneath the surface, but unless it is renewed, that tailwind is set to expire in May.

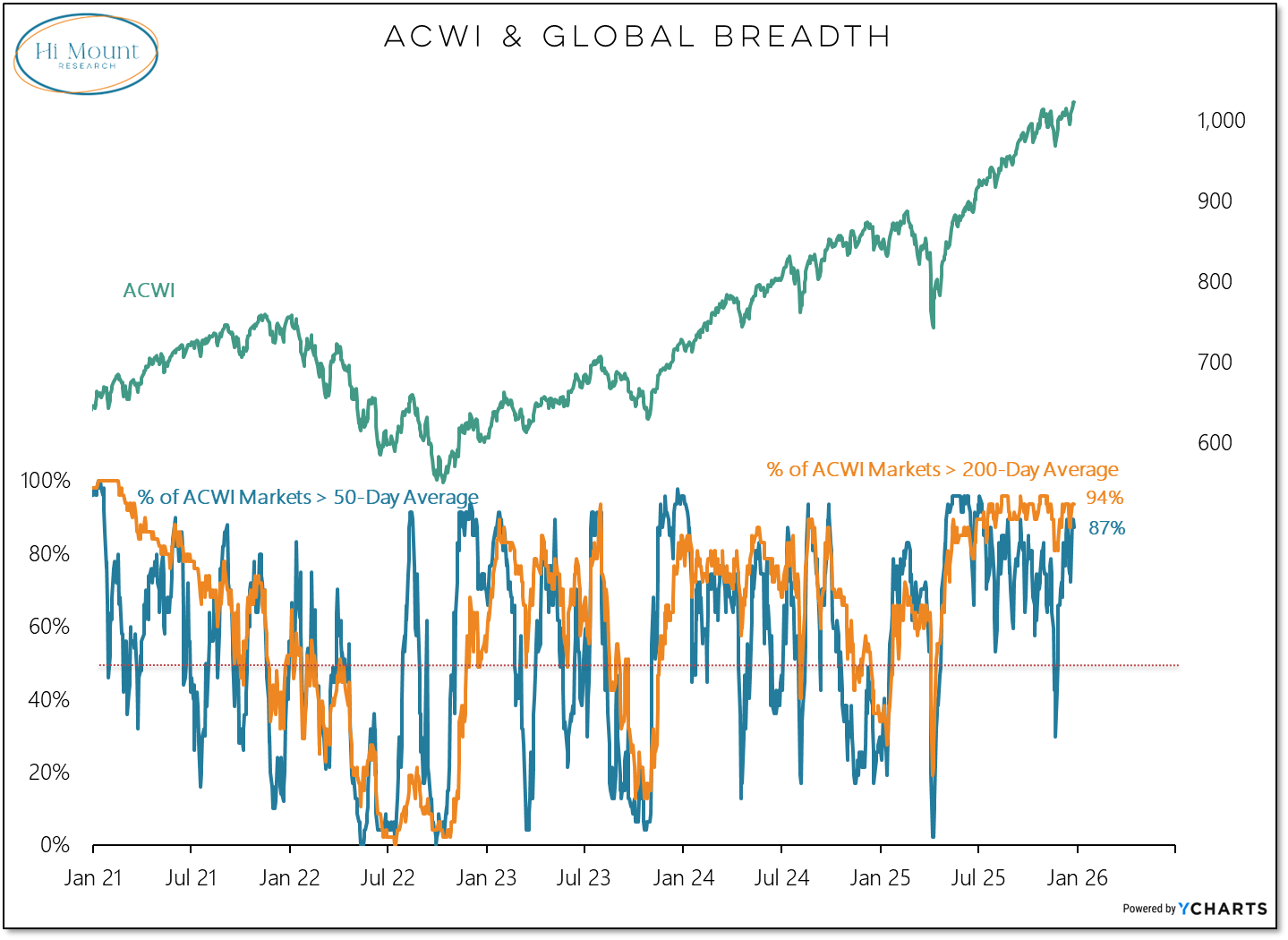

While domestic breadth has been uneven, global breadth strength has been resilient. The percentage of global markets above their 50-day average is in the 80’s and the percentage of markets above their 200-day average is in the 90’s.

Our global market trend indicator broke out to a new high last week and is at a level not seen since 2021. Global trends are strong and getting stronger.

The overall weight of the evidence in the US remains balanced between risk and opportunity.

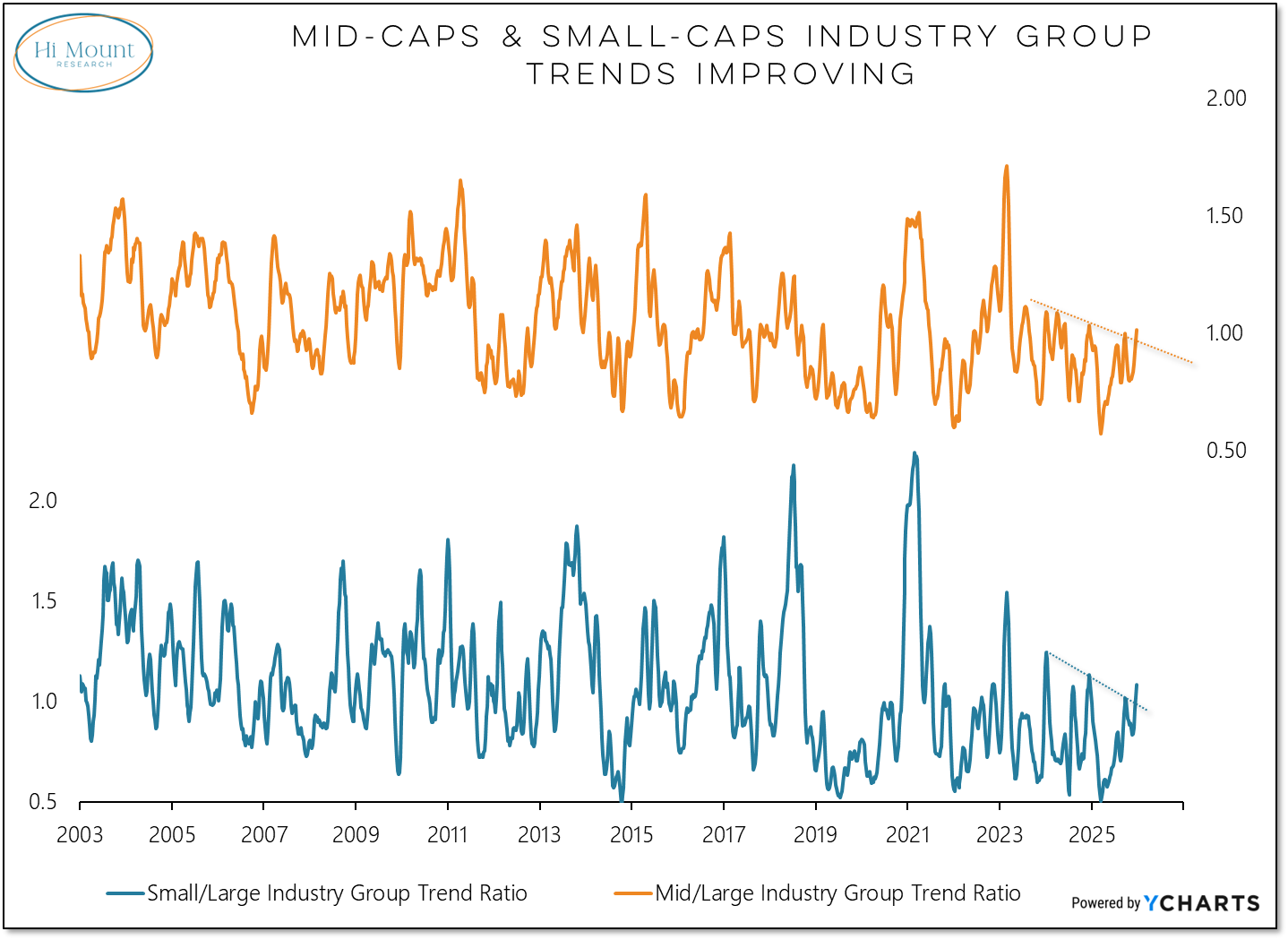

The trends we highlighted above argue for shifting exposure away from US stocks and toward Gold and the rest of the world. Within the US, Financials and Industrials are areas of strength and leadership. Finally, industry group trends suggest that small-caps and mid-caps have an opportunity to seize the leadership mantle from large-caps as we move into yet another New Year.

God’s Blessings to you and yours as you embrace whatever opportunities the New Year brings. Thanks for reading. -Willie