Weekly Market Notes: Room To Pause, Not Pivot

The Fed is unlikely to become market-friendly anytime soon, but that hasn't prevented equity market trends outside of the US from turning higher.

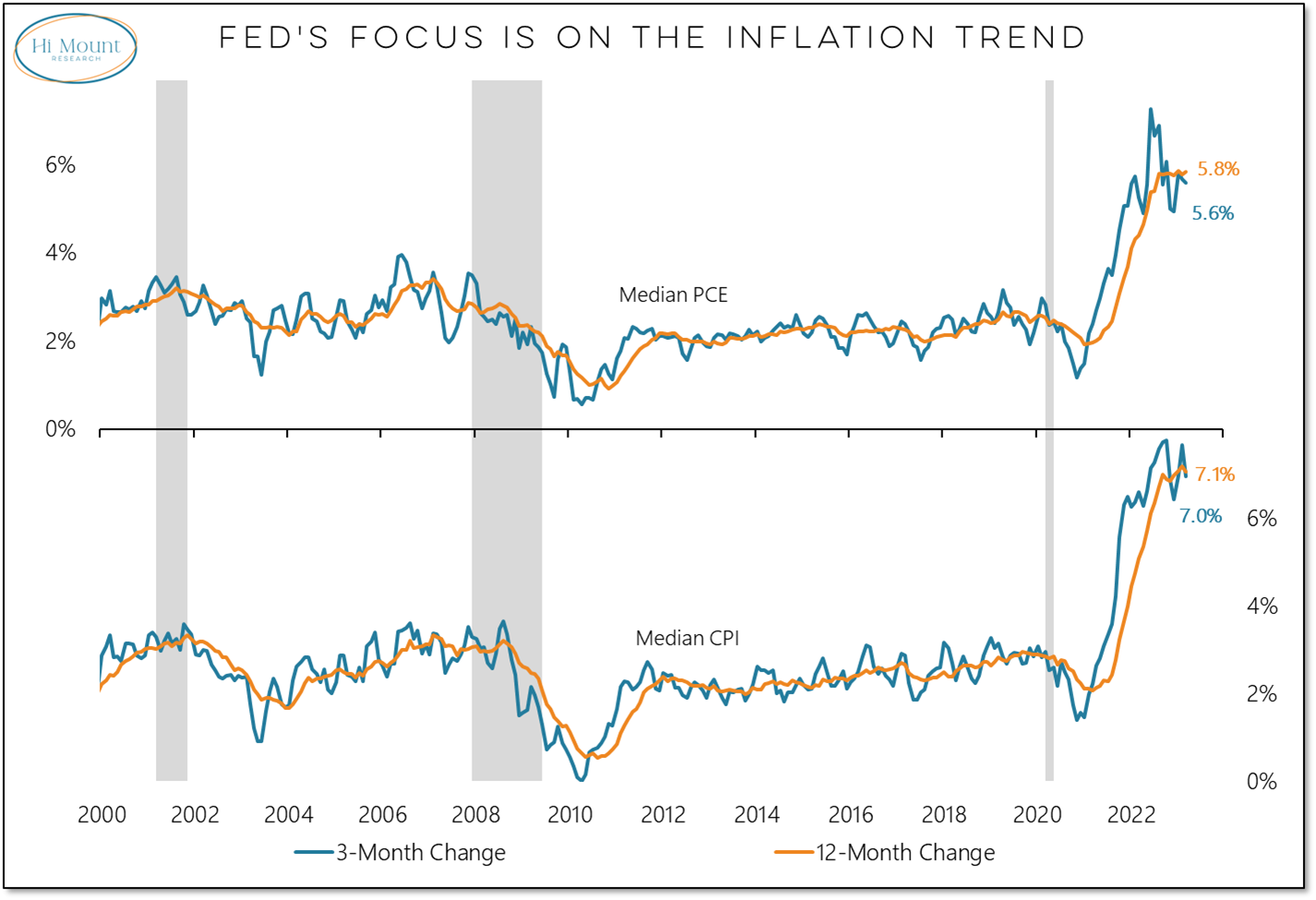

With financial stress fading, earnings data remaining resilient and the economy still surprising to the upside, the Fed’s focus can remain squarely on fighting inflation. Measures of median inflation remove noise outliers and show that while inflation may have stopped rising, there is little evidence that it is pulling back to the Fed’s desired level (around 2% for PCE, closer to 3% for CPI).

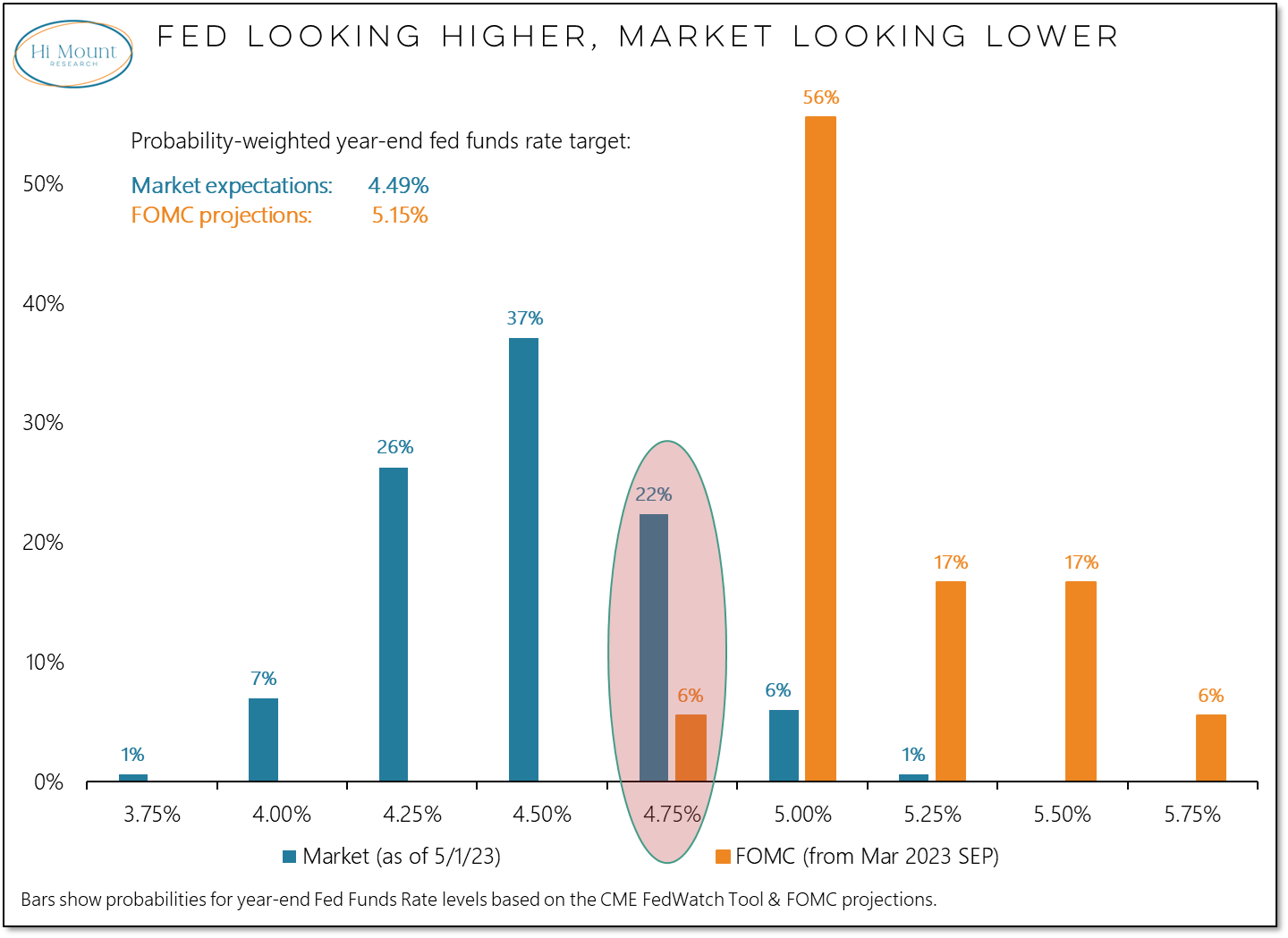

More Context: The Fed is expected to raise rates by 25 basis points this week – and that would take the Fed Funds rate to the level where a majority of FOMC participants think it will finish the year. For a Fed that is doing its best to provide as much clarity as possible about future policy actions, getting to the established year-end target is probably reason enough to signal a willing to pause the tightening cycle. The challenge for the Fed is that while it may pause, the market is pricing in a pivot. If the Fed is to keep its inflation-fighting credentials intact, Powell’s primary job on Wednesday will be to push back against an H2 2023 pivot.

Only one of the 18 YE2023 dots on the Fed’s March dot plot was below 5% but the market is currently pricing in a year-end fed funds rate of just below 4.5%. Signaling to the market that a pause does not mean a pivot may be a challenge for the Fed. As a reminder, all the net gains for stocks over the past 30 years have come after a majority of global central banks have started cutting rates.

Central bank policy notwithstanding, we are seeing more evidence of bull market behavior, especially when we consider stocks from a global perspective.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.