Money supply has fallen at a 10% annualized rate over the past three months, but that didn’t prevent core inflation from re-accelerating in Q1. Despite aggressive tightening by the Fed over the past year, its preferred inflation measure (PCE ex Food & Energy Price Index) not only remains elevated, it has actually turned higher.

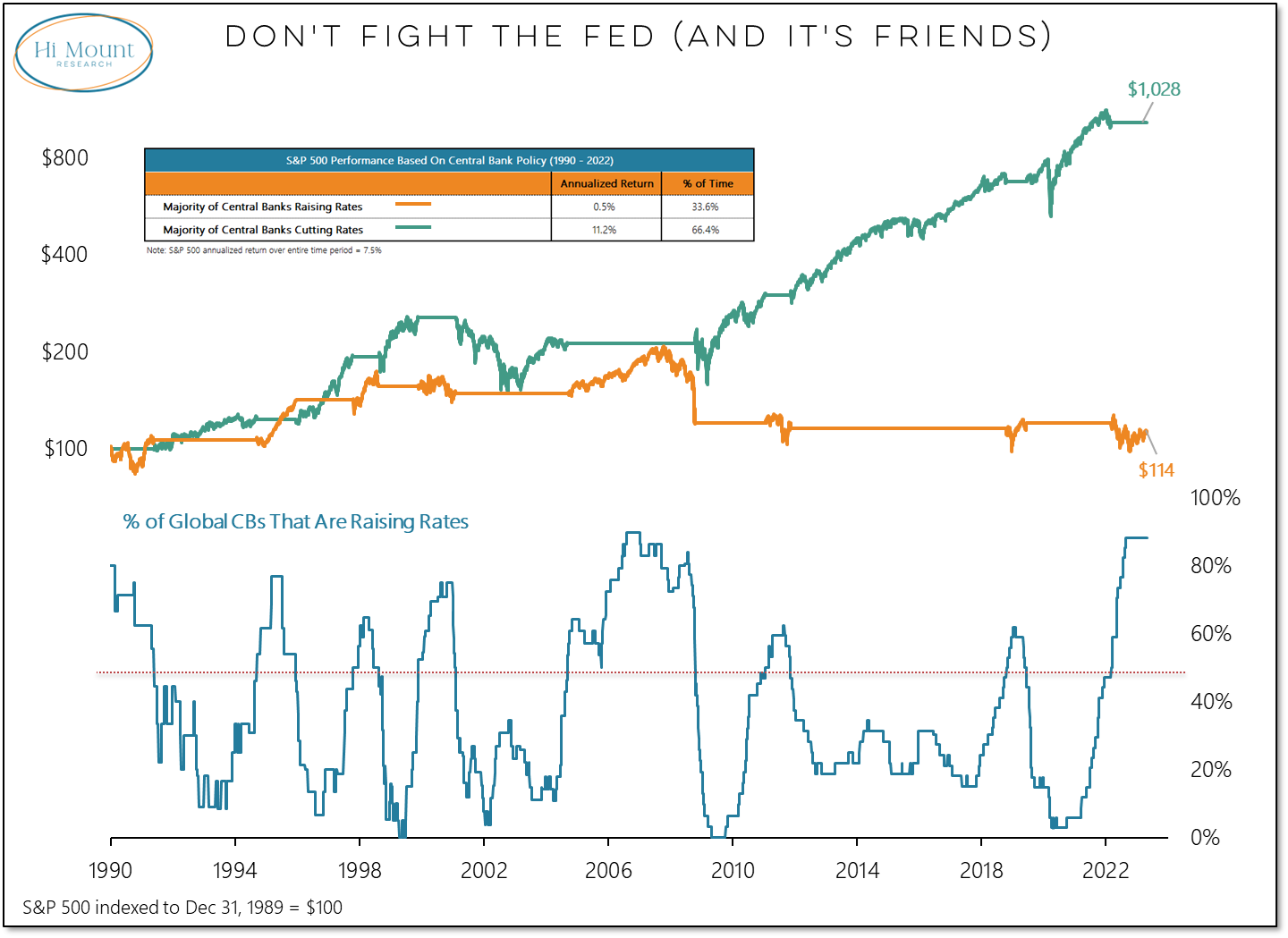

Key Takeaway: The Fed’s goal is to bring core inflation back toward its 2% target. Right now it is still near 5% and has turned higher. A lack of financial stress leaves the Fed with room to keep rates higher for longer than the market is currently expecting. The market has priced in a pivot, the best it can hope for at this point appears to be a pause. History doesn’t reward those who fight the Fed.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.