Turning Points Are Pivotal. . .

. . .but it is the underlying trend that is often more important

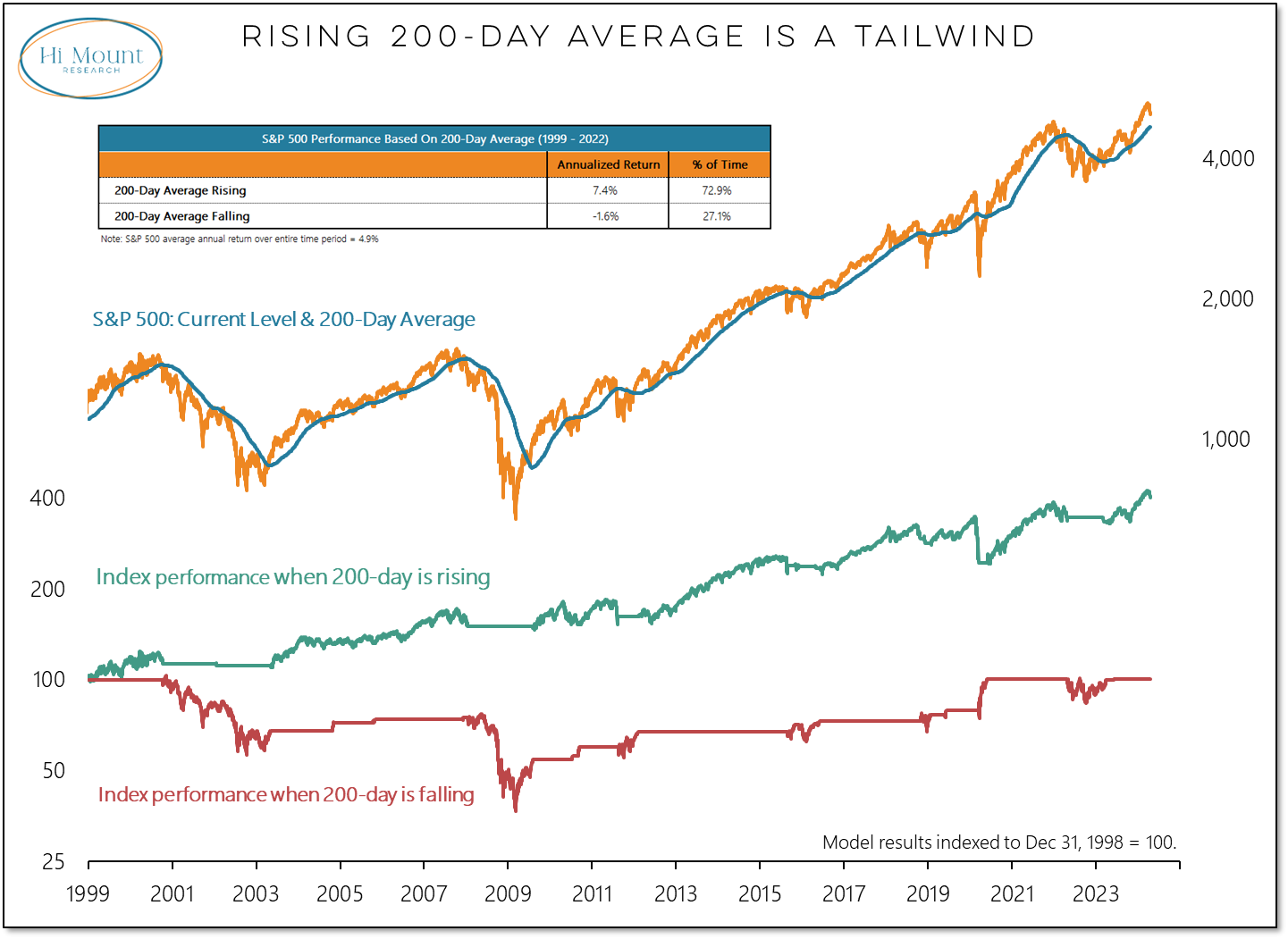

Key Takeaway: Peaks and troughs garner plenty of attention and we anchor off of turning points. Most investors aren’t able to consistently get out at the exact top or get in at the exact low. We can, however, keep our portfolios in harmony with the underlying trend environment.

The S&P 500 begins this week more than 5% below its March high but still more than 20% above last October’s low. The risk environment continues to deteriorate but is still positive. The 200-day average continues to rise and gives the benefit of the doubt to the cyclical strength that has been observed over the past two quarters. Trend following systems don’t catch the turn, but they tell you when to move.

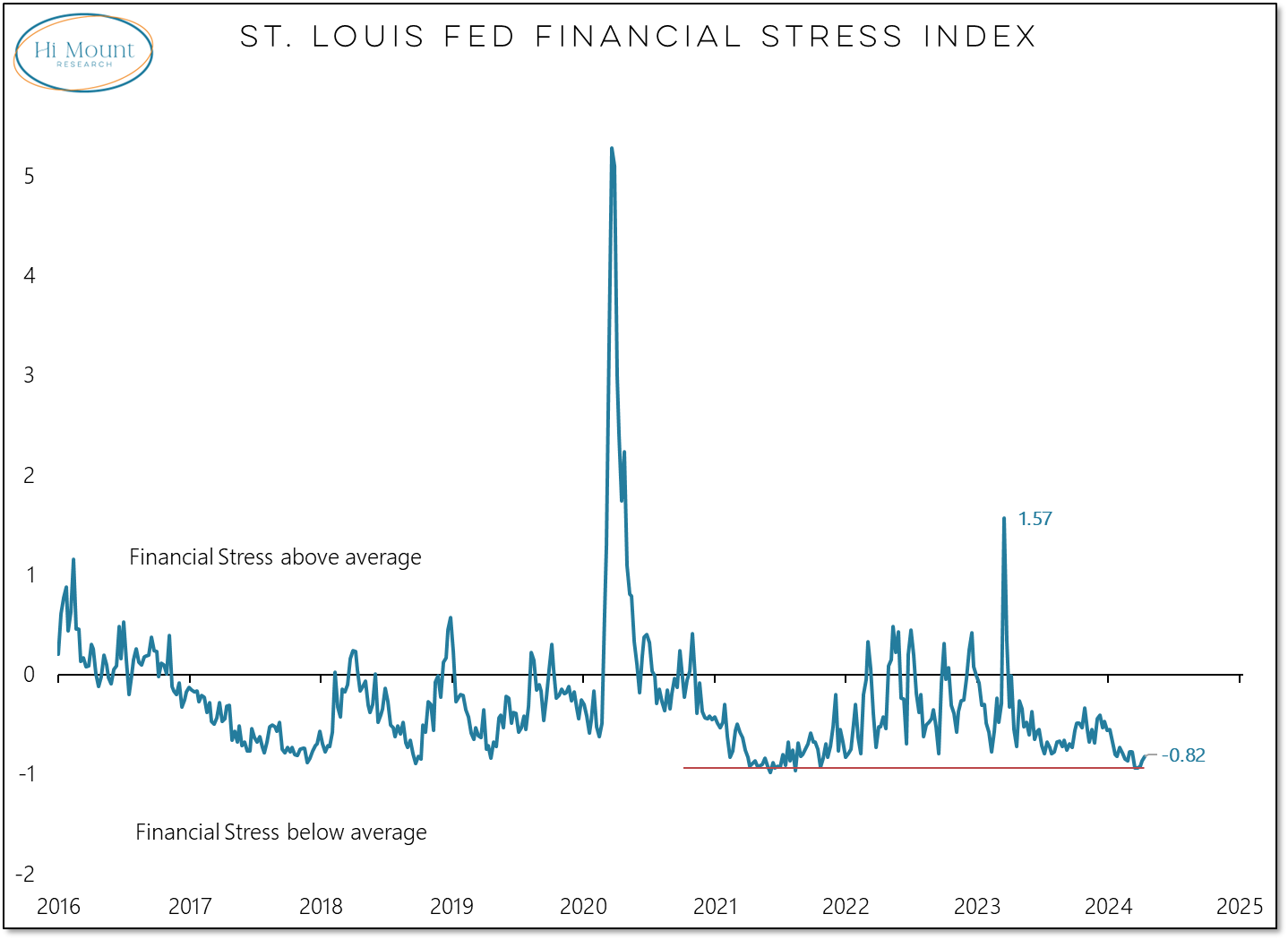

Even as bond yields have risen in recent weeks, indicators of financial stress continue to offer benign readings. Risks likely increase if (when) we again see the 10-year T-Note yield more than 5%.

Market behavior over the past few weeks has changed. We’ve seen new lows outnumber new highs 8 days in a row.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.