Risk Environment Gets Rattled

Deteriorating tactical conditions may not be a death knell to the cyclical rally.

Portfolio Applications Subscriber note: Our Fear or Strength Model has turned negative so we have reduced equity exposure in our Tactical Opportunity Portfolio.

Reach out with your questions if you would like more information about our ETF portfolios or the Portfolio Applications subscription package.

Key Takeaway: Risk-On appetites are waning but our Bull Market Behavior Checklist suggests the there may be life yet in the cyclical move off of last year’s lows.

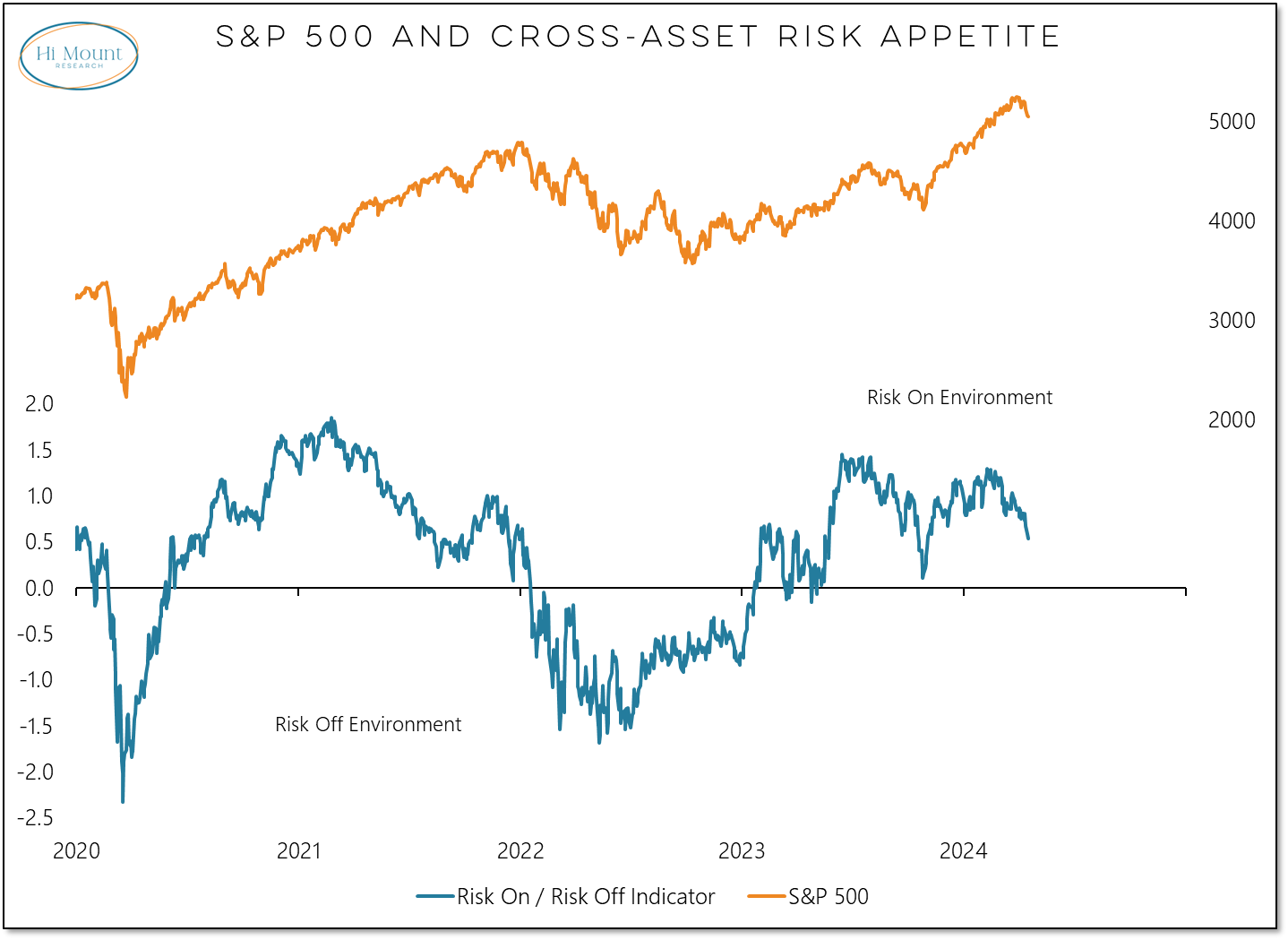

Our cross-asset risk appetite indicator has fallen to its lowest level of the year, but remains in positive territory.

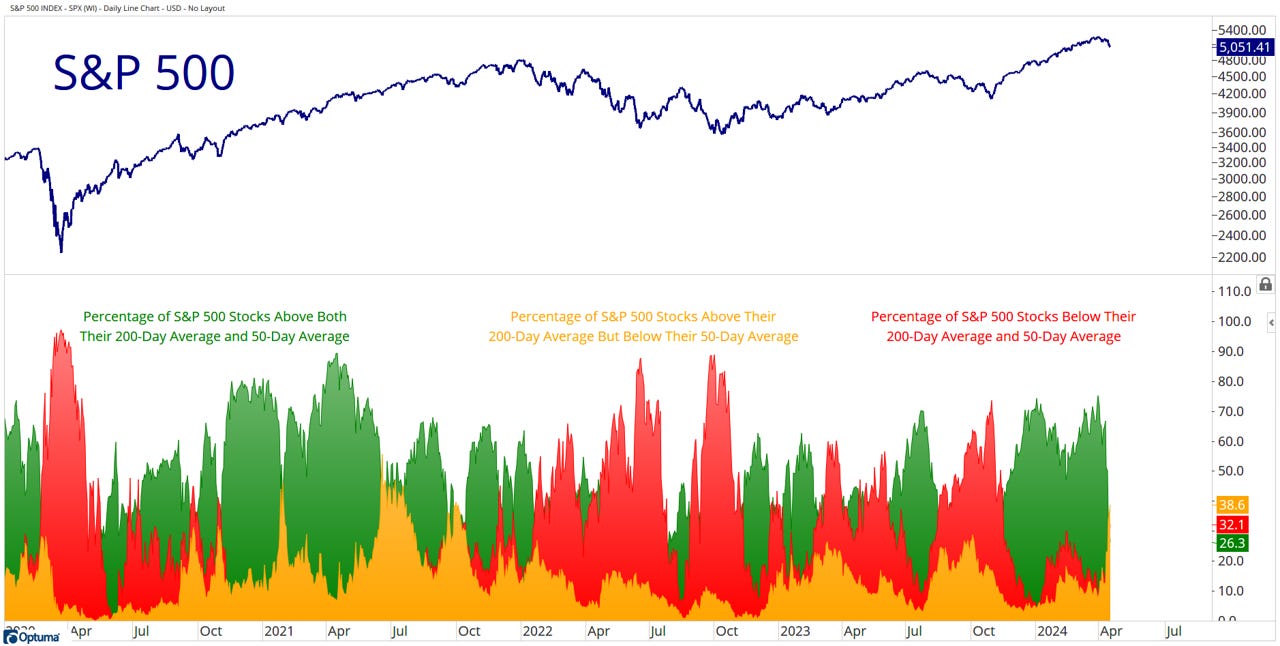

Short-term breadth trends have turned negative as new highs have collapsed and new lows have expanded. Relative to when the trends are positive, this breadth environment is typically sees one-third of the gains and more than twice the volatility.

From a longer-term trend perspective, we have lost the green light but the red light is not yet flashing (h/t to

for this great visual):While conditions have gotten noisier and sloppier, we don’t have evidence that the cyclical backdrop has meaningfully deteriorated. Further weakness from our Bull Market Behavior checklist (which dropped to 5 out of 6 last week and appears poised for a 3 out 6 reading this week) could adjust that thinking:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.