Trends Are Rising But Participation Is Lacking

Quiet calm is not evidence of robust strength

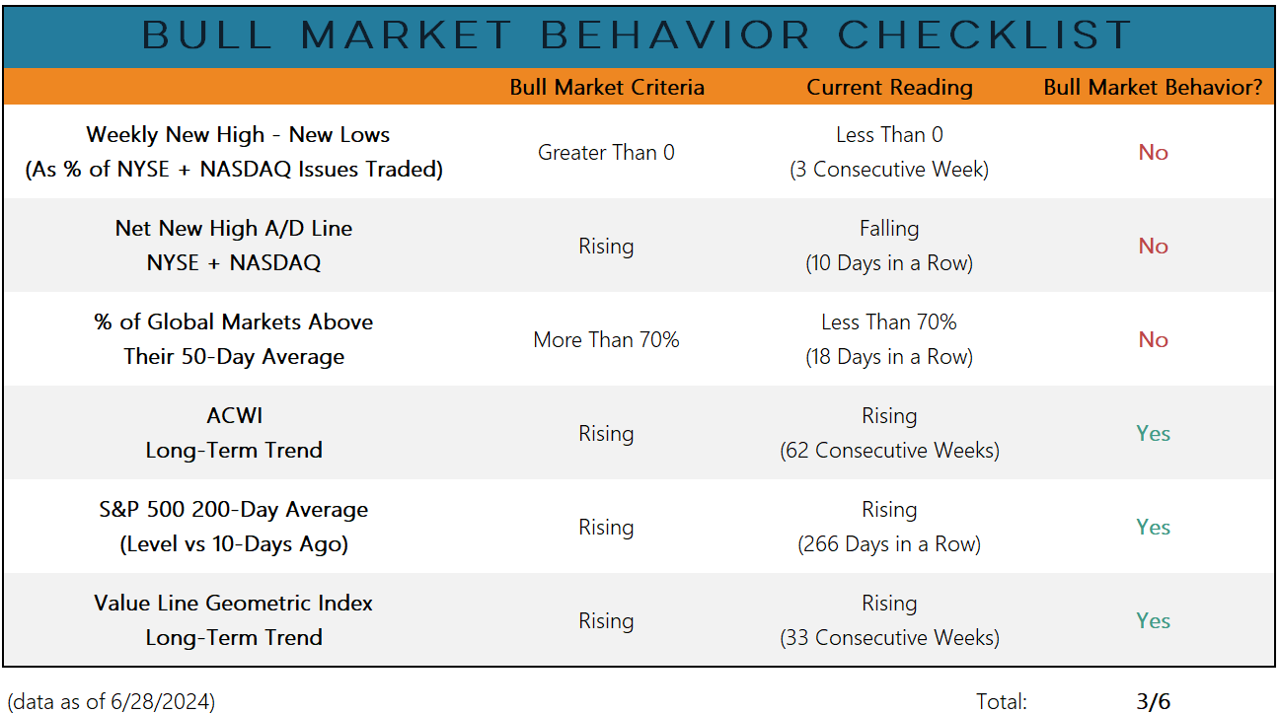

Large-cap growth is leading the market the higher. That is producing index-level strength and robust uptrends but historically narrow participation. The dichotomy between price action and breadth support is on display in our Bull Market Behavior Checklist.

This divergence has been building for a while. The S&P 500 is up 15% since the end of 2021 but fewer than half of the stocks in the index are positive in that time period.

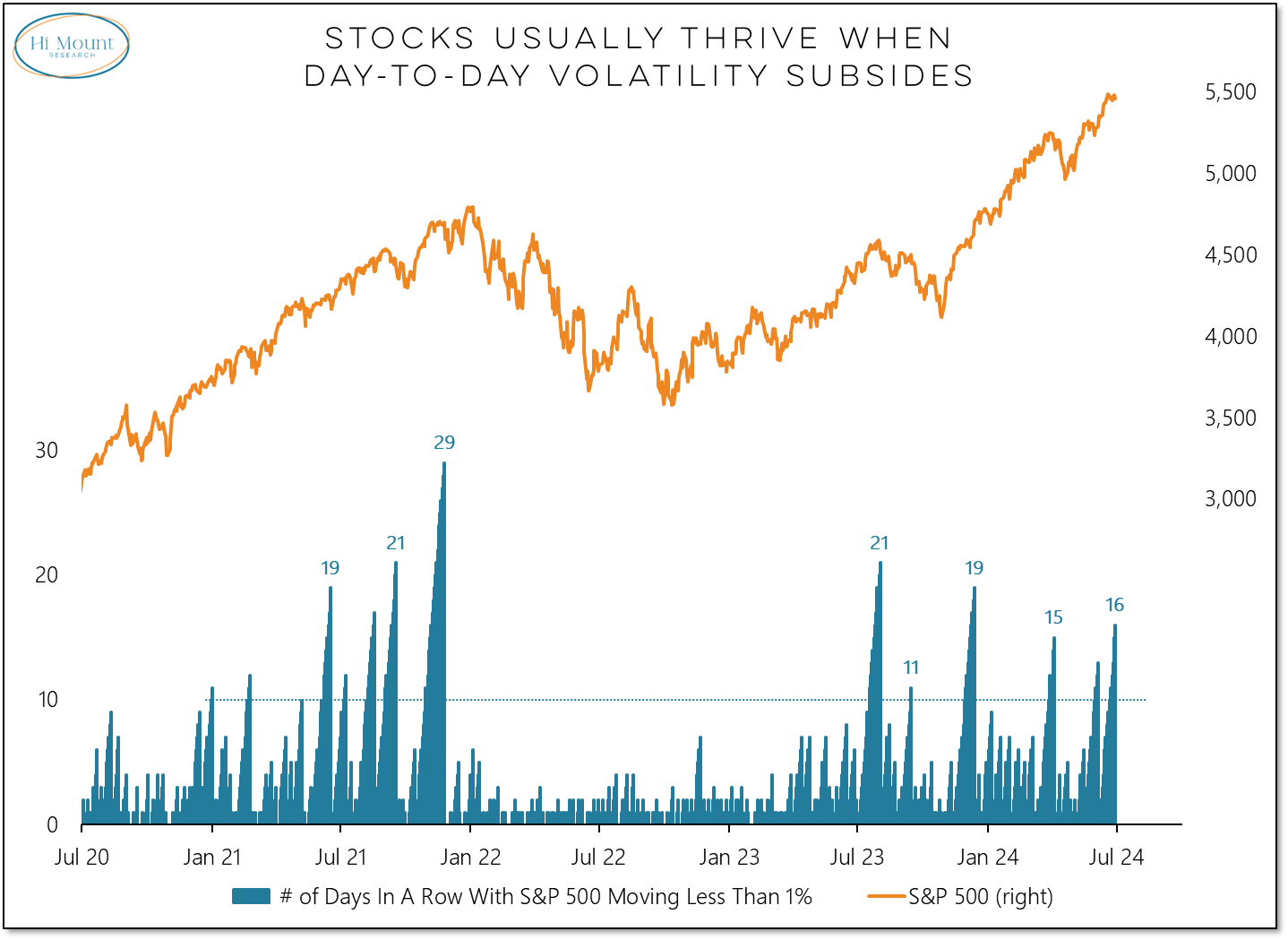

The equity market was extraordinarily calm in the first half of the year and markets that are quiet are usually strong. The S&P 500 has not moved more than 1% in either direction 16 days.

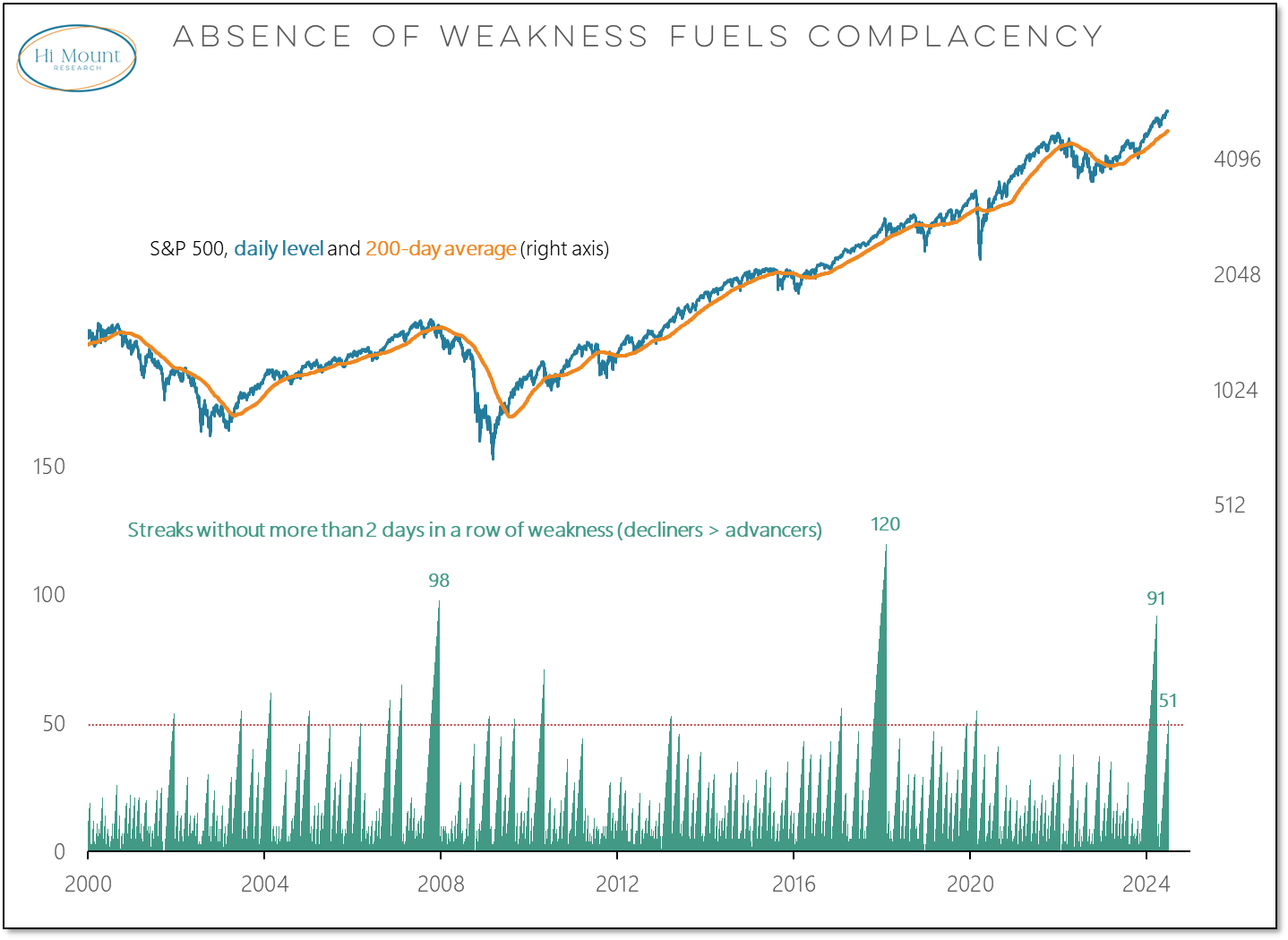

It has been more than 50 days since the index has had more decliners than advancers for more than 2 consecutive days.

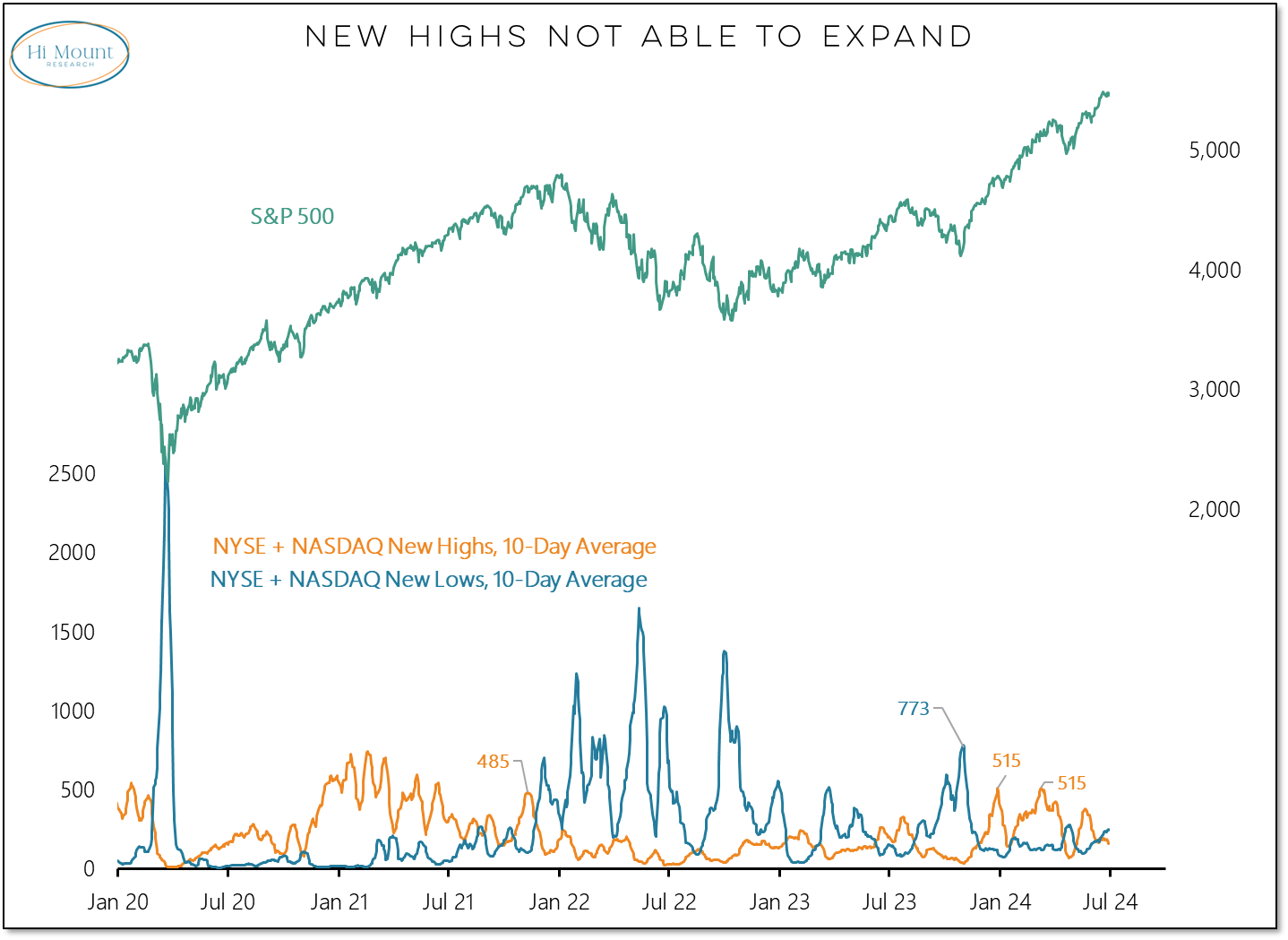

At the same time, new highs have failed to expand and are now less numerous than new lows.

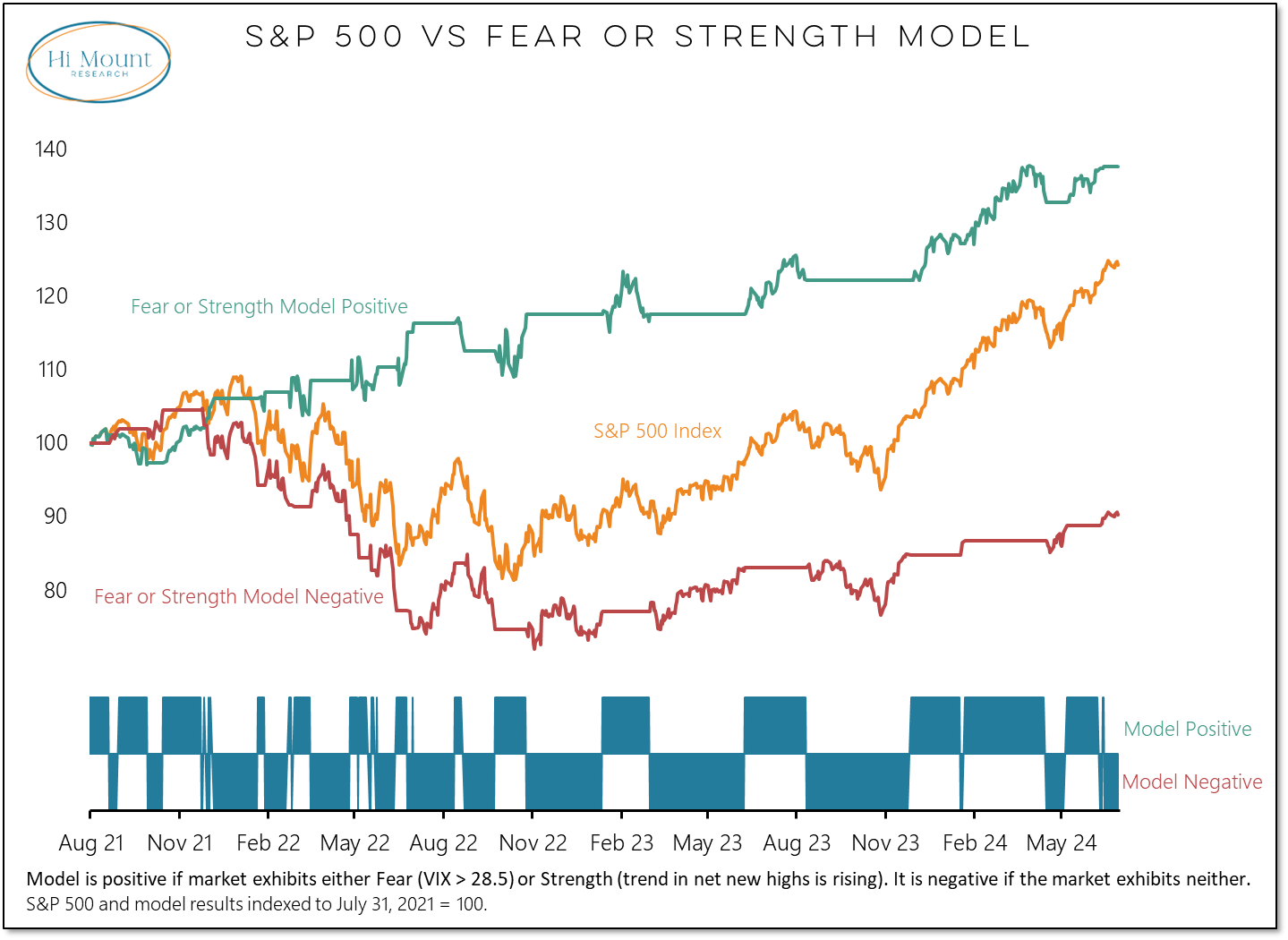

Quiet calm at the index level can lull investors into complacency. But the absence of strength (and/fear) has turned our tactical models negative and index-level strength tends not to persist in such environments.

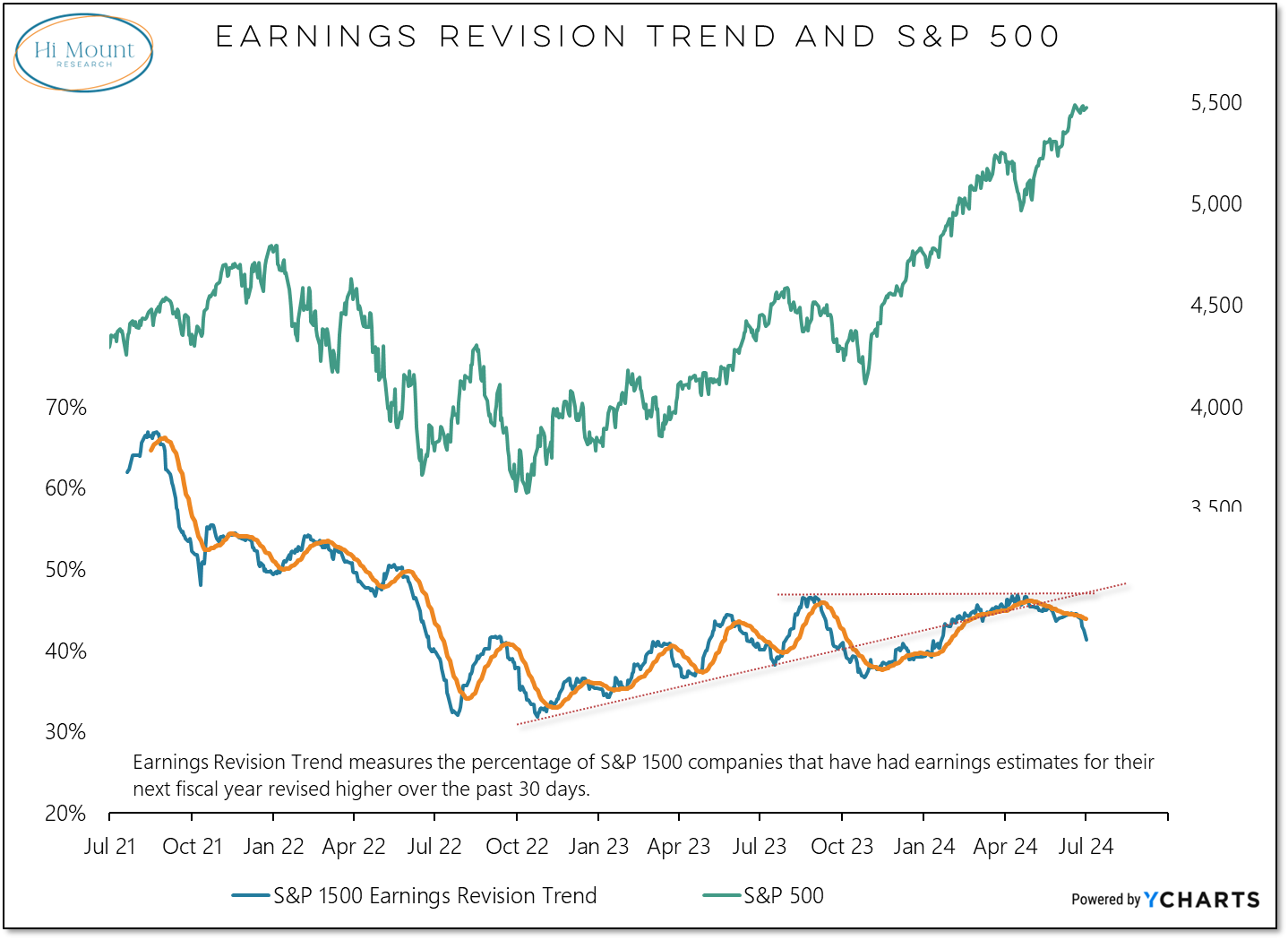

Breadth is struggling and bond yield momentum has become a headwind for stocks. The downturn in the earnings revision trend could be the catalyst for an increasingly bumpy ride in the second half of the year.

But when looking at relative leadership right now, it's

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.