Optimism Abounds, But Rally Narrows

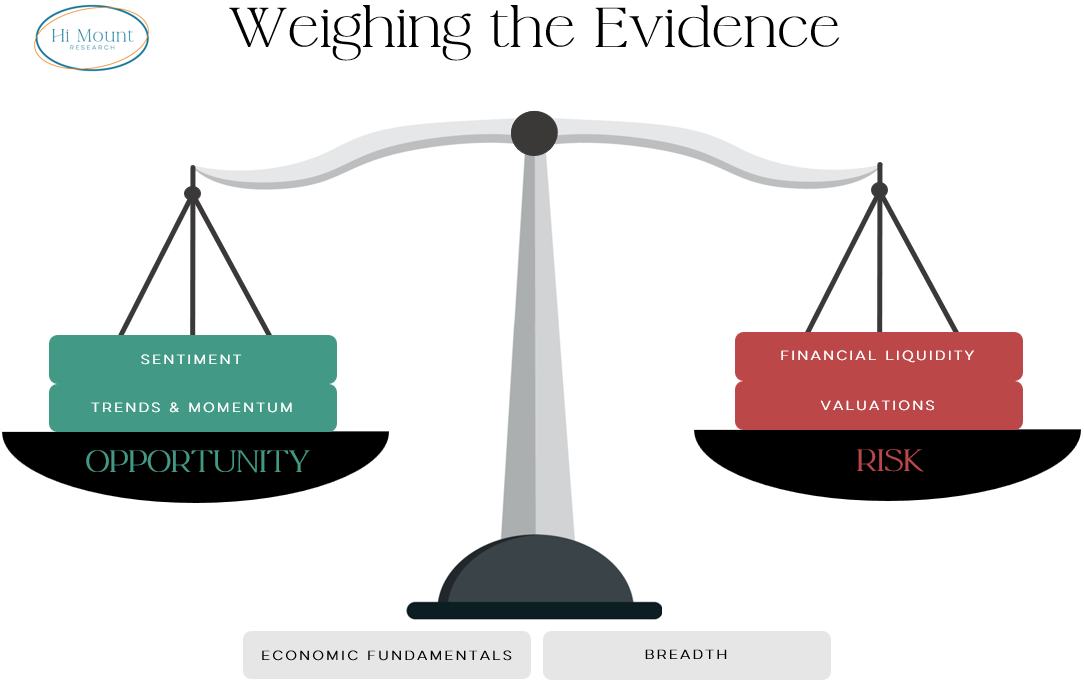

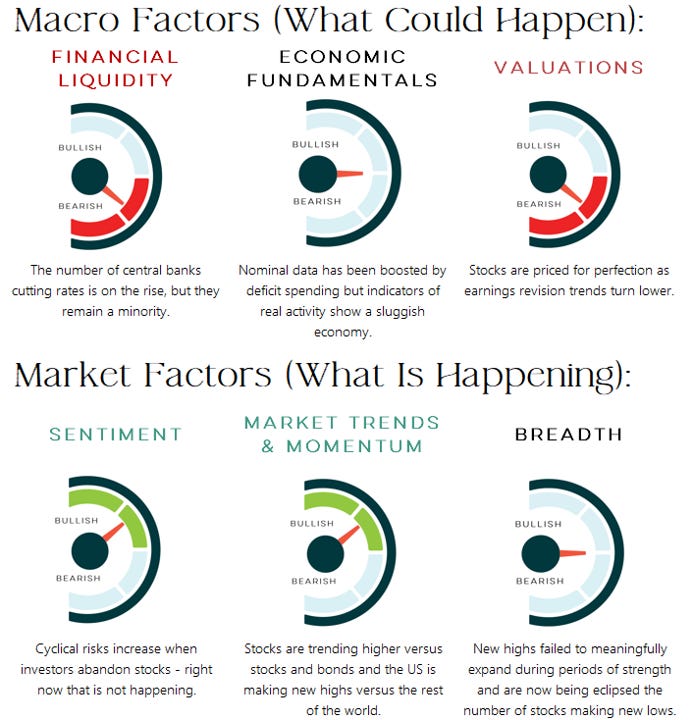

The weight of the evidence has slipped to neutral as Sentiment improves to bullish, Breadth drops to neutral and Financial Liquidity turns bearish.

Portfolio Applications subscriber note: We have made changes to the Dynamic Cyclical Portfolio in light of the deteriorating weight of the evidence (discussed below) and consistent with ongoing relative strength rotations. We are raising cash, adding to India and buying Communication Services.

Key Takeaway: Investors remain committed to stocks despite some early year hiccups and a deteriorating breadth backdrop. We are upgrading sentiment (it takes bulls to have a bull market) while downgrading breadth to neutral (it’s usually tough for the market to move higher when new lows outnumber new highs). Liquidity has turned bearish as central bank rate cuts continue to be delayed and bond yield momentum is no longer favorable.

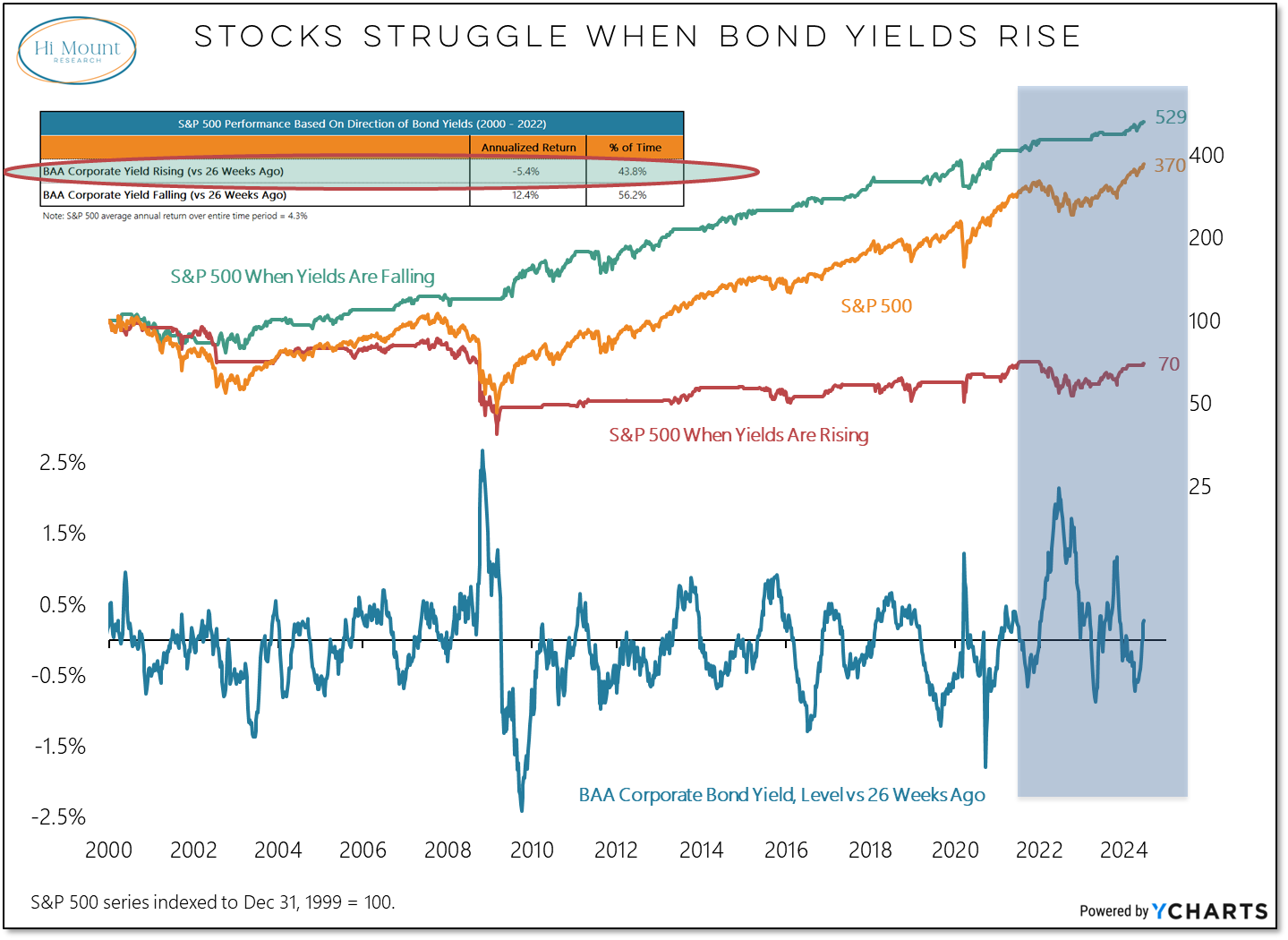

Liquidity: All the net gains for the S&P 500 over the past three years (as well as the past quarter century) have come when 6-month momentum in corporate bond yields was negative. While yields are currently off their peak, they are also higher than they were 6 months ago.

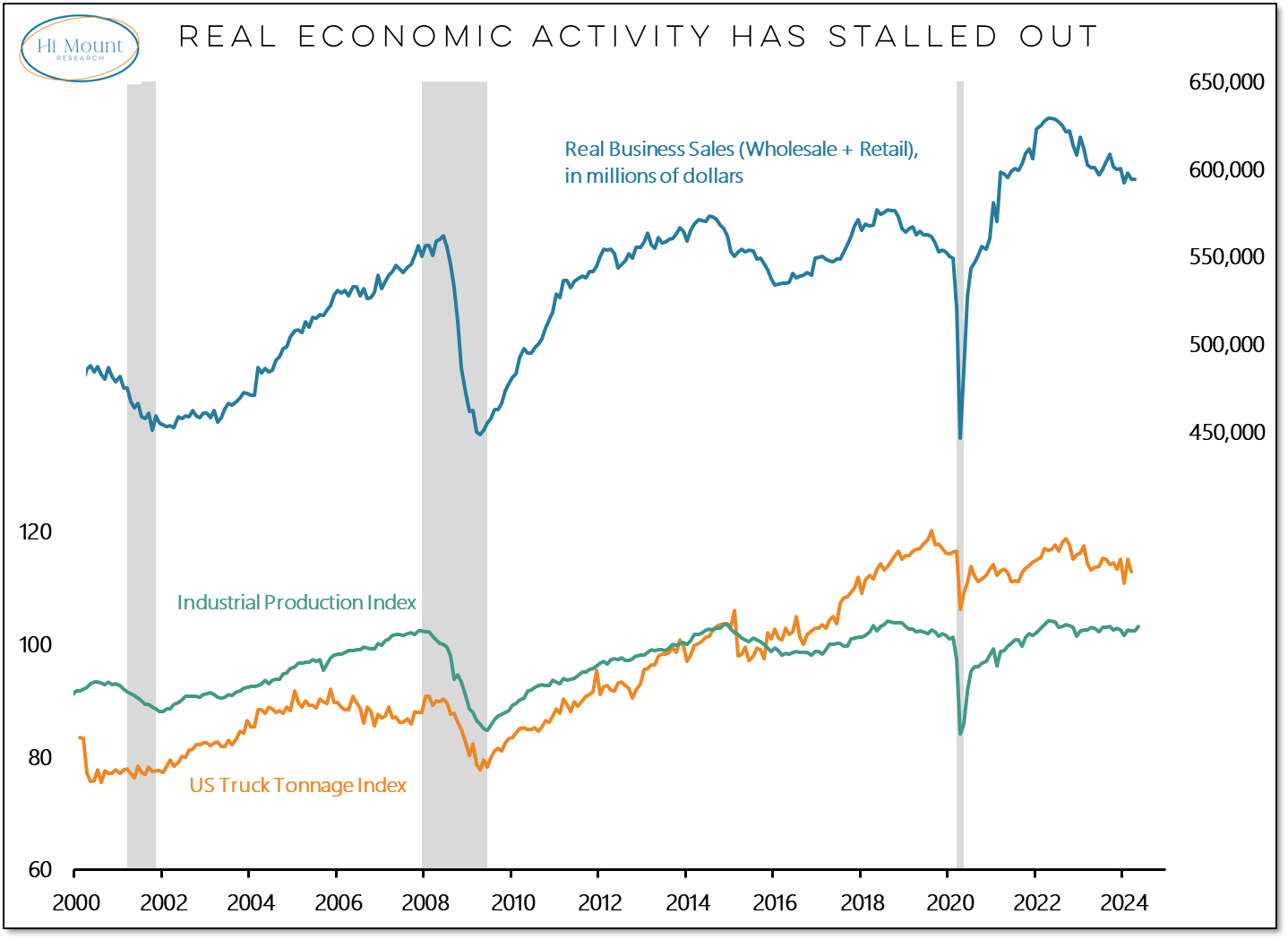

Economic Fundamentals: Nominal spending remains on a sugar high, while real spending, production and shipping have all struggled to expand. Now, residential construction is taking a hit.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.