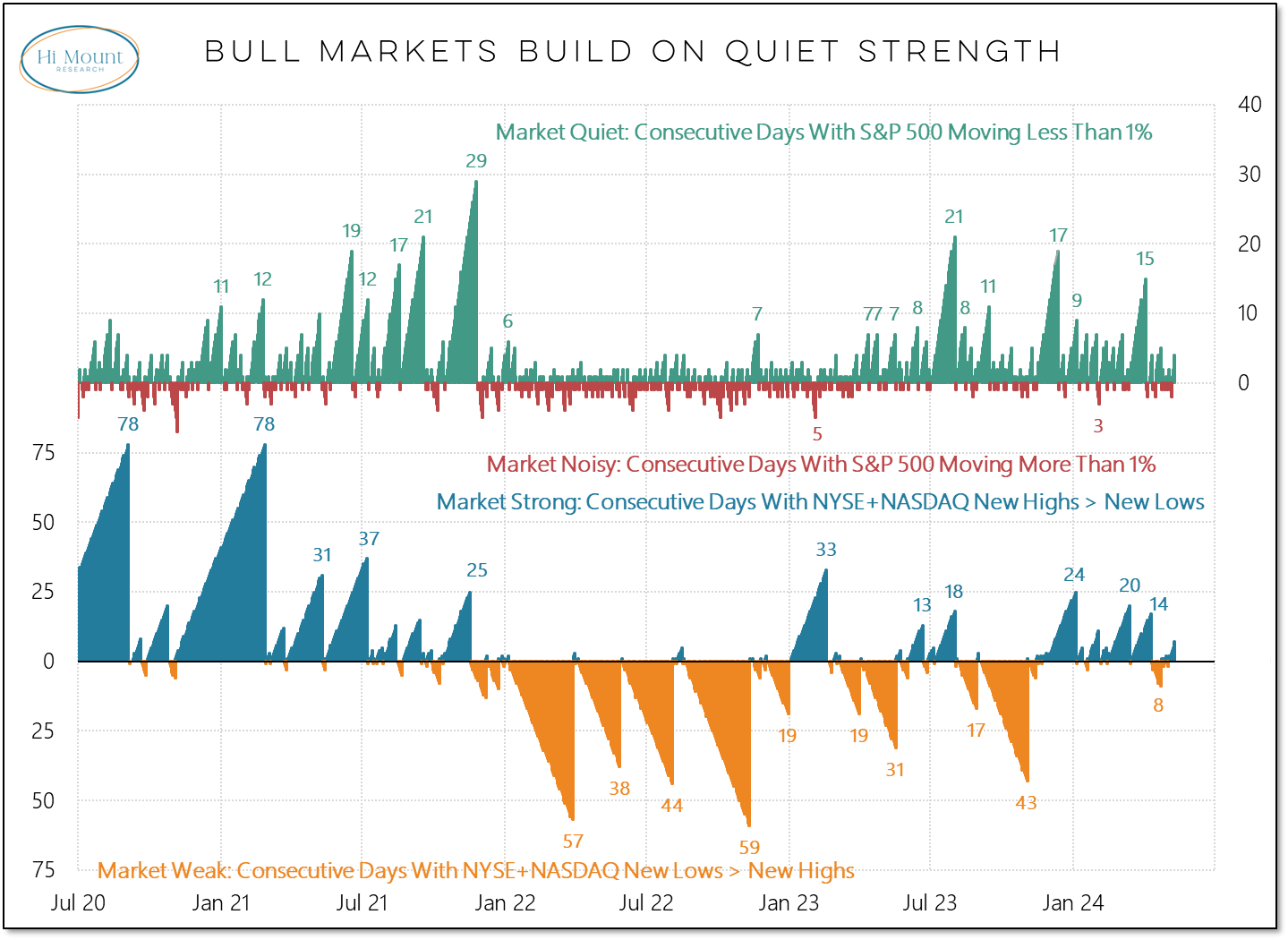

Key Takeaway: New highs exceeded new lows every day last week and only one trading day featured a 1% (or more) for the S&P 500. Simply put the quiet strength that is characteristic of bull markets and sustained moves higher is re-emerging in May. That is consistent with the view April’s volatility provided healthy re-set in sentiment and that the cyclical move off of last year’s lows has not yet run its course.

We are at seven days in a row of more new highs than new lows and four days in row without a 1% swing in the S&P 500. While it may be boring for headline writers, quiet strength is the normal condition during bull markets.

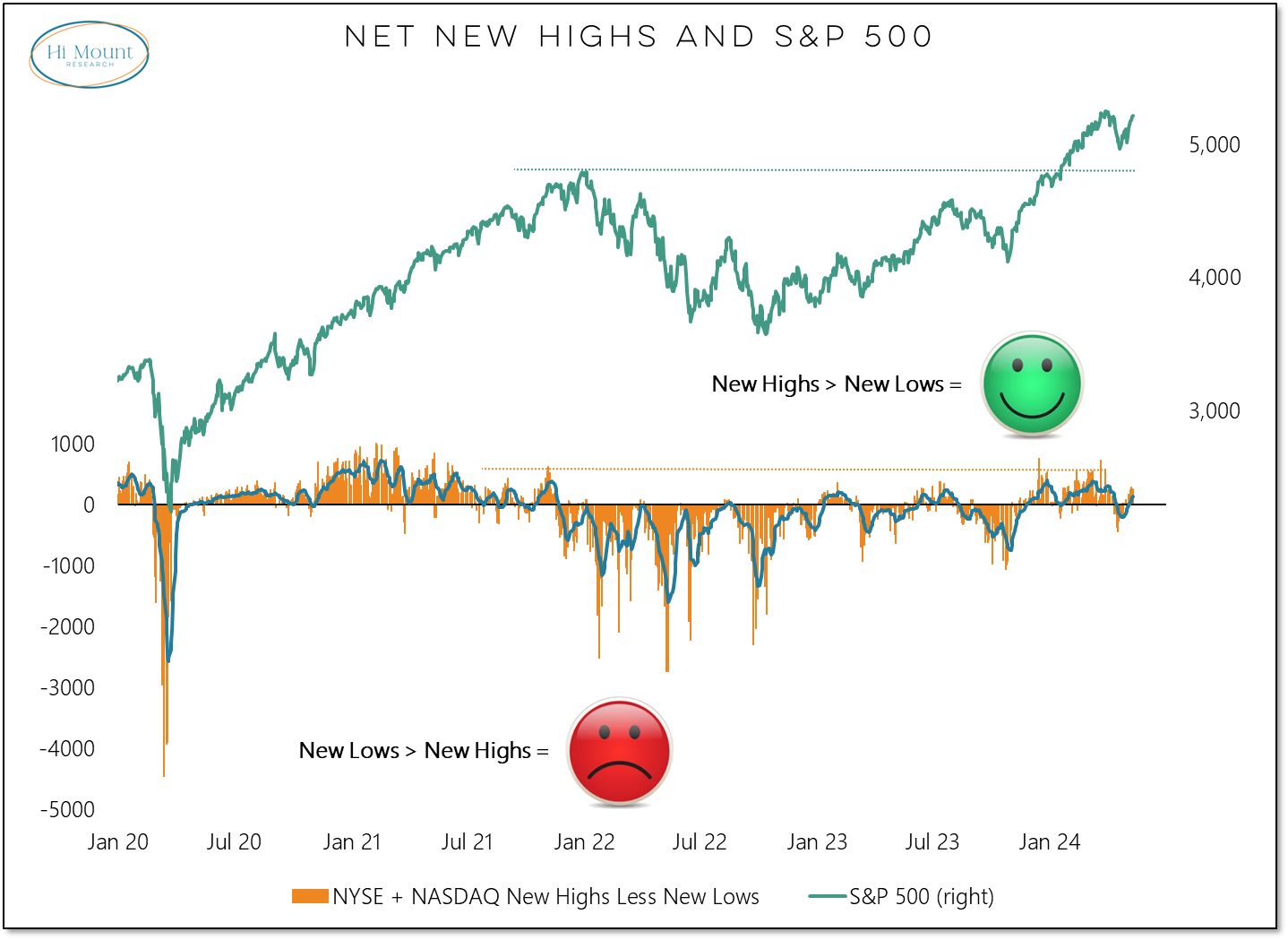

On a 10-day trend basis, new highs versus new lows are back in smiley face land. When that is the case, the S&P 500 is usually moving higher.

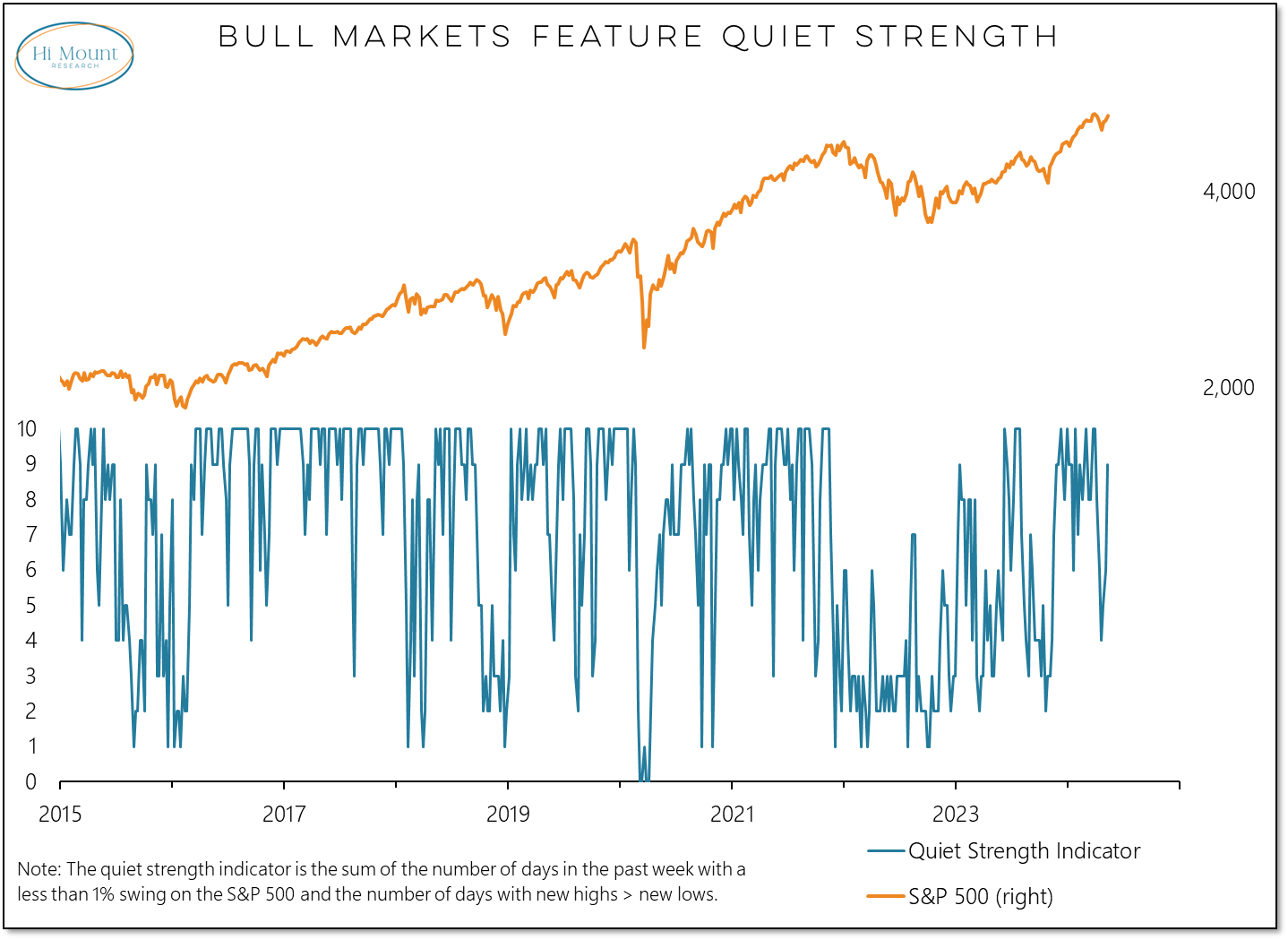

Quiet strength was notably absent from the market from early 2022 through mid 2023. It emerged on a consistent basis as the S&P 500 was moving to and through new highs in late 2023 and early 2024. It is now re-emerging after a brief hiatus in April. That is behavior that is characteristic of ongoing strength for stocks.

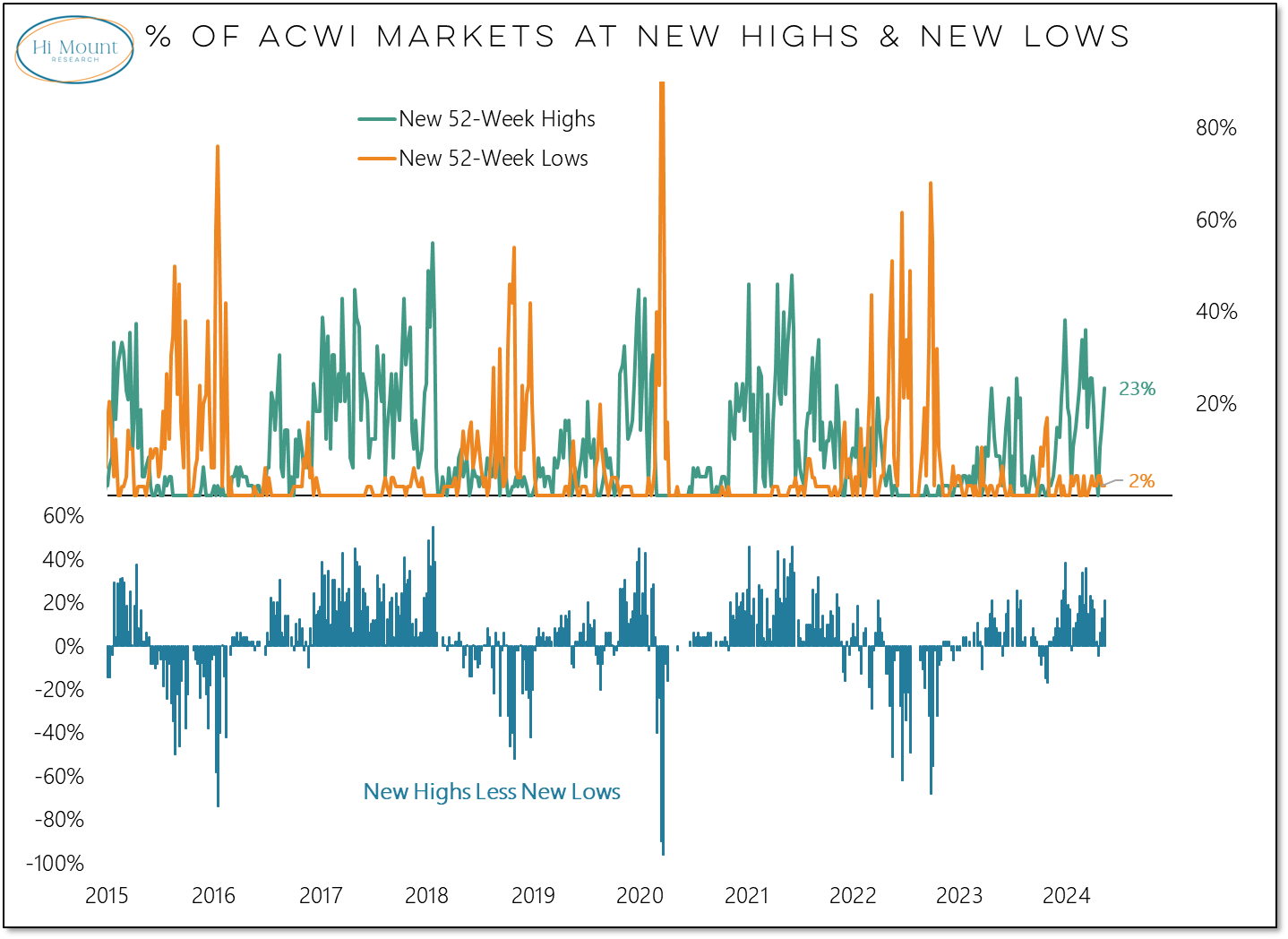

While US equities are getting back in gear, new highs last week from Europe, the UK and Pacific ex Japan (and new highs from EM the previous week) point to global equity market strength. Nearly one-quarter of ACWI markets made new highs last week (Japan, Canada and the US were notable exceptions).

This global strength is reflected in our Macro ETF rankings and our ACWI trend indicators:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.