Sentiment Doesn't Break As Breadth Gets Back In Gear

Bulls answer the call as strength is in bloom around the world.

Portfolio Applications subscriber note: We have published updates to our Blue Heron Systematic Portfolios and our discretionary Tactical Opportunity Portfolio. Bottom line: Trends favor commodities over equities while new highs exceeding new lows has turned our Tactical Model positive.

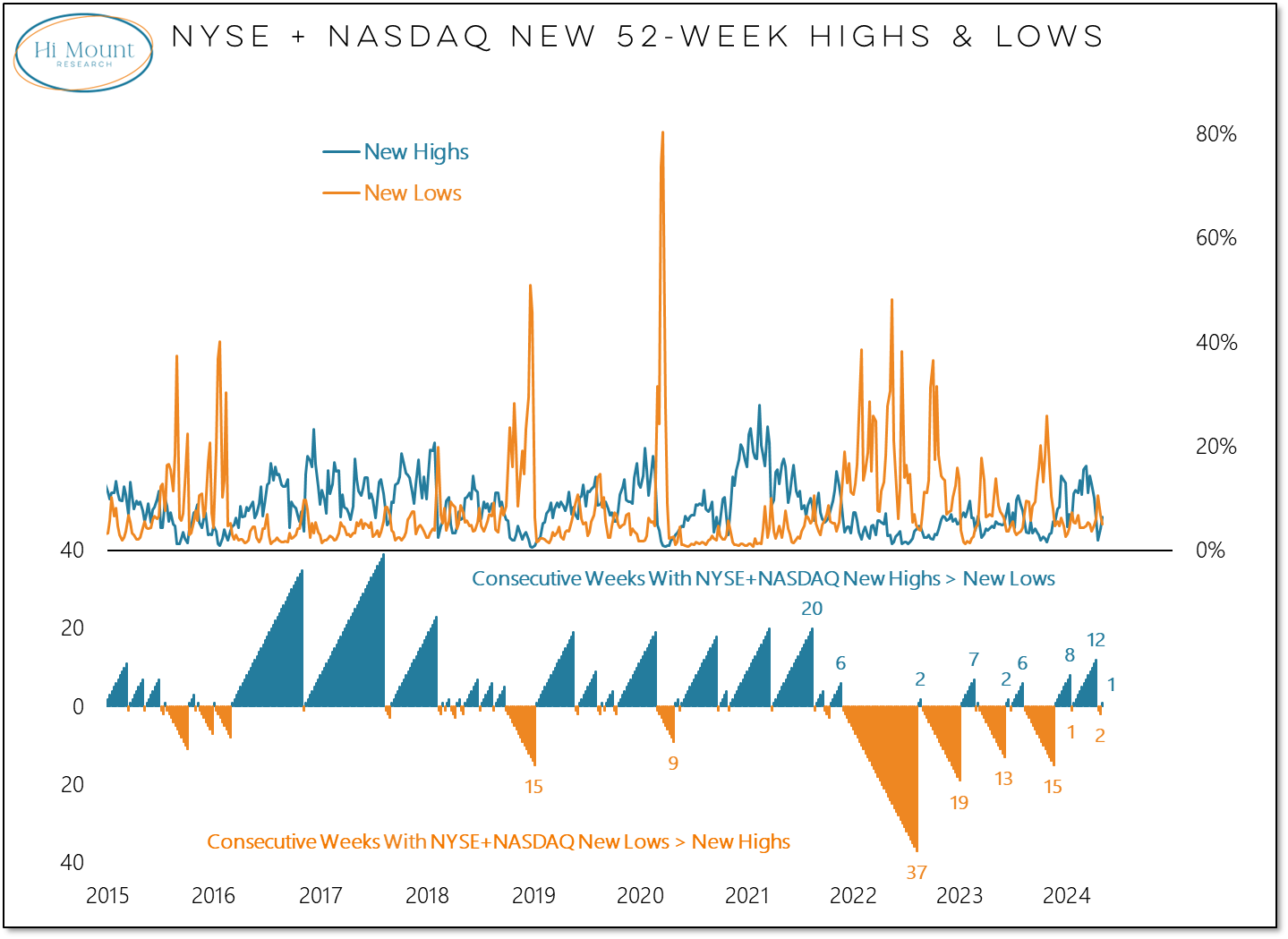

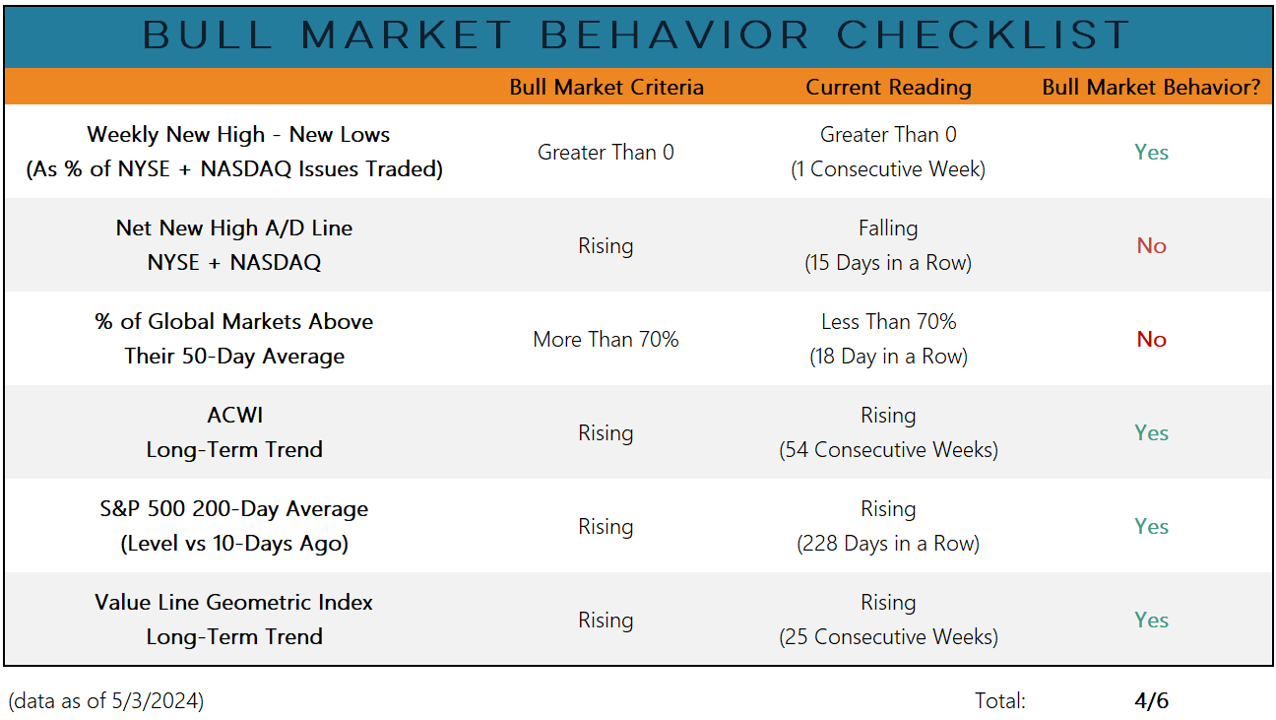

Coming into this week, the ball was in the bulls court, but they still had work to do. The price trend components on our Bull Market Behavior Checklist stayed positive in April, but breadth had turned suspect. The percentage of ACWI markets above their 50-day averages collapsed and on both a daily and weekly basis, new lows outnumbered new highs.

The weekly data on new highs and new lows turned positive last week and that pushed our overall checklist to 4 of 6 components reflecting bull market behavior.

After bending but not breaking from a sentiment perspective, bulls have regained the initiative this week and the cyclical rally off of last year’s lows remains intact.

Rather than “sell in May and go away”, a more appropriate adage this year may be “April showers bring May flowers”.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.