Key takeaway: Last week finished with a thud for stocks as the rally off of the October 2023 lows has lost steam. Investors in all three asset classes (stocks, bonds, commodities) are trying digest the implications of a rate environment that has changed as inflation has persisted.

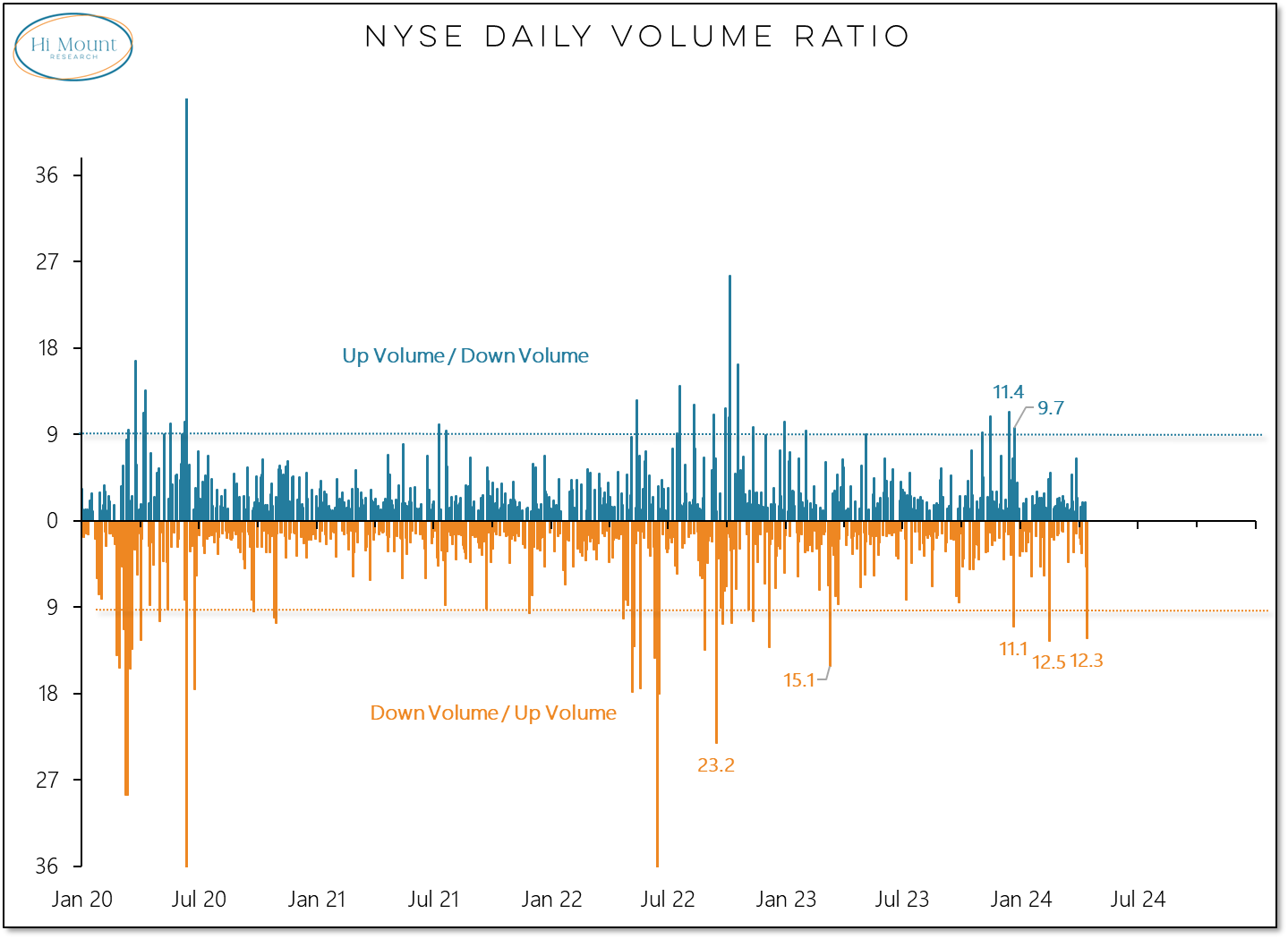

Downside volume exceeded upside volume by more than 12-to-1 on Friday. Paired with the 12-to-1 down volume day in February, we have had two downside volume thrusts since the last upside volume day.

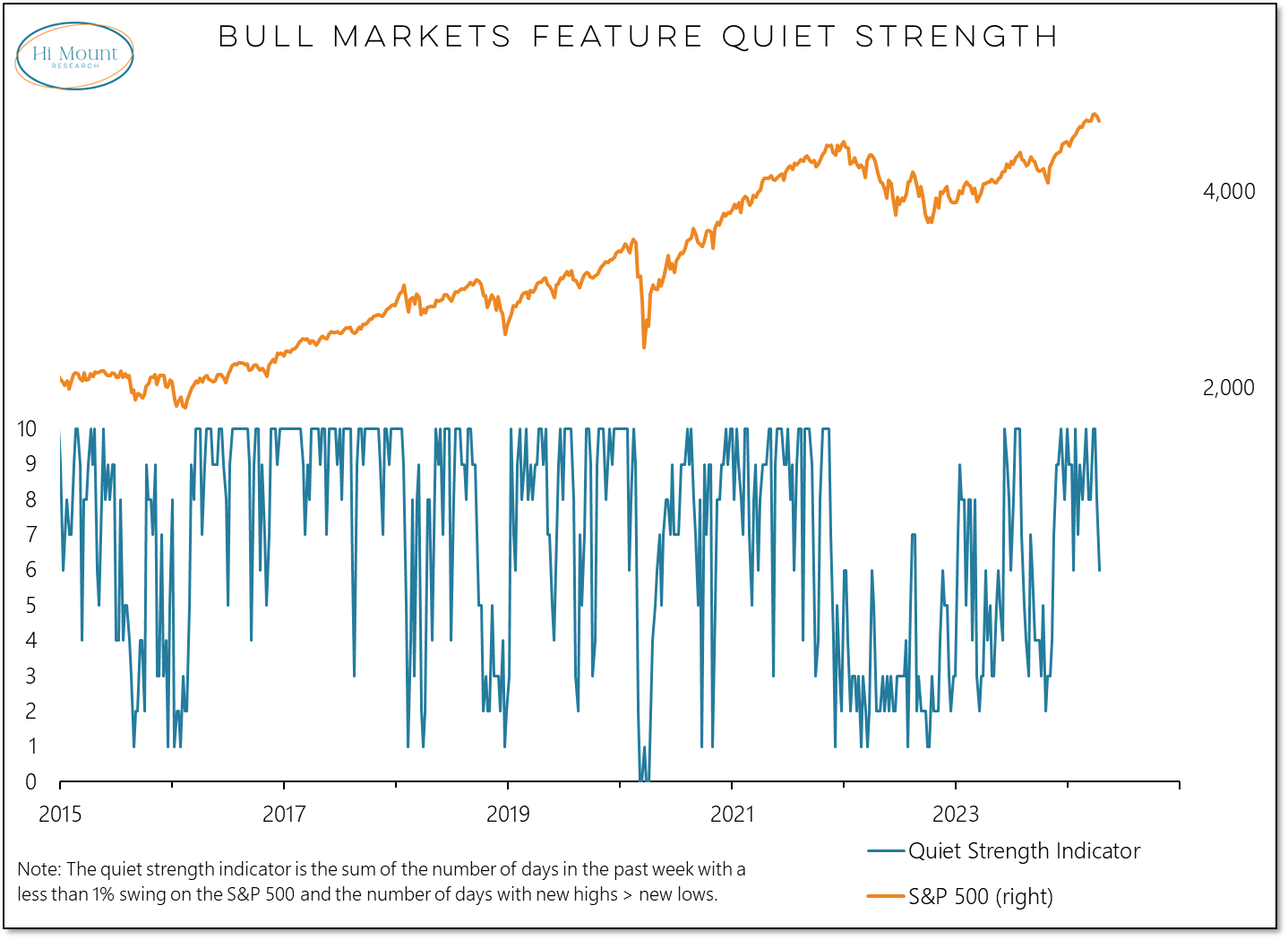

Last week also experienced a retreat in the quiet strength that is a hallmark of bull markets.

After a historic run of strength, some consolidation should not come as a surprise. But it is time for equity market bulls to either take a stand or take a hike. We will take a closer look at whether they are taking a stand (so far, they have) when we update our Bull Market Behavior Checklist later this week and will keep a close eye on incoming updates to the various sentiment surveys.

After the release of the March CPI data, it looks more like disinflation was transitory. That has pushed yields higher, putting pressure on bonds and adding to risks for stocks. The long-term environment for yields has already shifted and new highs there are more likely a question of when, not if.

While that has negative implications for stocks over the long-run, shorter-term momentum in corporate bond yields remains negative and that is typically bullish for stocks.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.