Quiet Optimism Outweighing Bond Market Moves

Expectations for a pivot are being disappointed but bull market behavior persists

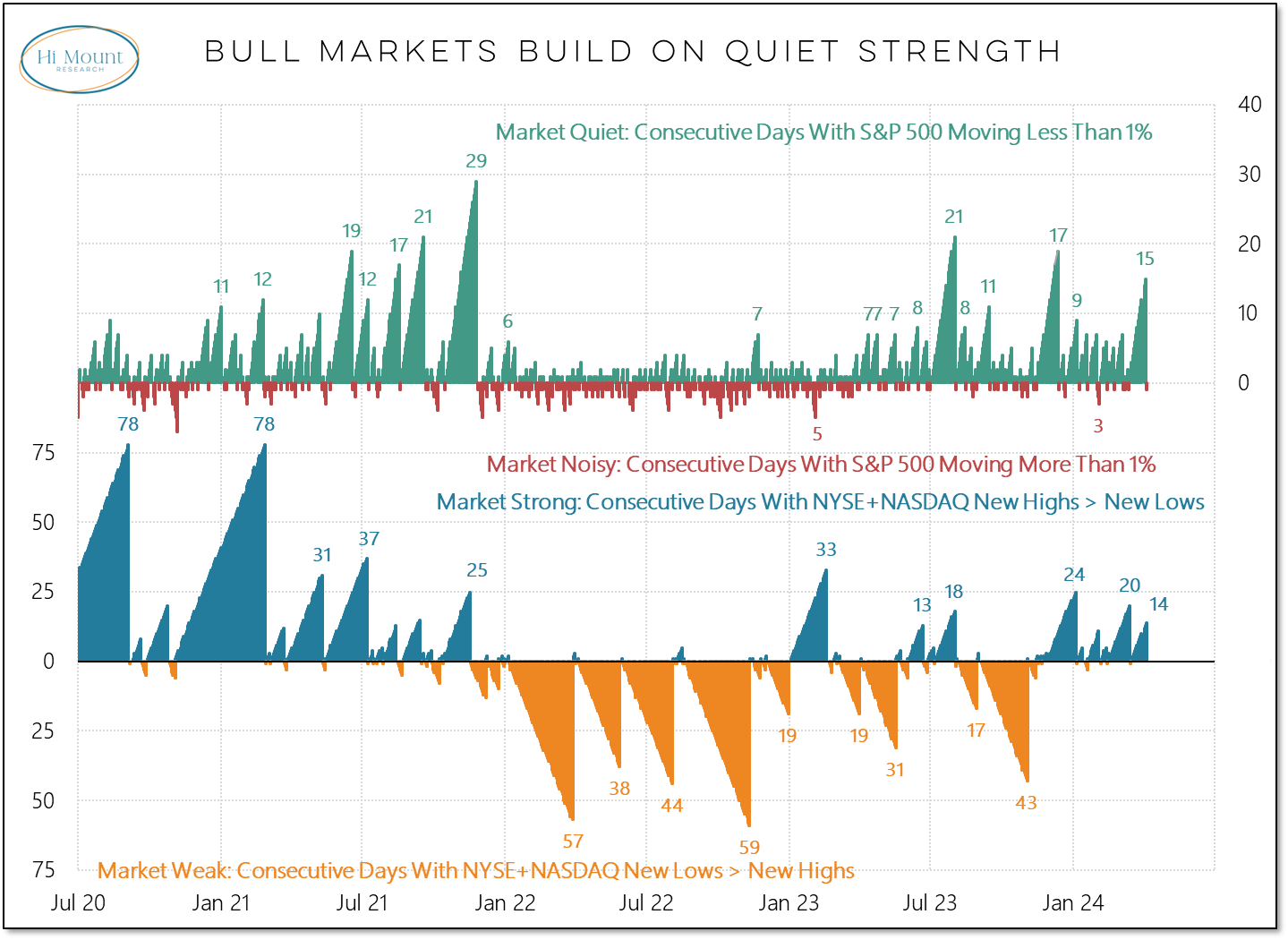

Quiet markets are characteristic of sustained strength. Think back to 2017: stocks hardly moved on a day-to-day basis but drifted steadily higher over the course of the year. Prior to yesterday’s intraday reversal that had the S&P 500 finishing the day with a 1.2% decline (after being up nearly 1% in the morning), the index had gone three weeks with a 1% move in either direction. This was the third longest stretch of quiet action in more than two years.

Even bull markets have bad days. What we don’t want to see is several bad days stretching into bad weeks and bad months. One day’s worth of volatility is not enough to meaningfully disrupt the pattern of quiet strength that has emerged over the past two quarters.

The proximate cause for yesterday’s reversal was concern that the bond market’s expectations for a Fed pivot are being disappointed and delayed. With inflation not yet dead, the Fed should be in no hurry to cut rates. The reality is that the bond market has been doing the pivoting, looking for the Fed to change course since late 2022. Unless yields break above last year’s high, stocks can probably withstand short-term zigs and zags from the bond market.

Quiet strength in equities and hopes for a friendlier Fed have fueled investor optimism. The crowd is looking for stocks to move higher and our various sentiment gauges are certainly elevated (we will have a complete update to our sentiment scorecard next week). But sentiment usually peaks be for price and the last two times the Investors Intelligence Bull-Bear spread climbed to its current level, the peak in prices was at least 9 months away.

In case you missed it, I covered the strong momentum environment and the risks associated with rising bond yields when I checked in with Oliver Renick on the Schwab Network earlier this week:

https://schwabnetwork.com/video/what-a-bond-sell-off-means-for-stocks