Inflation: "I'm Not Dead Yet"

Fed pivot is on pause, but weight of the evidence tilts toward opportunity

Subscribers can access our latest Weight of the Evidence update or reference the summary below. For more information on the services we offer or if you are interested in becoming a subscriber, please be in touch.

Key takeaway: The market is reckoning with narrative-disrupting data on the inflation front. If bonds can remain well-behaved (and yields not break-out to new highs) then rate cuts delayed can be more of persistent carrot for stock market bulls than building headwind.

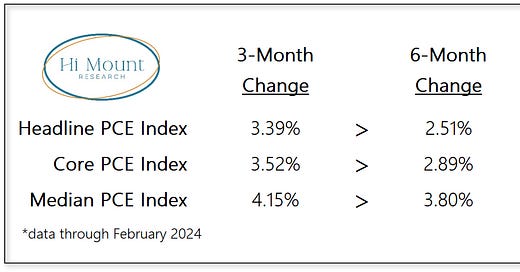

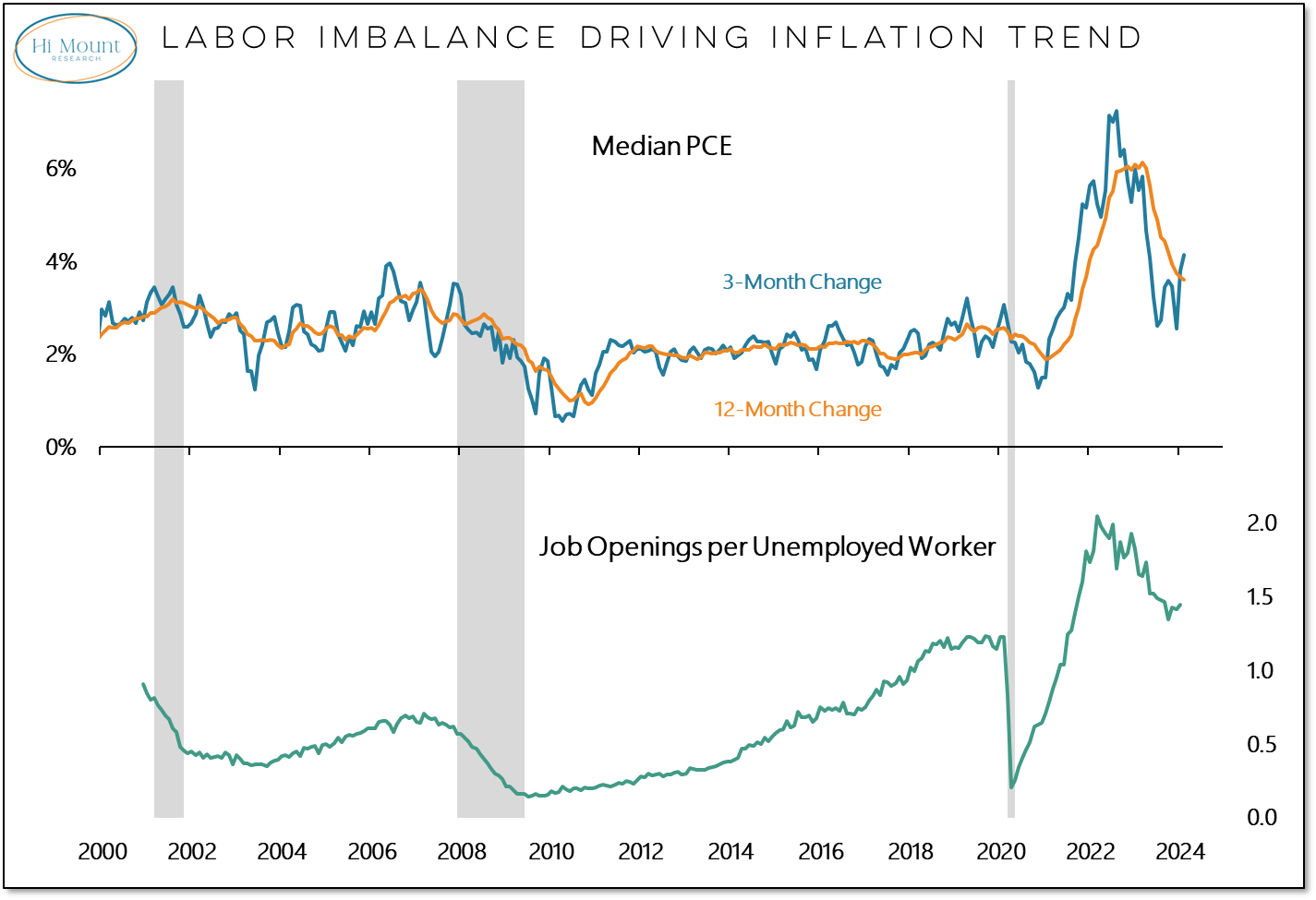

What was true with the latest CPI data has been confirmed with the most recent PCE data: Inflation is not dead yet. In fact, with shorter-term rates of changes above long-term rates of change, it appears that dis-inflation was transitory and risk of reaccelerating inflation are on the rise.

Even at recent trough levels, inflation this cycle has remained above the previous cycle peak. Structural imbalances in the economy are likely to keep inflation higher for longer than many hoped for or expected.

So far the market has absorbed this news without much disruption. Rate cut expectations have been pushed out, but there is little evidence of financial stress, breadth remains strong and investor interest in stocks remains elevated. If bond yields can remain well-behaved, rate cuts delayed are likely to be a nuisance at worst and more likely a continued carrot for the bulls.

Either way, our Asset Allocation models and Relative Strength Rankings are already encouraging investors to expand their horizons and give Commodities a seat at the table and a place in their portfolio.

Weighing the cyclical weight of the evidence reveals more opportunity than risk even if stocks need to catch their breath after a historic rally over the past two quarters.

Weight of the Evidence update:

Rate Cuts Delayed But Stocks Roll On: Re-accelerating inflation may dash the market’s expectation for multiple rate cuts this year. But in the absence of broad signs of financial stress, hopes for a more accommodative Fed may be enough of a carrot to keep recent equity market trends intact. Risks increase if

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.