More Ragged But Still Resilient

The market is getting noisier but the weight of the evidence suggests that this bull still has further to run

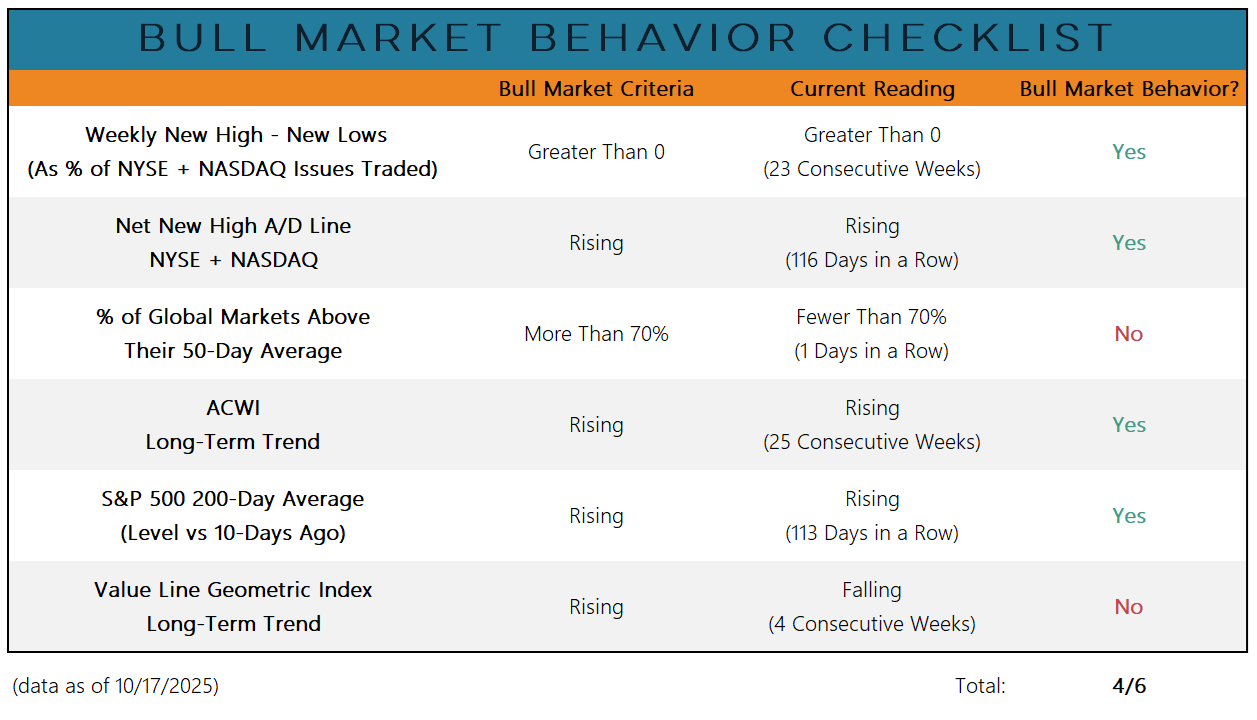

The market’s behavior has gotten more ragged in recent weeks. A big down day on the S&P 500 early this month brought to a close the longest stretch of quiet for stocks since prior to COVID. So far that has not opened the door to more selling. While our bull market behavior checklist has deteriorated, we continue to see 4 out of 6 trend/breadth indicator remaining consistent with an ongoing bull market.

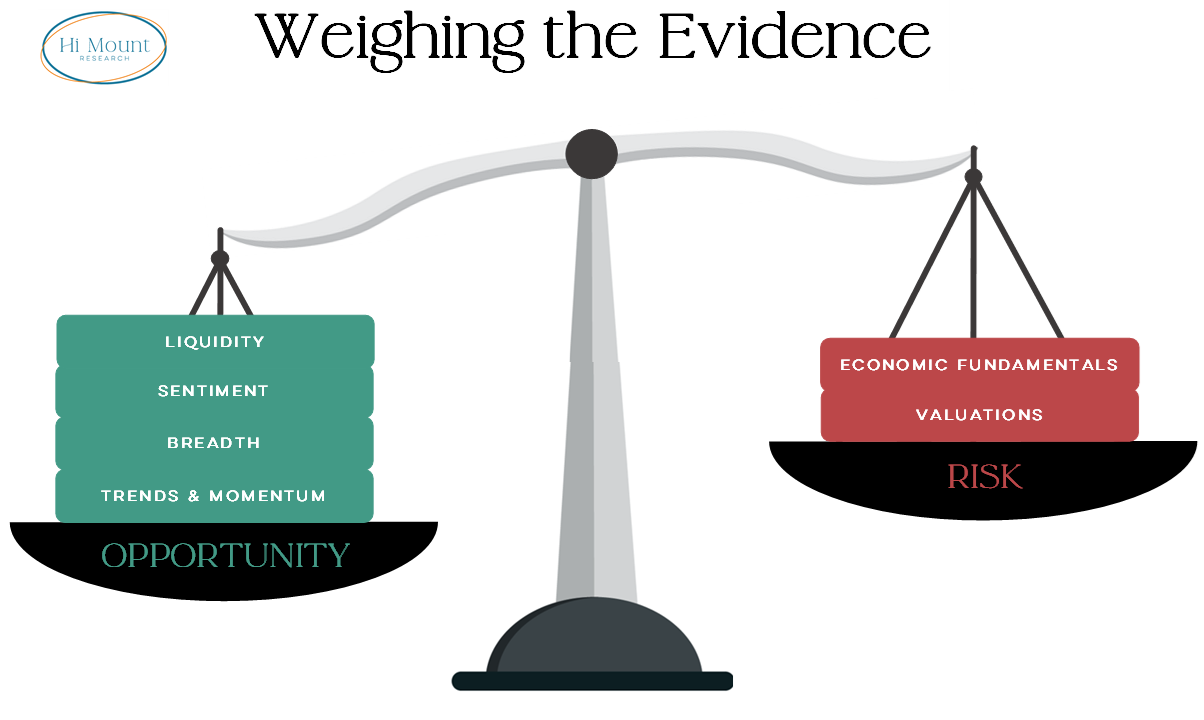

While are bull market continues to get the benefit of the doubt and the weight of the evidence remains tilted toward opportunity, the risk is that the recent uptick in noise persists and saps the strength of the bull market.

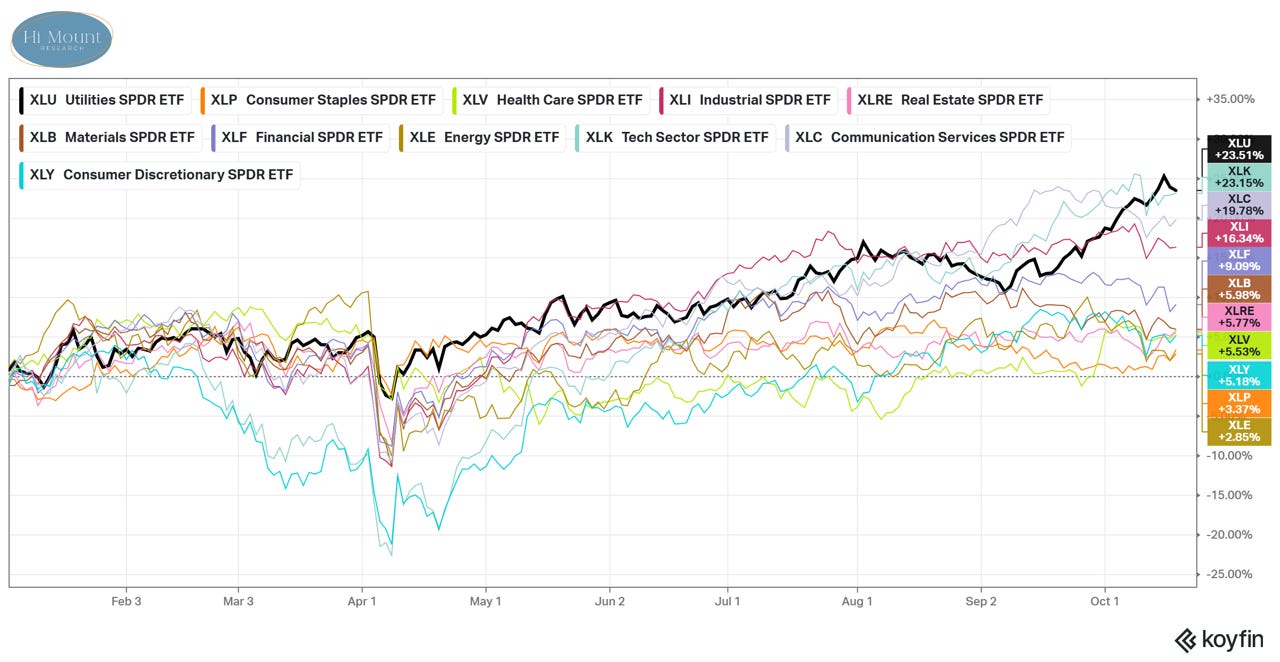

In this environment it is notable that through mid-October, it is Utilities that are leading the way in terms of YTD sector performance.

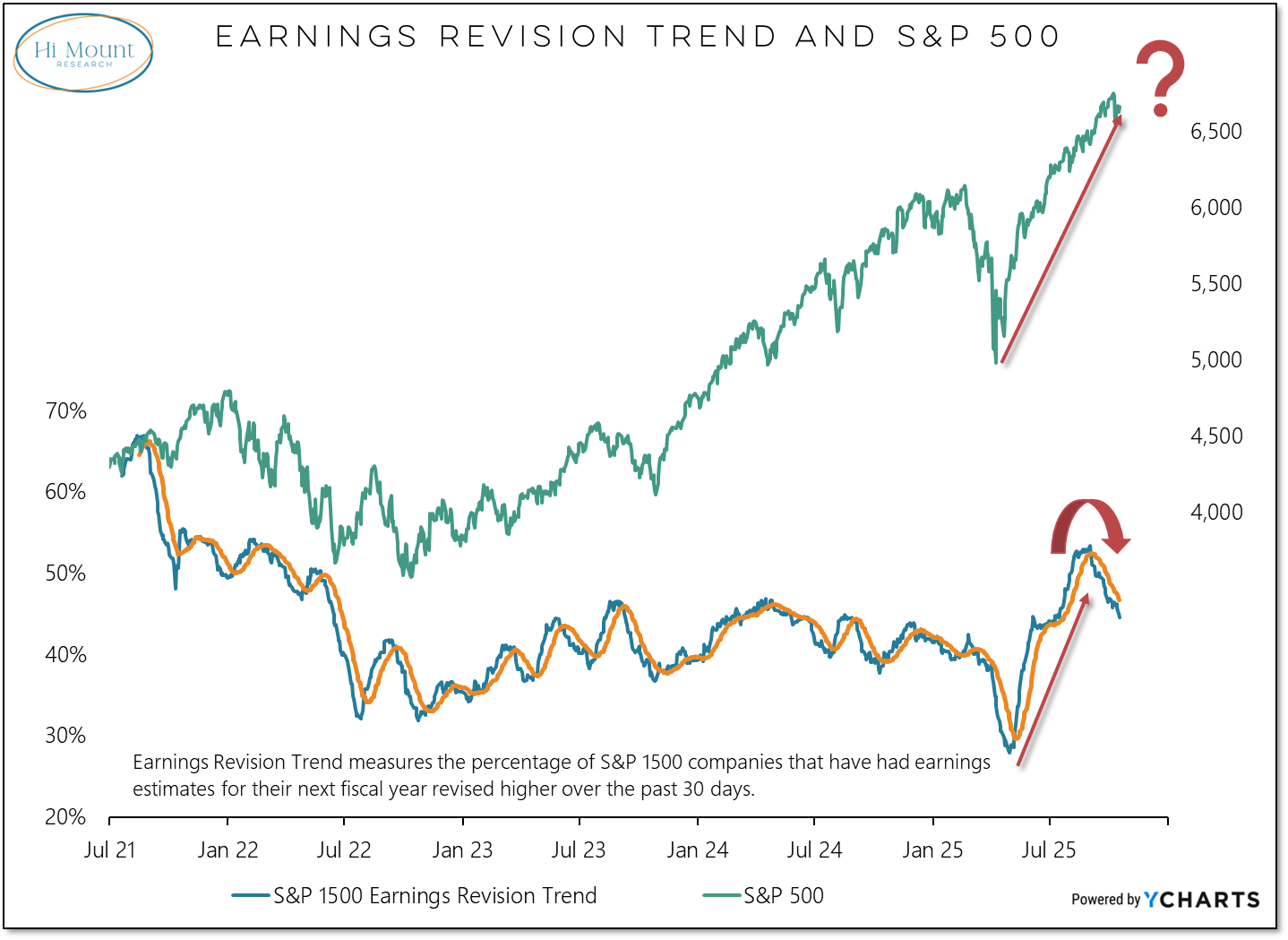

Further, the upward trend in earnings revisions, which had been a significant tailwind for stocks coming off of their early-year lows, has decisively rolled over. The resiliency of this rally could be tested as 2025 draws to a close.

For now, though, the scales remain tilted toward opportunity and the path of least resistance remains higher. This could change if bull market attitudes (e.g. Sentiment) or behavior (e.g. Breadth and Trends) take a turn for the worse.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.