Will Friday's Noise Open The Door To More Selling

Last week's swoon brought an end to two notable market streaks, but left a third, more important streak intact

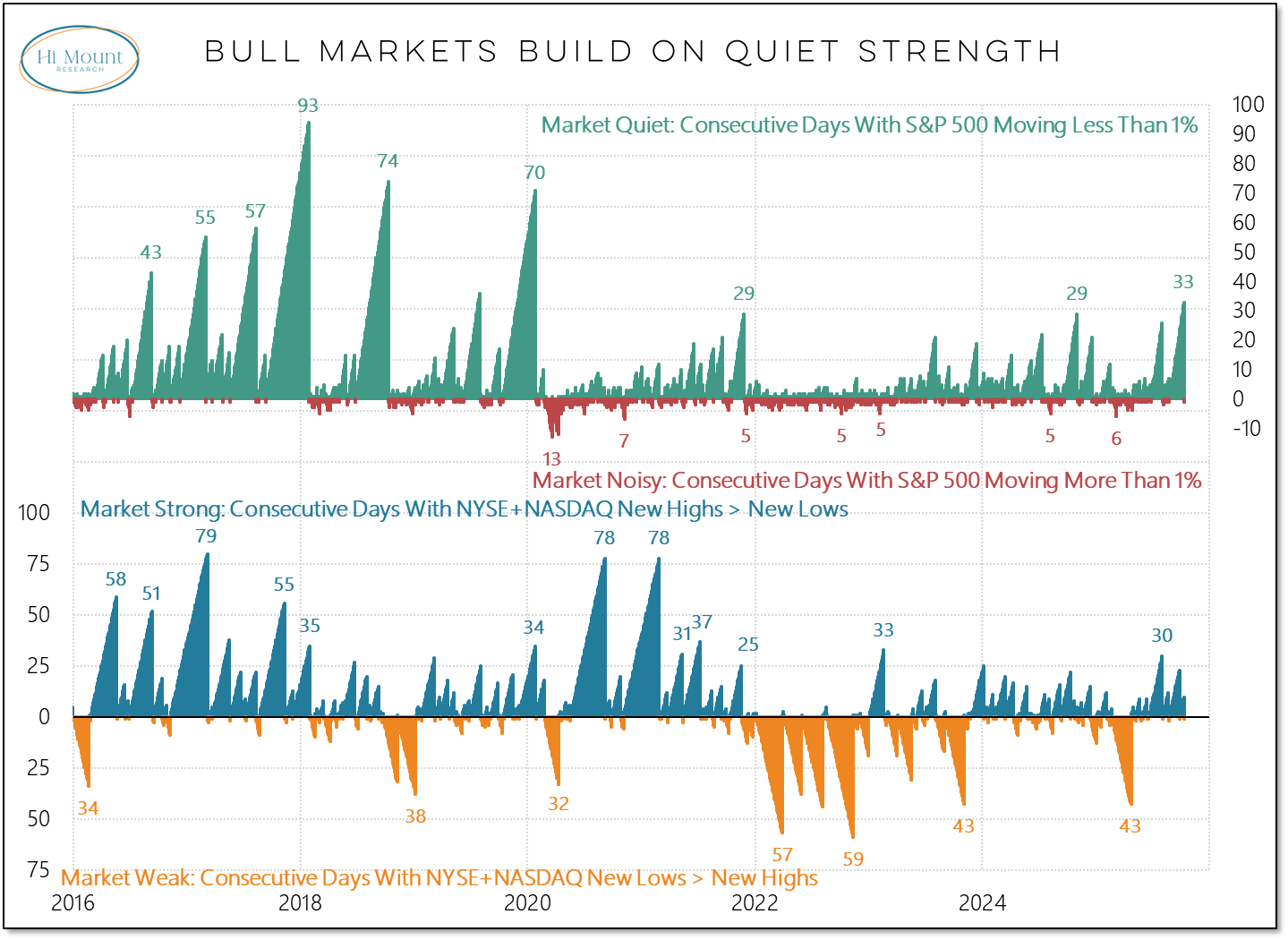

A new round of tariff threats late last week unleashed a wave of selling in stocks. Friday’s 2.7% decline brought to an end the longest stretch without a 1% daily move since prior to COVID. Friday was a noisy day at the index level and a weak day beneath the surface as more stocks on the NYSE+NASDAQ made new lows than new highs.

If quiet and strength return in short-order, Friday’s selling may ultimately be regarded as little more than an aberration within an ongoing uptrend. The risk is that we are entering a period in which noise and weakness emerge with more frequency.

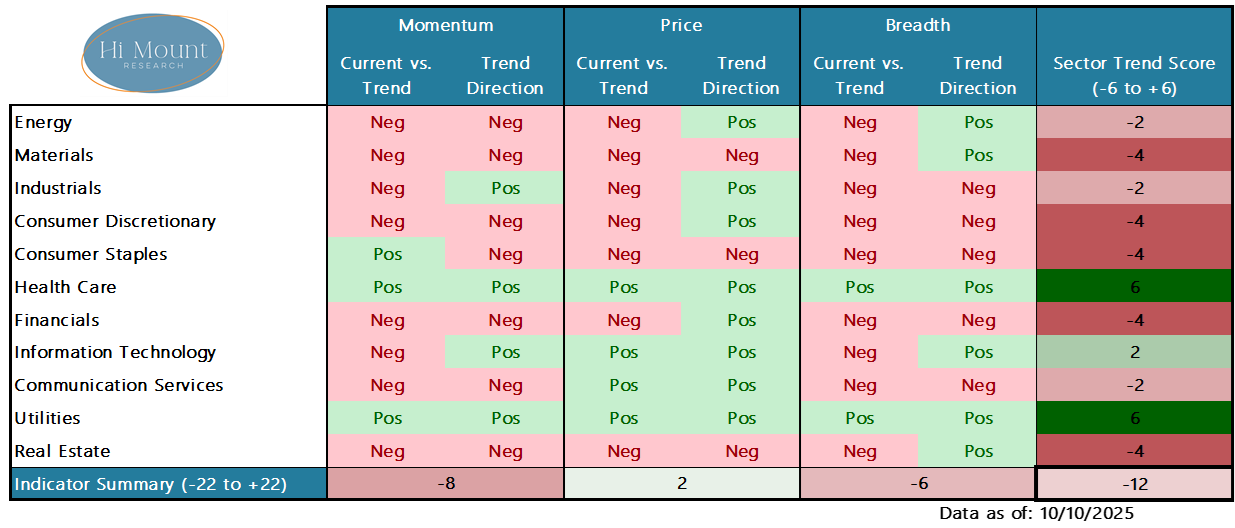

Friday’s selling accelerated some deterioration that had been showing up in our sector-level momentum-price-breadth model (we include this table every week in our Rankings Report).

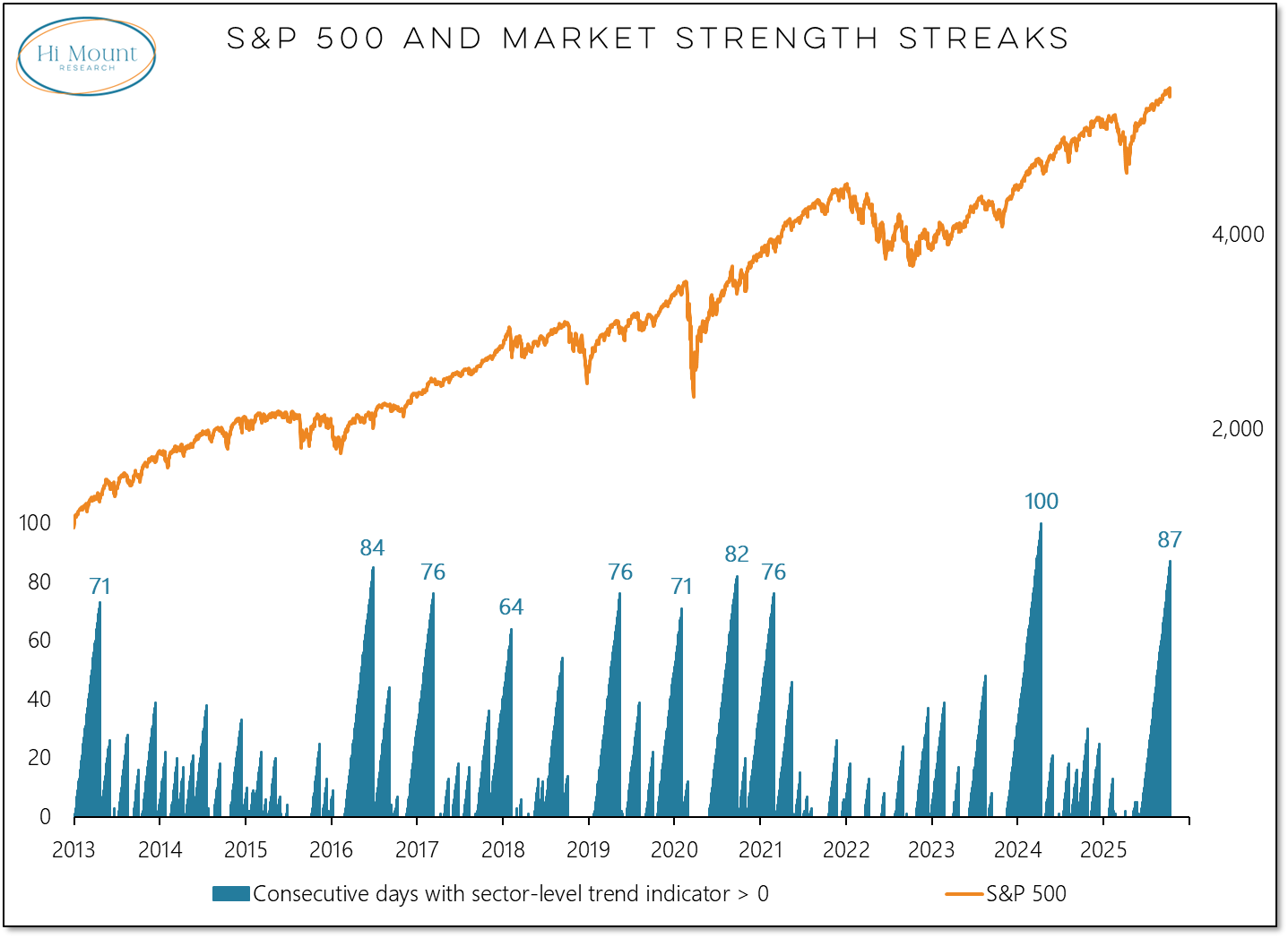

Friday’s selling pushed the overall trend score below zero for the first time since the recovery off of the April lows, ending the second-longest stretch of sustained sector strength in the past decade. One measure of the market’s resiliency will be whether or not the overall sector trend score rebounds quickly or stays in negative territory for an extended period of time.

While the ending of the two aforementioned streaks is notable, a longer and more important streak remains intact and while it does, the risk of sustained selling is minimal.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.