Key Takeaway: Last week’s stock market celebration provided plenty of fireworks. But with bond yields rising and a breadth thrust conspicuous by its absence, whether this is the beginning of a new and sustainable leg higher remains an open question.

There was plenty of good news to go around last week when it came to the stock market.

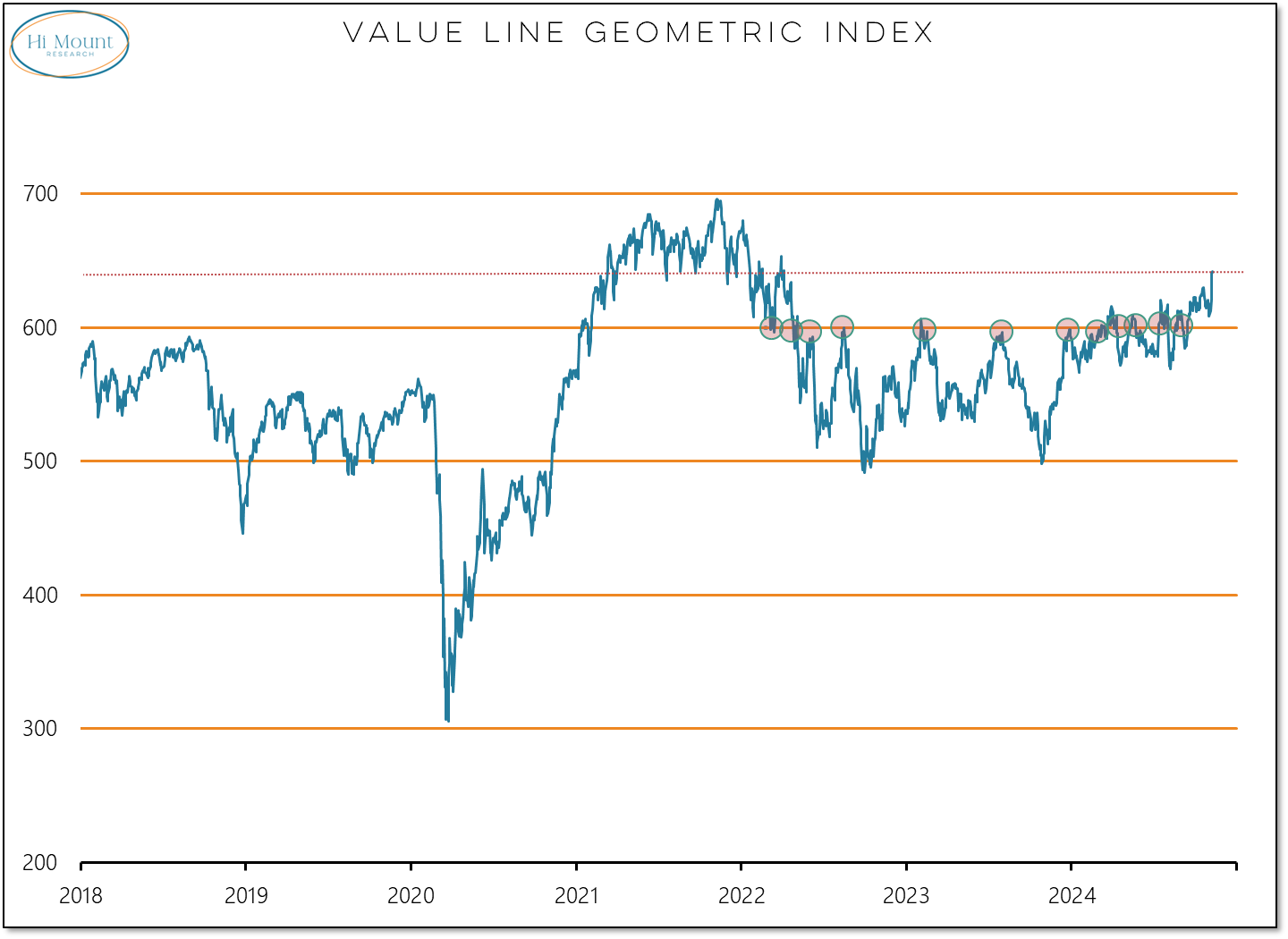

The Value Line Geometric Index did not make a new all-time high last week. But it did make a new multi-year high and continues to make upside progress as it moves away from an extended period of no net progress (it traded to or thru the 600 level a dozen times since 2022). In some ways, the median stock is just getting going.

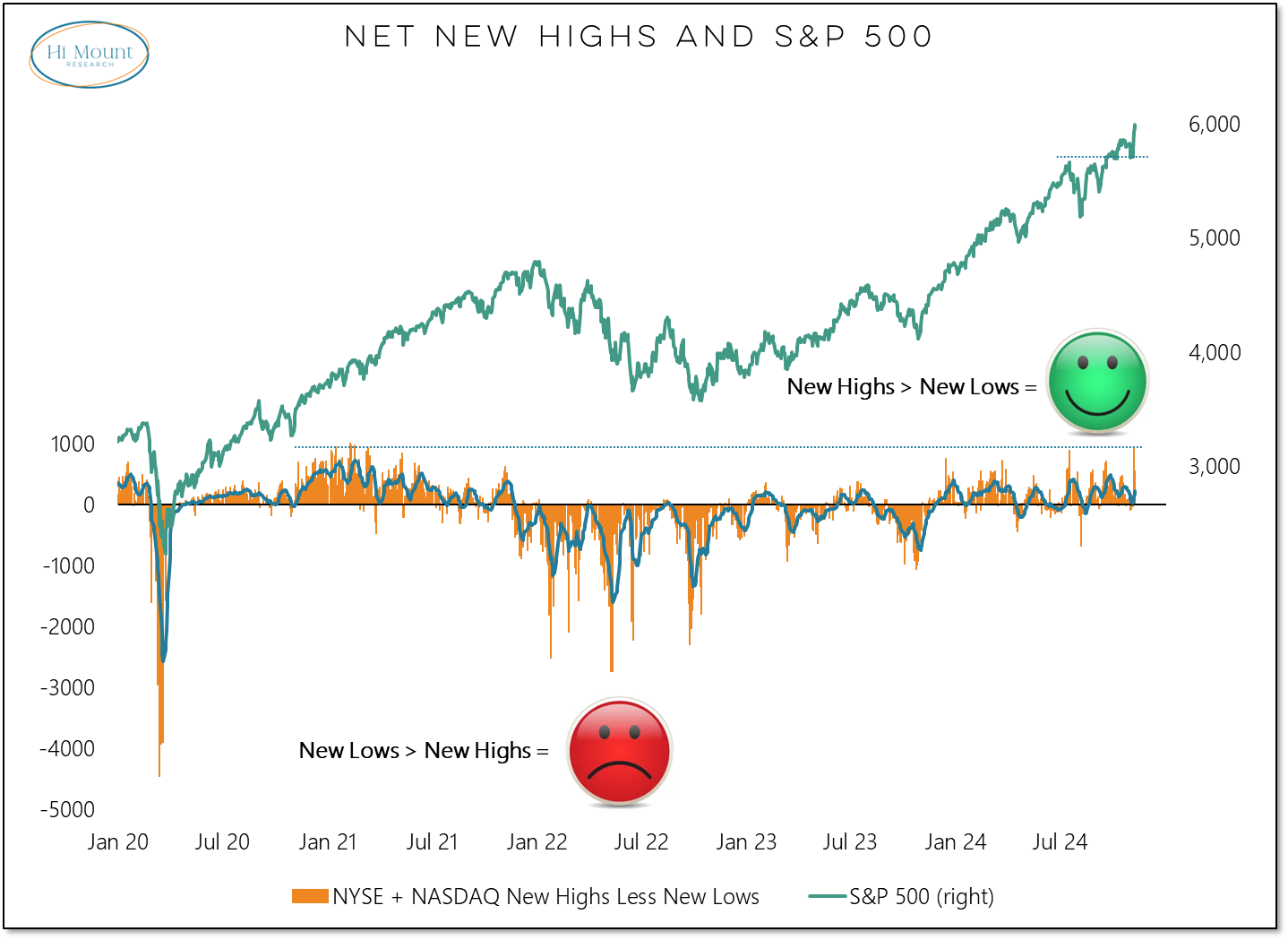

On Monday, more stocks were making new lows than new highs. By Wednesday, net new highs reached their highest level since early 2021.

Set politics aside and focus on the market facts: as long as new highs are consistently exceeding new lows, it’s a smiley face market.

The trend in net new highs has been rising for 58-days in a row (the longest stretch since 2022). That helps keep our Tactical Fear or Strength Model on a positive signal. But as good as the broad market’s performance was last week, we failed to trigger a new breadth thrust (based on our preferred indicator, which measures the percentage of S&P 500 stocks making new 20-day highs) - refer back to last week’s update for more details. Th lack of a breadth thrusts means that the current breadth thrust regimes expires in three weeks. And the going could get tougher without that tailwind.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.