Stocks Behaving Like Harris Will Win

Quiet strength has ebbed, but market behavior favors the incumbent party

Portfolio Applications update: We have published updates to both our Systematic and Dynamic model portfolios. Subscribers can click on the links to read the reports or scroll down to see a summary of the current holdings in our Blue Heron Allocation Portfolio and Dynamic Cyclical Portfolio

Key Takeaway: Despite last week’s uptick in volatility, stocks are behaving like they usually do when the incumbent party wins the presidential election. But fading global strength and a retiring breadth thrust regime could point to more of struggle as we head into 2025.

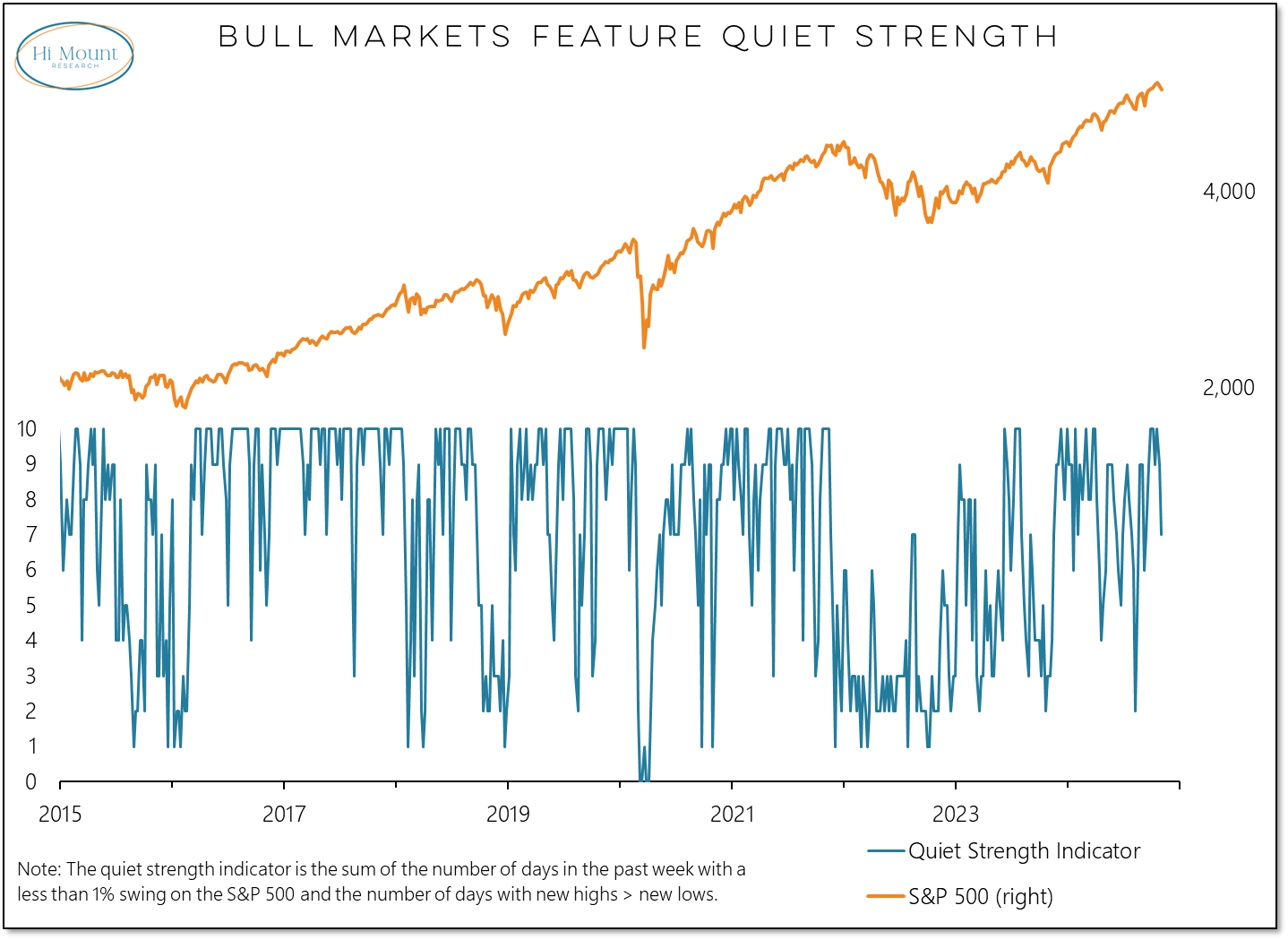

A remarkable run of quiet strength was interrupted last week. Not only did the market experience its first 1% swing in 30 days, but there were also multiple days with more new lows than new highs.

After faltering in early October, the percentage of ACWI markets above their 50-day averages has accelerated its decline as we have entered November. Global equity market trends are becoming more challenging, but our Bull Market Behavior checklist has been resilient overall.

On a global basis, last week saw more 52-week lows than highs for first time since May and most new lows since last October.

For the first time this year, 12-month new lows exceeded 12- month highs in October.

In 2020 the Dow Industrials lost ground between the 2nd convention and election day and the incumbent party lost the election. The same thing happened in 2016.

This year the Dow gained 2.7% during that time period. You need to go back to 1968 to see a gain that large in a year when the incumbent party lost:

Going back to 1900, the Dow has posted a median gain of 5.8% between the 2nd convention and election day in years when the incumbent party won, versus a median loss of 1.5% in years when the incumbent party lost.

The market continues to enjoy a tailwind provided by last December’s surge in new 20-day highs. This has been a reliable signal of persistent strength going back 40+ years. But without a near-term surge, this tailwind expires in less than a month.

The lesson from Breadth Thrusts is that strength begets strength. The corollary is that the market has tended to struggle in the absence of breadth thrust regimes.

For more charts and commentary, download the entire weekly deck.