Exuberant Investors Leave Little Margin For Error

We need bulls to have a bull market but excessive optimism is a headwind as we begin 2024.

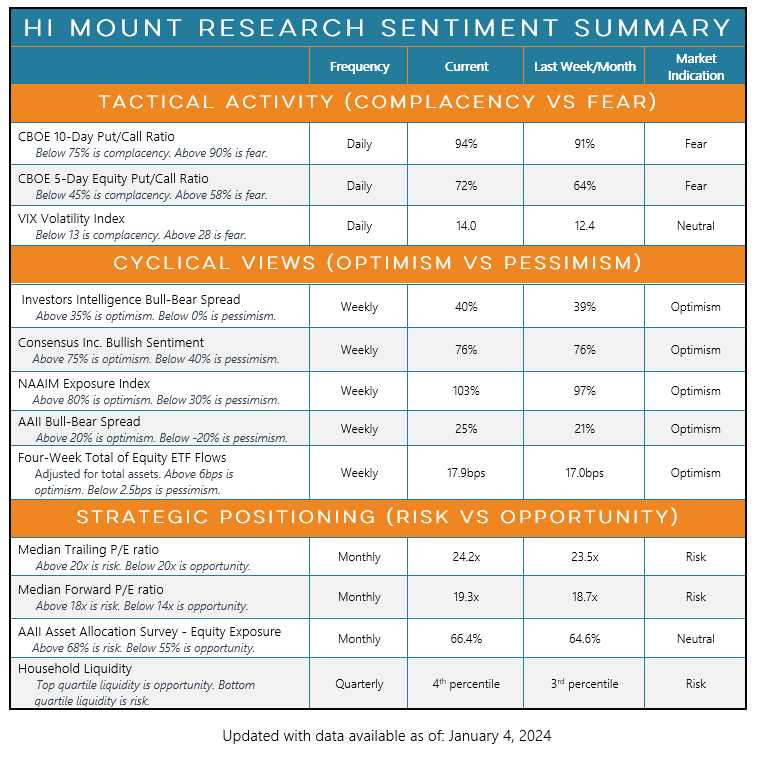

Key Takeaway: Investor optimism has soared to multi-year highs and strategic positioning indicates more risk than opportunity. Risks are most acute after excessive optimism reverses, sentiment is a headwind for stocks from both a cyclical and secular perspective.

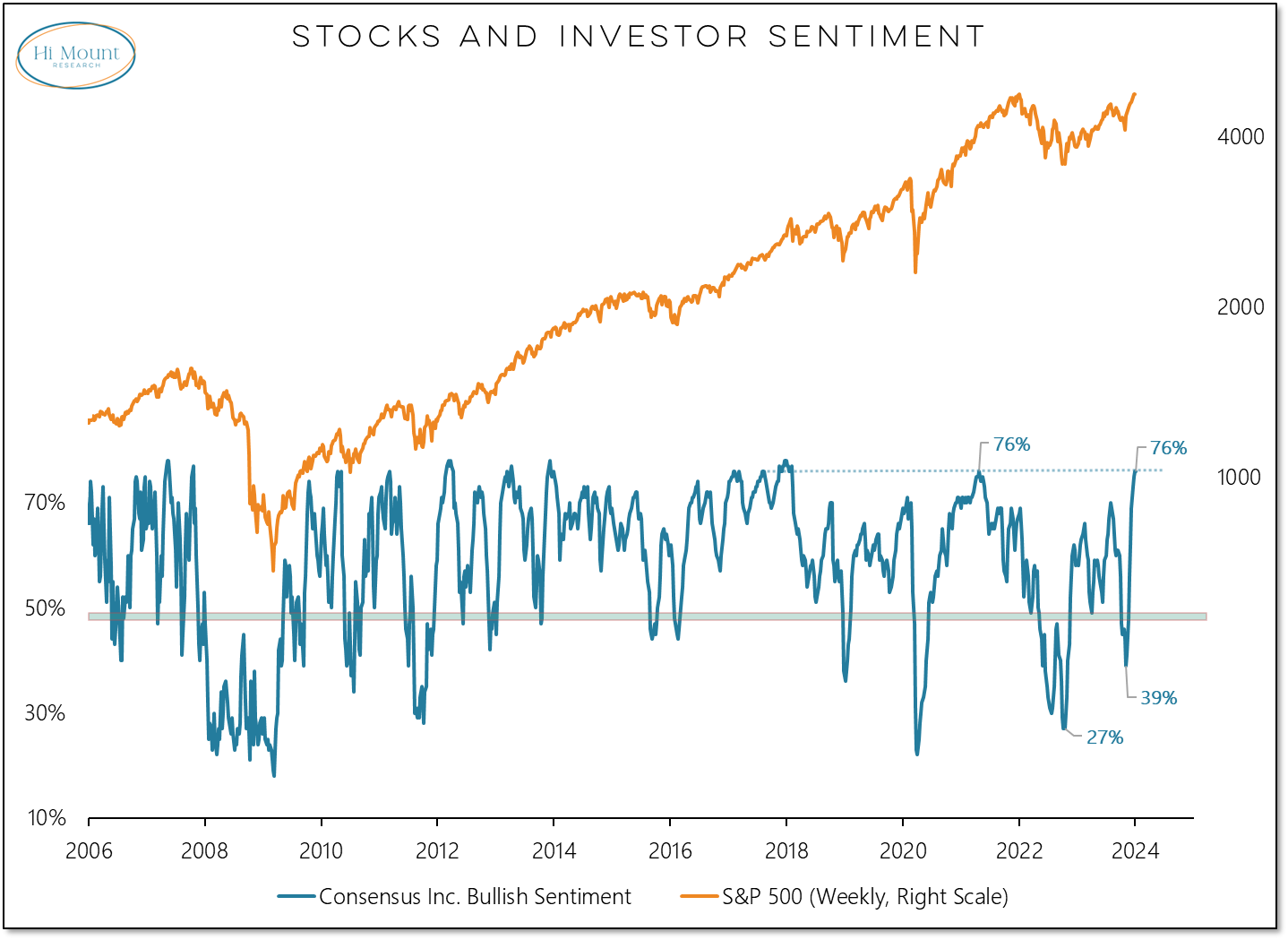

Consensus Bulls are at their highest level in over six years, matching the peak level from 2021.

This is not an isolated reading.

The Investors Intelligence bull-bear spread has moved to a new cycle high.

Before pulling back this week, the NAAIM exposure index had climbed to its highest level since just prior to the 2022 S&P 500 peak.

The AAII asset allocation survey shows equity exposure rising and cash levels collapsing.

These rising cyclical headwinds come at a time when strategic positioning continues to point to more risk than opportunity. The relationship between consumer sentiment and investor positioning has been busted.

Consumer moods are sour but household equity exposure is still historically high and household liquidity is historically low. Both of these have negative implications for equity market returns in the years ahead:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.