S&P 500 Still Shy Of A New High

2023 finished with plenty of quiet strength and broad participation but investor positioning leaves little room for disappointment.

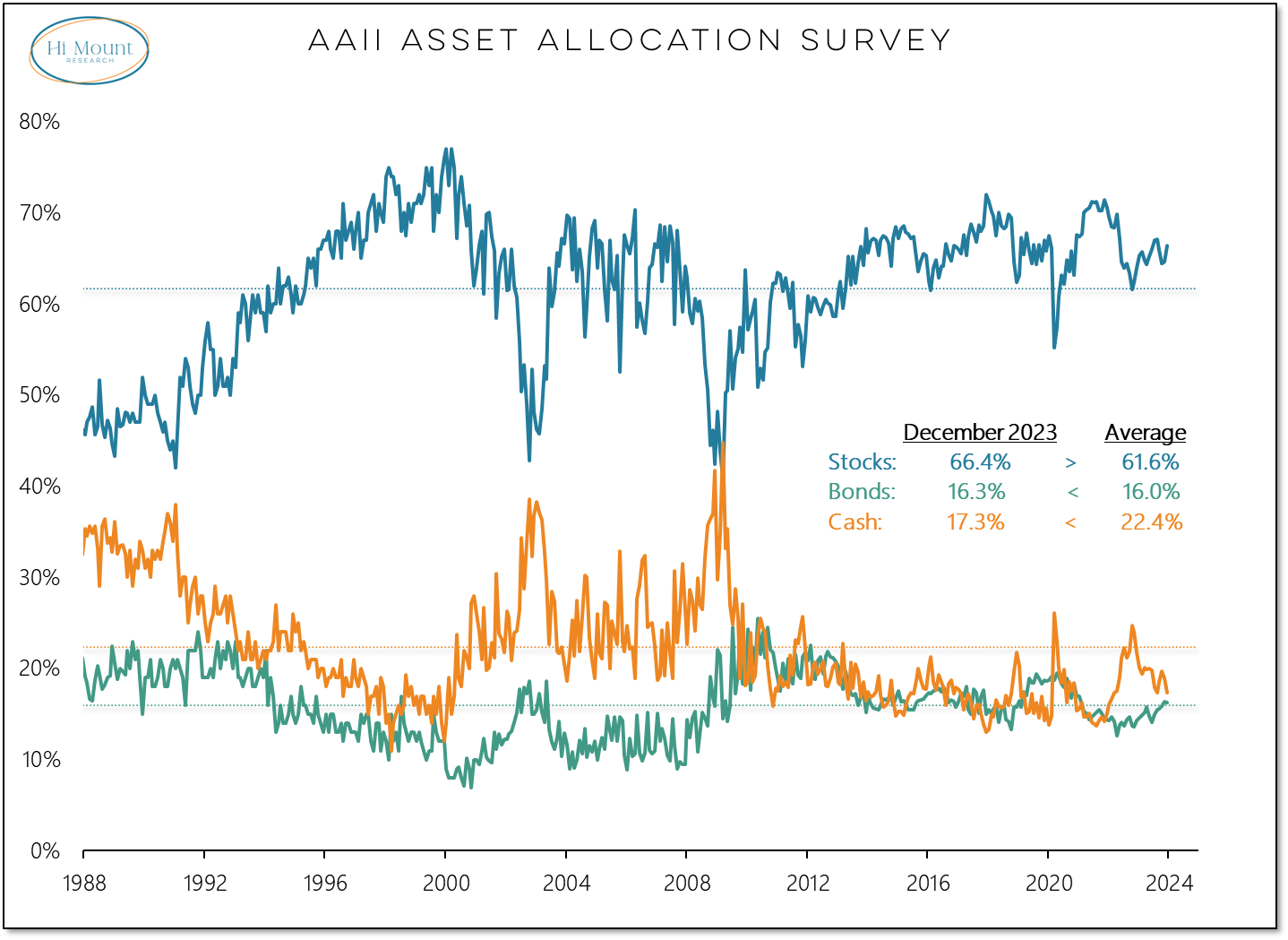

Key Takeaway: Investors are loaded up on stocks (and loathe cash) while the S&P 500 is still below its Jan 2022 peak.

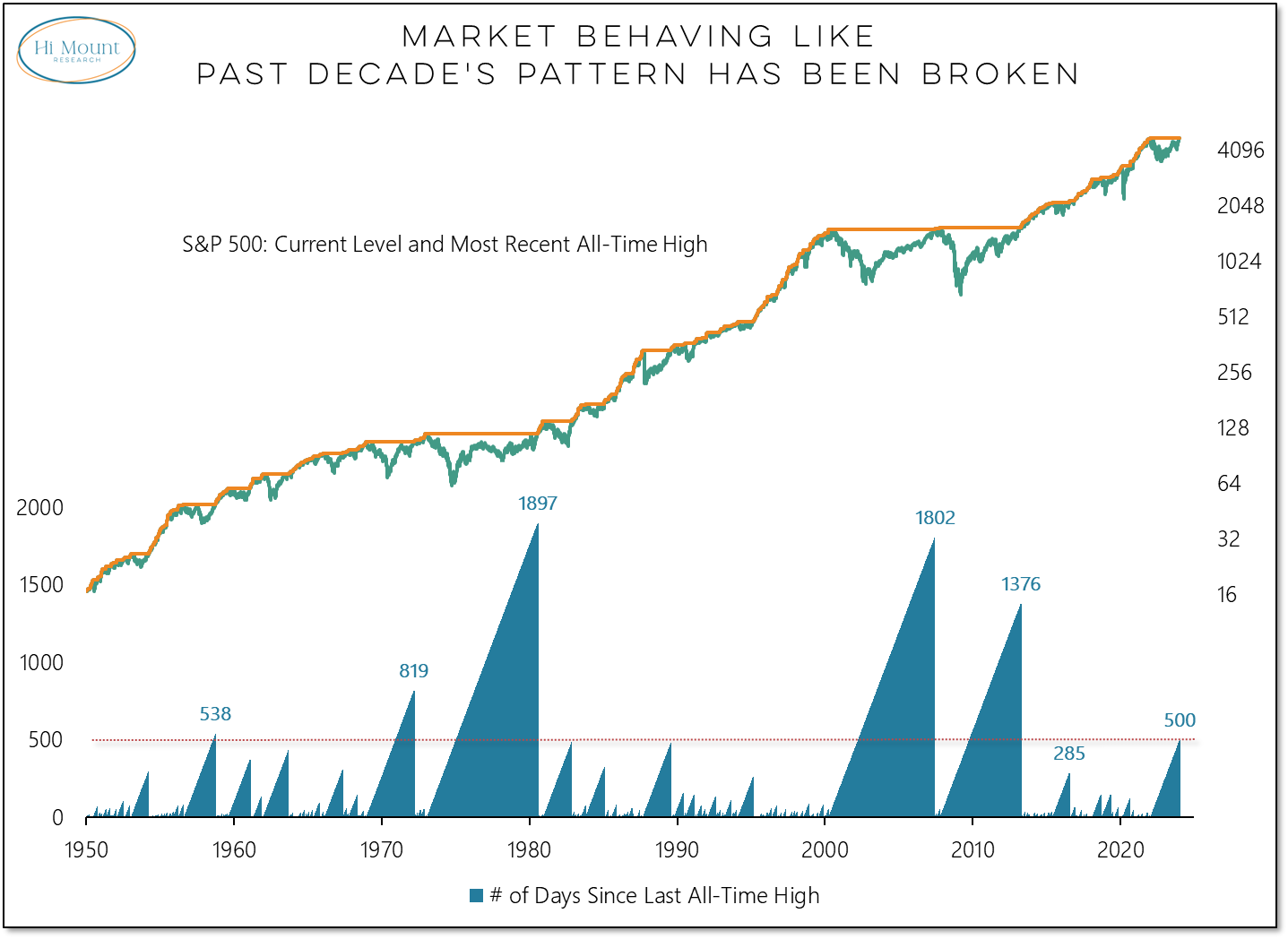

It has been 500 days (and still counting) since the last all-time high for the S&P 500. That is the longest stretch without a new high in over a decade (and the sixth longest stretch in the past 75 years).

While there has been plenty of discussion about what happens after the S&P 500 makes new highs (spoiler alert: strength begets strength), the quiet part is that new highs have not yet been achieved and a failure to get through resistance is not a sign of strength.

We will have a more in depth sentiment update later this week (among other changes that are in the works for 2024, we will be re-introducing our weekly Sentiment Report), but the monthly AAII asset allocation data for December shows that investors remain fully invested in stocks and cash on the sidelines is at below average levels (and falling). That is late-stage positioning.

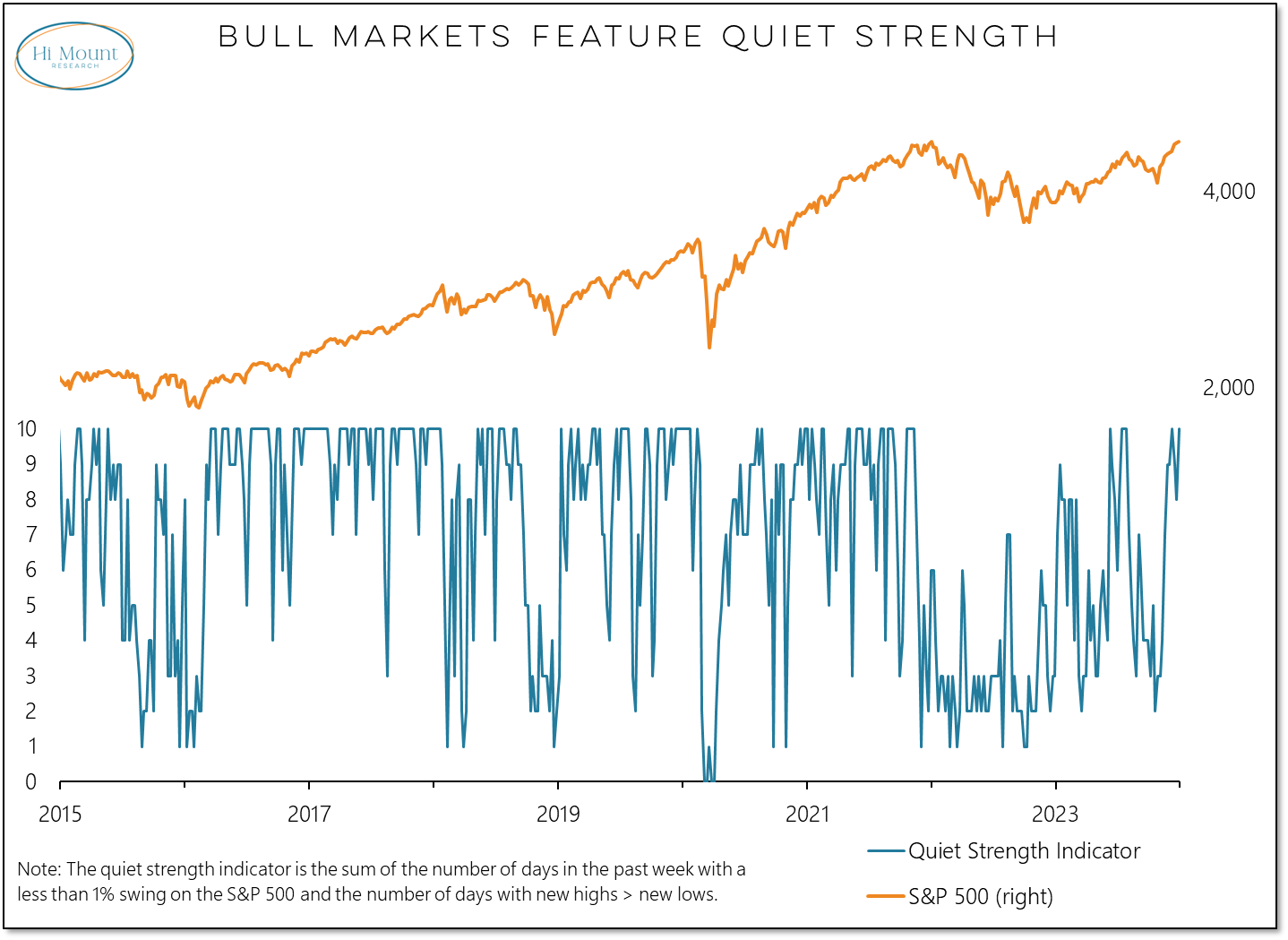

While the risks of disappointment are high and the lack of a new high for the S&P 500 is a potential irritant, recent market behavior has been robust. We are seeing the type of quiet strength (lack of big swings plus more new highs than new lows) that is characteristic of sustained rallies. If this persists, the market is probably not getting in much trouble.

Paid subscribers can keep reading for the latest updates to the Bull Market Behavior Checklist (still 6 out of 6) and our Relative Strength Rankings (small-caps are in the lead).

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.