Equities Are In The Spotlight But Its Time For A Broader Conversation.

This new environment calls for a return to old approaches

The journeys continue, and there is rarely a dull moment.

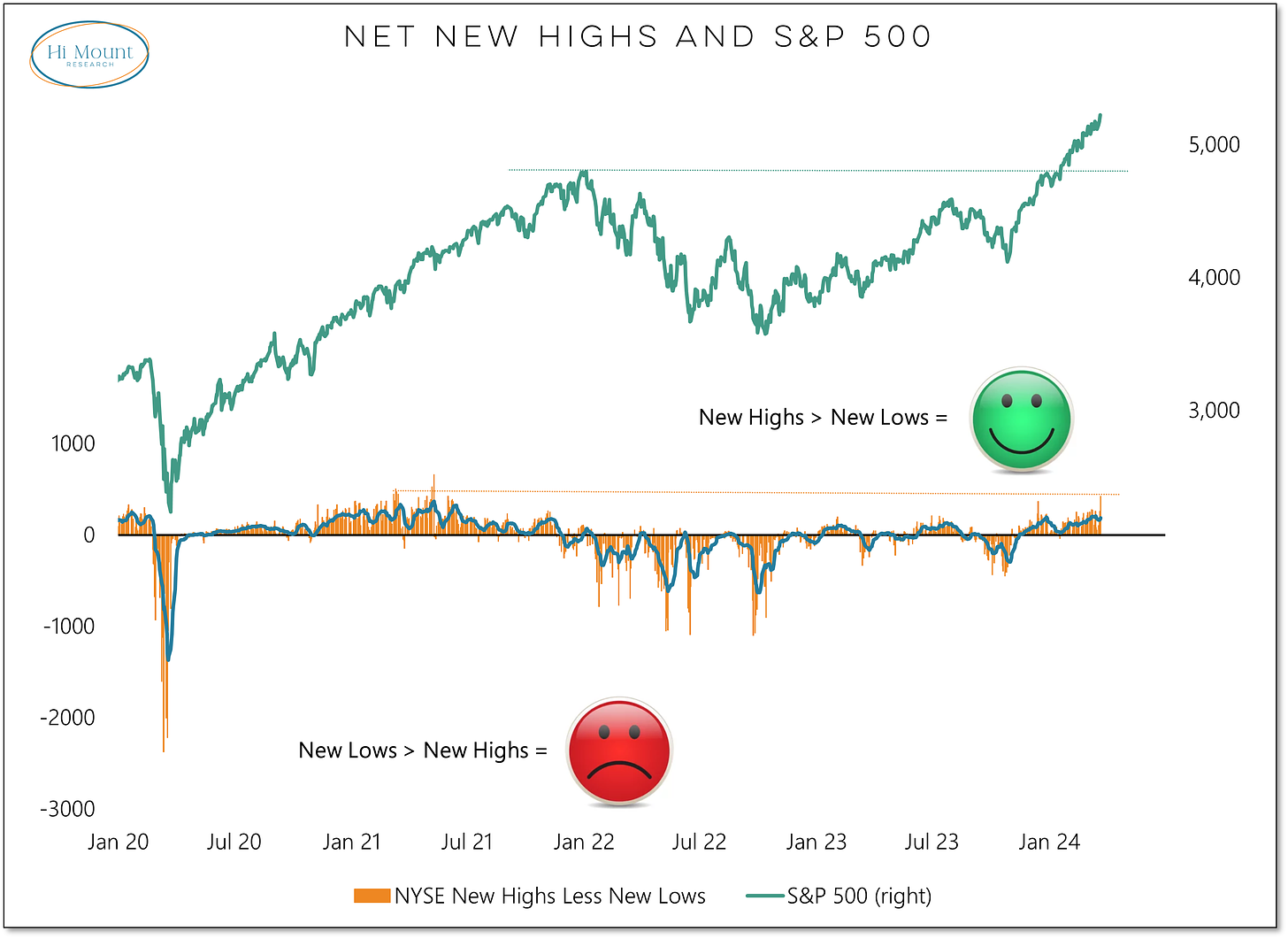

Stock market indexes continue to climb, and participation is robust. This week has seen the most stocks making new highs in nearly three years. New highs in new highs lead to new highs elsewhere. Financial stress is absent and, at least for now, this everything rally is on firm footing.

Simply put, if this isn’t putting a smile on your face, you might just be a congenitally unhappy person.

For a closer look at current breadth and trend conditions, download and review our latest Bull Market Behavior Checklist.

But as engaging, or even entertaining, as it may be to consider the relative health of an equity market rally, the more important questions for the months and years ahead have to do with portfolio management from an asset allocation perspective. There is ample evidence that equity market returns over the next decade are unlikely to match the experience of the past decade.

For many, asset allocation now means a binary decision between stocks and bonds. Remembering to include commodities as part of the asset allocation conversation (even if they are not always part of the portfolio) will be one of the keys to success going forward. This is not a novel insight – it is remembering the lessons of history. As you can see below, commodities right now are not just asking to be discussed in conversation, they are deserving to be included in portfolios.

As I told one of my Econ students earlier this week, smaller moves that keep you in harmony with the underlying trends can help avoid big mistakes in periods of stress or euphoria. Investment decisions have both a financial and psychological calculus. Ignoring this reality and refusing to adapt to market conditions can be expensive.

Hi Mount Research was launched just over a year ago with the exact goal of helping financial advisors and investors embrace these new & old realities. In balancing the financial and the psychological, we provide the tools necessary to tune out the noise, listen to the message of the market and adapt as necessary.

On many fronts, 2023 turned out to be the most unexpected year of my professional life, peppered with unexpected challenges and unanticipated opportunities. Now as we move towards the second quarter of 2024, I invite you to take a closer look at what we have to offer and become part of the Hi Mount Research community.

When you are ready to become a paid subscriber or have any questions, please let me know.

Thanks for reading.