Commodities Make Their Move

Equities receive attention as commodities request an allocation

Key Takeaway: Stocks limped into last weekend and while hair-line cracks exist beneath the surface, the overall trend environment remains strong. While stock market squiggles get investor attention, many are forgetting to include commodities as part of the asset allocation discussion. Now more than ever, that appears to be a major oversight.

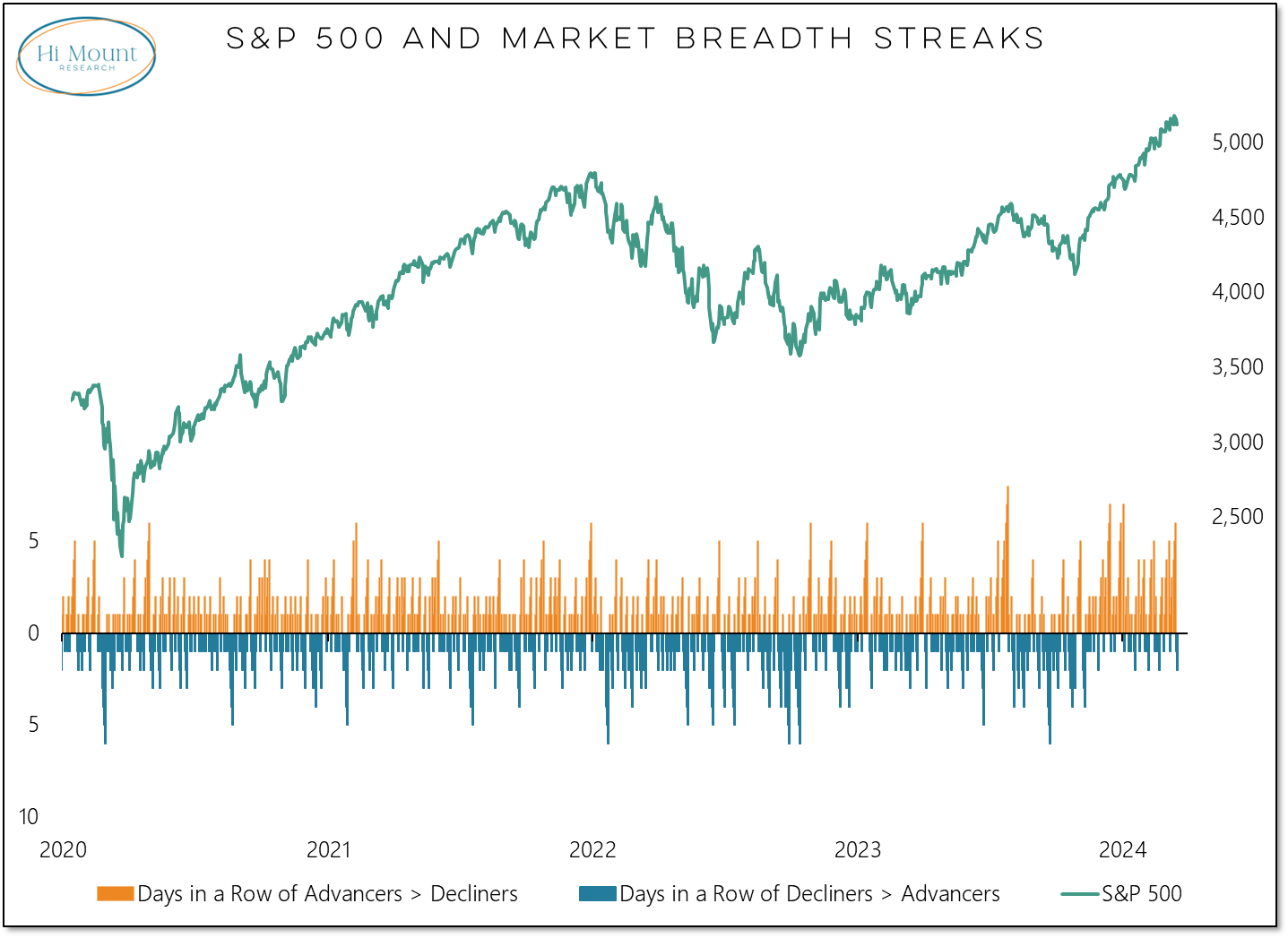

Last week finished with two consecutive days of decliners outpacing advancers on the S&P 500. We have not seen three-in-a-row in that direction since November. The way stocks have opened this morning, it appears unlikely that streak will be broken today.

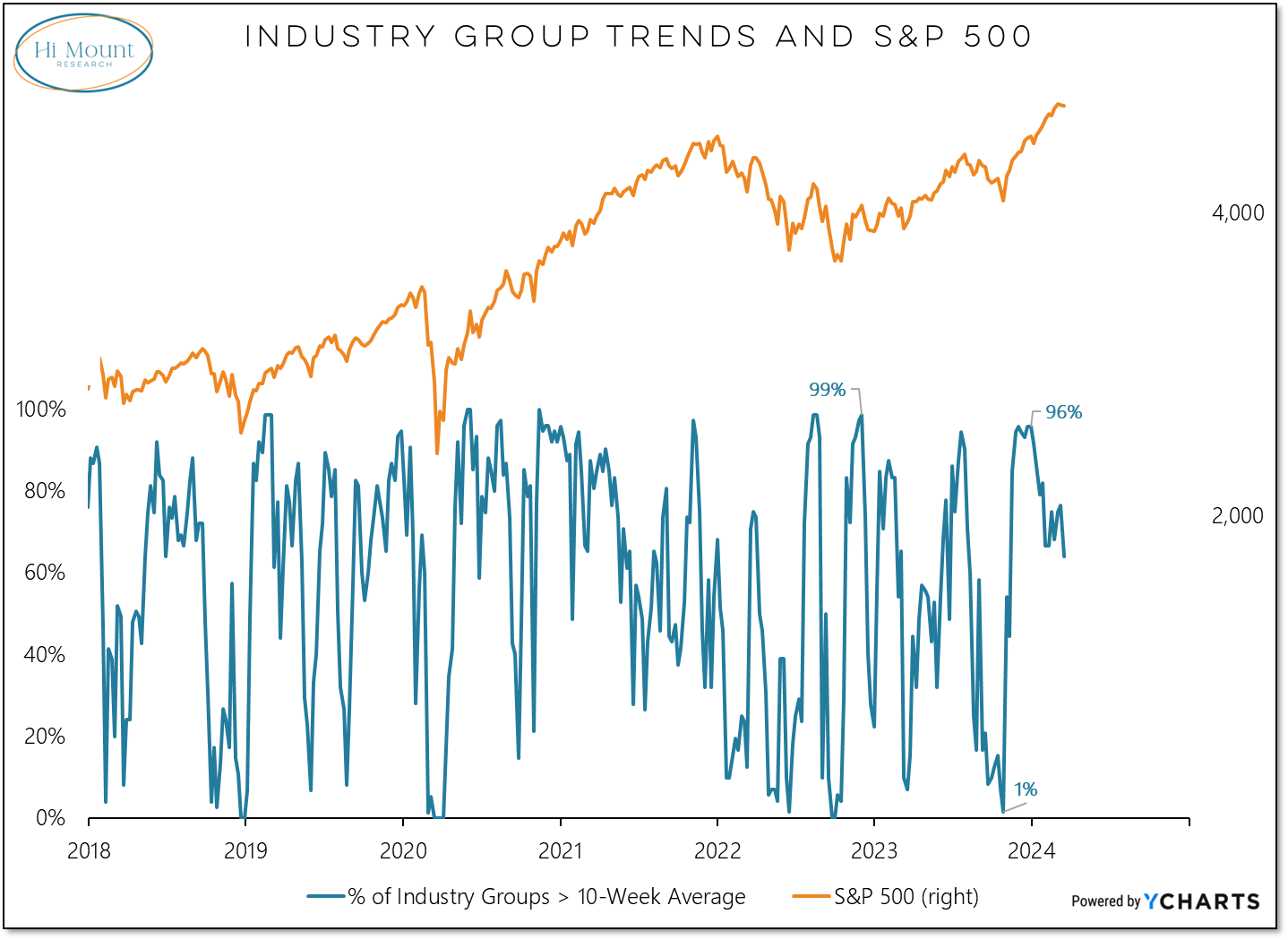

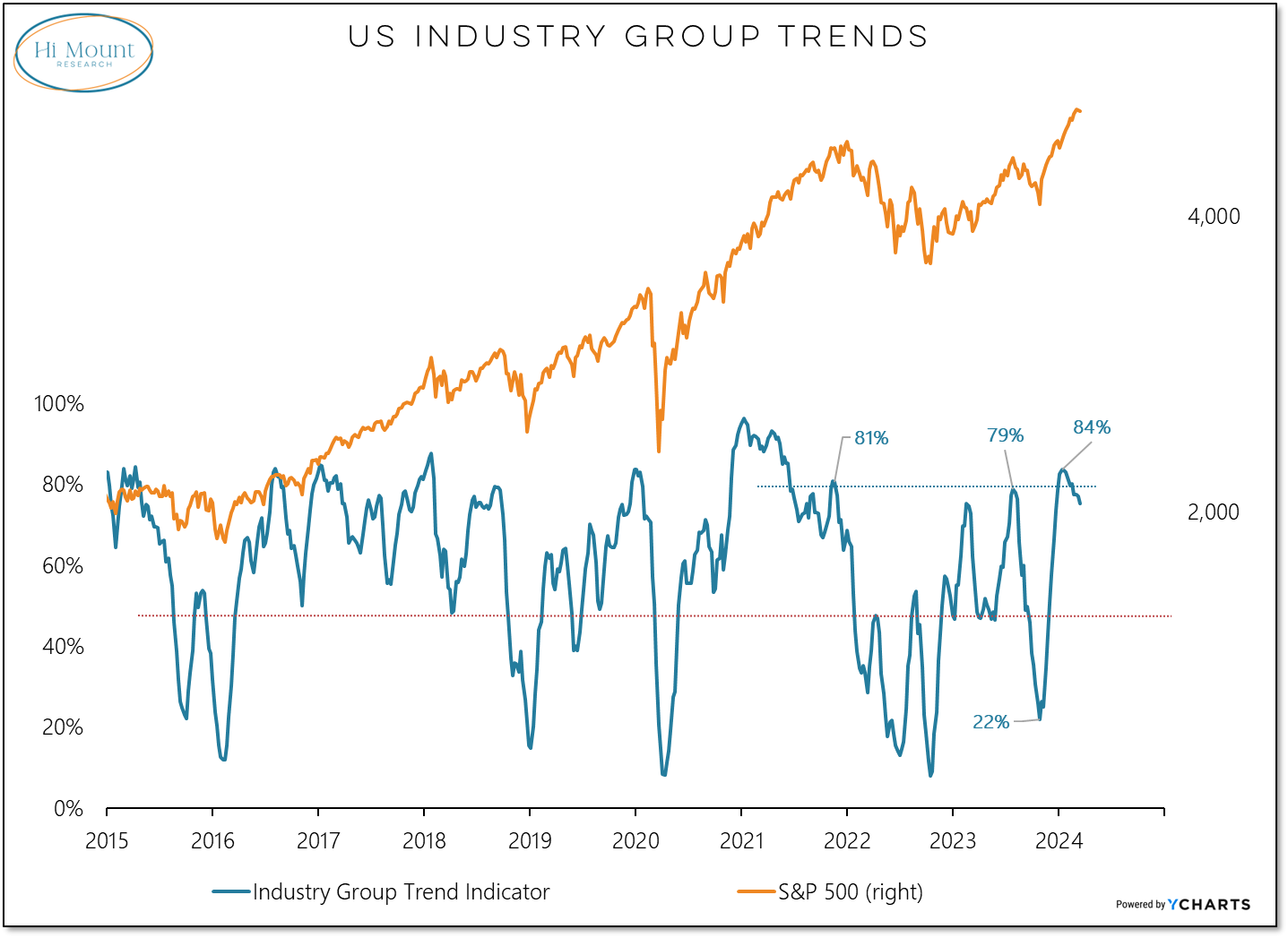

Zooming out, we are seeing the percentage of stocks with 50-day averages above their 200-day averages roll over and the percentage of industry groups above their 10-week average has dropped to its lowest level since mid-November. While this may get bears salivating, it is not catastrophic.

In fact, the overall breadth environment remains strong. Our industry group trend indicator may have peaked but is still elevated, we are just a week removed from a new cycle high in the number of stocks making new highs and all eleven sectors are trading above their 200-day averages.

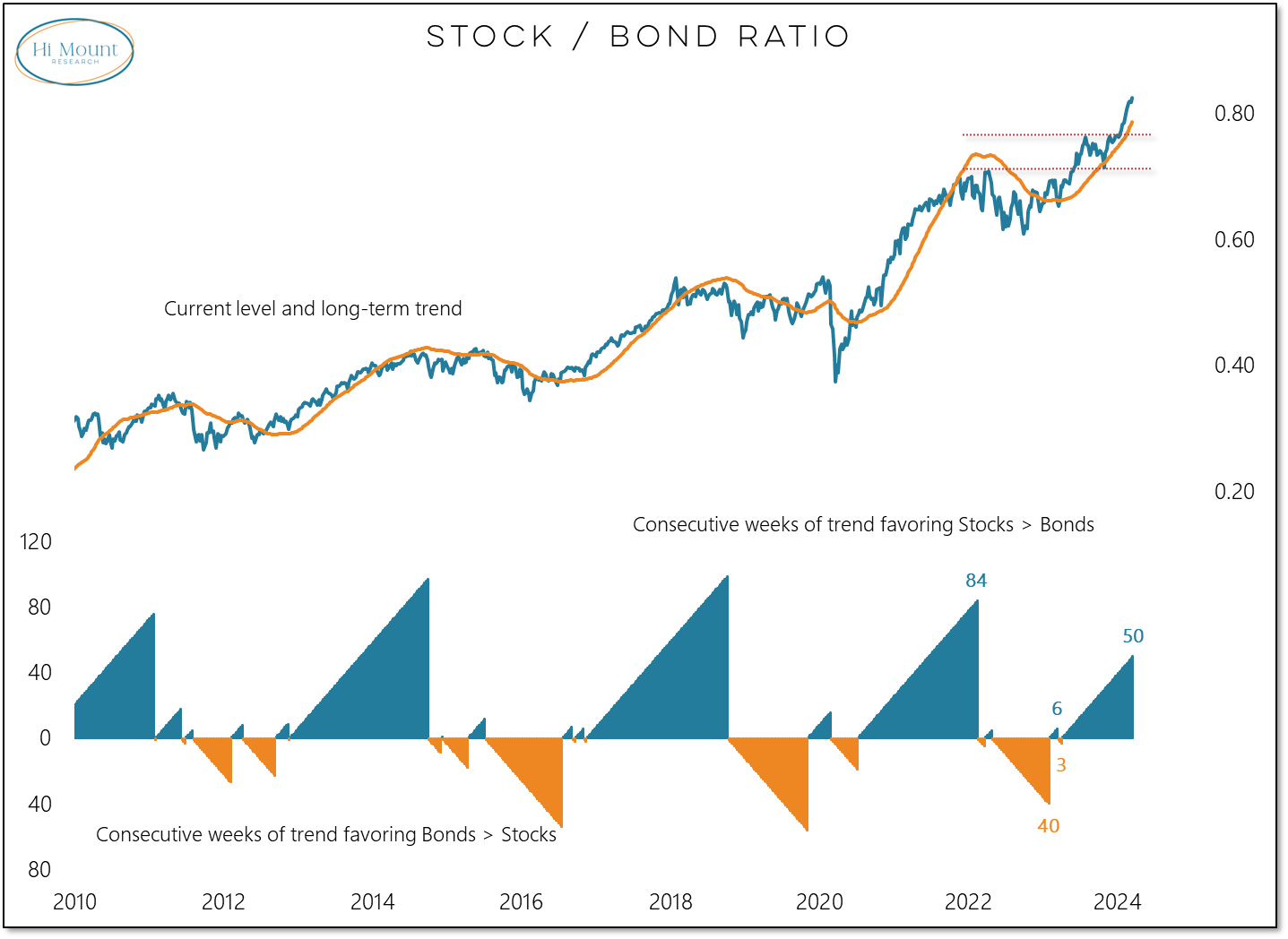

For many, asset allocation decisions come down to a question of stocks versus bonds. On that front, stocks are making new highs versus bonds and deserve the attention they are getting.

But this overlooks commodities as a critical part of the asset allocation conversation. As we discuss below (and in more detail in this week’s Relative Strength Rankings update), commodity strength is improving - our models and rankings reflect that but investor allocations do not.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.