Chart for the Weekend: Who's Driving

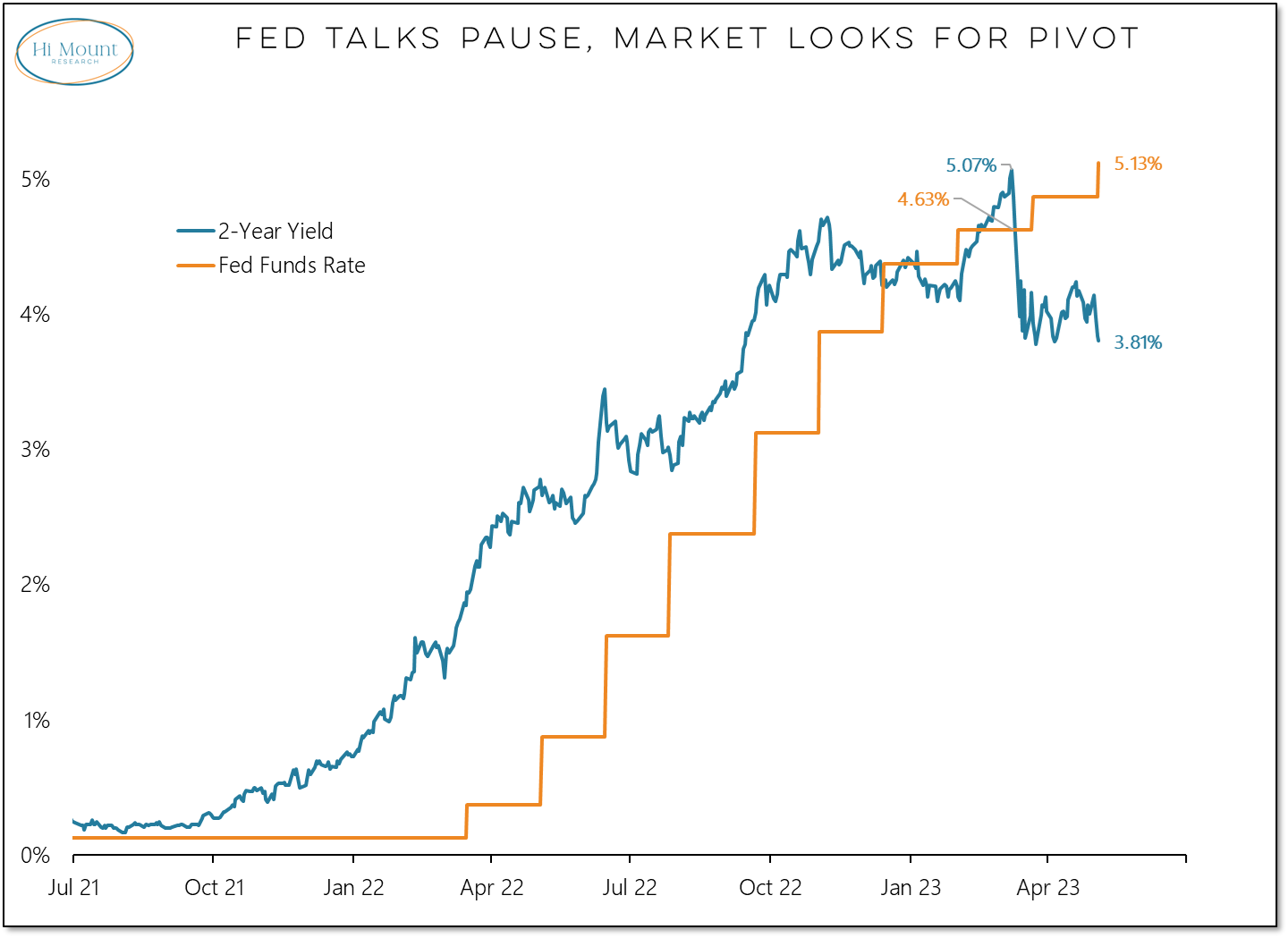

They are fighting over the wheel as Fed talks pause but market prices in pivot

The Fed has raised rates to where it expects them to be at the end of the year and is ready to talk about a possible pause. The market is in full pivot mode, with the yield on the 2-year T-Note falling by more than 125 basis points since early March.

More Context: The dispute between the Fed and the market is becoming historically extreme. For the 2-year T-Note yield to be below the Fed Funds rate is not exceptional though to see the Fed still raising rates in that environment is extremely rare. The spread between the 2-year and the Fed Funds rate falling by 175 basis points over the course of two months is something that has not been seen since the early 1980’s.

Where do we go from here? The Fed is open to a pause, though even if no further rate hikes are necessary, it doesn’t expect to cut rates until next year at the earliest. The market, meanwhile, is pricing in a 4.5% year-end fed funds rate and sees a zero percent chance that rates finish the year where they are now. Two competing forces trying to get to two separate destinations. Something’s got to give.

In case you missed it: our May Weight of the Evidence update (and related Market Insights video) have been unlocked so that prospective paid subscribers can see what lies behind the paywall. Reach out if you would like more info about Hi Mount Research and what we offer from both a Market Insights and Portfolio Applications perspective.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.