Unable To Get Back In Gear

Cyclical weight of the evidence continues to argue for caution

May 3, 2023 – Key Takeaway:. After losing the luster of early-year strength, the stock market spent April trying to gain traction. Secular headwinds aside, the acute challenges are these: The market is pricing in second half Fed pivot that seems unlikely and all the net gains for the S&P 500 in the past 30+ years have come in periods of either strength (new highs > new lows) or fear (VIX > 28). In this environment, stock market bulls are fighting both the tape and the Fed.

Liquidity: Money supply is still 30% higher than it was pre-pandemic but is falling on year-over-year basis for the first time in history.

Economic Fundamentals: Labor market imbalances are heading in a favorable direction, but inflation is proving to be more persistent than transitory – almost as if these pressures had been building for years.

Valuations: Stocks may be less expensive on an absolute basis than they were when the bear market began, but relative to bonds, they are more unattractive (from a valuation perspective) than at any point in the past 2 decades.

Sentiment: Despite claims of record pessimism in 2022, the investor love affair with US equities persisted. In 2023, investors are looking elsewhere. Secular challenges become more acute if that behavior persists.

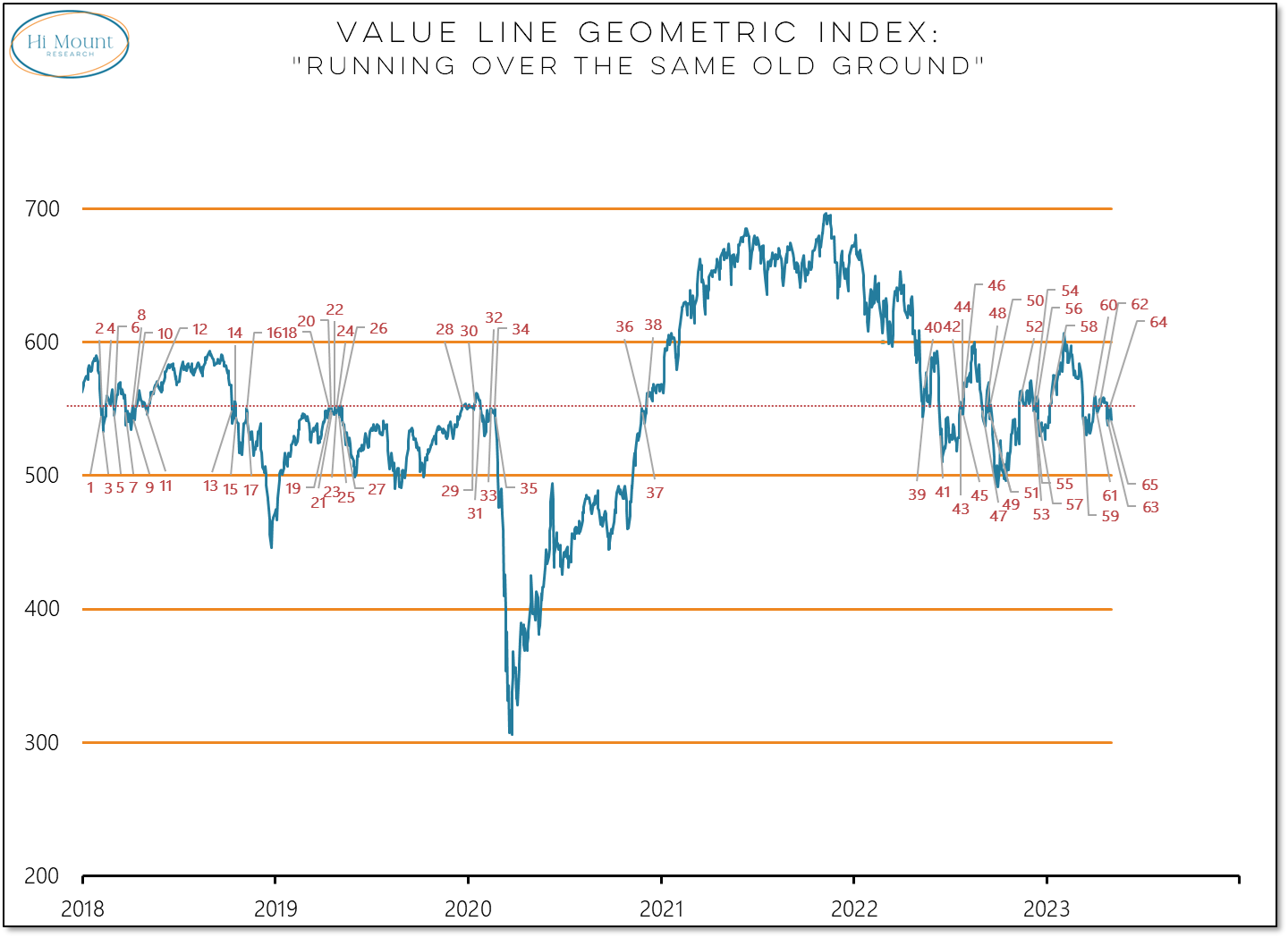

Market Trends & Momentum: The trends in market cap-weighted indexes are turning higher, but the median stock keeps running over the same old ground. The Value Line Geometric Index has passed through the 550 level 65 times since the beginning of 2018 (that’s an average of once a month for 5+ years).

Breadth: The bloom is off the breadth rose with only one day in the past two months producing more new highs than new lows. Global breadth is getting in gear, but the US is not participating.