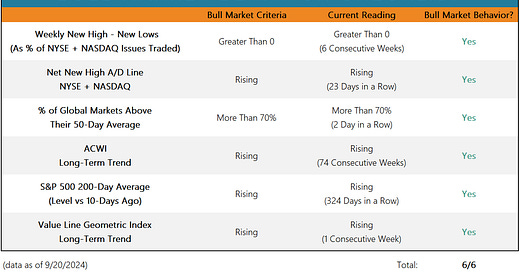

Key Takeaway: With the indexes hitting new highs and the broad market remaining in gear, there is no shortage of bull market behavior from a price and breadth perspective. Sentiment continues to play a key role in this year’s stock market rally.

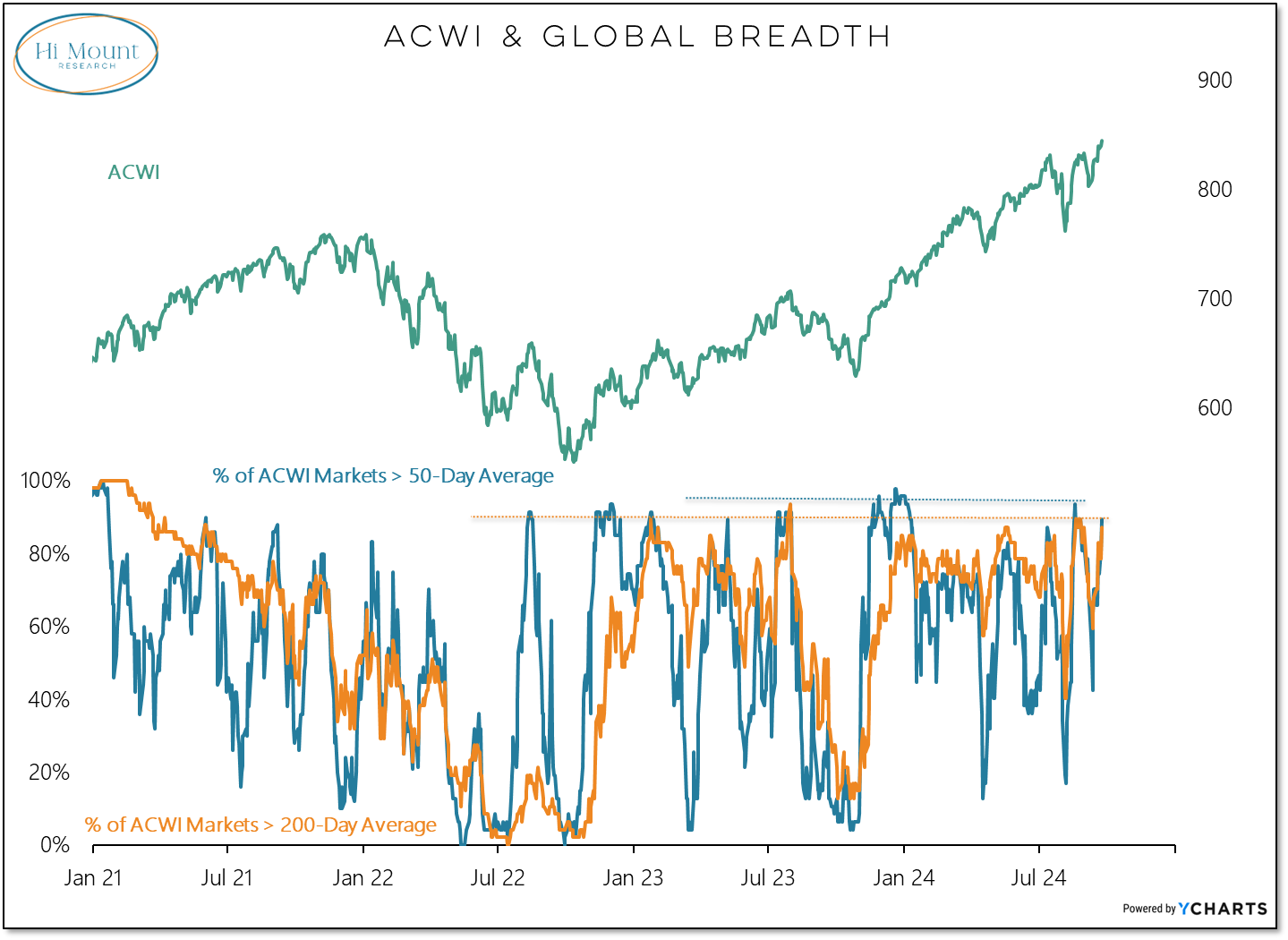

Net new highs hit a new cycle high last week and the 200-day average for the S&P 500 has relentless moved higher for over a year. The percentage of ACWI markets is back into the green after flirting with a breakdown earlier this month.

In August, the percentage of ACWI markets above their 50-day average reached the highest level of this year, and the percentage of markets above their 200-day average reached the highest level in over a year. After an early-September swoon, both measures have bounced back and are approaching those August highs.

Price strength and robust breadth have become well-advertised at this point. Sentiment gets overlooked in the supportive role it continues to play. In dropping to its lowest level of the year two weeks ago, the Investors Intelligence Bull-Bear Spread approached what has been an important threshold over the past decade. All the net gains for the S&P 500 over the past 10 years have come with the bull-bear spread above 20%.

Optimism bounced back last week and has continued to improve this week. With bulls at 52.5% and bears at 22.9%, the spread has climbed back toward 30%. While too much optimism can make some folks nervous, it’s important to remember that it takes bulls to have a bull market.

Macro risks notwithstanding, with sentiment, trends and breadth remaining positive influences for stocks, its easy to see that the weight of the evidence remains tilted toward Opportunity.