Bonds Get Their Wish, Stocks Get To New Highs

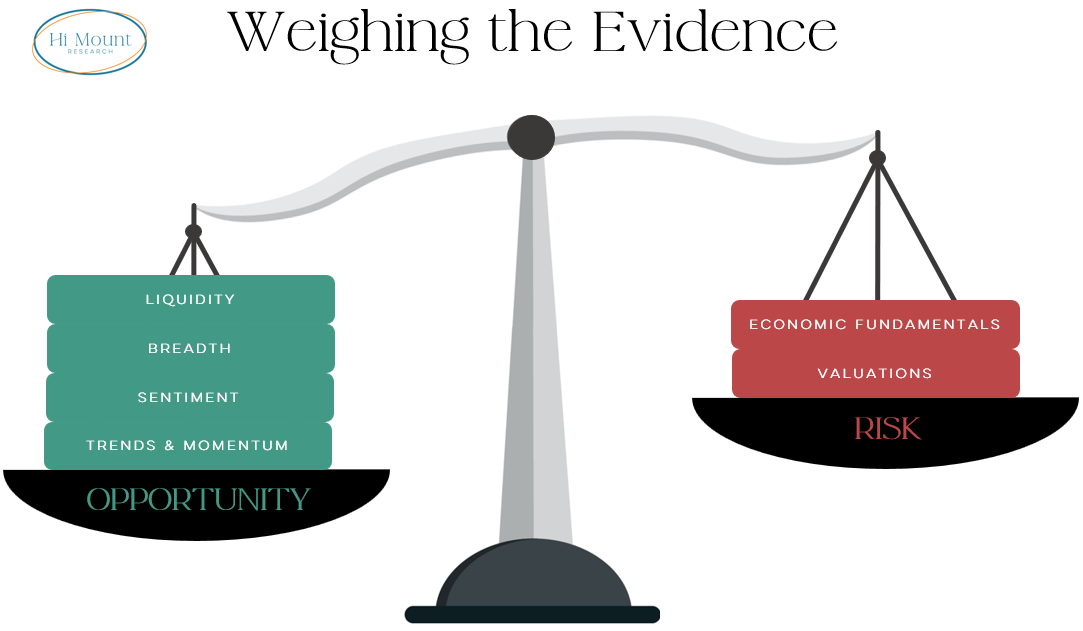

Central bank rate cuts helping tilt scales away from risk and toward opportunity

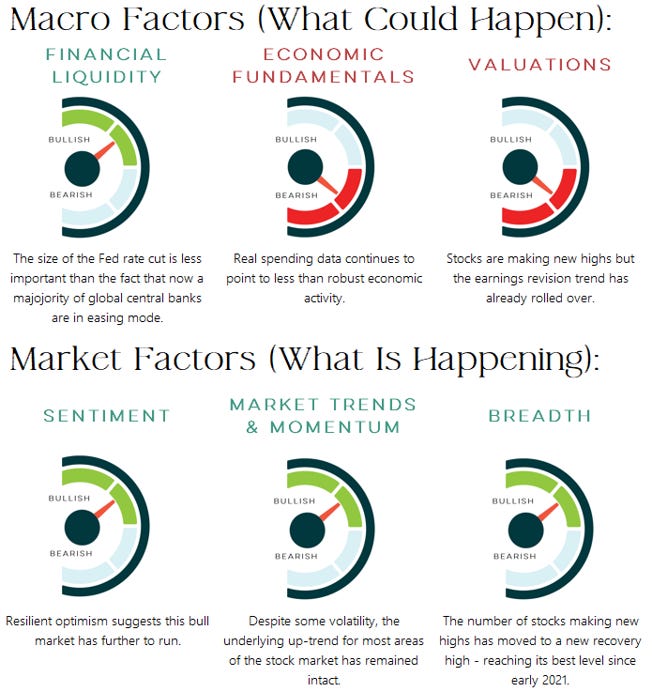

Key Takeaway: Liquidity has improved on the back of central bank rate cuts this past week. While elevated valuations and deteriorating economic fundamentals could end up derailing the rally, we are not seeing evidence of that right now.

Prior to last week’s 50 basis point rate cut by the Fed, the spread between the 2-year yield and the Fed Funds rate was as negative as it has been in the past 40 years. The market was looking for an aggressive move by the Fed and the Fed delivered.

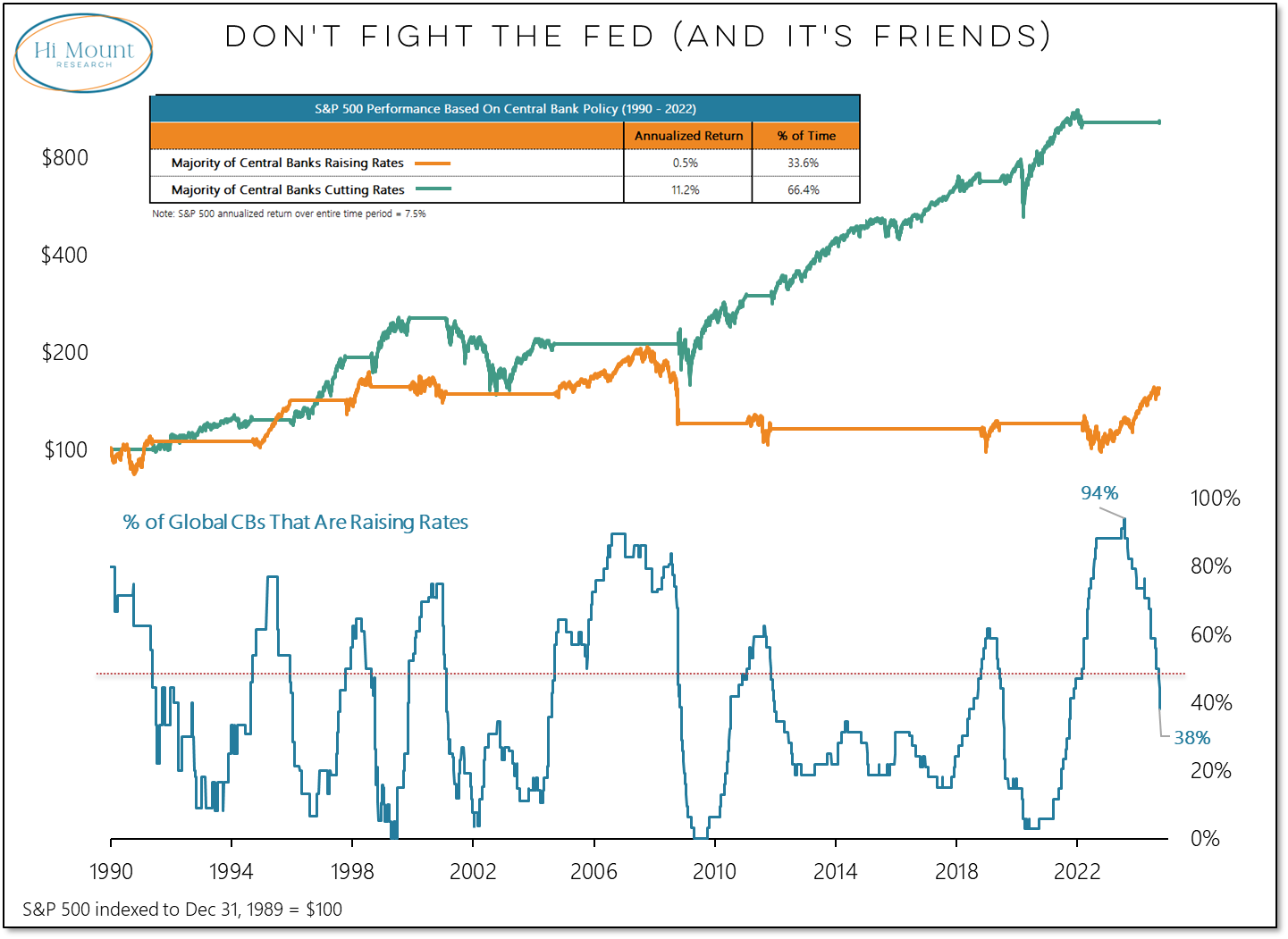

When it comes to Fed rate cuts, size doesn’t matter as much whether they are a lone wolf or in the majority. Virtually all the net gains for the S&P 500 since 1990 have come when more than half of global central banks have been in easing mode.

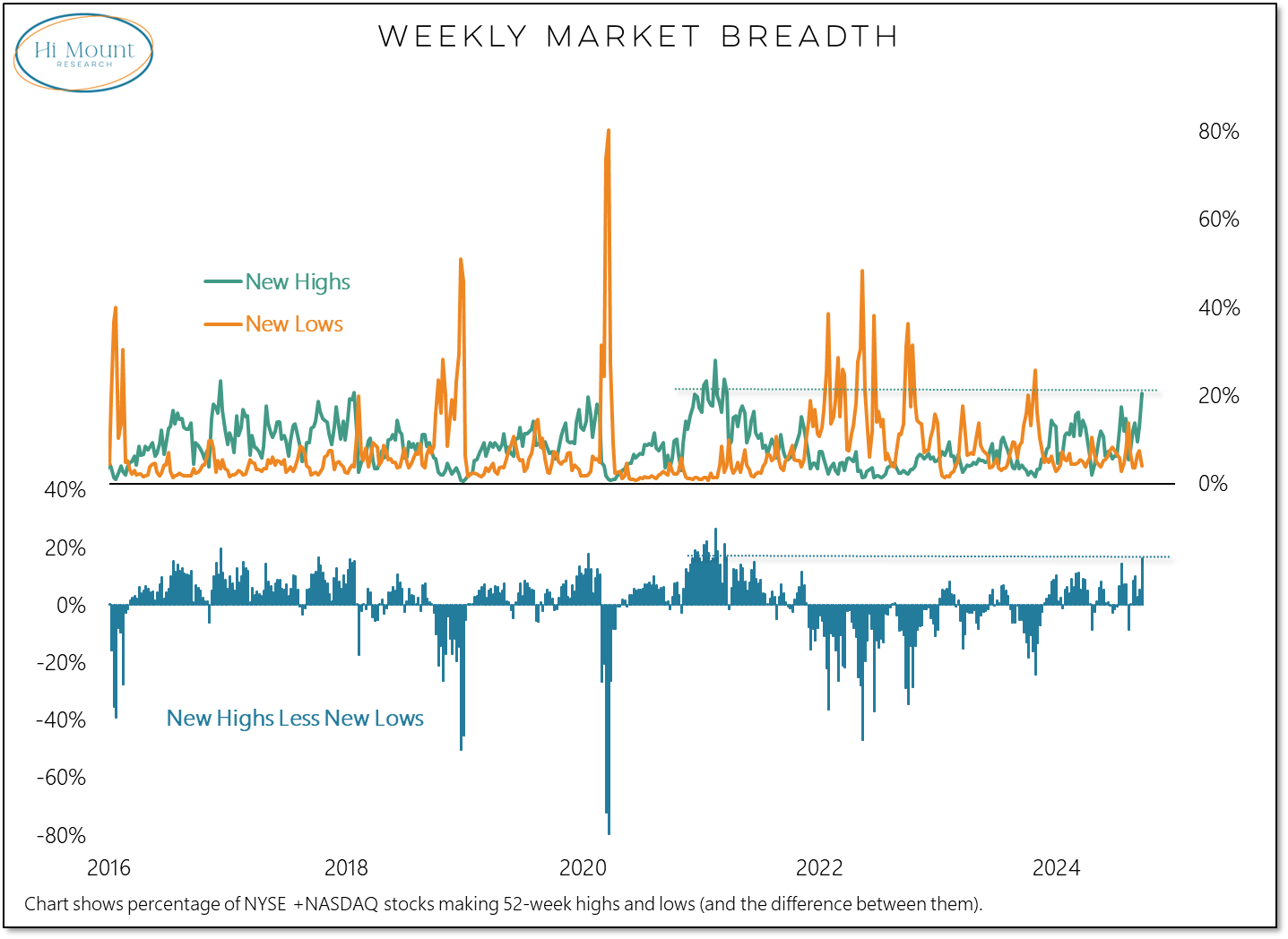

Stocks rallied in the wake of last week’s decision by Fed (and follow-on cuts by other Central Banks). The new high on the S&P 500 was accompanied by an expansion in the number of stocks making new highs. The number of stocks on the NYSE+NASDAQ making new highs last week reached its highest level since early 2021. Don’t fight the tape. Don’t fight the Fed.

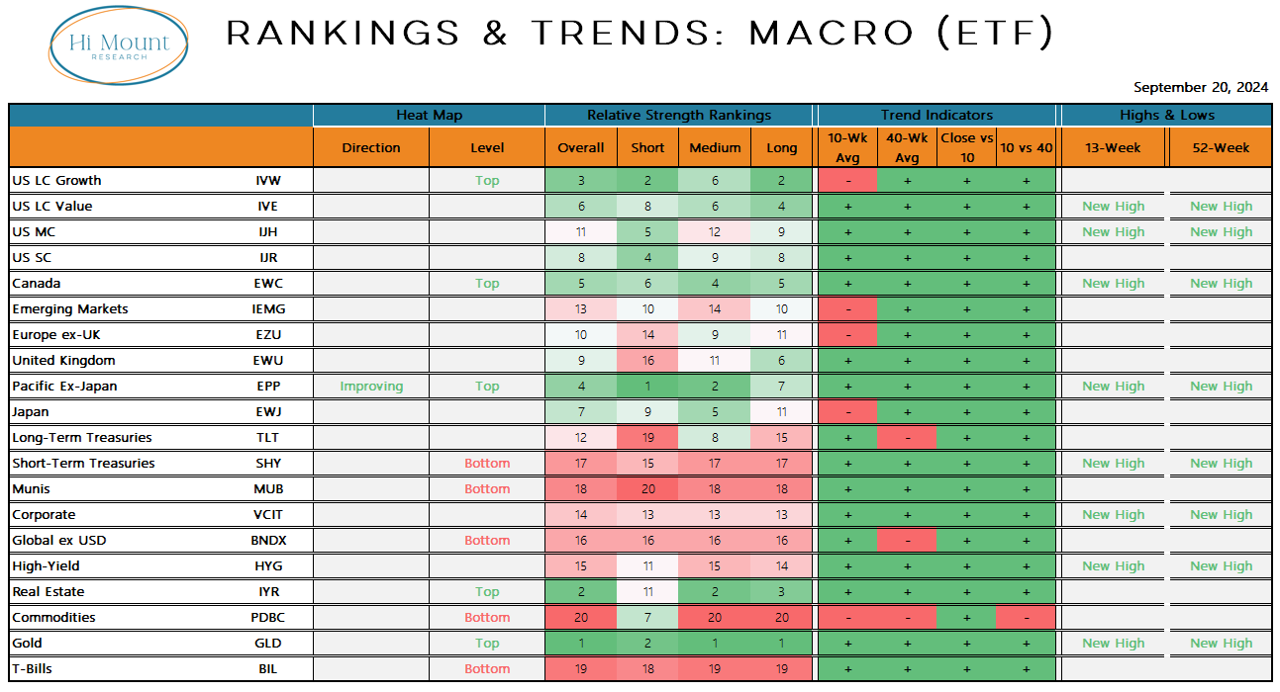

Our global macro rankings show that Gold continues to make new highs and sits atop the rankings. Global equity market strength is broadly-based. US Large-Cap Value and Mid-Caps made new highs last week, as did Canada and Pacific Ex-Japan. Singapore and Malaysia are at the top of our Global Equity Rankings - those rankings are on pages 25-26 of our weekly deck, which is accessible via the link below.

Other key insights from this week’s deck:

Sentiment (pg.13): The weekly AAII sentiment survey has shown more bears than bulls only once this year. If optimism is going to remain resilient, this bull market likely has further to run.

Economy (pg.10): Adjusted for inflation, retail sales are 7% below their 2021 peak and have been positive on a year-over-year basis only once in the past 24 months.

Interest Rates (pg.5): It is not uncommon for the Fed to cut rates with stocks at or near their highs.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.