Broad Market Cracks Challenging Best Month Mantras

When sector breadth is middling, the market is usually muddled

Key Takeaway: Breadth hasn’t broken down, but it is doing things I’ve never seen before. Longer-term trends are fine for now but the path has narrowed and risks are rising.

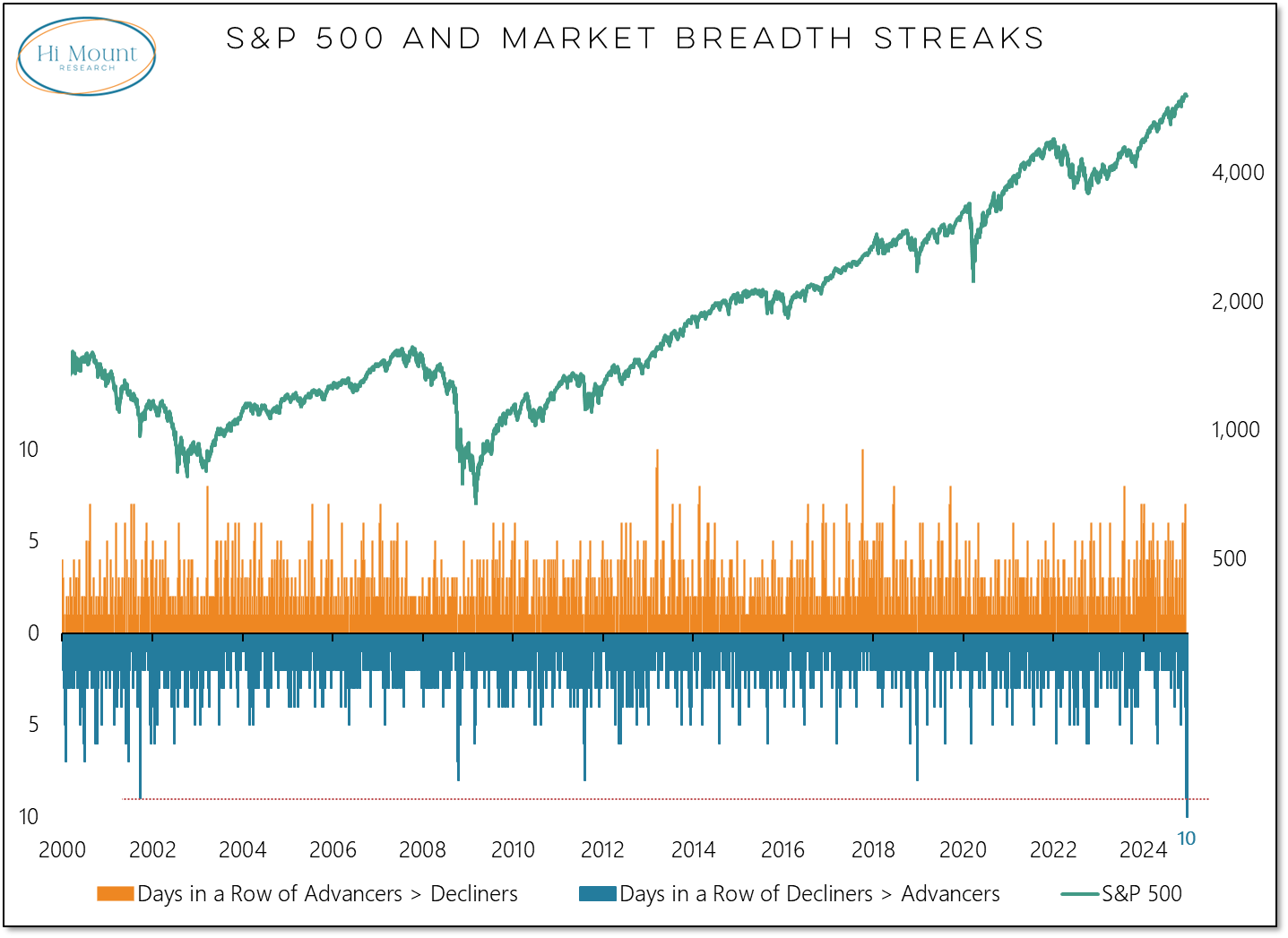

We are 10 trading days into the “best month of the year for stocks” and every day so far has seen more decliners than advancers on the S&P 500. I’ve been watching the market for a quarter of a century and have never seen more sustained weakness beneath the surface.

It is all the more exceptional that the S&P 500 has hit multiple all-time highs during this period.

The market remains quiet, as we are at 19 days and counting without a 1% swing in the S&P 500.

However, we are starting to see new lows outnumber new highs on a daily basis.

On a 10-day average basis, new highs remain more numerous than new lows. But the longer breadth remains weak, the more likely we are to see new lows outpacing new highs and that inevitably puts pressure on the popular averages.

We downgraded breadth to neutral last week due to the lack of a breadth thrust regime. But with the trend in net new highs still rising (for now) it does not pay to get too bearish on breadth.

At the same time, breadth deterioration showing up at the sector level does suggest it is a more challenging environment for the index overall.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.