Risk On, But Less Than Robust

Market action is producing more warning lights, but the exit sign has not been lit.

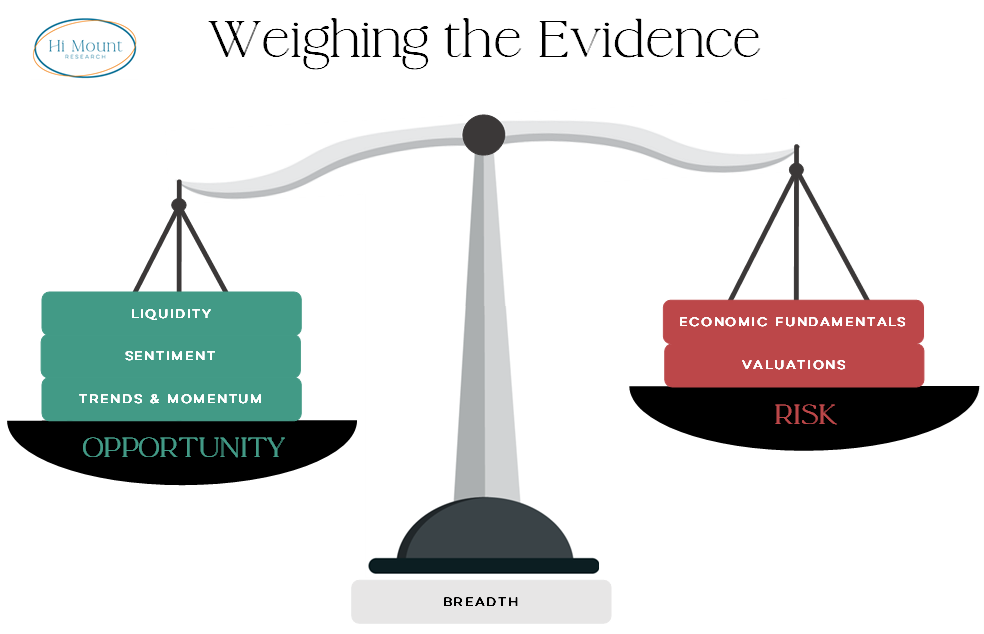

Key Takeaway: Breadth is deteriorating, but there is still evidence of bull market behavior and the weight of the evidence remains tilted toward opportunity. Upward pressure on bond yields and stretched valuations could pressure stocks in 2025.

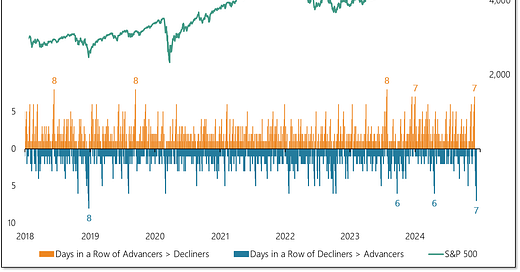

November ended with one of the longest sustained periods of strength of the year. While the S&P 500 has continued to make new highs in December, every day of the month so far has seen more stocks down than up. That makes this the longest sustained period of weakness in more than five years.

While more decliners than advancers is a warning light for the market, a more acute exit sign would be seeing more stocks making new lows than new highs. So far that has not happened and the trend in net new highs continues to rise.

Most price and breadth tends are rising and that is consistent with bull market behavior. The exceptions emerge when we look overseas.

The percentage of ACWI markets above their 50-day averages has moved off its recent lows, but in this environment, anything less that 70% strength is a sign of weakness. By “in this environment,” we mean one in which a breadth thrust regime is not intact. The post-election rally did not produce a breadth thrust and the bullish signal following last December’s breadth thrust has expired.

Adding to the concerns about the broad market is the drop in the number of sectors trading above their 200-day averages. Energy, Materials and Health Care are all now below their respective 200-day averages. When sector strength is middling, the S&P 500 tends to struggle.

From a weight of the evidence perspective, Breadth is now neutral. The scales still tilt toward opportunity, but the margin has narrowed.

Keep reading for more details on how we view the weight of the evidence and the overall macro backdrop:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.