Bonds About To Get Their Pivot

Rate cuts are coming as the trend environment gets more challenging for stocks

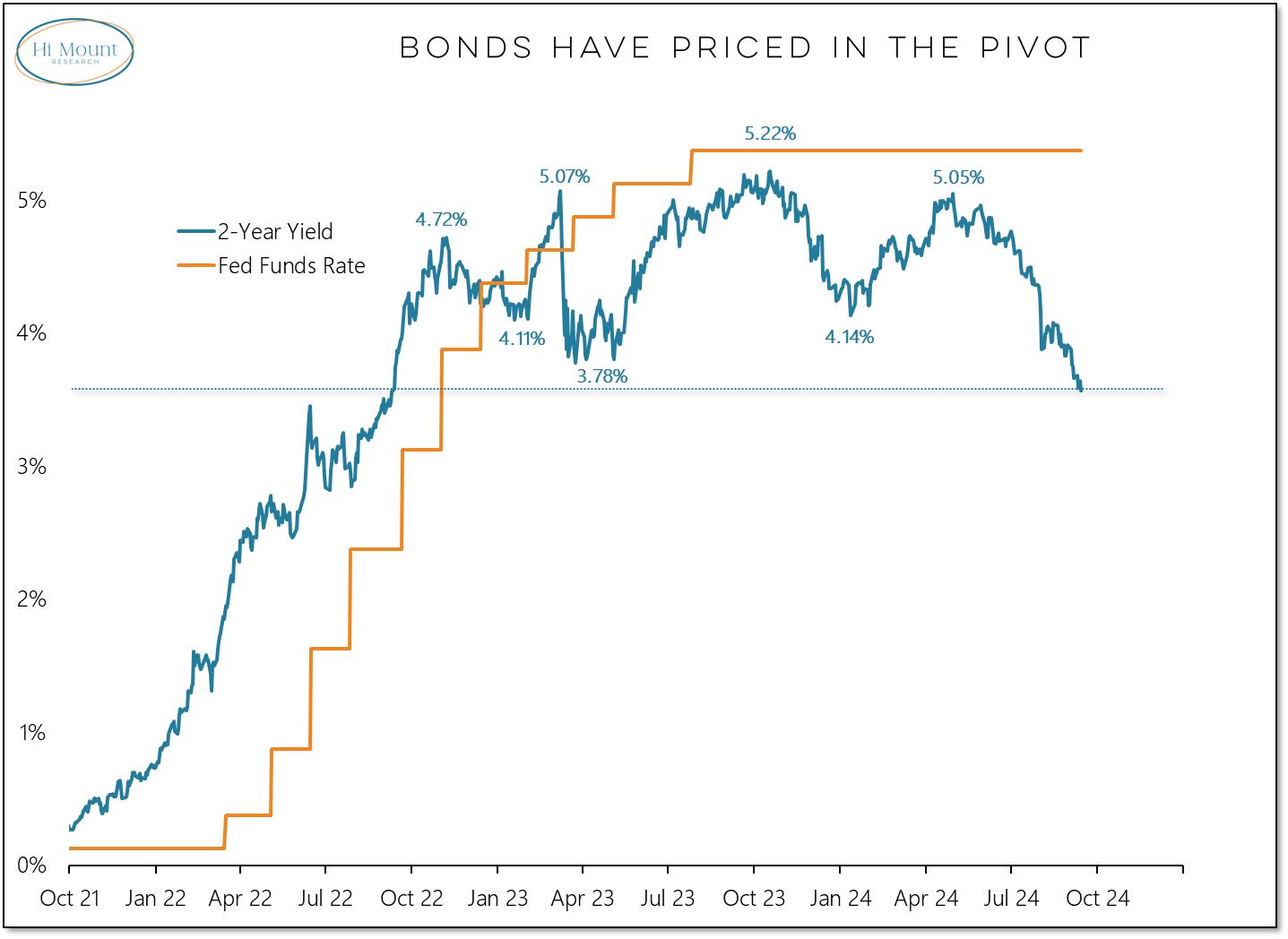

The Fed is in focus this week. The headlines focus on the question of 25 vs 50 basis points for the initial cut. The bond market is pricing in nearly 175 basis points of total easing as 2-year yields drop to their lowest level in over two years.

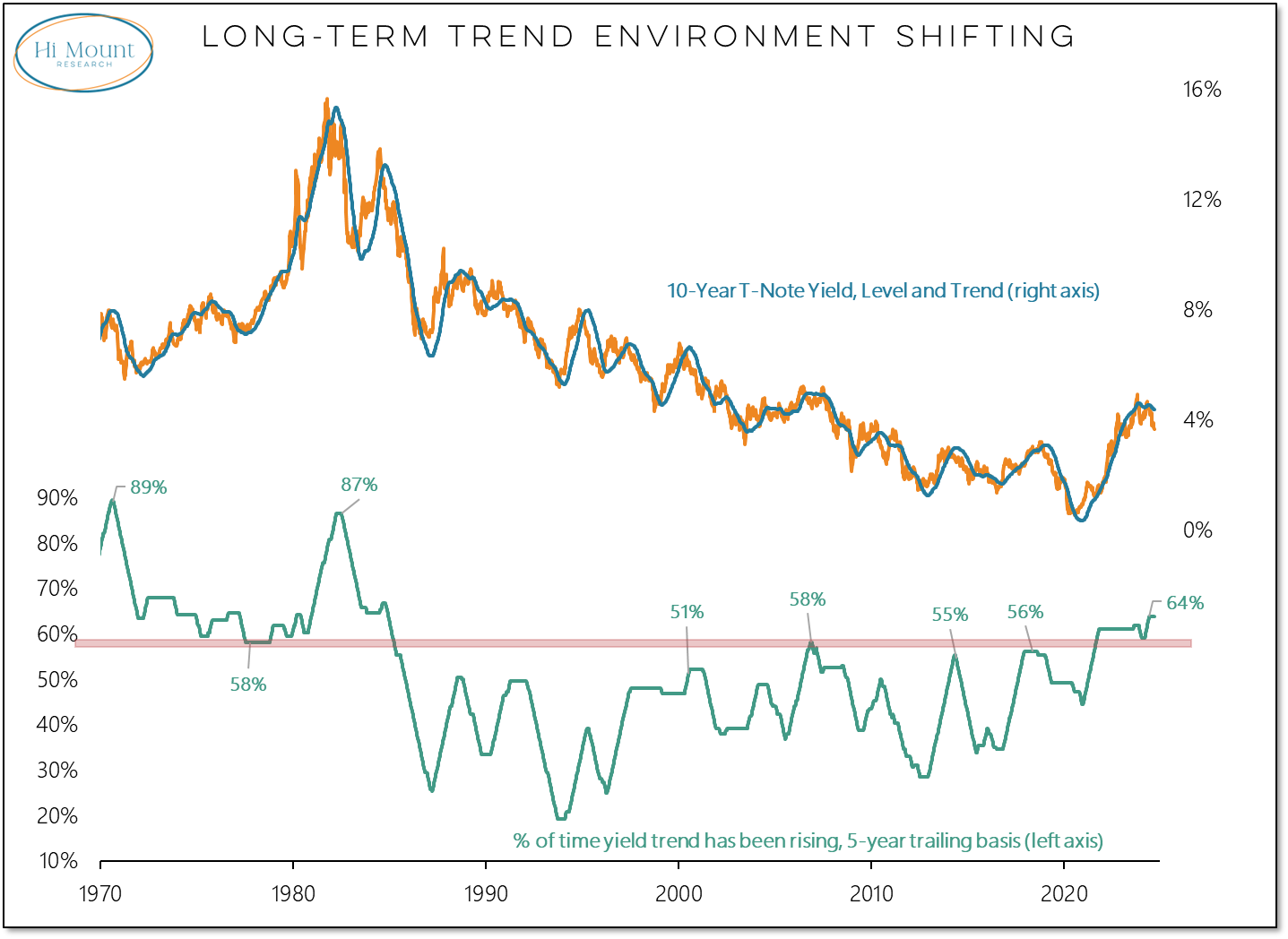

The long-term trend environment for bonds has shifted. Looking through the easing cycle that will begin this week, yields are likely to remain higher for longer than the experience of recent decades would suggest is likely.

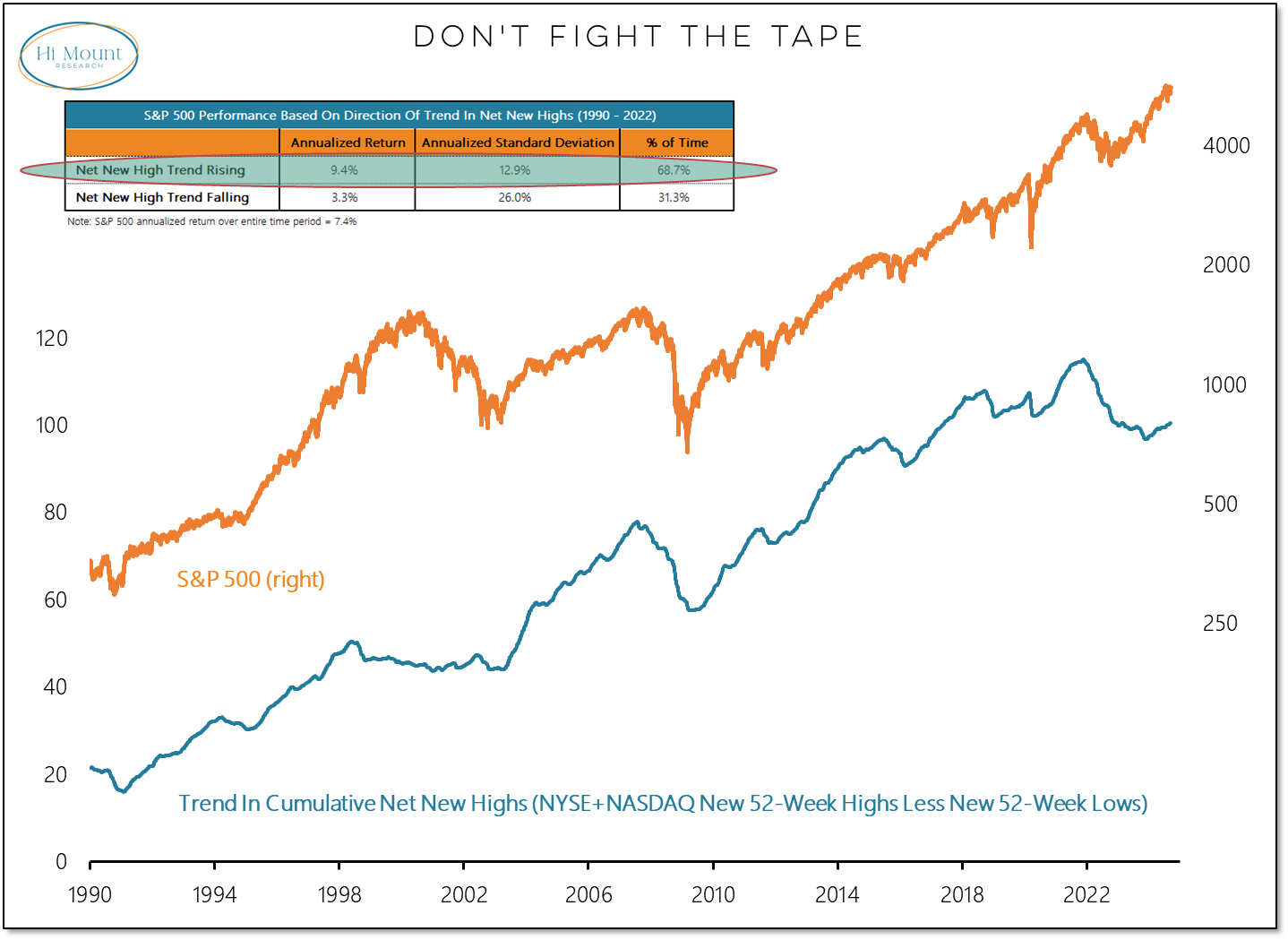

Breadth has been bullish as new highs exceed new lows. But while net new highs have been positive, they have struggled to expand. That leaves stocks vulnerable to rising volatility. But as long as more stocks are making new highs than new lows, odds favor above average returns and below average risk.

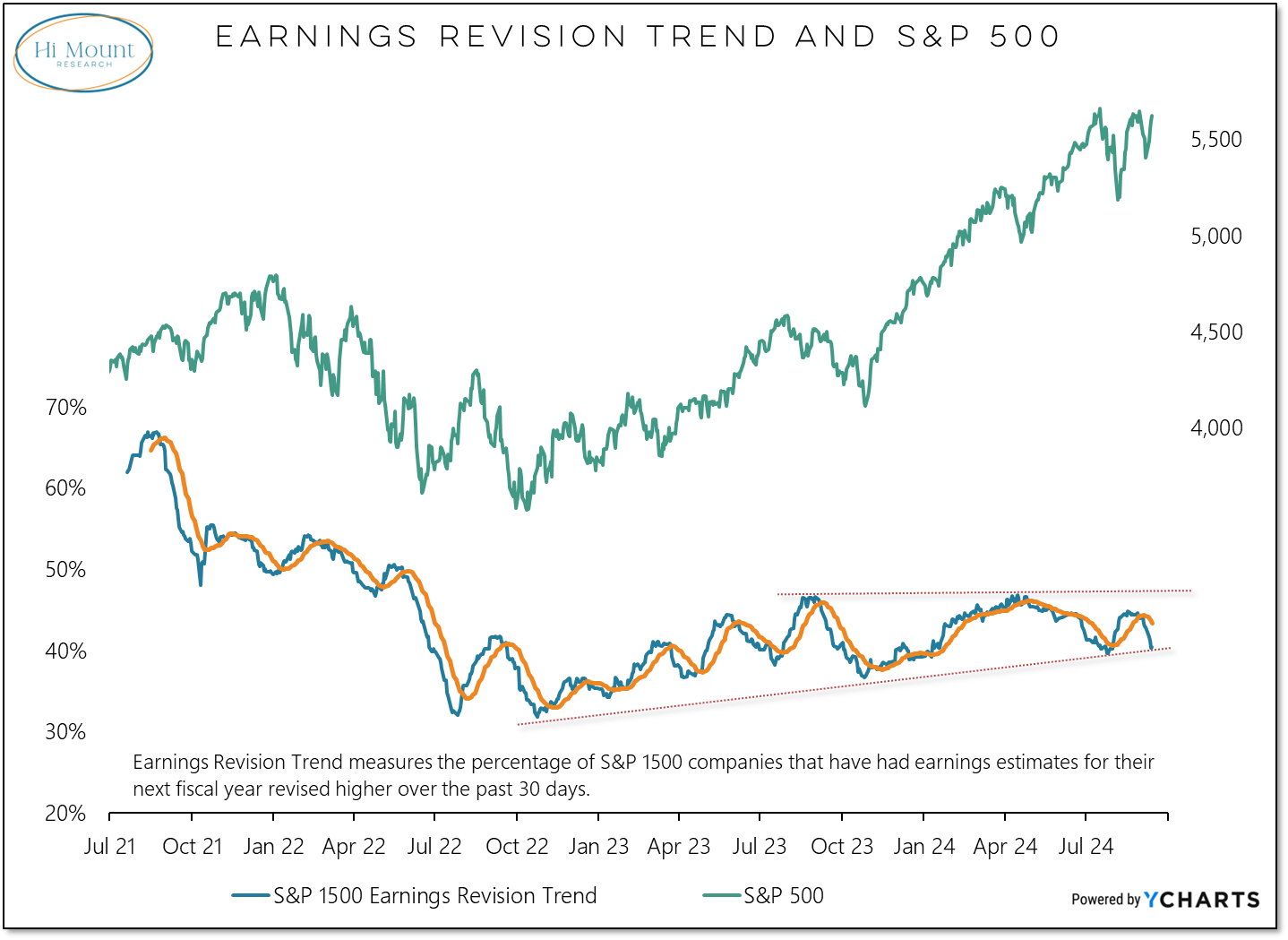

Concerns would intensify if our earnings revision trend continues to break down. The macro environment is such that fewer sell-side analysts are feeling the need to raise their earnings estimates.

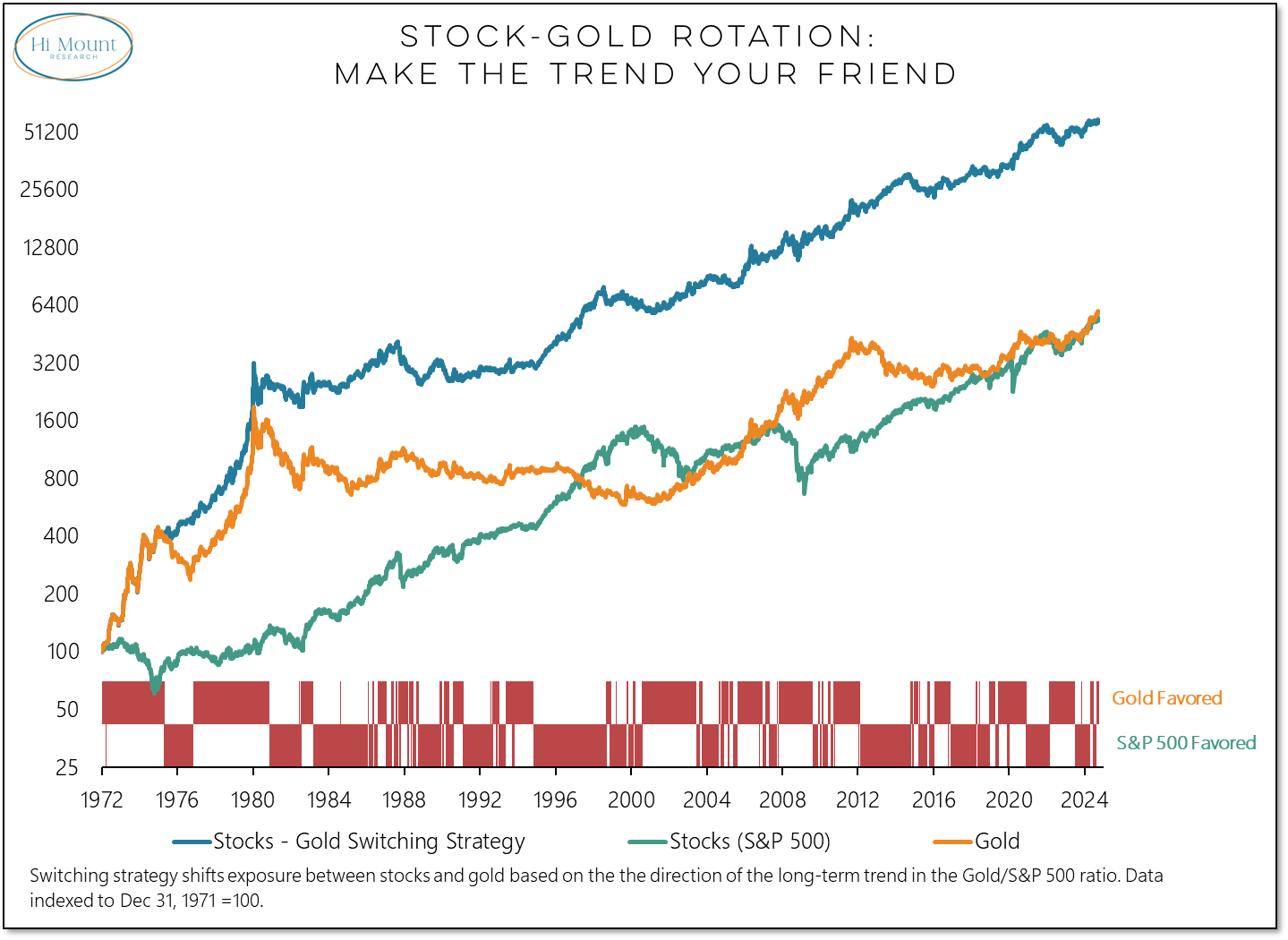

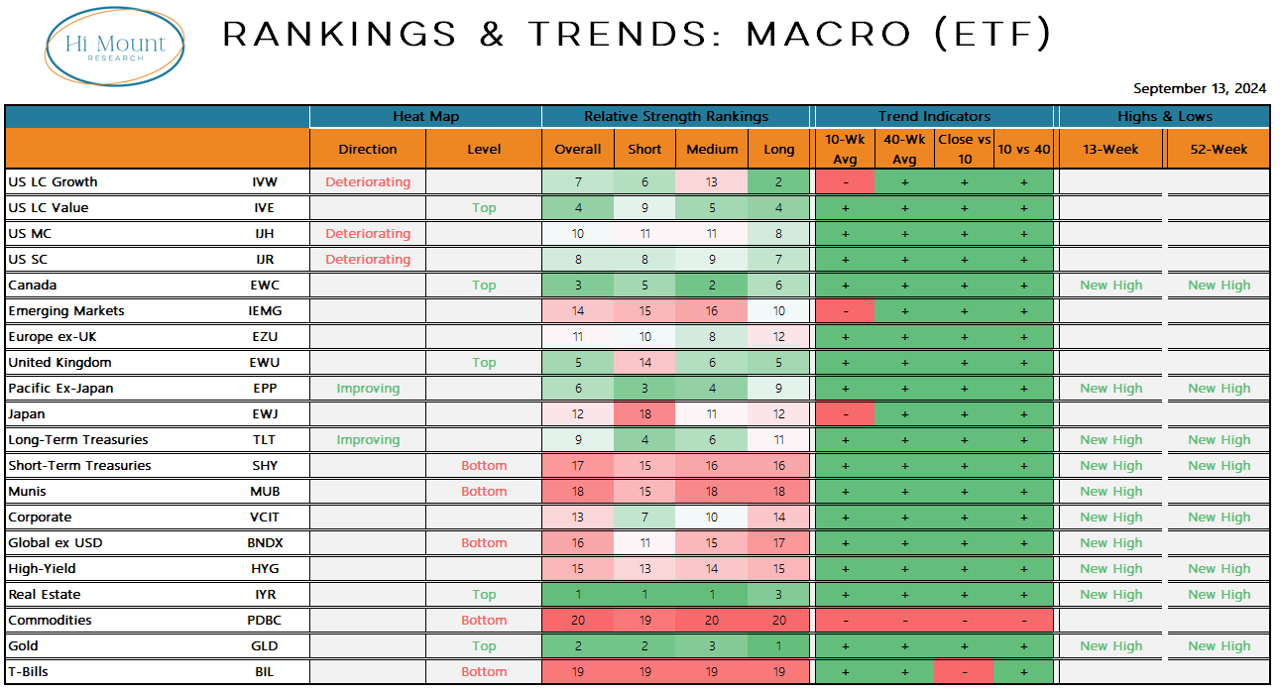

If nothing changes, the trend in the stock/bond ratio is only about two weeks from turning away from stocks and favoring bonds. The trend has favored stocks > bonds for nearly 80 weeks. If this happens, our rules-based approach would follow the leader and shift exposure away from stocks and toward bonds. Our stocks vs gold model has already turned away from stocks.

Gold and Bonds are showing signs of life in our rankings and are making new highs.

A link to our annotated weekly chart deck and relative strength rankings summary for subscribers is available below.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.