Weight of the Evidence Improves As Market Looks For Clean Slate In 2024

What to do now as stocks rally on the hopes of a more friendly Fed

Portfolio Applications subscribers can skip the commentary and go directly to the latest updates for our Blue Heron Systematic Portfolios and the changes we have made to our Dynamic Tactical and Cyclical Portfolios.

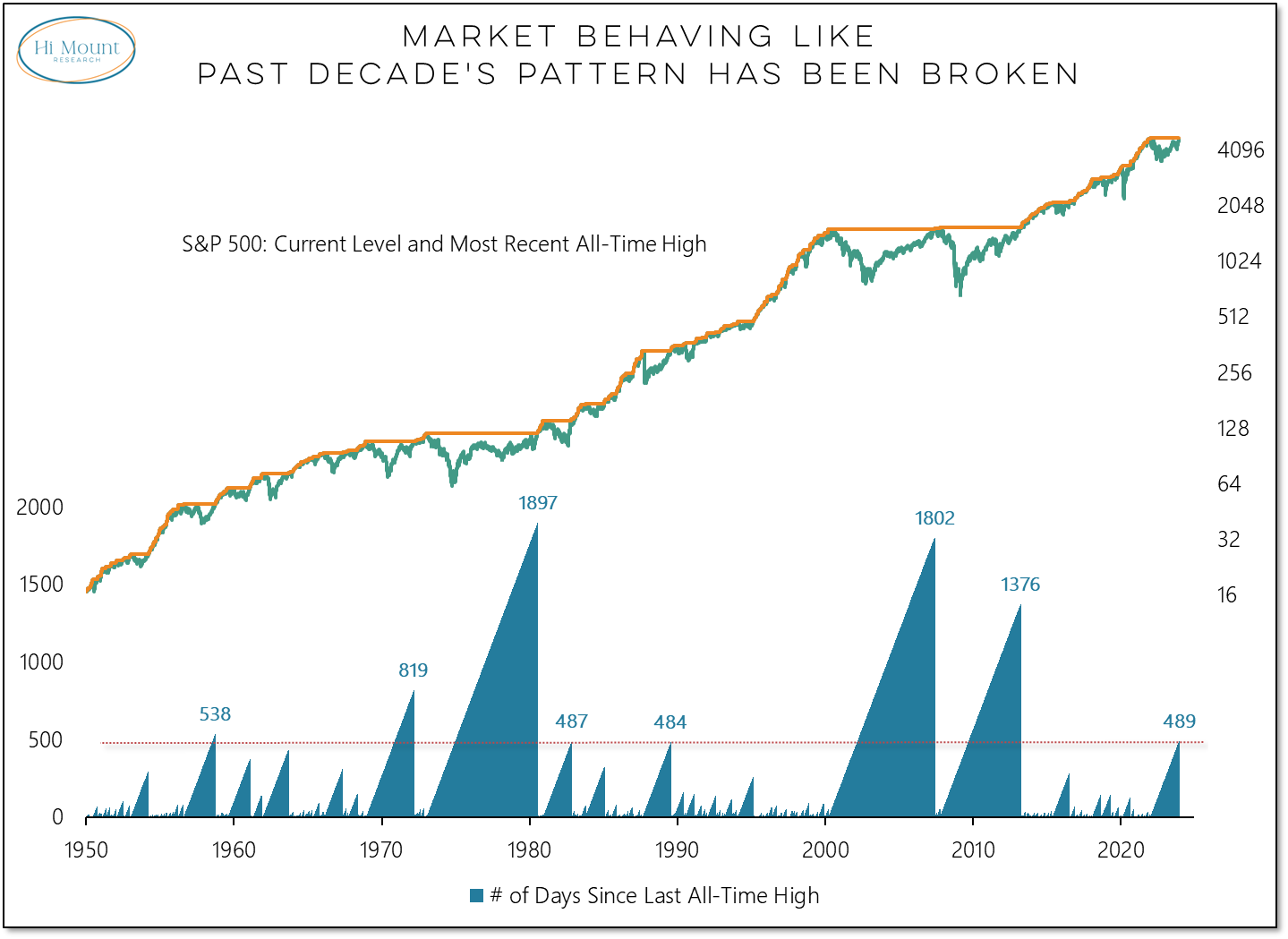

Key Takeaway: After the Fed signaled its intention to put out the punch bowl in 2024, the S&P 500 has rallied to within a one good day’s gains of its January 2022 peak. While the Dow Industrials managed to move to record territory (i.e. reach a 0.00% drawdown), the S&P 500 is still stuck in the 6th longest stretch in the past three-quarters without a new all-time high.

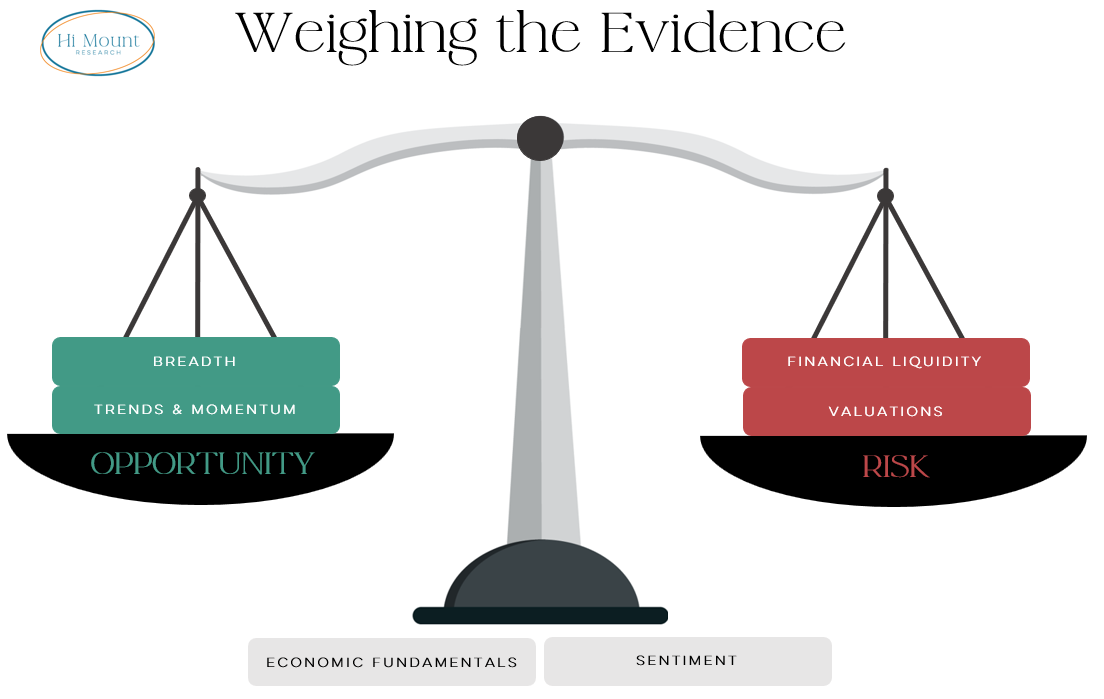

Heading into the new year, our Weight of the Evidence scales are back in balance between risk and opportunity.

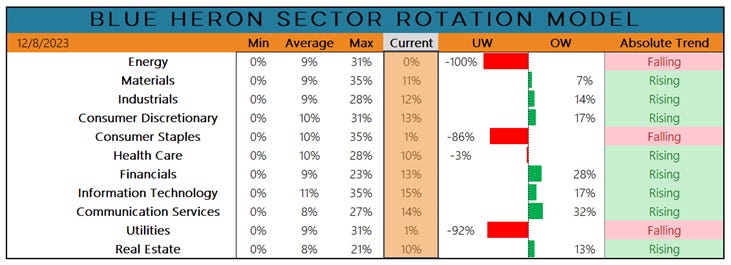

Market Insights subscribers can keep reading to dig into the details of the Weight of the Evidence report. Before getting to that, however, a reminder that in January we will be formally launching our Systematic Sector Rotation portfolio. If it were running today, this is how it would be positioned:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.