Weekly Market Notes: Upside Volume Surge

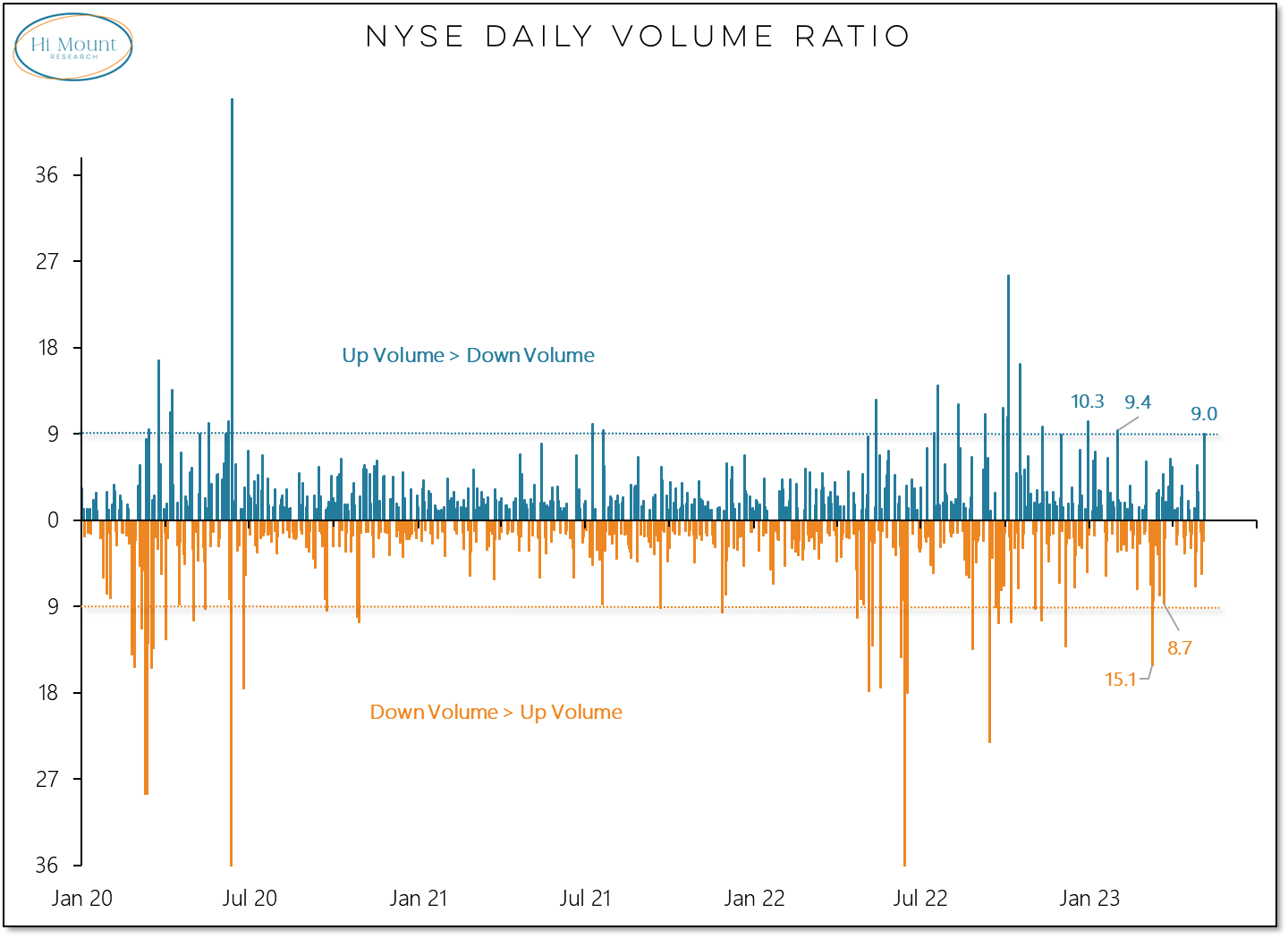

The is plenty of room for improvement beneath the surface and Friday's 9-to-1 up-volume day looks like a first step in a favorable direction

Friday’s price rally was accompanied by a surge in upside volume. On the NYSE upside volume exceed downside volume by 9-to-1, the strongest showing since the end of January and a hopeful sign that the downside pressure that became acute in March may be fading.

More Context: One of the clear lessons of the past year is that when volatility emerges it usually comes in both directions and is not typically a sign of market strength or rally sustainability. A clear break of downside volatility usually requires two (or more) days of with upside volume exceeding downside volume by better than 9 to 1. We got that in December and January. But relief was short-lived as the market was unable to build on early year strength. New highs failed to expand and were overtaken by new lows and selling in March produced a 15 to 1 down volume day. Friday’s rally didn’t change the relationship between new lows and new highs, but surging upside volume could set the stage for improving conditions as we move though the second quarter.

Paid subscribers can keep reading this week’s Market Notes, in which we review a few important ways the market can build on Friday’s strength and prove its resiliency.

We also look closely at the current environment’s challenge for US investors: global trends are strong but relative to the rest of the world, our model has the US at max underweight for the first time in more than 15 years.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.