Weekly Market Notes: Progress or Pause

A lack of day-to-day volatility is typically evidence of improving market conditions

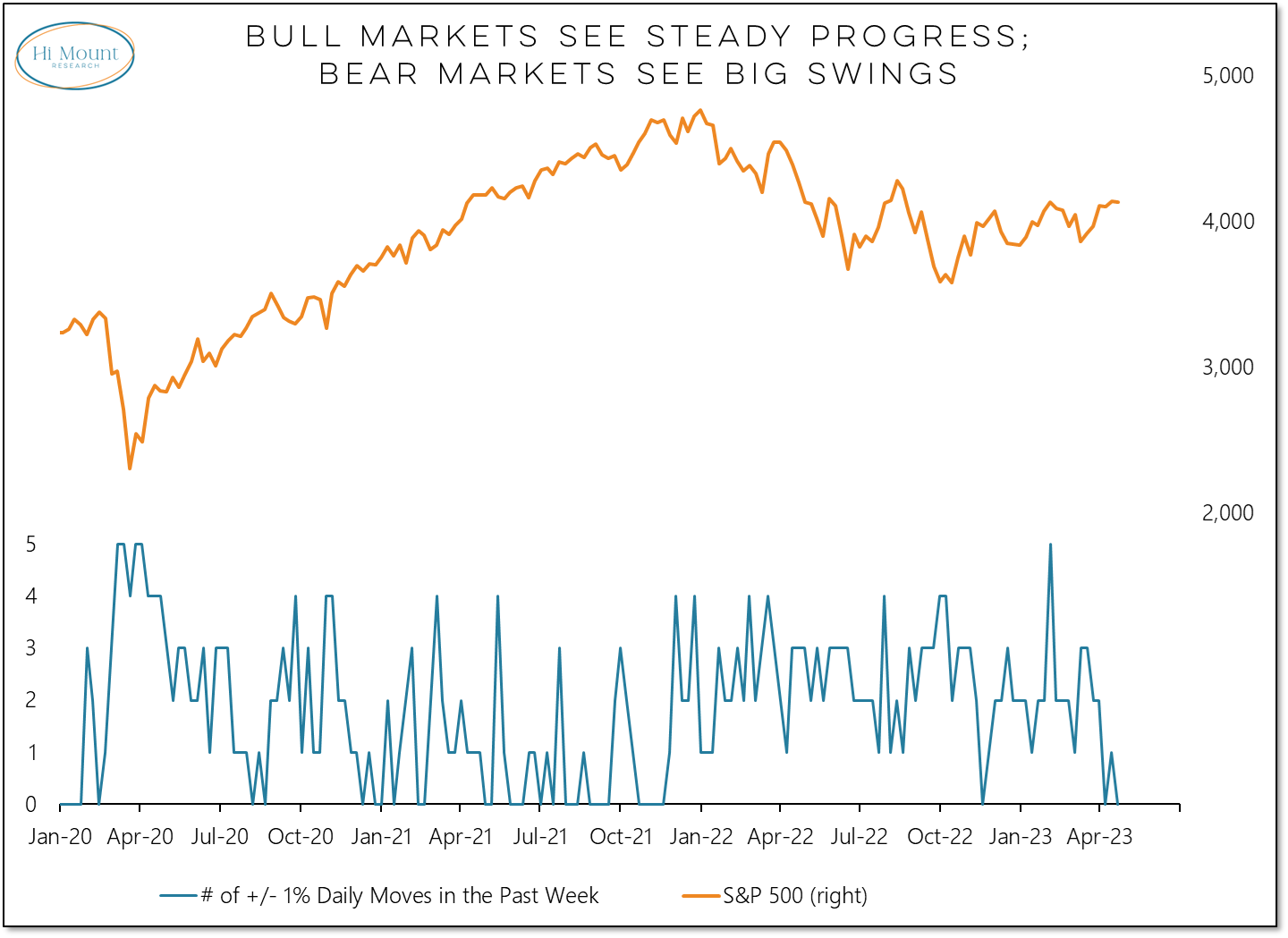

For the second time in April, the S&P 500 didn’t record a single 1% daily swing last week. Prior to this month, stocks had been this quiet only once since the S&P 500 peaked in January 2022.

More Context: Bear markets are characterized by noisy price-action (in both directions) and persistent weakness beneath the surface. Bull markets are noted for their quiet and consistent strength. Nearly half of all trading days in 2022 experienced a 1% swing in the S&P 500 and that pattern continued through Q1 of this year. This month has brought an abrupt change, however, and so far, there has been only a single 1% daily swing in April. But while a lack of volatility suggests important progress is being made in the transition from bear market to bull market, the absence of strength beneath the surface remains conspicuous by its absence. While the bull/bear debate rages in the US, we continue to see consistent and persistent strength overseas. Global trends are improving even as US trend struggle. That alone is enough to suggest that a new environment is at hand.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.