Townhall Takeaways podcast:

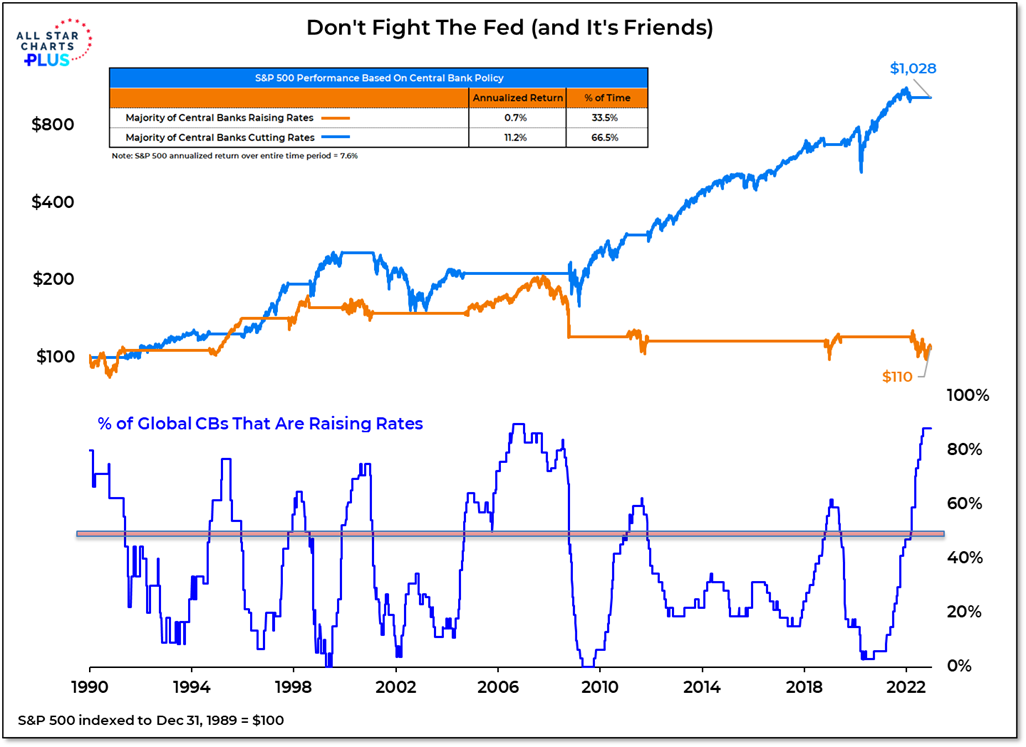

Don't fight the Fed (and its friends). Rate hikes hurt more when everyone is doing them. Right now the Fed and all its Central Bank friends are leaning in the same direction. Stocks don't do well in those environments. Over the past 30+ year stocks have gone nowhere when a majority of Central Banks are raising rates (as is now the case).

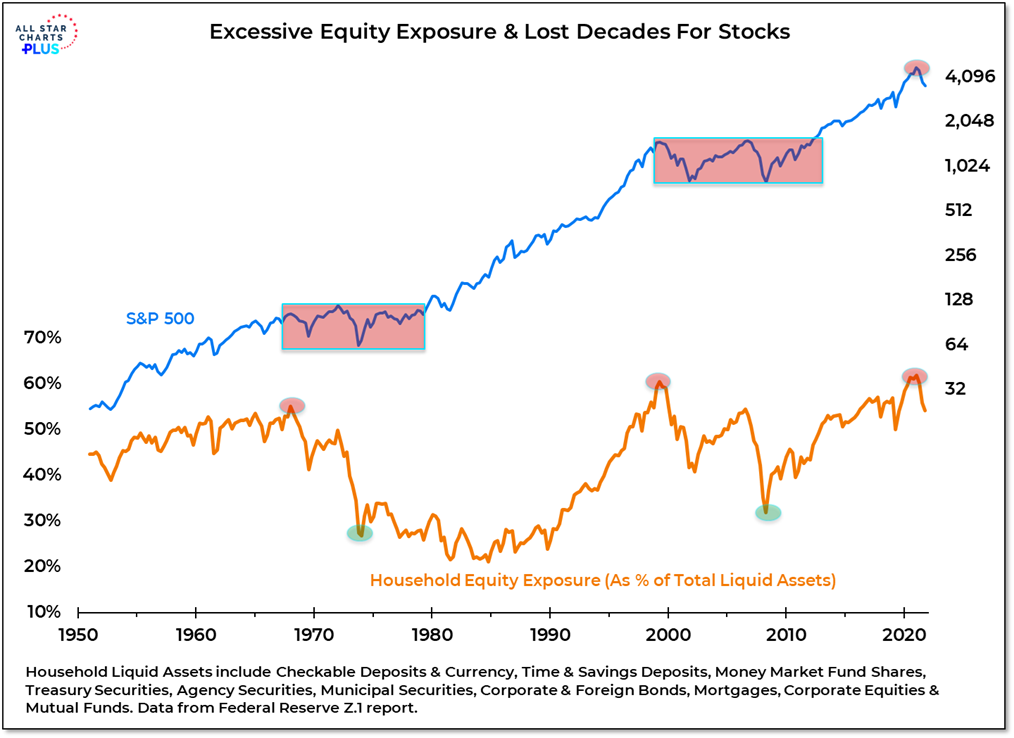

Elevated equity exposure could lead to a lost decade for stocks. Stocks have been despised all year but yet remain historically over-owned. If past is prologue, that's a recipe for a secular bear market that raises the risk of a lost decade of equity market returns.

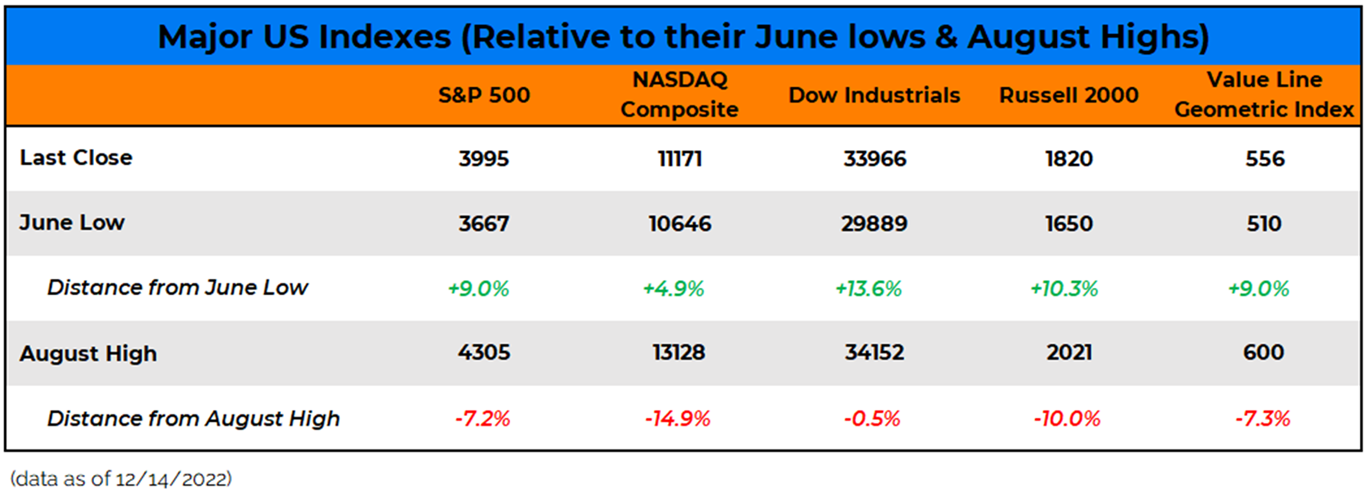

Market would surprise bulls & bears by grinding in a wide range. Bears are looking for a break below the June lows, the bulls are eager for a break above the August highs. A market that does neither for some time might be the thing that makes the most people uncomfortable.

Townhall Takeaways on YouTube: