Unanchored Inflation Expectations and the Absence of a Breadth Thrust Leave Stocks In Limbo

We are conditioned to find things - sometimes it is more important to take note of what is missing

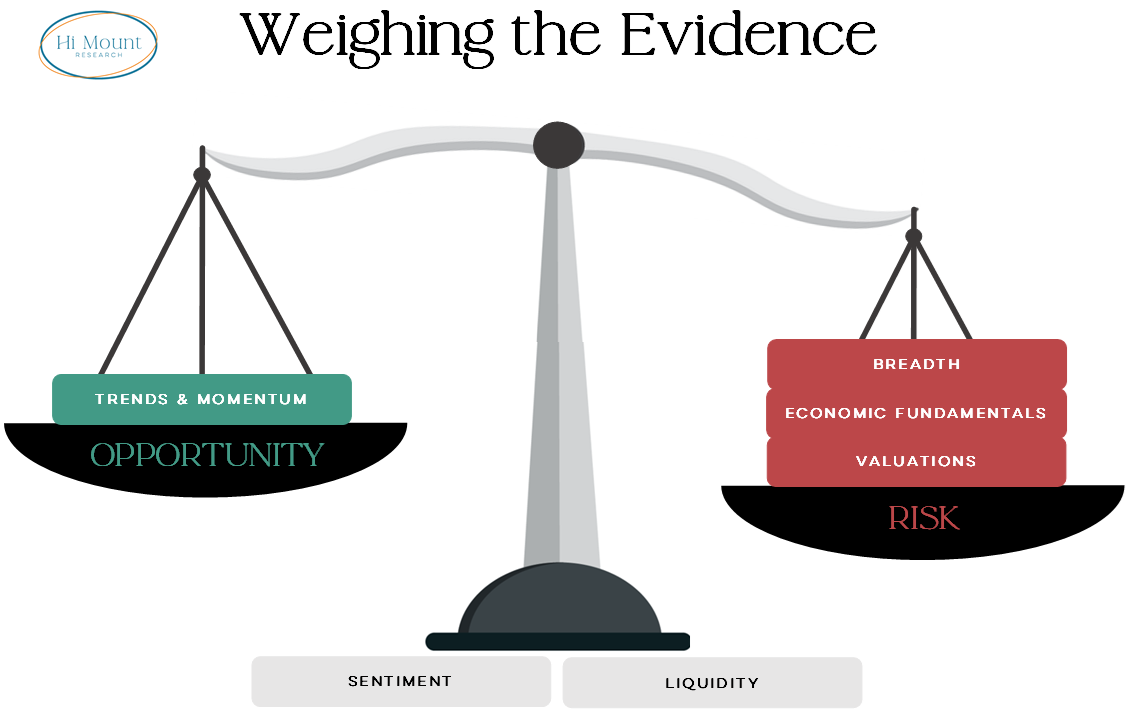

Key Takeaway: Waning optimism and poor breadth weigh on the prospects for stocks at a time when the Fed is facing economic stresses and upward pressure on inflation expectations.

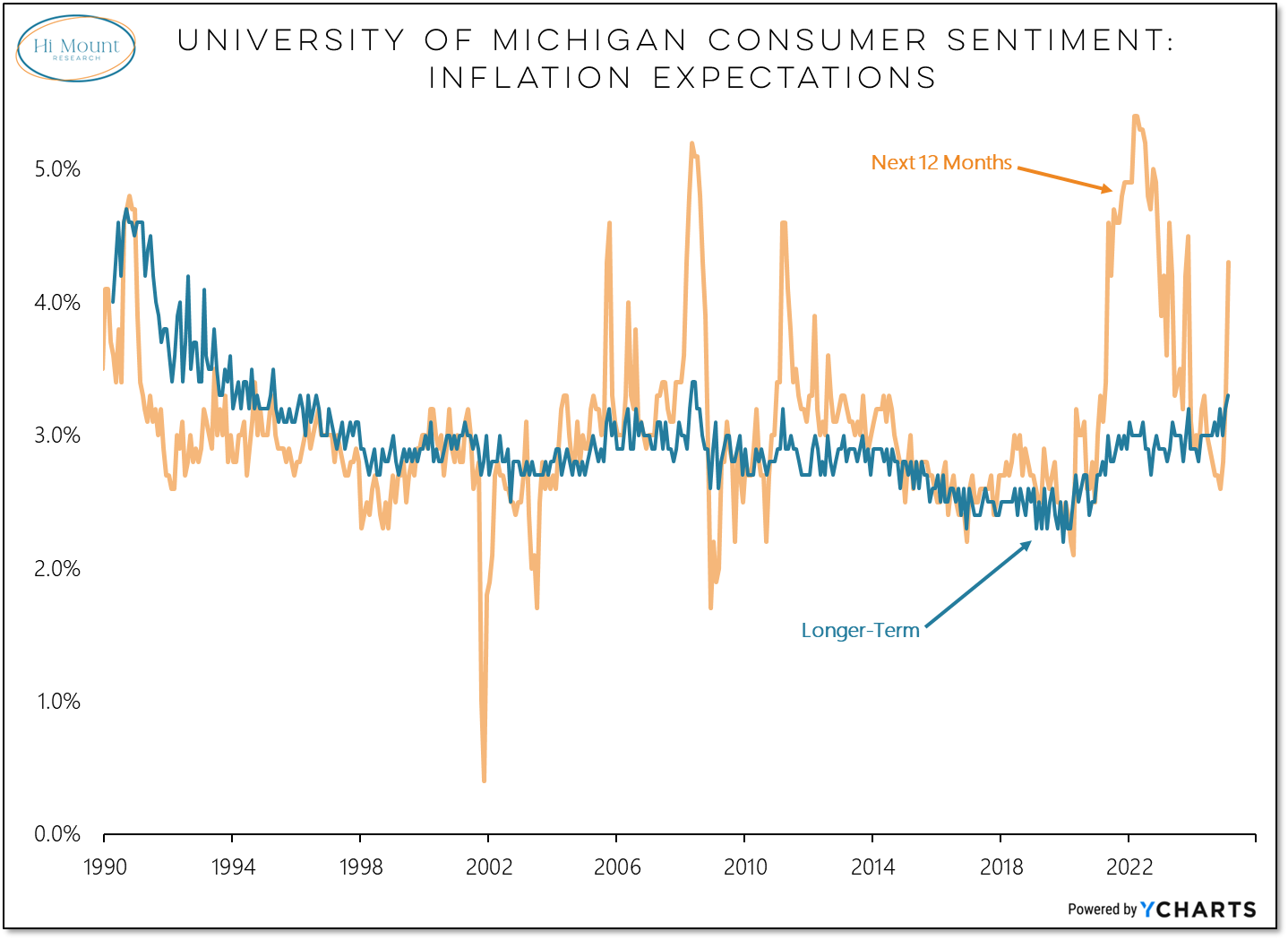

The latest data from the University of Michigan shows a spike in expectations for inflation over the coming year and longer-term inflation expectations are now at their second highest level in the past 2+ decades. The Fed’s ability to fight inflation becomes more difficult when expectations become unanchored.

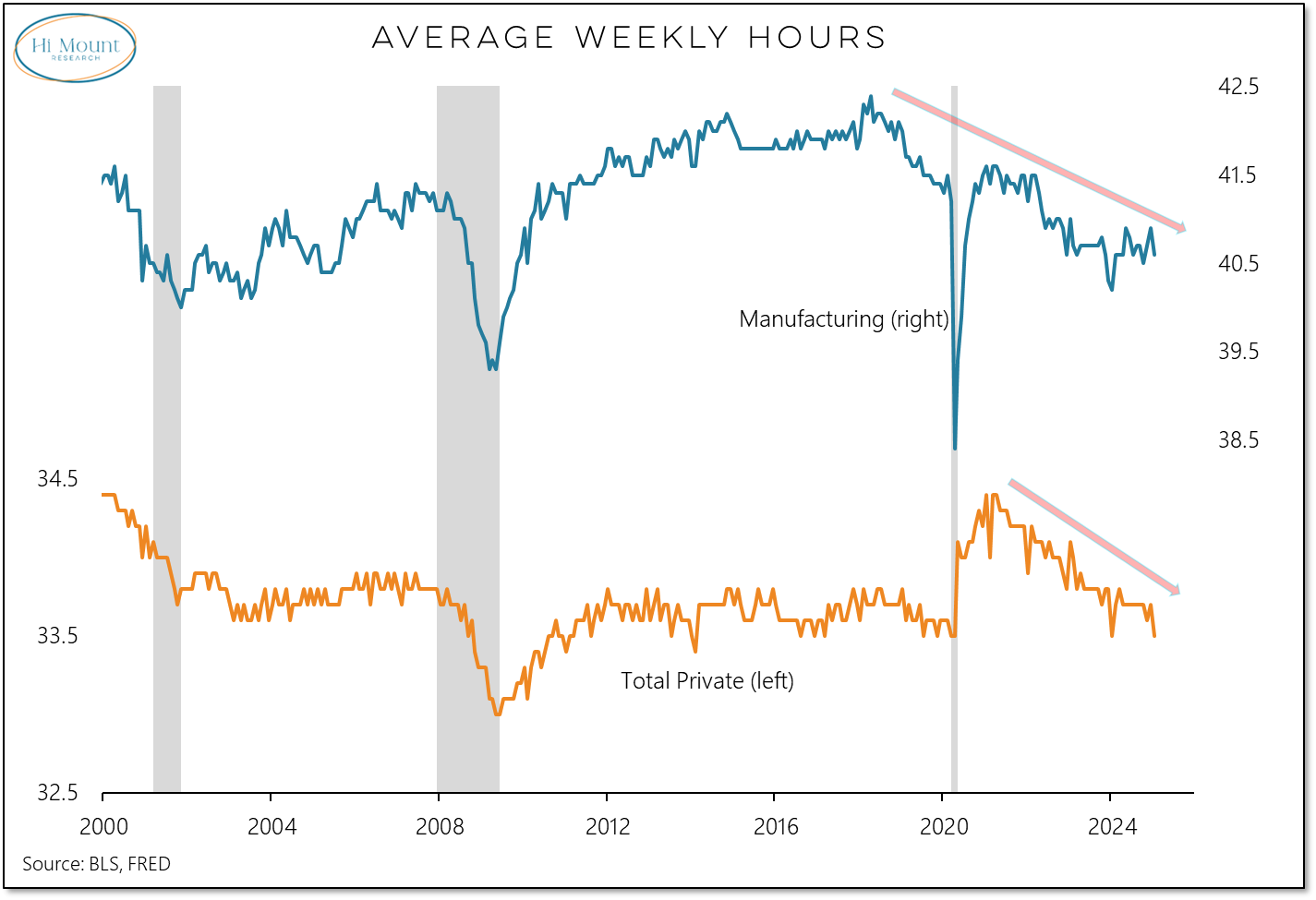

This is happening at the same time that economic trends continue to deteriorate. Benchmark revisions to the employment data subtracted hundreds of thousands of jobs from the aggregate tally and while employers are not cutting jobs they are cutting hours. The average workweek is now as low as it has been at any point in the past decade-plus.

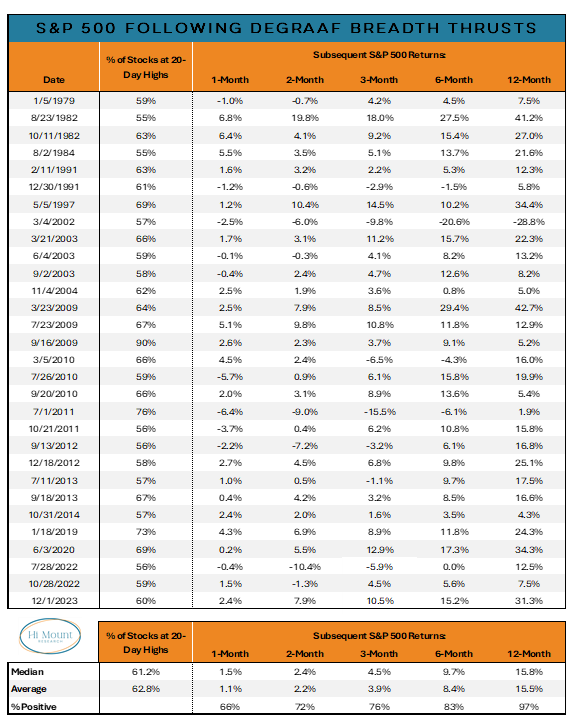

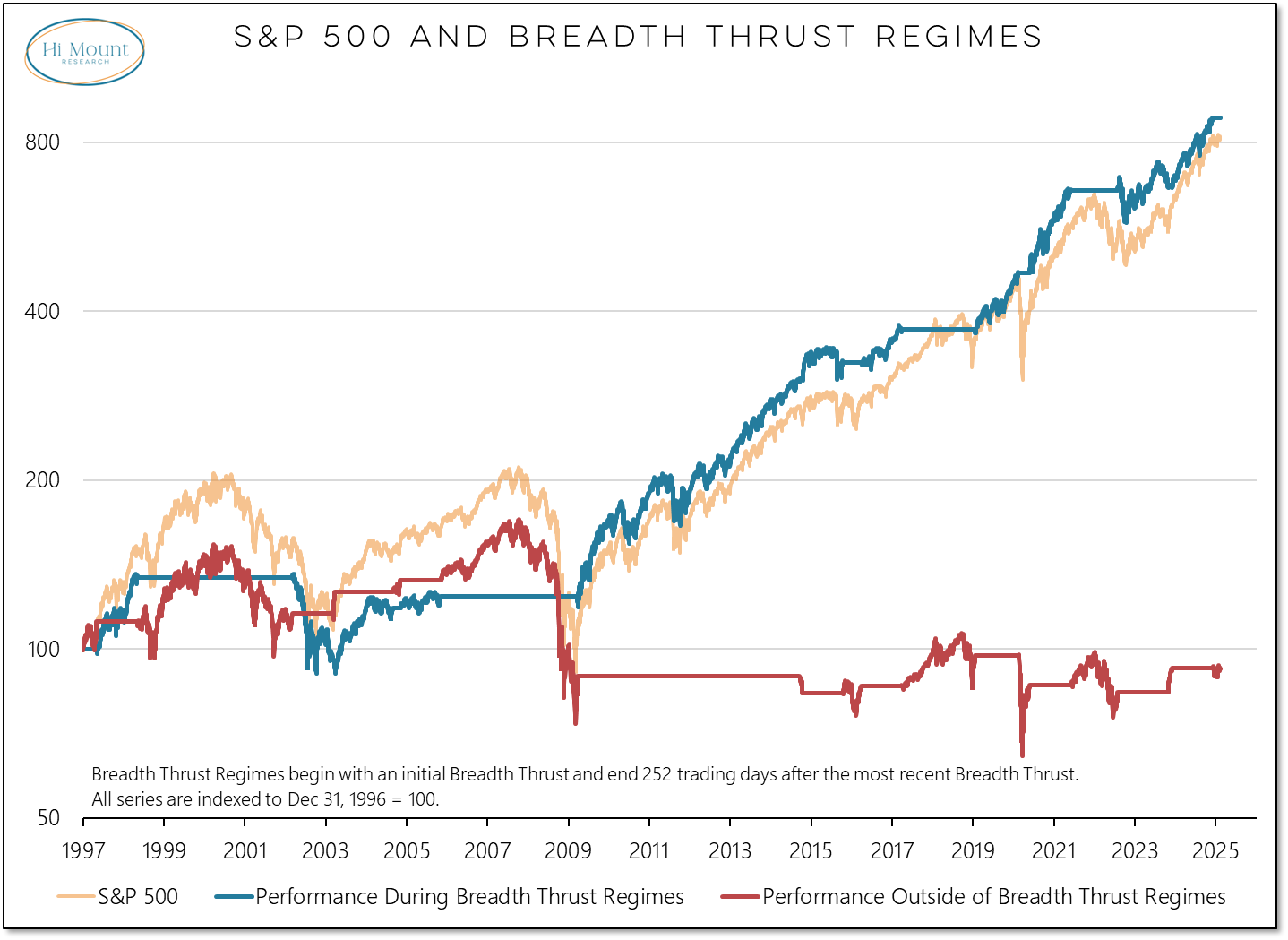

Stocks meanwhile are struggle to sustain strength and the S&P 500 has been noisy but has gone nowhere since the last Breadth Thrust Regime expired in December (Breadth Thrust Regimes last for one year following a Breadth Thrust) The most recent breadth thrust fired on December 1, 2023 and was followed by sustained strength in the S&P 500.

This not surprising. All the net gains for the S&P 500 over the past quarter century have come when a Breadth Thrust Regime has been intact.

When we weigh all the evidence, it argues for a Risk Off environment and one in which Capital Preservations is the most prudent strategy.

Subscribers can review the key takeaways below or read the entire Weight of the Evidence report:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.