Too Much Noise?

Weighing 1% daily moves and 1% weekly moves for stocks as the long-term trend in commodities turns higher

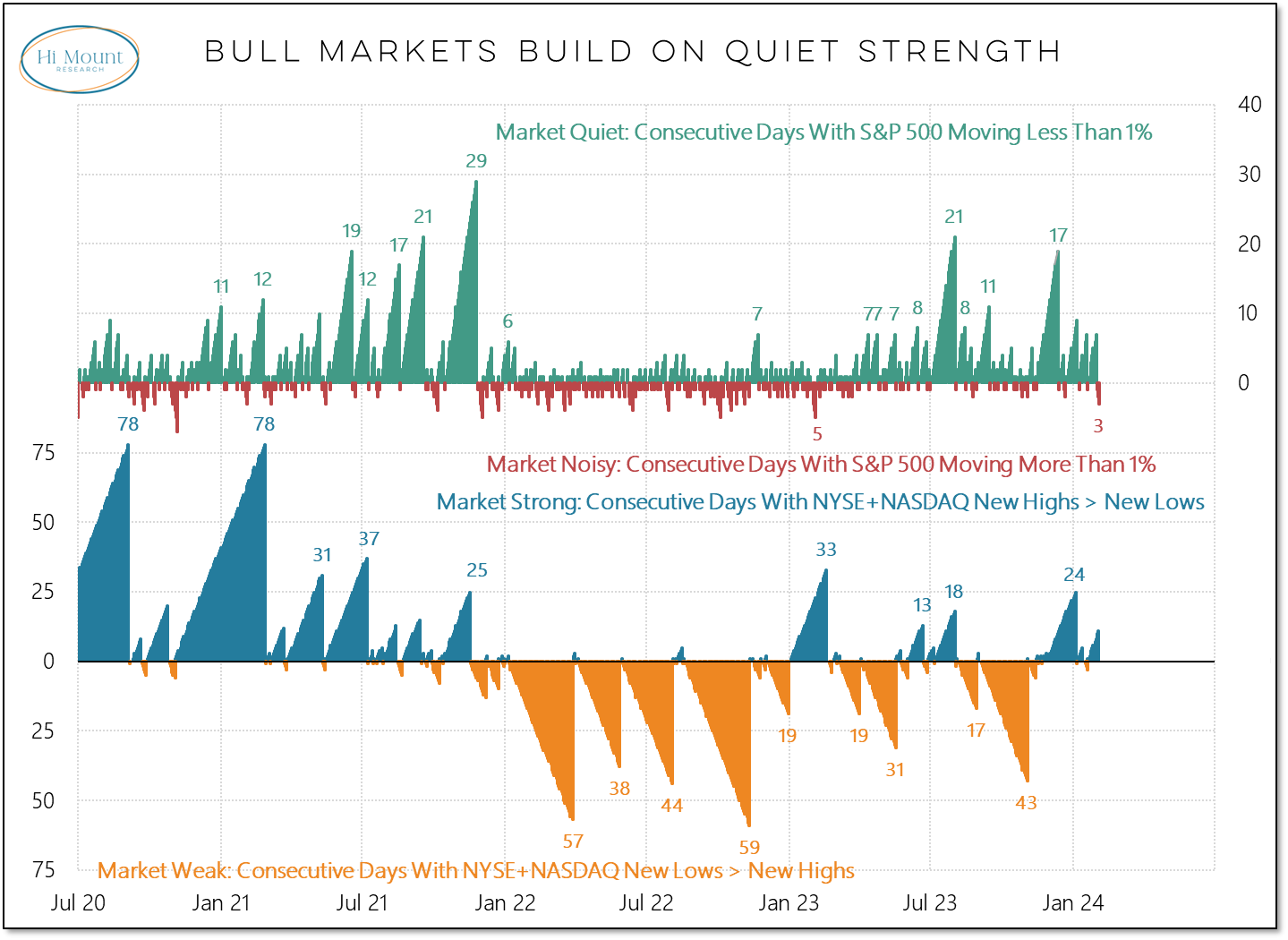

What: The S&P 500 finished last week with back-to-back-to-back 1% moves (two, higher, one lower). This is the longest stretch of 1% daily price swings in a year. Bull markets tend to experience quiet strength, so an up-tick in day-to-day volatility can raise some eyebrows.

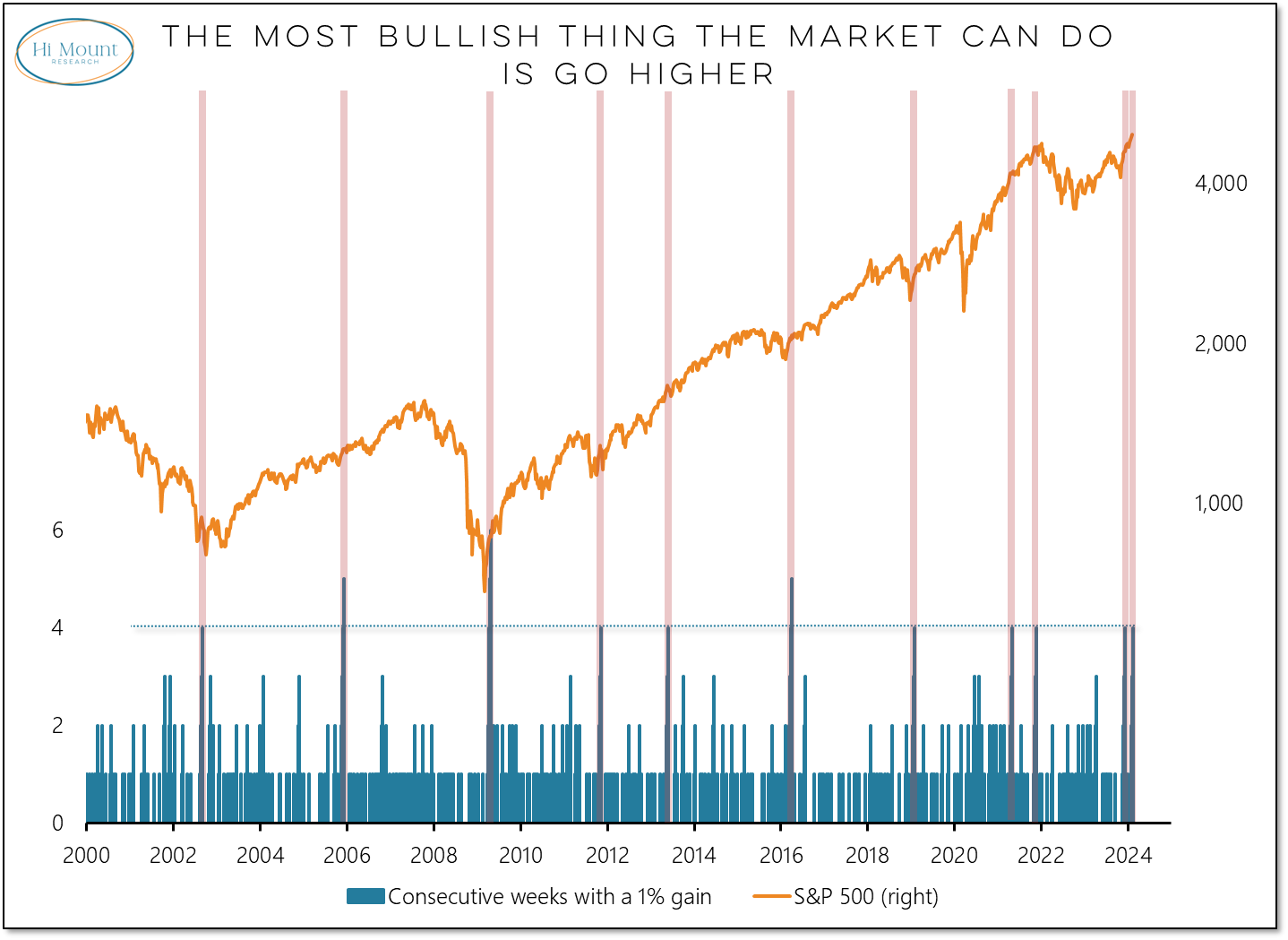

So What: Zooming out, the S&P 500 last week posted a 1% gain for the 4th consecutive week. That’s tied for the longest stretch since 2016. Over the past quarter century, this sort of sustained strength has supported the view that the most bullish thing the market can do is go higher.

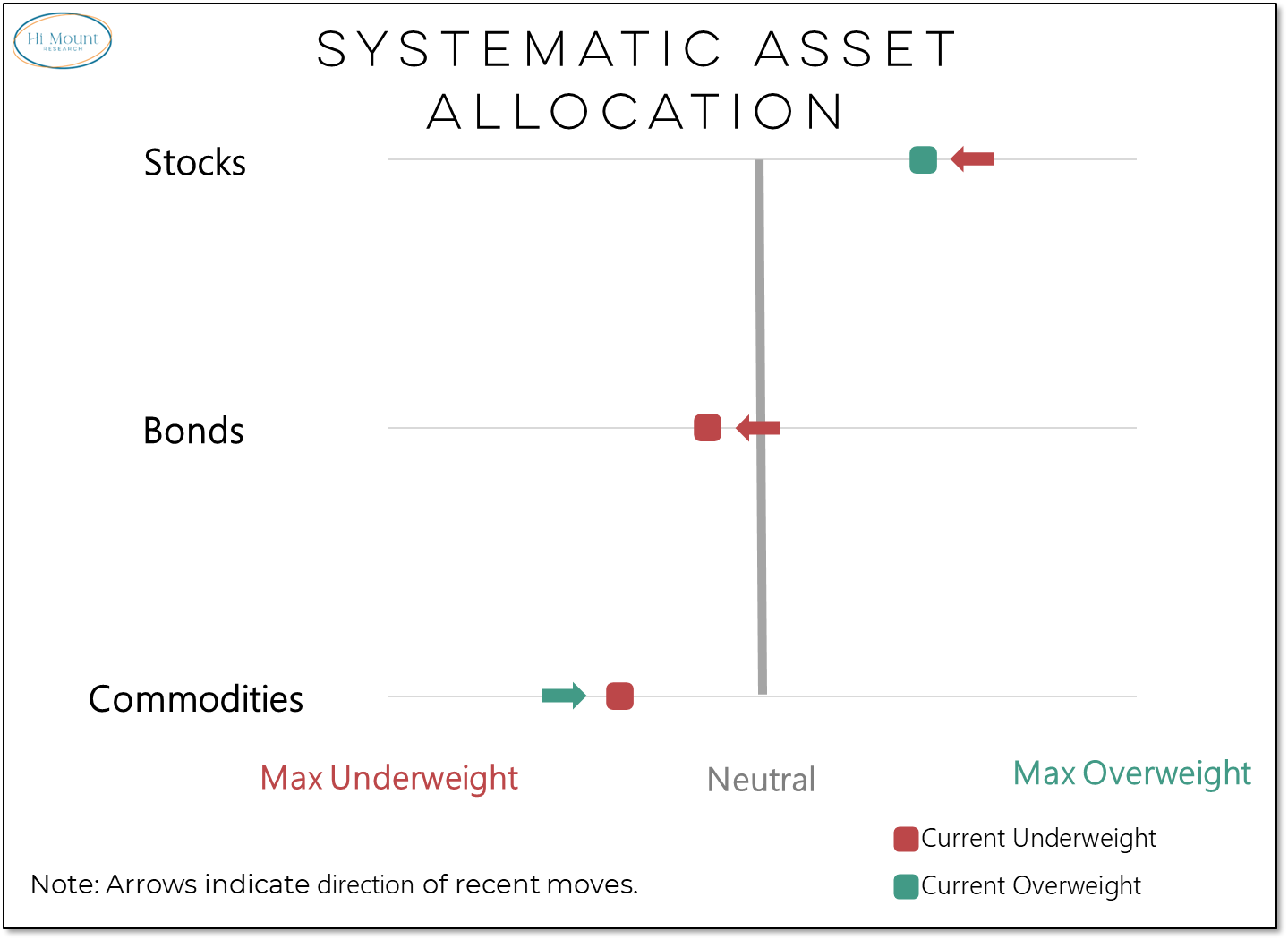

Now What: Pivoting away from whether this uptick in equity market noise is bullish or bearish, the most important development last week from an asset allocation perspective may be the turn higher in the long-term trend for commodities.

As we discuss in this week’s Relative Strength Rankings update, commodities are still relative a laggard but our rules-based models will respect a sustained turn higher on an absolute basis.

Paid subscribers can download the entire Relative Strength Report or keep reading to see a summary of the Macro rankings and how our Blue Heron Asset Allocation Model has adapted to improving trends from commodities.

***We have tweaked both our schedule of reports and pricing structure. Visit Hi Mount Research or reach out via e-mail (info@himountresearch.com) for more details.***

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.