The Subtle Power of Quiet Strength

Global equity market strength could open the door for a new leadership regime

Key Takeaway: The role of quiet strength in bull markets often goes overlooked. It doesn’t generate headlines, and it can seem boring. But it allows gains to accumulate and brings in more participants.

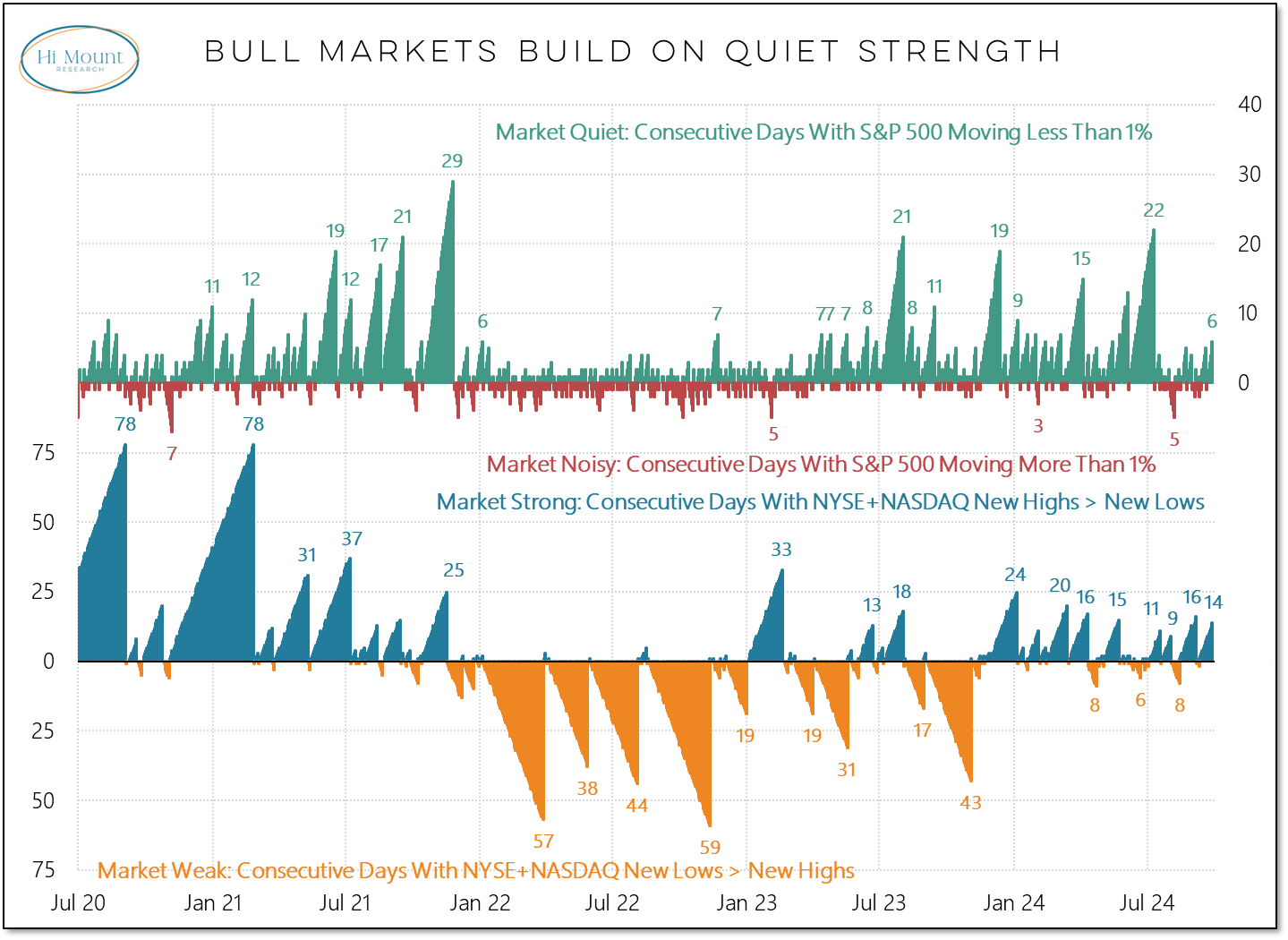

Six days in a row without a 1% move from the S&P 500 is the longest period of quiet for the market since the beginning of the third quarter. This quiet market coincides with persistent strength in terms of more stocks making new highs than news.

Last week was the first time since March that every day brought more new highs than new lows and less than a 1% swing on the S&P 500. This is the stuff that bull markets are made of.

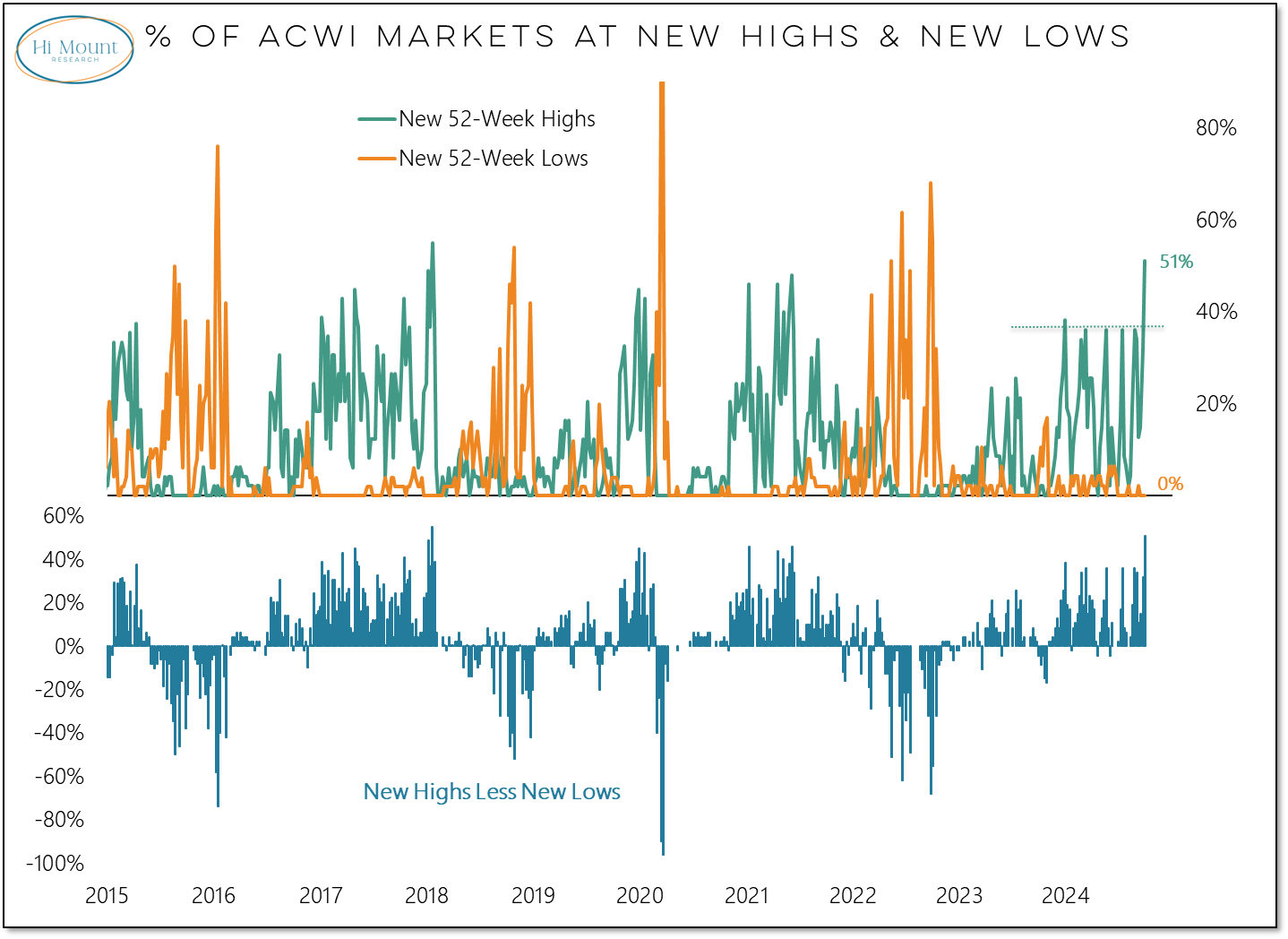

Global new highs not only outpaced new lows but they broke out to a new high. For the first time since 2018 more than half of the ACWI markets made new highs.

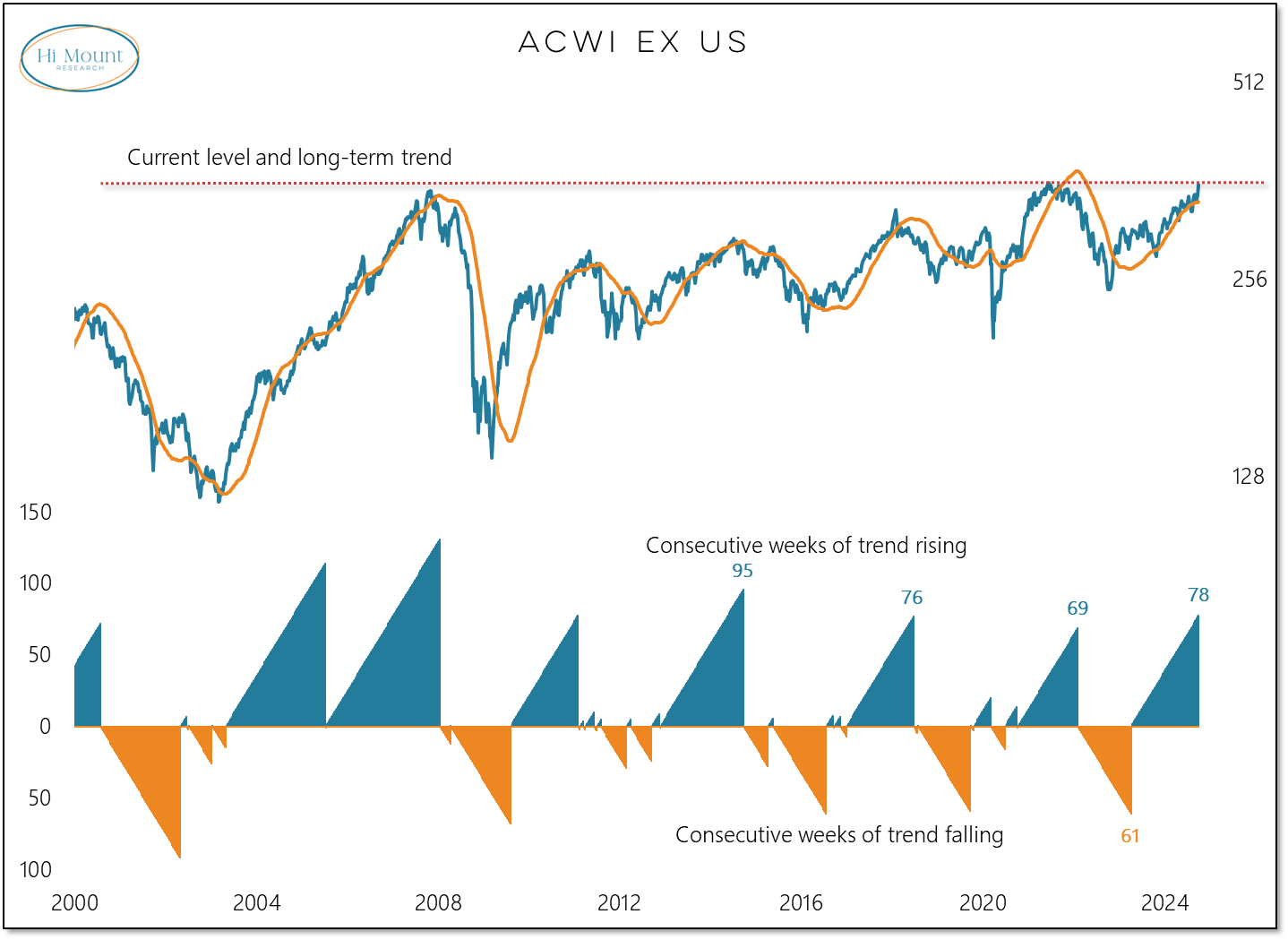

Equity market strength is evident even without considering the US. The ACWI ex US is in the midst of its longest sustained uptrend in a decade and is approaching important resistance. The long-term trend continues to favor the US vs the rest of the world. But if the recent strength seen overseas persists, this well-established trend in US dominance could soon turn. Now may be a good time to ask if you have enough international equity exposure.

Our global macro rankings already show a shift in leadership. The top four spots are occupied by non-US equities and Gold. The US is a middle-of-the-pack performer in our country level rankings.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.