The Absence Of Weakness Fuels Complacency

Steady as she stalls: Underlying uptrends are intact but warnings accumulate.

Last week (on an abbreviated trading day ahead of the July 4th holiday) I checked in with Oliver Renick at Schwab Network. We touched on the Fed’s progress in fighting inflation, investor positioning and some context for the extended period of quiet complacency. You can check out the entire conversation or just download the charts.

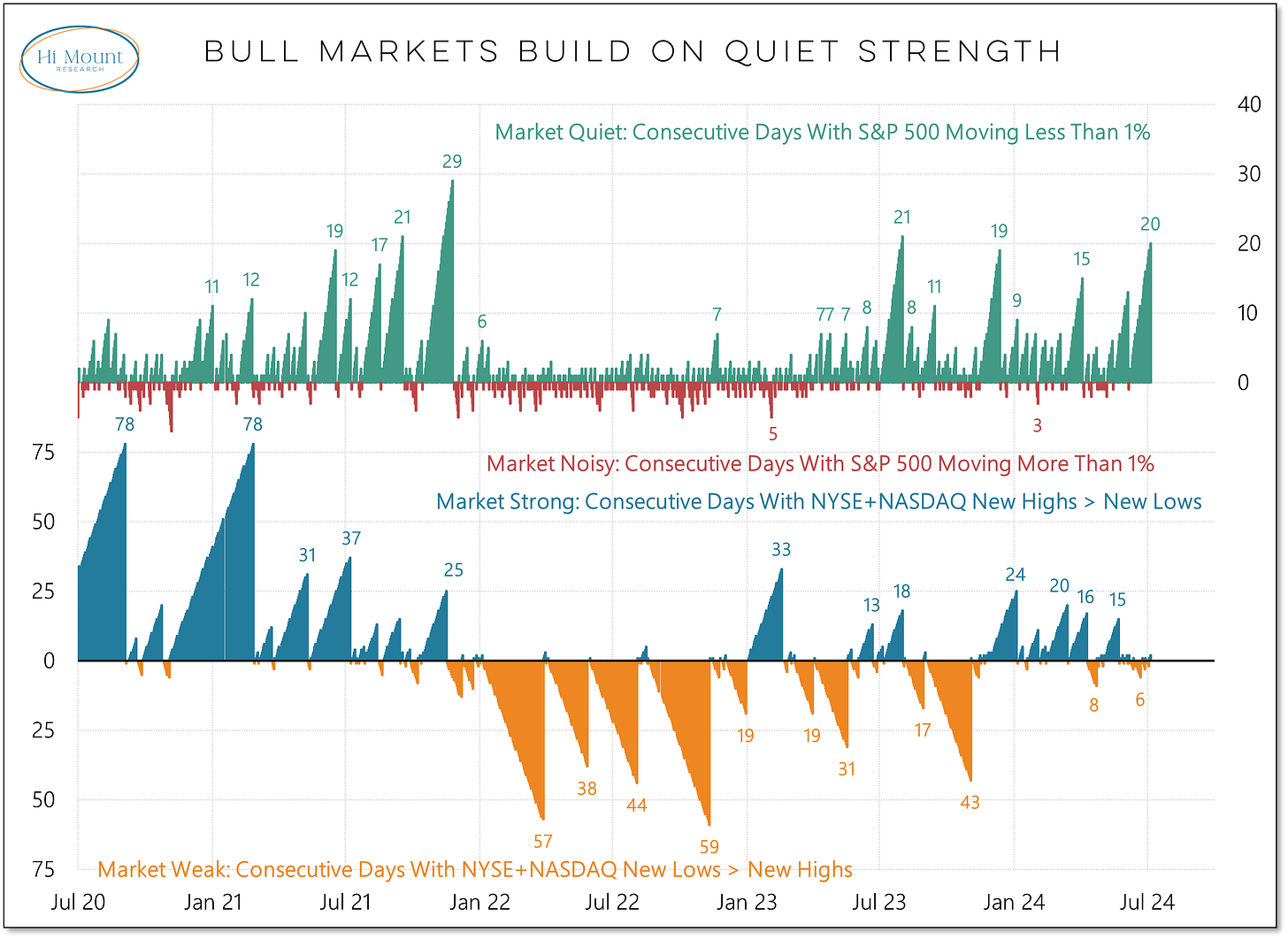

Quiet complacency remains intact as we begin a new week. Barring a big move today, we will match the longest stretch without a 1% swing in the S&P 500 since late 2021.

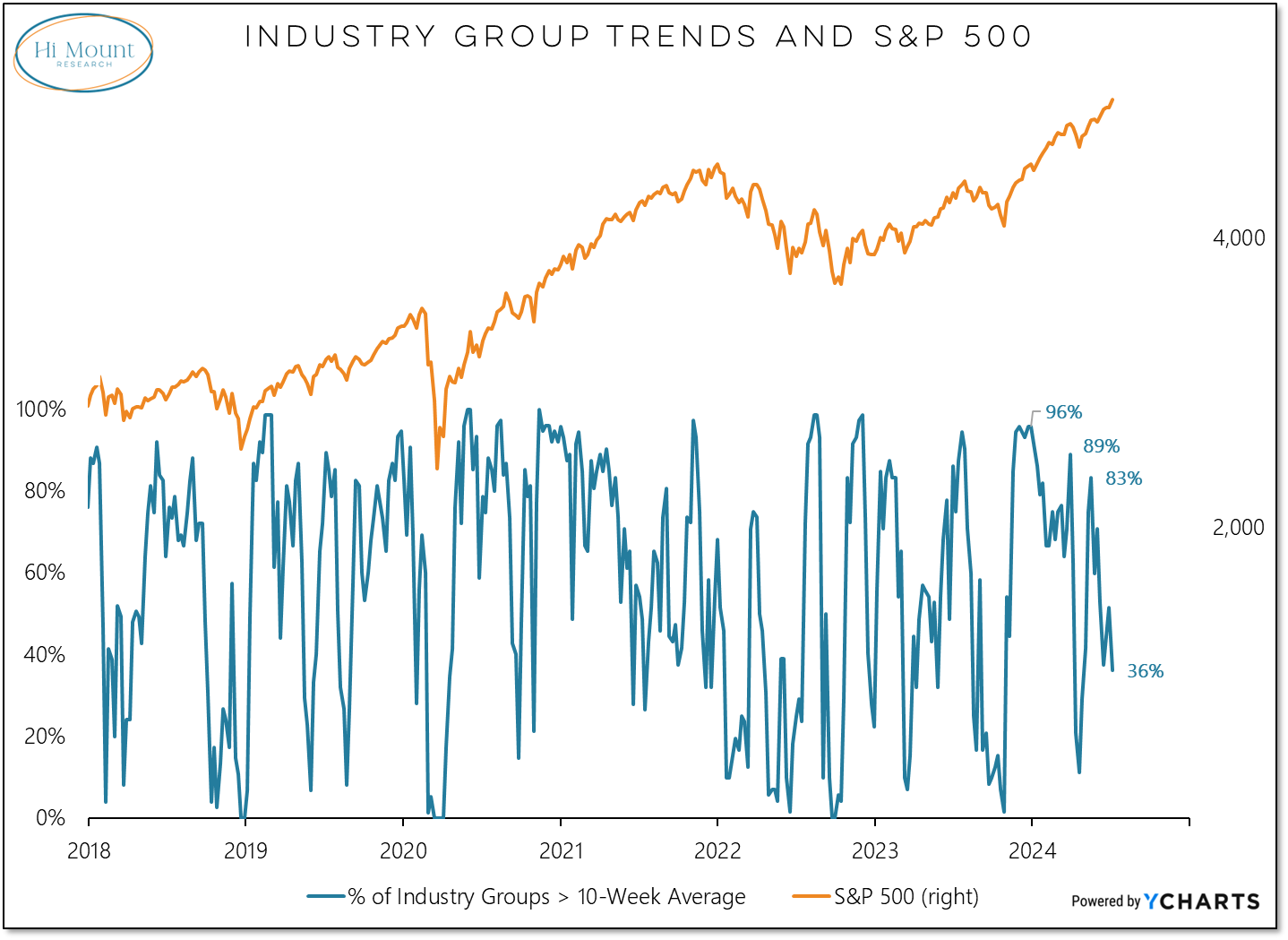

While we are seeing surface-level strength and gains in large-cap growth stocks are pushing the S&P 500 to new highs, we are seeing more stocks make new lows than new highs. A little more than a third of the industry groups in the S&P 1500 are even above their 10-week averages. This a far cry from the 90%+ reading that accompanied the initial move to new highs earlier this year.

Two important takeaways from our latest Relative Strength Rankings Report focus on the persistence of underlying trends:

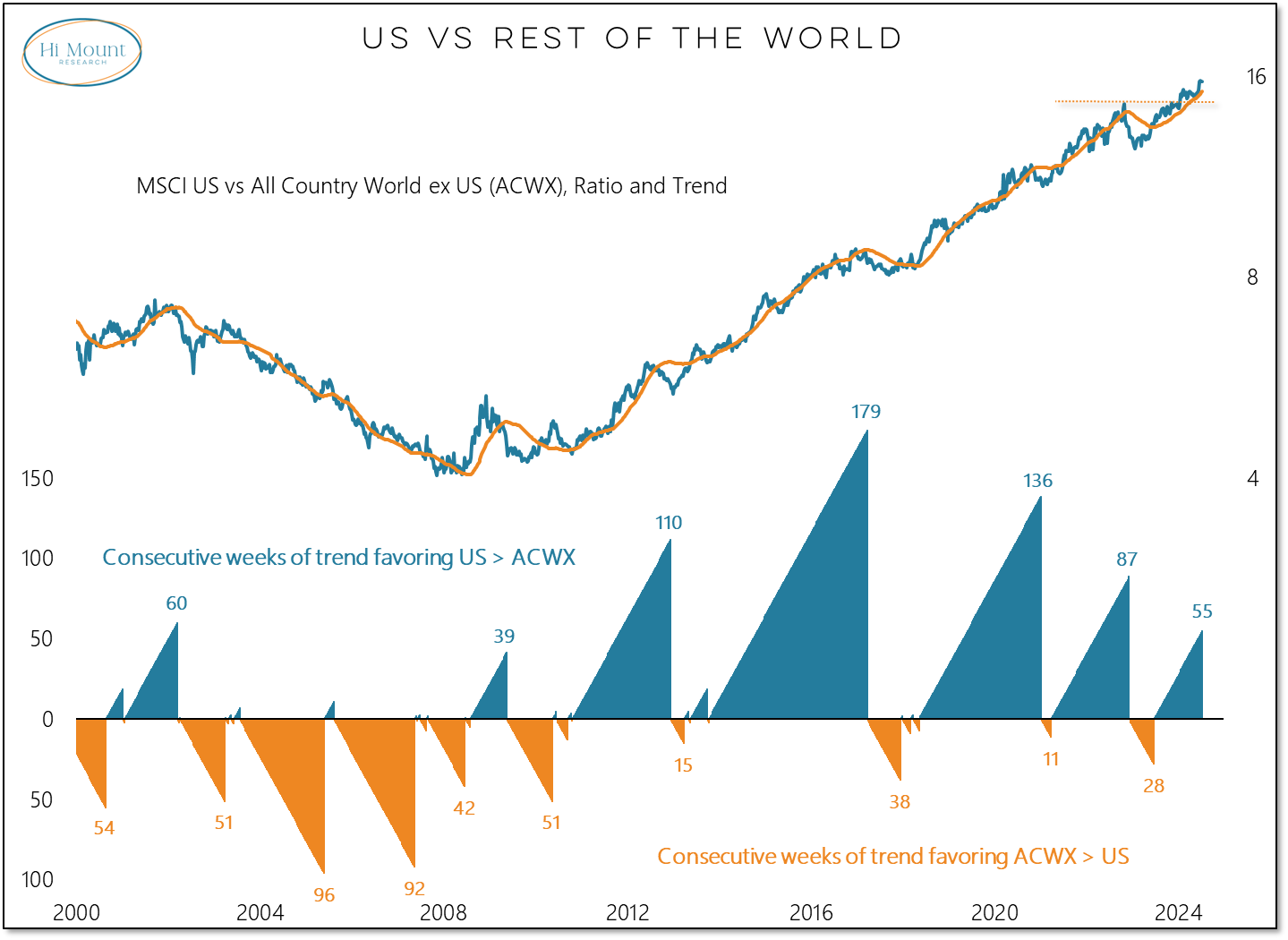

The US has been trending higher versus the ACWI ex US for 55 weeks and counting.

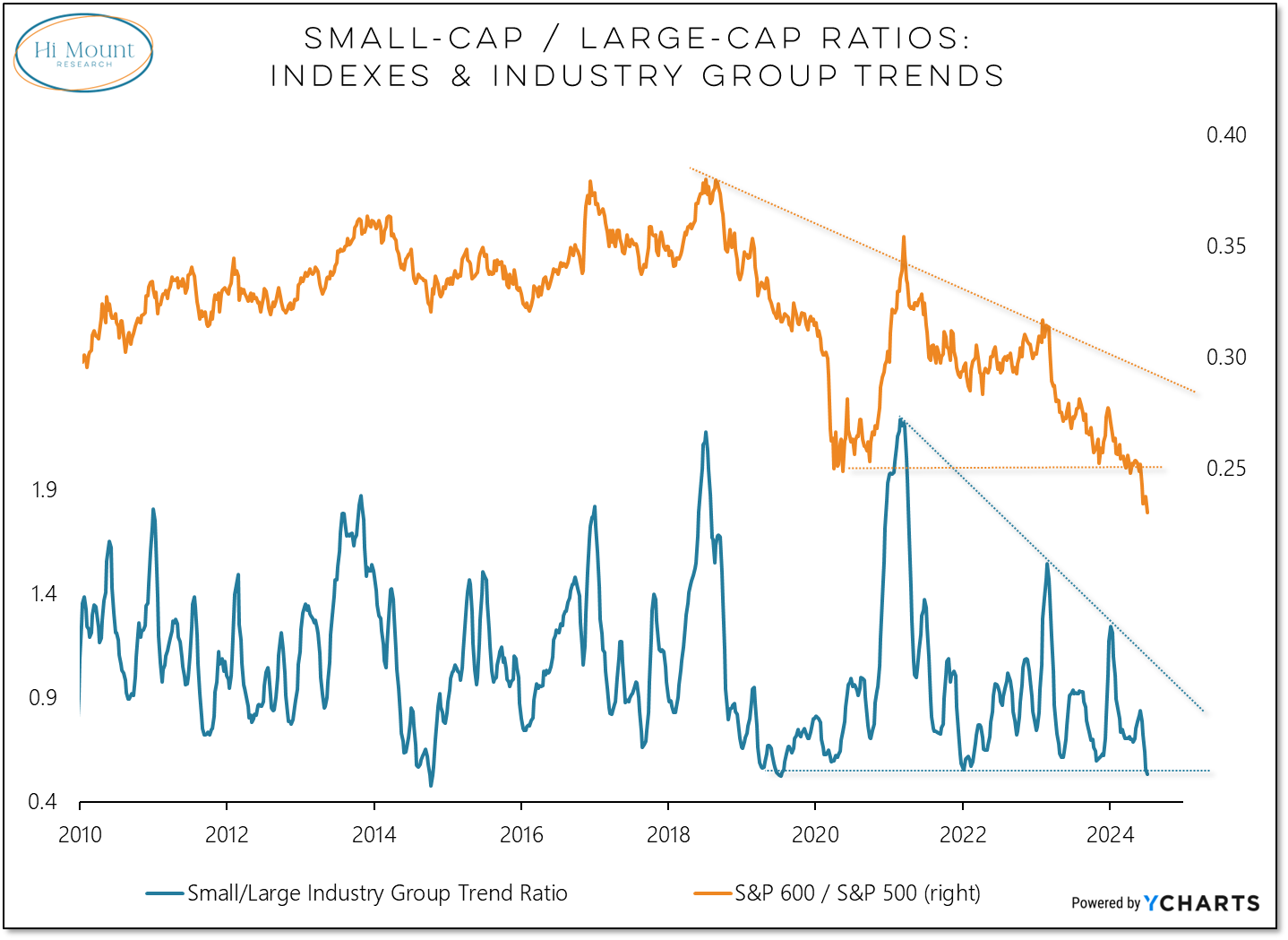

Within the US, the cap-weighted S&P 500 has been trending higher versus its equal-weight counterpart for 68 weeks and counting while small-caps are breaking down versus large-caps at both the index and industry group-level.

Summary tables from our latest rankings report show. . .

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.