Tactical Strength Sets Up Larger Tests

Path of least resistance is higher for now, but tests of market strength lie ahead

Please reach out for more information about Hi Mount Research and options for accessing subscriber-only content.

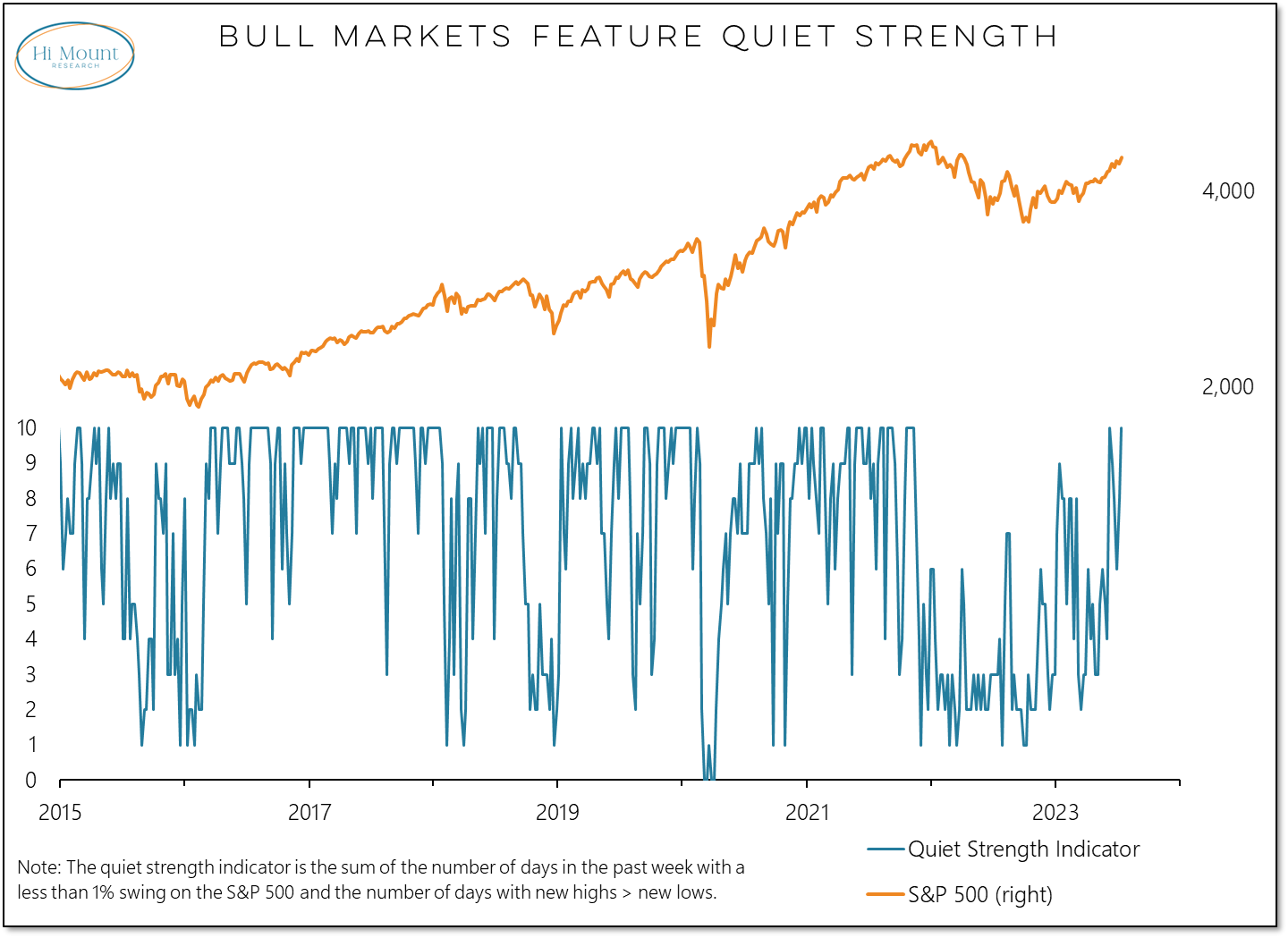

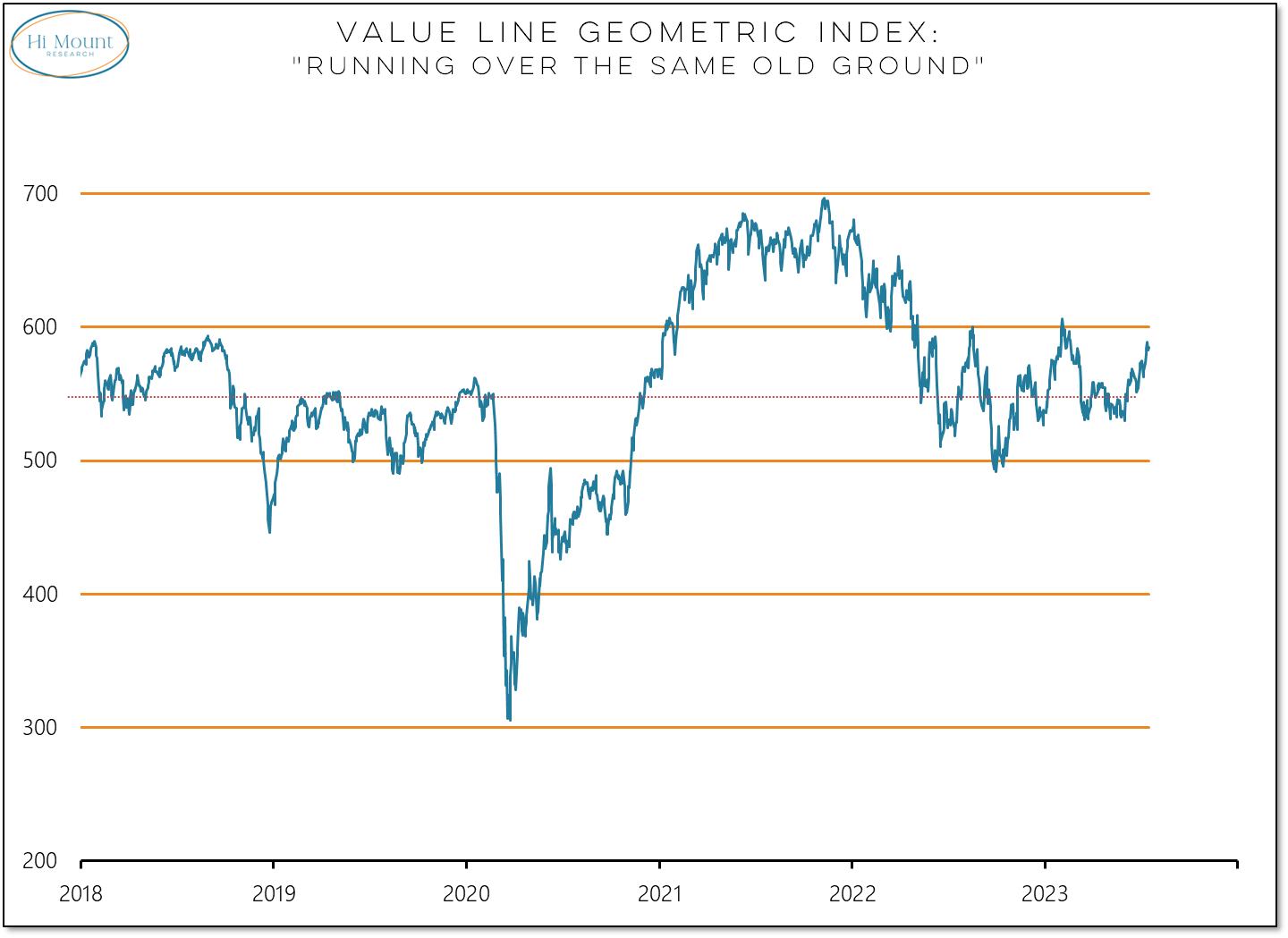

Key Takeaway: For only the second time since the end of 2021, stocks experienced strength (new highs > new lows) and quiet (S&P 500 moved less than 1% on a daily closing basis) every day last week. While tactical strength in the US and around the world is encouraging, zooming out shows a market that remains stuck in sideways action.

More context: Moving from the noisy weakness that we experienced in 2022 to quiet strength as we move into the second half of 2023 reflects an important shift in near-term market behavior. When we look at the Value Geometric Index, the pattern of of the past five years has hardly been broken. This index, a proxy for the median US stock, continues to run over well-traveled ground. Getting above and staying above the 550 level in early June was encouraging. Moving to and through 600 could prove to be a larger challenge and a more important test.

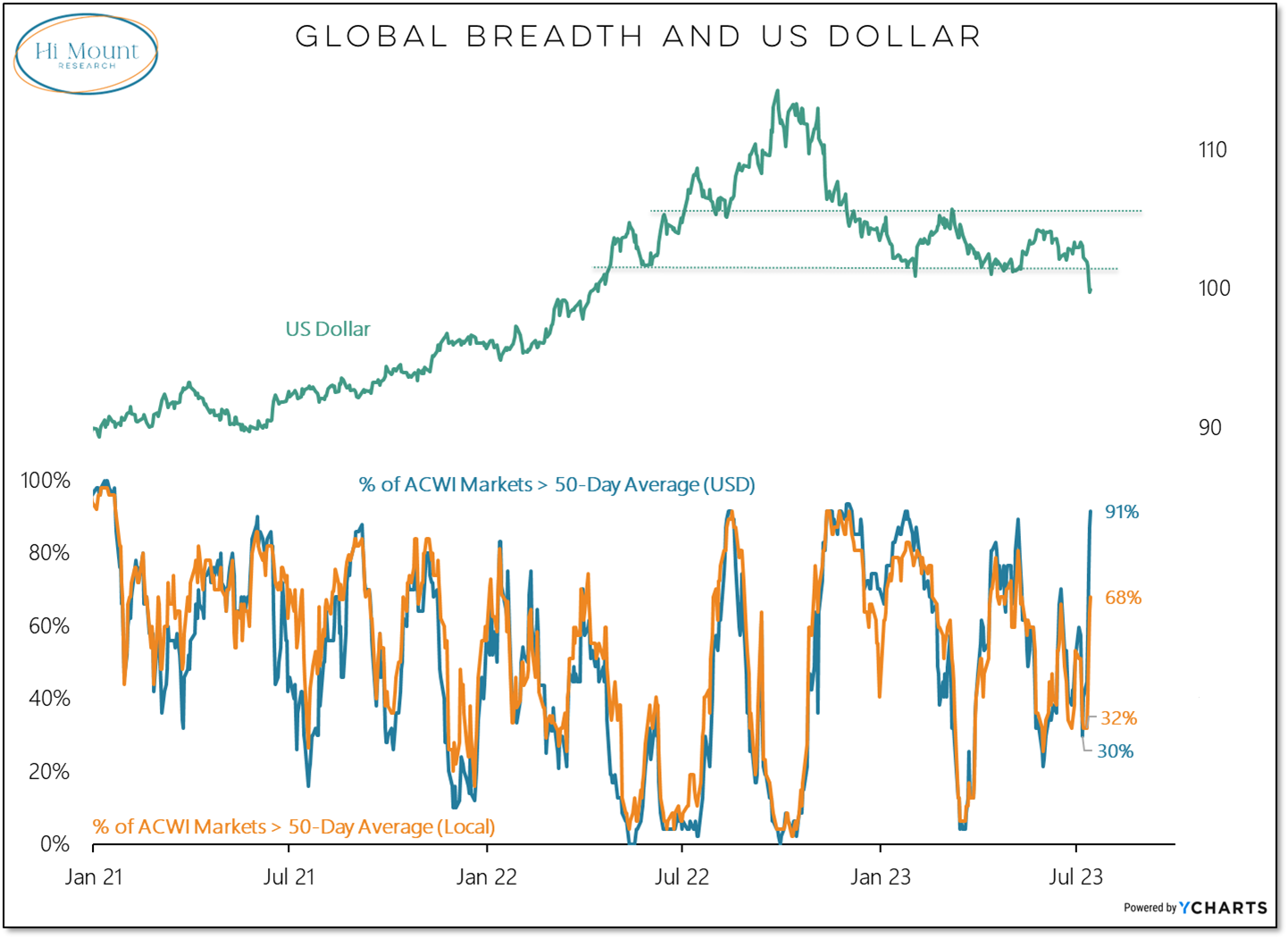

Stocks, both in the US and around the world, are getting an assist right now from the decline in the US dollar. While the percentage of global markets above their 50-day averages has more than double when calculated in local currencies (from 32% to 68%), it has tripled when calculated on a USD-basis (from 30% to 91%). A disorderly decline in the dollar would not be healthy, but right now we are seeing the value of the dollar go down, and the value of assets priced in dollars move higher. This isn't macro, its mathematics.

Go Deeper: Portfolio Applications subscribers can download our latest Weekly Chart Pack and also review this week's Relative Strength Rankings and Asset Allocation Model updates.