Struggle For Traction Makes For An Unprecedented Quarter

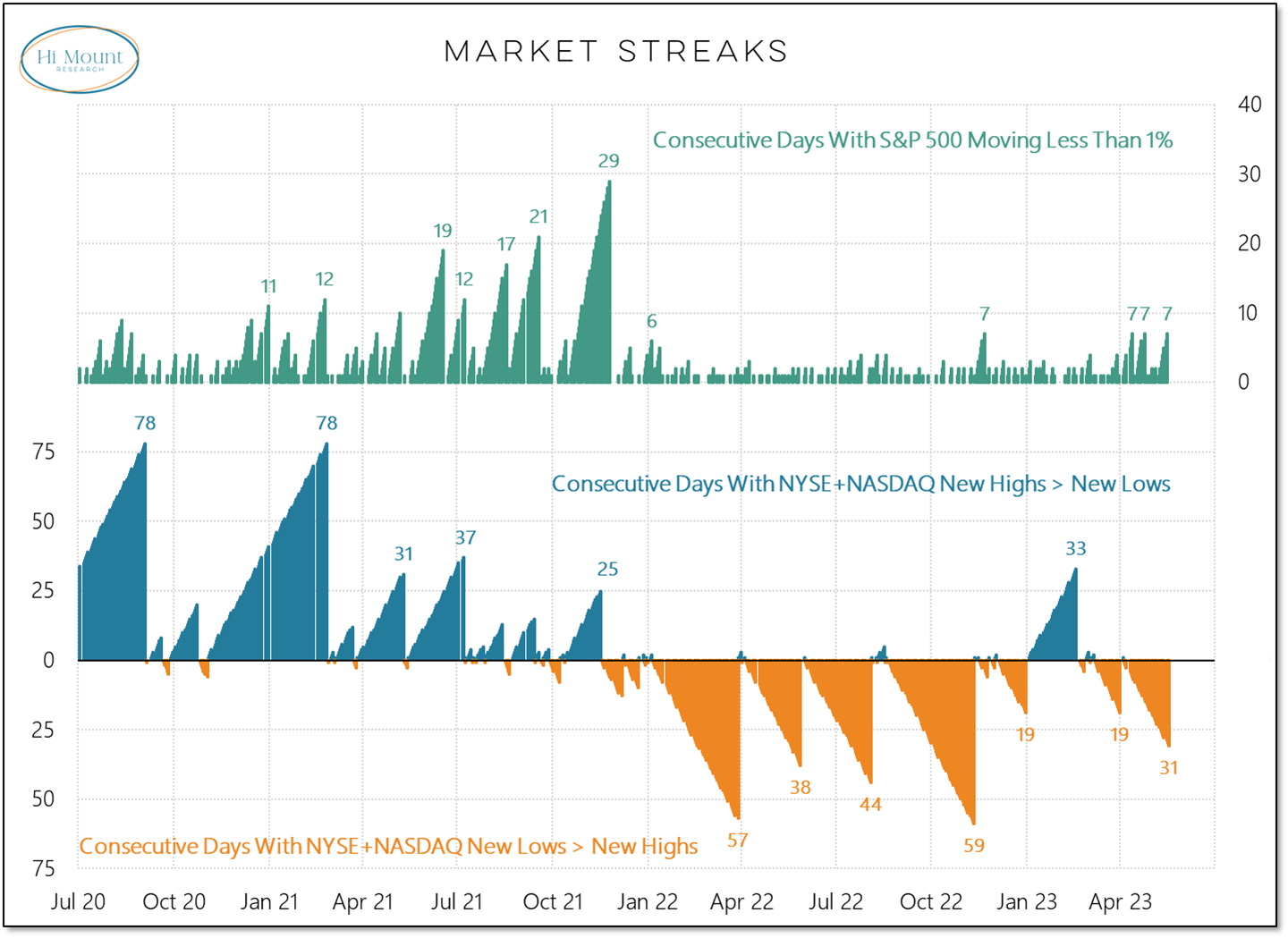

Weakness beneath the surface has come with a notable lack of volatility

The percentage of stocks with 50-day averages above their 200-day averages continues to deteriorate. For the S&P 400, this peaked at 72% (in March) and has now dropped back to where it was in mid-December. For small-caps (S&P 600), its the lowest since early December. Even among large-caps, fewer than half still have 50-day averages that are above their 200-day averages.

Why It Matters: There has been steady deterioration beneath the surface. The median S&P 500 stock is struggling to remain in positive territory on a YTD basis even as the index has quietly bumped up against resistance (and mega-cap indexes have pushed to new 52-week highs). We’ve had three seven day stretches without a 1% swing in the S&P 500 already this quarter but prior to today only once this quarter had the new high list been longer than the new lows list.

This quarter’s combination of quiet and weakness is unprecedented (over at least the past quarter century). That is the first of the discussion points covered this week’s Three for Thursday Market Insights video.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.