Strength Will Be Tested

Rising bond yields add pressure to economy & stock market at a pivotal time

Register for Observations-level access to the Hi Mount Research website here.

Key Takeaway: Bond yields push higher as economic growth stalls and equity market strength gets tested.

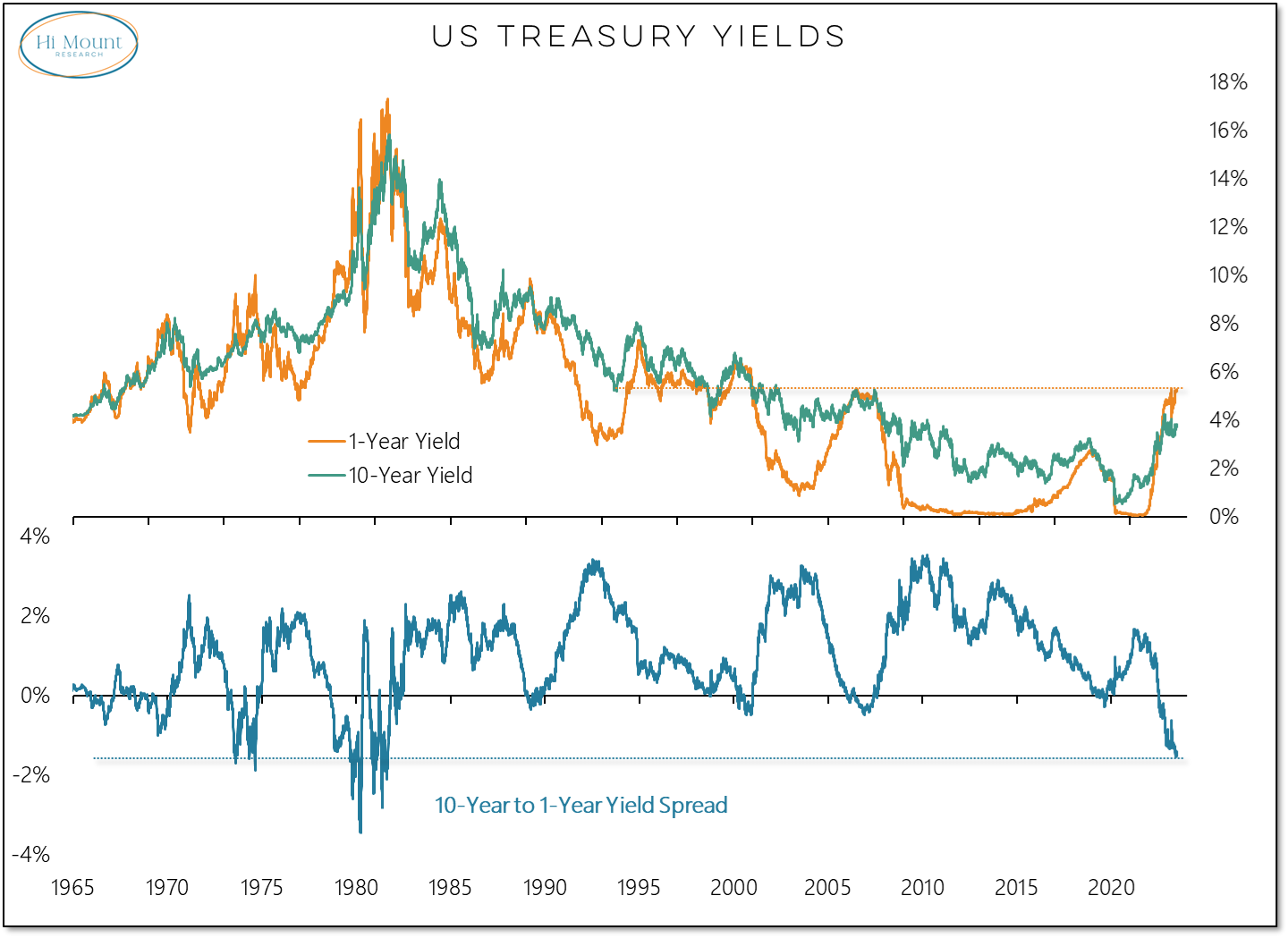

More Context: The long-term trend in the 10-year T-Note yield is experiencing its longest sustained rise in more than six decades even as the yield itself has not surpassed last year's peak (the trend is still rising even as yields consolidate). At the shorter-end of the curve, the yield on the 1-Year Treasury has climbed to its highest level in two decades and this has sent the spread between the 1-year and 10-year to its most extreme level in four decades. This is not a fixed income environment that many investors have experience dealing with.

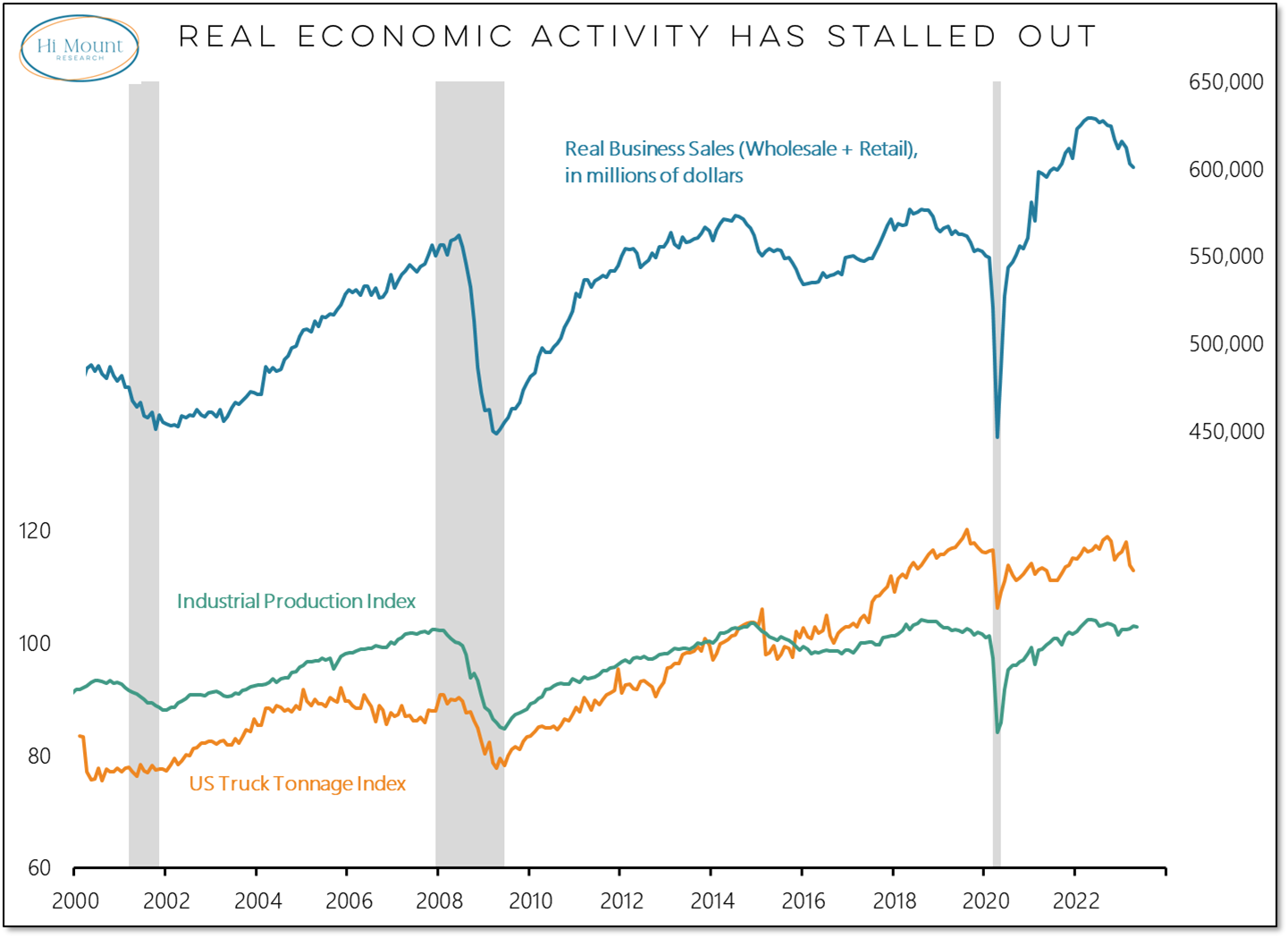

Depending on which probability model you are looking, odds of recession are somewhere between 0% and 100%. I've seen models showing both extremes in recent days. Inflation is providing a veneer of strength. Nominal growth appears relatively robust while real activity is struggling to expand. Business sales have turned lower, fewer goods are being transported on trucks and industrial production has stalled. The economy may not be on as firm a footing as the job data suggests.

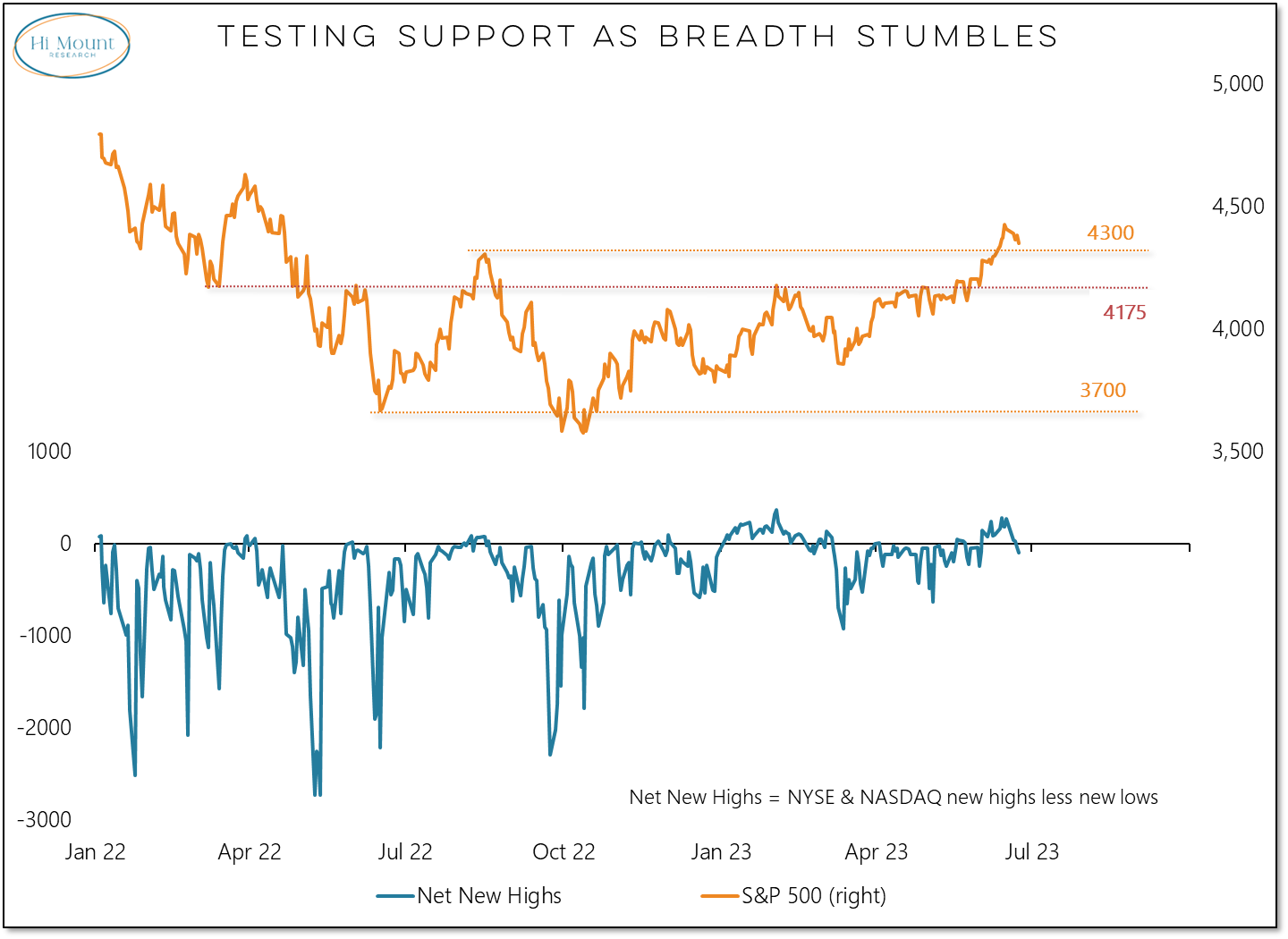

A lack of a firm foundation can also be seen in the stock market. Despite index-level strength, the market is still struggling to produce more stocks making new highs than new lows. Breadth could improve and help support the strength that has been seen in the indexes, but so far that has not been the case. With one week to go in the first half, the S&P 500 is up 13% YTD and the median stock in the index is up less than 1%. Tests of support for the index are less likely to be successful if breadth isn't able to get in gear.

Go Deeper: Portfolio Applications subscribers are encouraged to review this week's Chart Pack.