Strength Is Widespread But It Comes At A Cost

Bull market behavior is intact as price gains outpace fundamentals

Key takeaway: Broad strength pushed stocks to new highs in August but valuation are stretched. A less than robust recovery in risk appetite could signal that investors are reconsidering their aggressive allocation to equities.

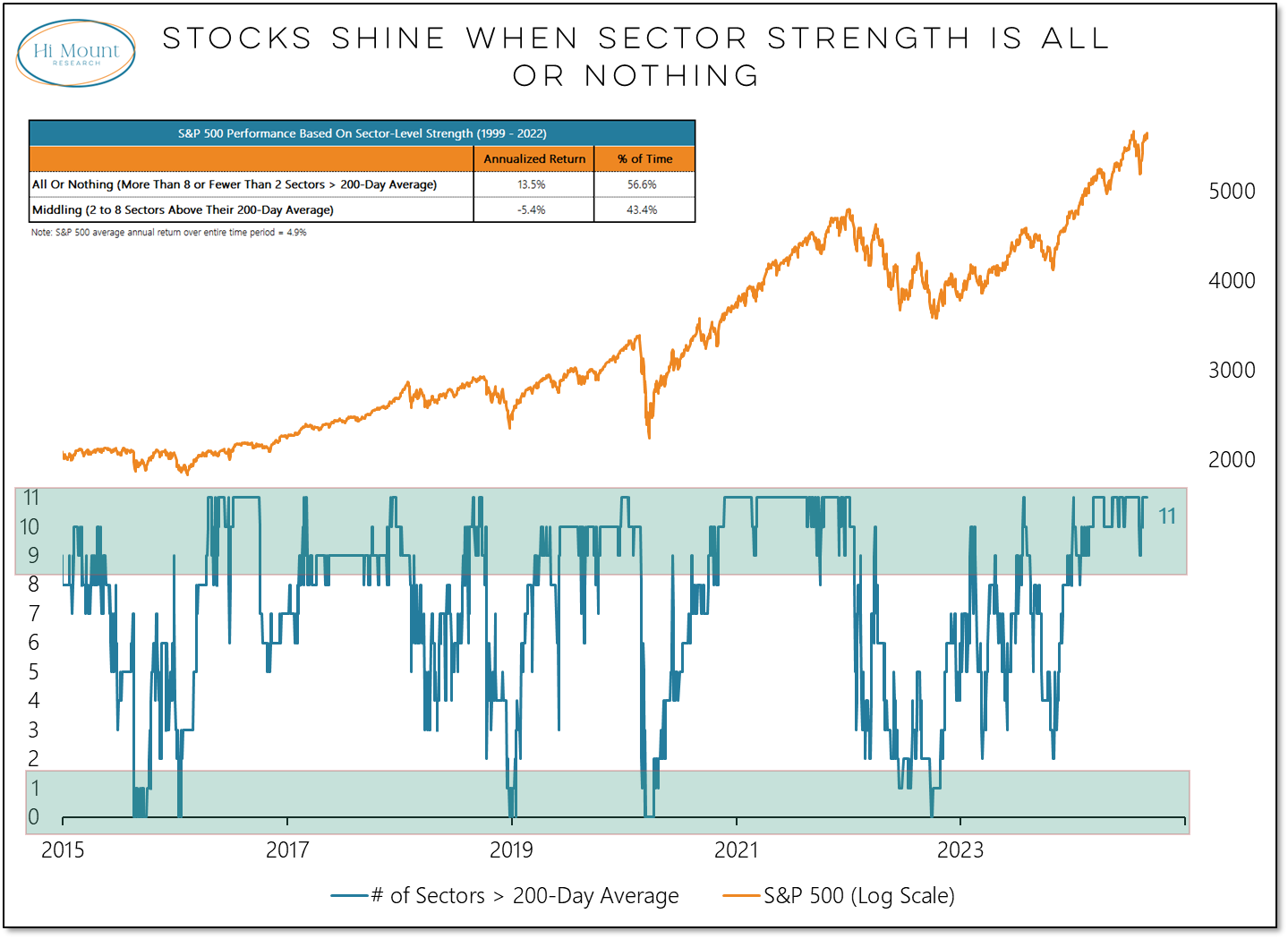

Everybody knows that election year seasonal patterns are not friendly to the bulls this month. But not is the 200-day average for the S&P 500 continuing to rise. we also have all eleven sectors in the index are above their own 200-day averages.

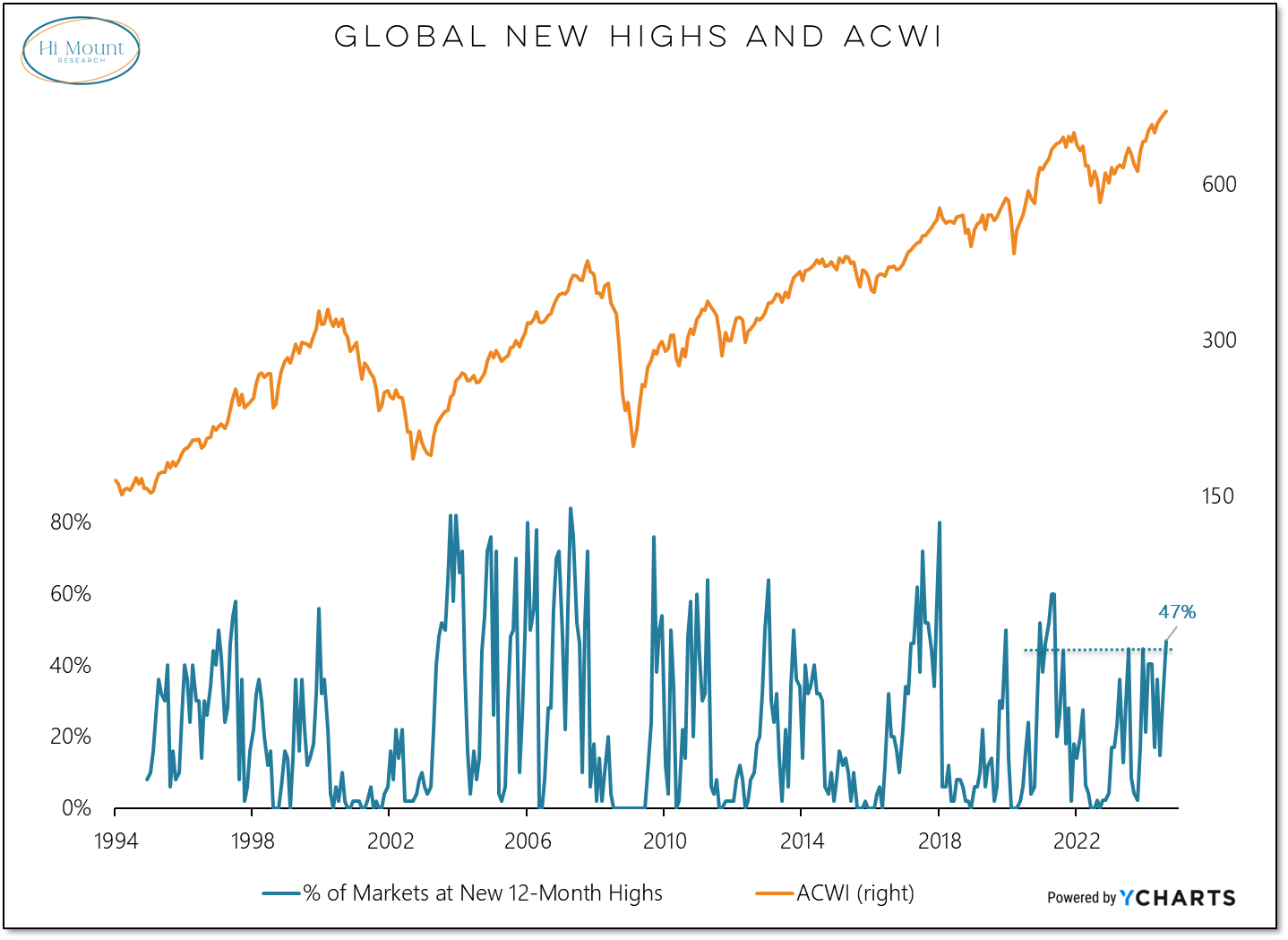

Nearly half the world made new highs in August, the best showing since May 2021.

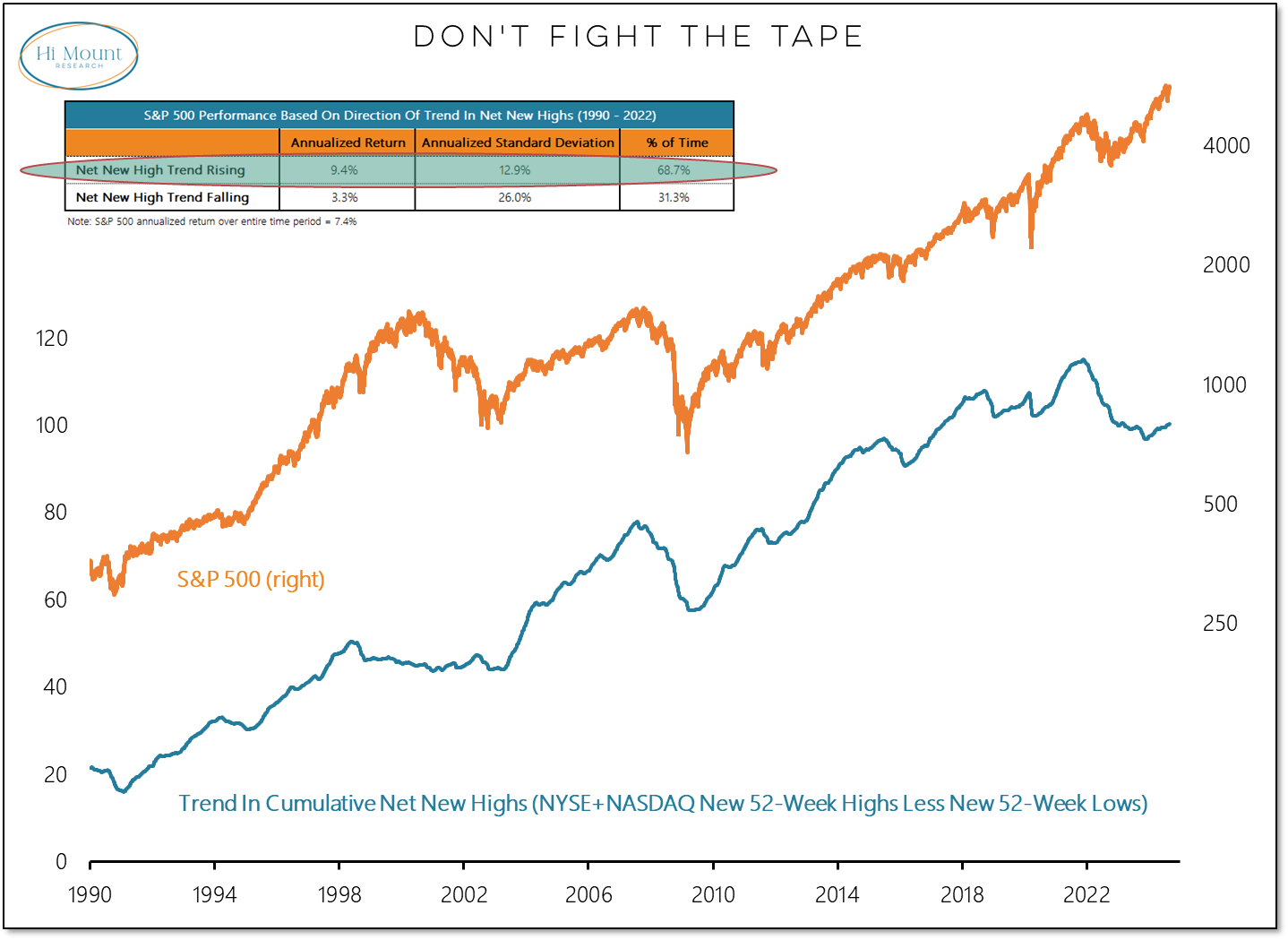

An expansion in new highs is not usually a harbinger of weakness. The S&P 500 experiences a stronger, smoother ride when the trend in net new highs in the US is rising (like it is now) than when it is falling.

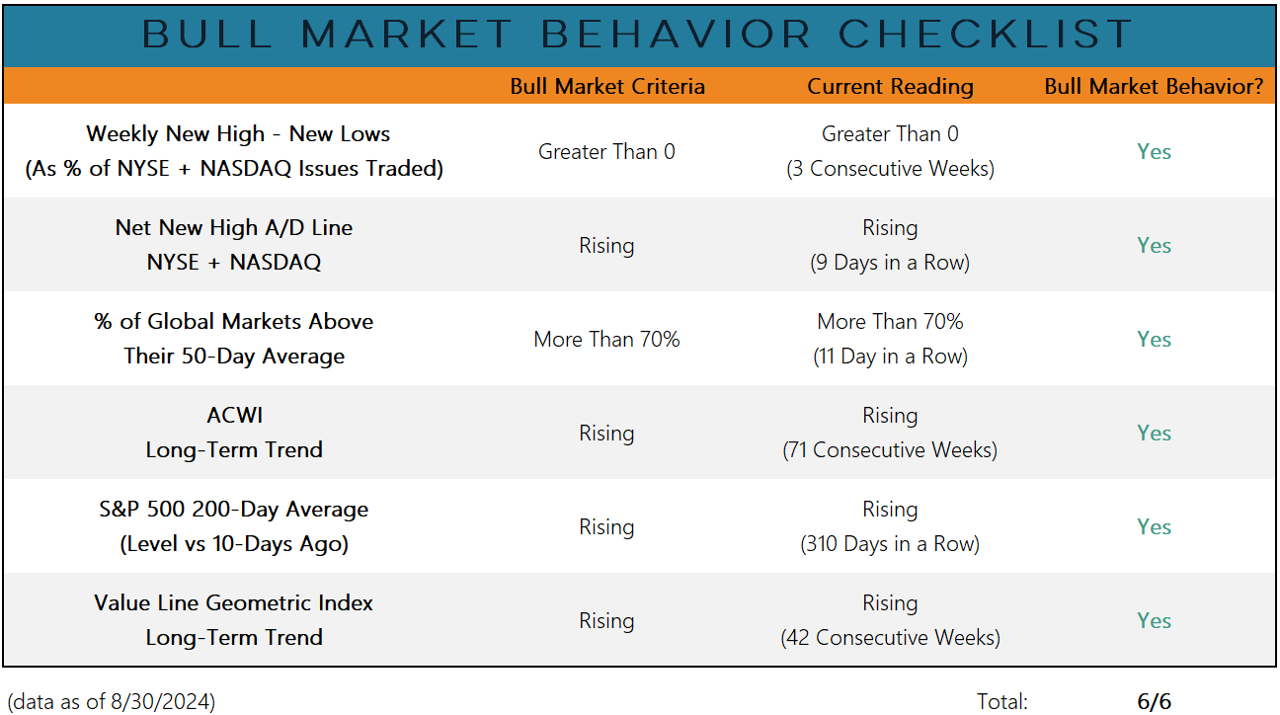

Our bull market behavior checklist looks as domestic and international price and breadth trends. From the perspective of those indicators, the market is firing on all cylinders.

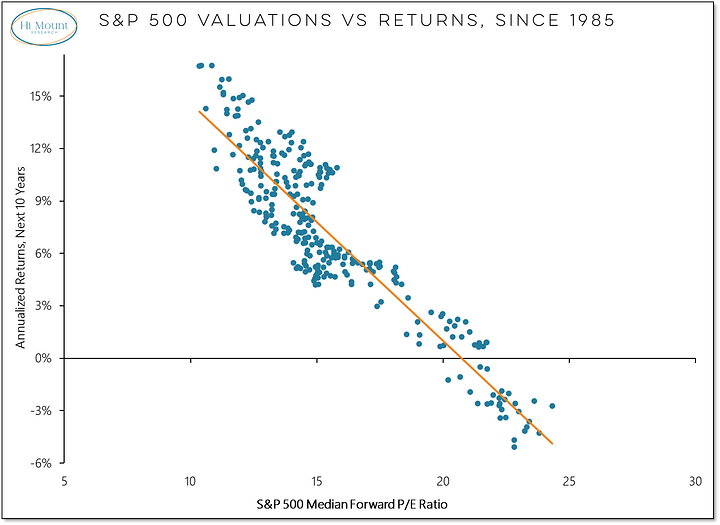

Fundamentals, however, have not been keeping pace with price gains. That has pushed valuations to new cycle high, translating into an unfavorable risk/reward profile from a longer-term perspective.

These valuations imbalances become more acute when the economy is slowing and upward earnings revisions roll over.

Accompanying deteriorating economic fundamentals and extended valuations is on ongoing shift appetite for risk.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.