Stocks Start To Disappoint

Every rally deals with eventual disappointment - the really strong ones are able to shake it off.

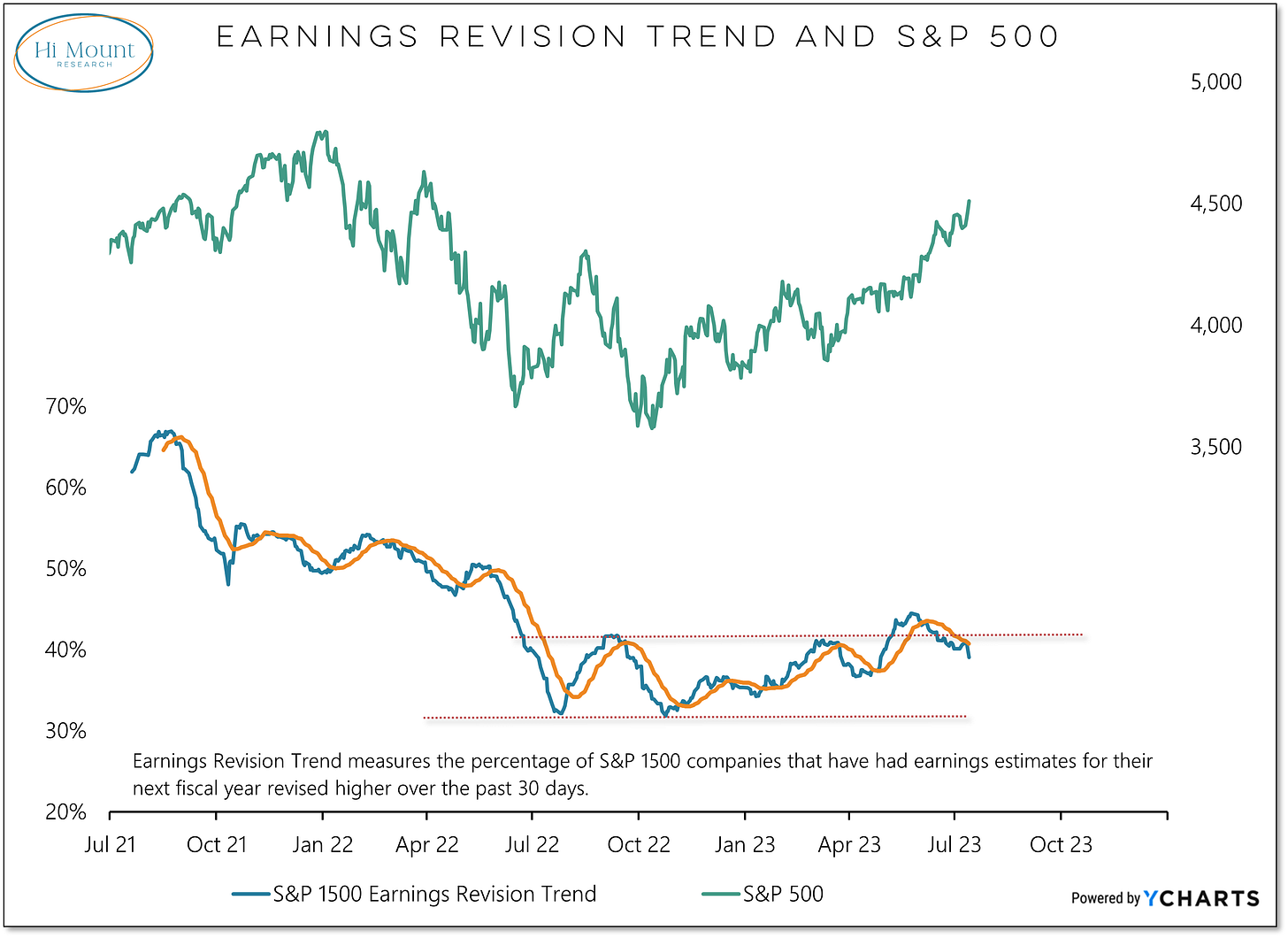

Key Takeaway: The S&P 500 has climbed to new recovery highs but further upside could be a challenge with the trend in earnings revisions rolling over.

More Context: Since the S&P 500 bottomed in October 2022, the earnings revision trend has been generally rising, making a series of higher highs and higher lows. While stocks have surged since the end of May, the trend in earnings revisions has rolled over. This deterioration in the expectation for earnings comes as economic data continues to surprise to the upside and investors have rushed to embrace stocks. The ability of investors to deal with disappointment (not with numbers for the last quarter but estimates for the coming year) could be an important test of strength as Q2 earnings season gets underway in earnest.

Following are links to the paid-subscriber content published this week. If you are not a subscriber, let’s talk about increasing your access to Hi Mount Research.

Market Notes: Entering H2 With Quiet Strength (7/10)

Weight of the Evidence: Price Strength Defies Macro Headwinds (7/11)

Weekly Touchpoints: Stocks Start To Disappoint (7/14)

Asset Allocation Model: Price Trends Favor Stocks Heading Into H2 (7/10)

Relative Strength Rankings: Mid-Cap Industrials In Relative Strength Sweet Spot (7/10)

Monthly Conference Call (Video Update): Mixed Messages Across Time Frames (7/13)

Discretionary Dynamic Portfolios: Strategically Cautious But Tactically Bullish (7/12)

Systematic Blue Heron Portfolios: Trend-following System Favors Stocks Over Bonds & Commodities (7/12)

Have a great weekend.