Stocks Remain Well-Loved and (Mostly) Well Behaved

Elevated optimism can seem scary but rather than fighting the crowd, realize that it takes bulls to have a bull market.

If you are interested in learning more about what Hi Mount Research is all about and what we have to offer, please reach out and set up a time to chat.

Now, a few updates/observations before shutting down for a few days as we move toward Holy Week observations that culminate with the Celebration of Easter on Sunday morning:

Three days in a row of decliners > advancers. Going back to early November, weakness beneath the surface had not lasted for more than two days. That marks only the third time in the past quarter century that the market has gone 90 or more days without experiencing three consecutive days with more stocks in the S&P 500 falling than rising.

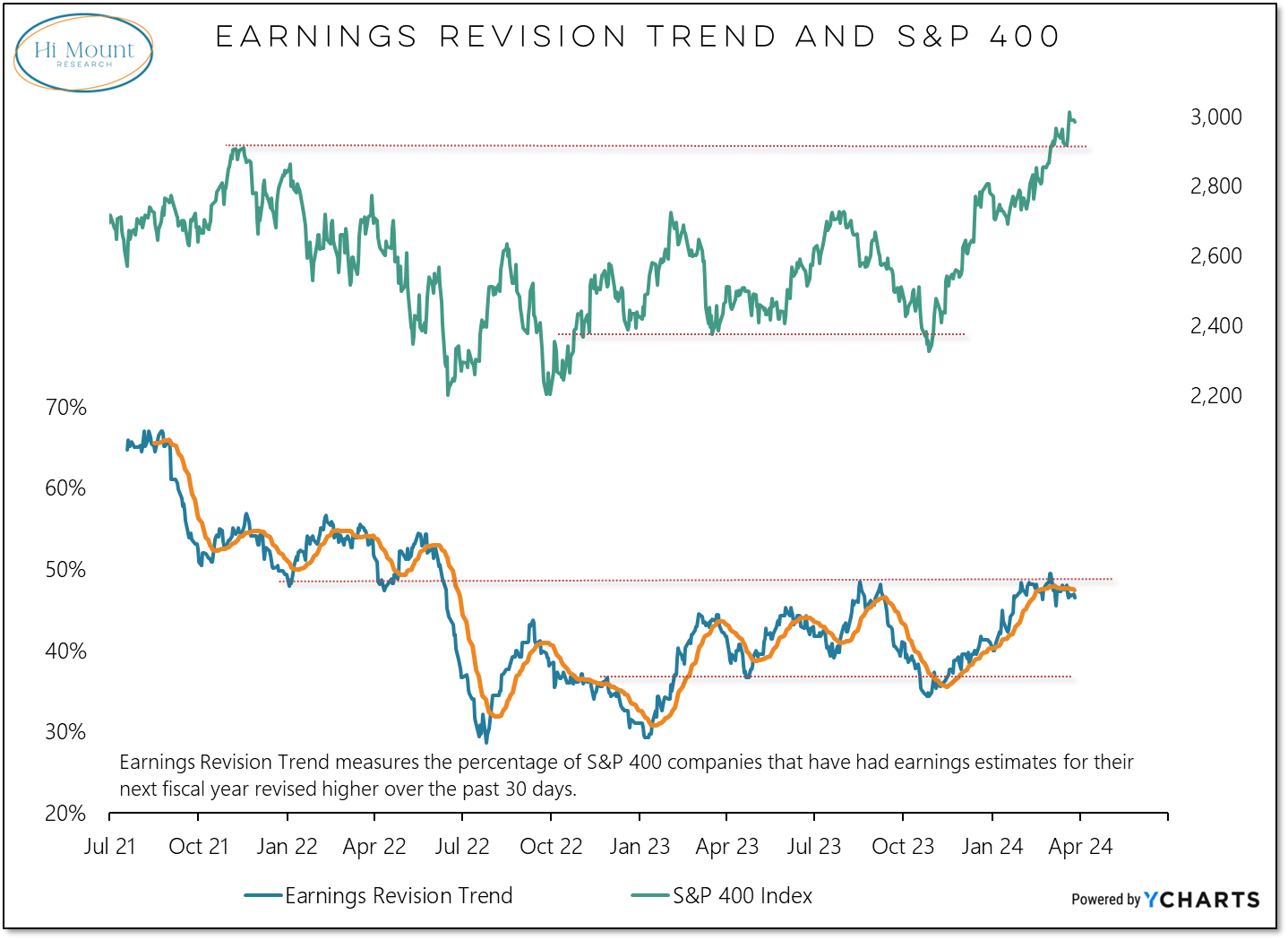

Earnings revision trend rolling over. The improved price and breadth trends for stocks that emerged late last year was accompanied by a steady rise in the earnings revision trend. While the price action has remained strong in recent weeks, earnings revisions have stalled and are rolling over. What had been a tailwind for stocks is becoming more of a headwind.

The crowd still loves stocks. Consensus bulls remain at 79% - the highest reading in the data I have that stretches back nearly two decades. II bulls are at 60% and bears are at 15%. The bull-bear spread has been above 40% for 8 of the past 9 weeks (during which time the S&P 500 has rallied from below 5000 to above 5200). Elevated optimism can seem scary but rather than fighting the crowd, realize that it takes bulls to have a bull market. Risks increase when the bull-bear spread drops below 20%.

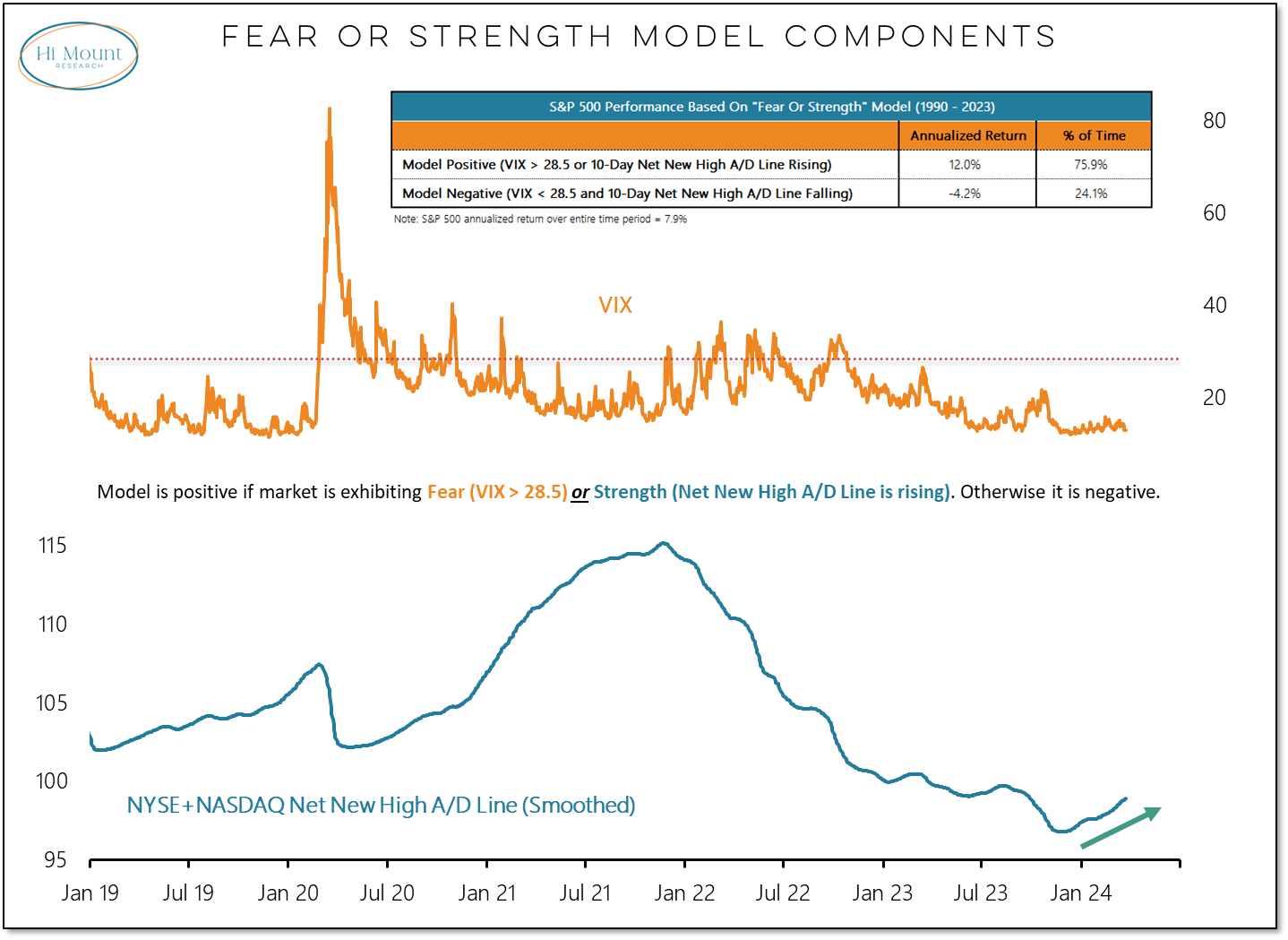

No fear, but plenty of strength. Market hiccups can occur at anytime and there are always a few Apples falling off the cart. But when new highs are persistently exceeding new lows (as is now the case), those stumbles do not usually lead to big spills. Even with the market on the cusp of back-to-back double-digit quarterly gains for only the sixth time in the past quarter century, our tactical Fear or Strength Model argues that the bullish case gets the benefit of the doubt.

Something to put on your radar:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.