Stocks Have Been Strong, Gold Has Been Even Stronger

Gold has out performed the S&P 500 on a total return basis since 2000 yet it is systematically excluded from asset allocation conversations

Key Takeaway: Stock market behavior continues to be characterized by quiet strength. But it is gold that is the relative strength leader.

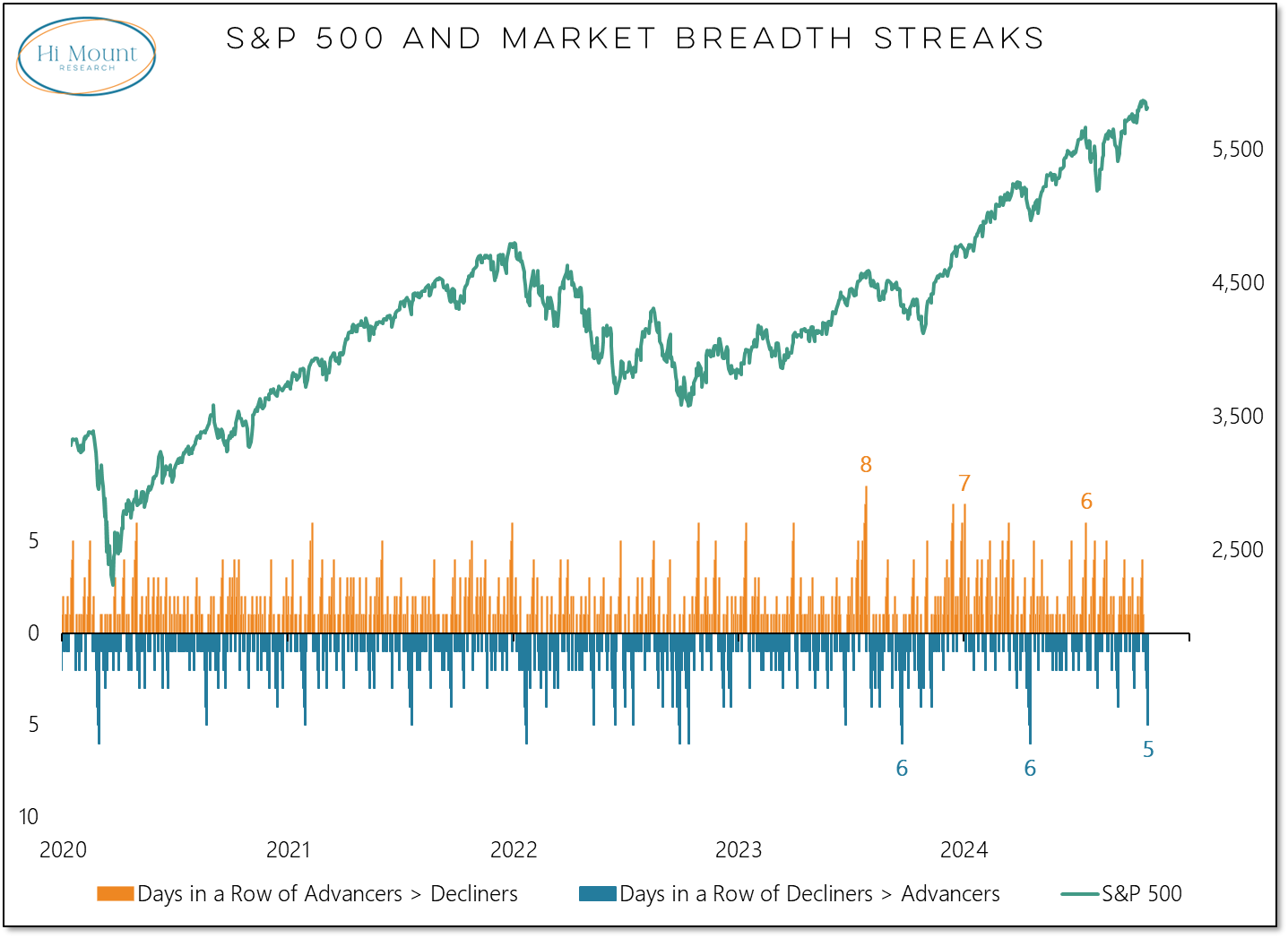

More stocks were down than up on the S&P 500 every day last week. That’s the longest stretch of decliners > advancers since April. We haven’t seen more than six down days in a row since late 2018.

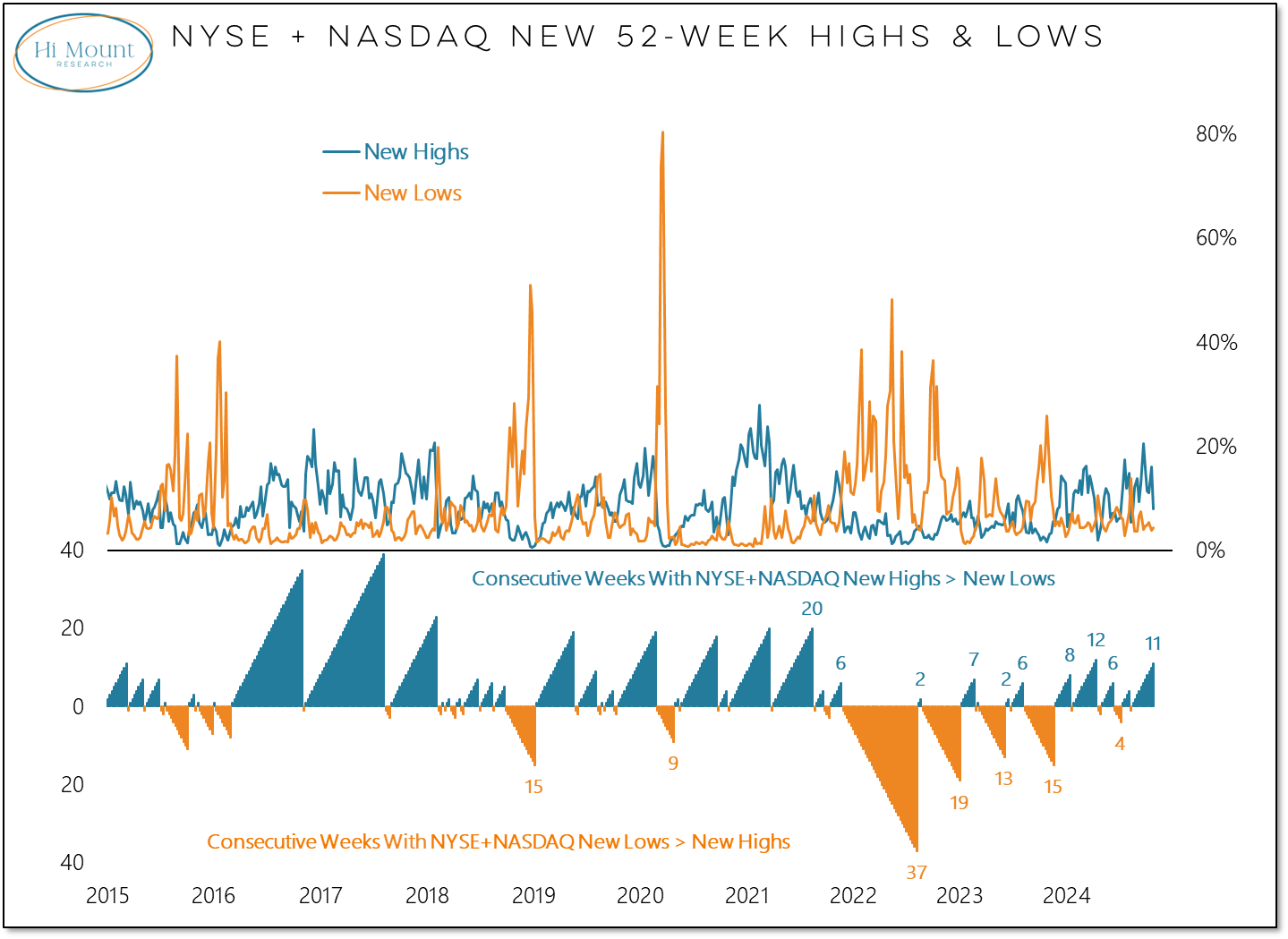

Despite the day-to-day weakness in the broad market, the weekly new high list remains longer than the new low list. When it comes to breadth, new highs vs new lows is a much more important metric than advancers than decliners.

Moreover, the market remains quiet. It has been 26 days since the last 1% move on the S&P 500. That is the longest such stretch since mid-2021. Quiet markets tend to be strong markets.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.