Stocks Flourishing In The Wake Of Persistent Pessimism

Investors have turned giddy but broad strength in equities and beyond is rewarding that optimism

Portfolio Applications subscriber note: We have published an update to our Dynamic Cyclical & Tactical Opportunity Portfolios. While equity market leadership persists, we are following the lead of our systematic models and have added exposure to commodities.

Key Takeaway: Optimism and strength are a potent mix that can help sustain a bull market. Given the pessimism of the past few years, looking at sentiment from a contrarian perspective may not be the right call.

The latest Investors Intelligence data shows the most bulls since July 2021, the highest bull-bear spread since April 2021 and the fewest bears since February 2018.

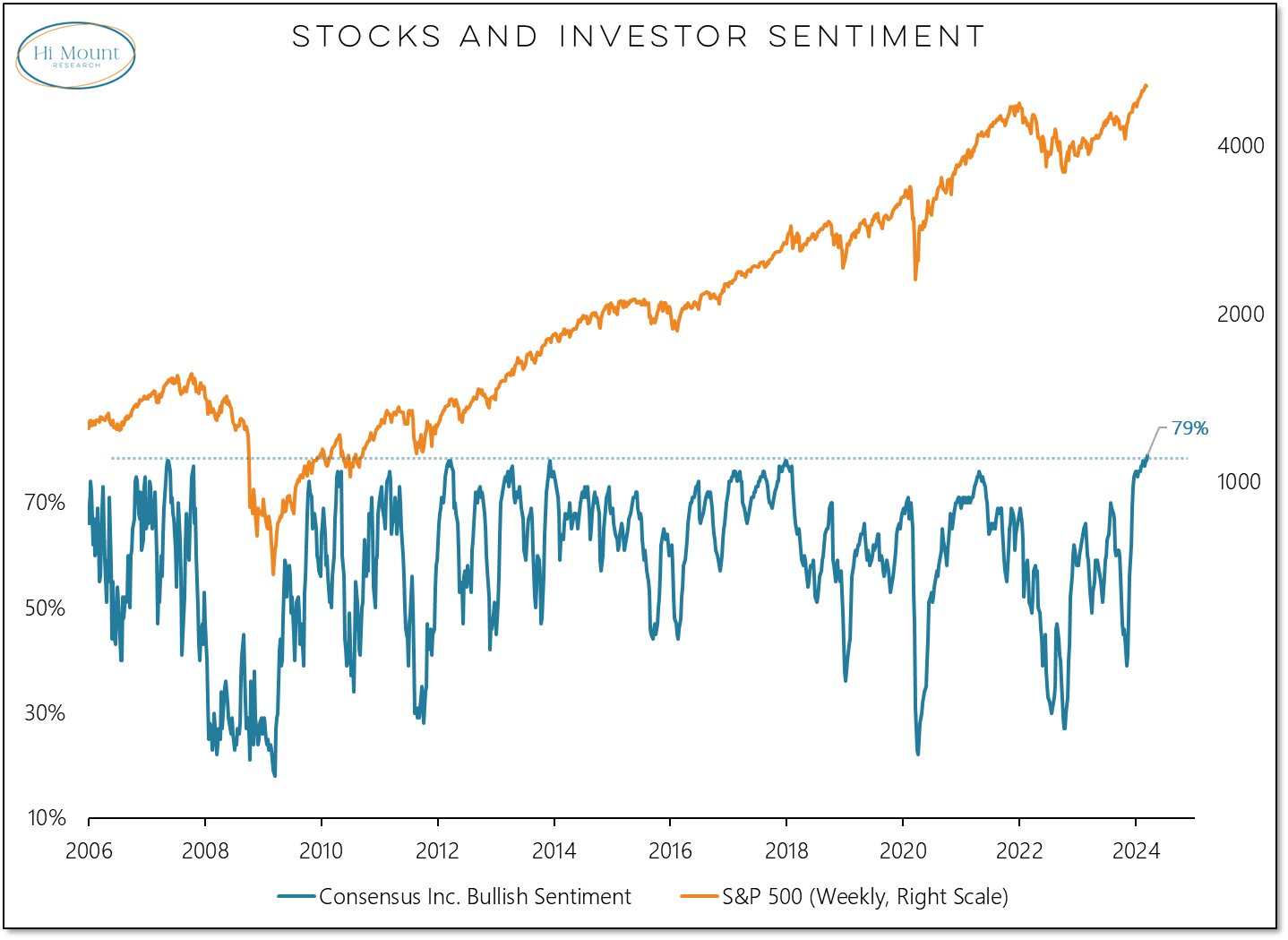

I’ve got data from Consensus Inc going back nearly 20 years and bullish sentiment has never been as high as it is right now.

But accompanying all this optimism is plenty of broad strength. The number of stocks making new highs just hit a new high. The percentage of S&P 500 stocks above their 200-day average this week has climbed to a new recovery high.

In strength begets strength fashion: when it has gotten above 80% in the past, it has tended to stay above 80% for an extended period of time.

So not only are those mid-February “divergences” dissipating one-by-one, but investors are being rewarded for their optimism. Given what we know about stocks flourishing in the wake of persistent pessimism, taking a contrarian view on sentiment (looking for weakness in light of the widespread optimism) may be premature.

We discuss this in our latest Weight of the Evidence update: Needing bulls to have a bull market is a reality and so we’ve taken Sentiment out of the Risk camp and that tilts our scales toward Opportunity.

We take a closer look at sentiment and strength, as well as summarizing our views across the various weight of the evidence categories below:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.