Steady Strength Fueling Recent Rally

Weekly & quarterly gains accumulate without day-to-day fireworks

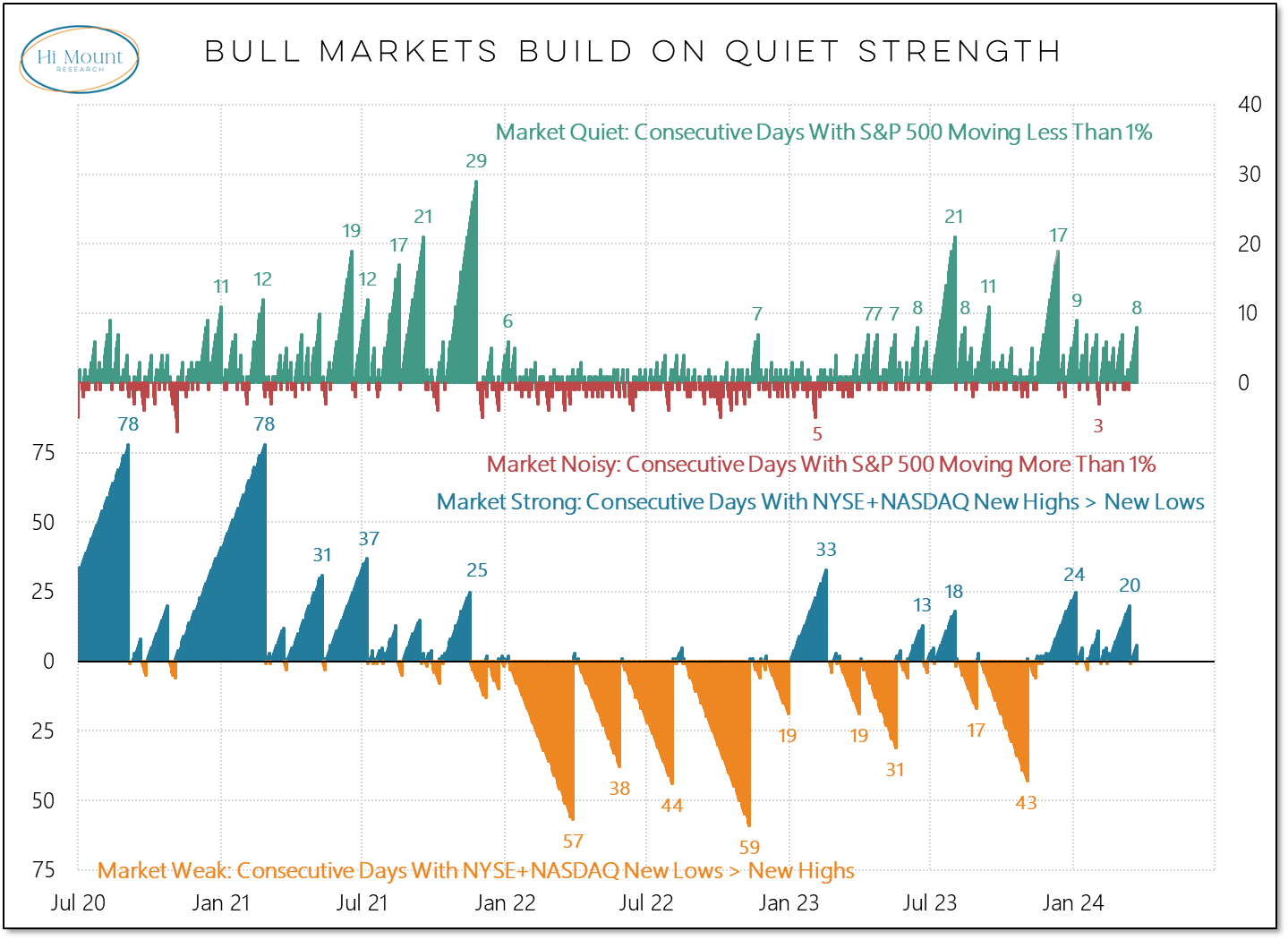

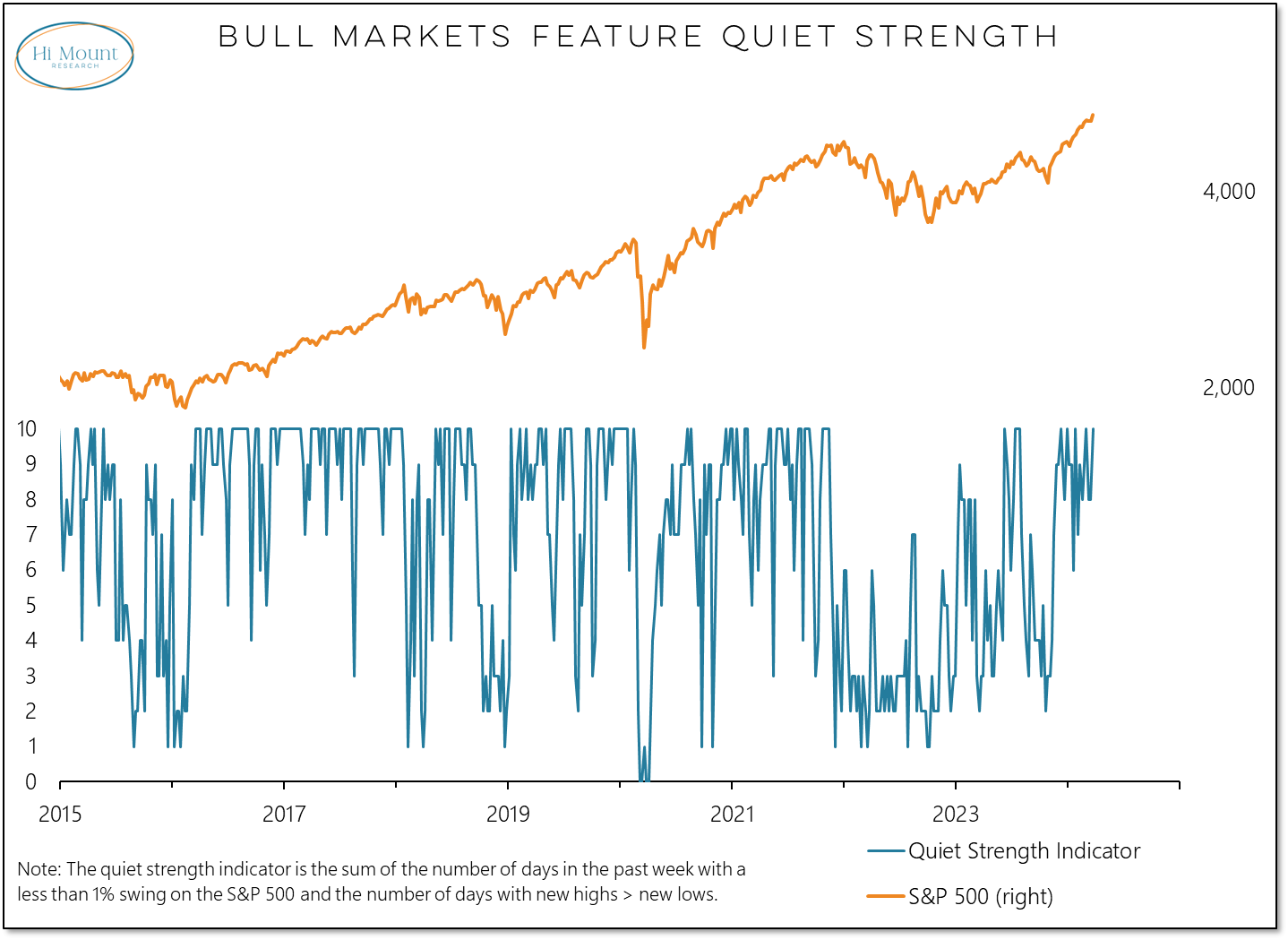

It’s been over a week-and-half since the S&P 500 last moved by more than 1% in a single-day in either direction. While the market turned quiet in the middle of last year, it wasn’t until late in the year that strength became more persistent.

While markets that are quietly strong may not make for great headlines, they have been a signature of bull markets in the past. That continues to be the case in the present.

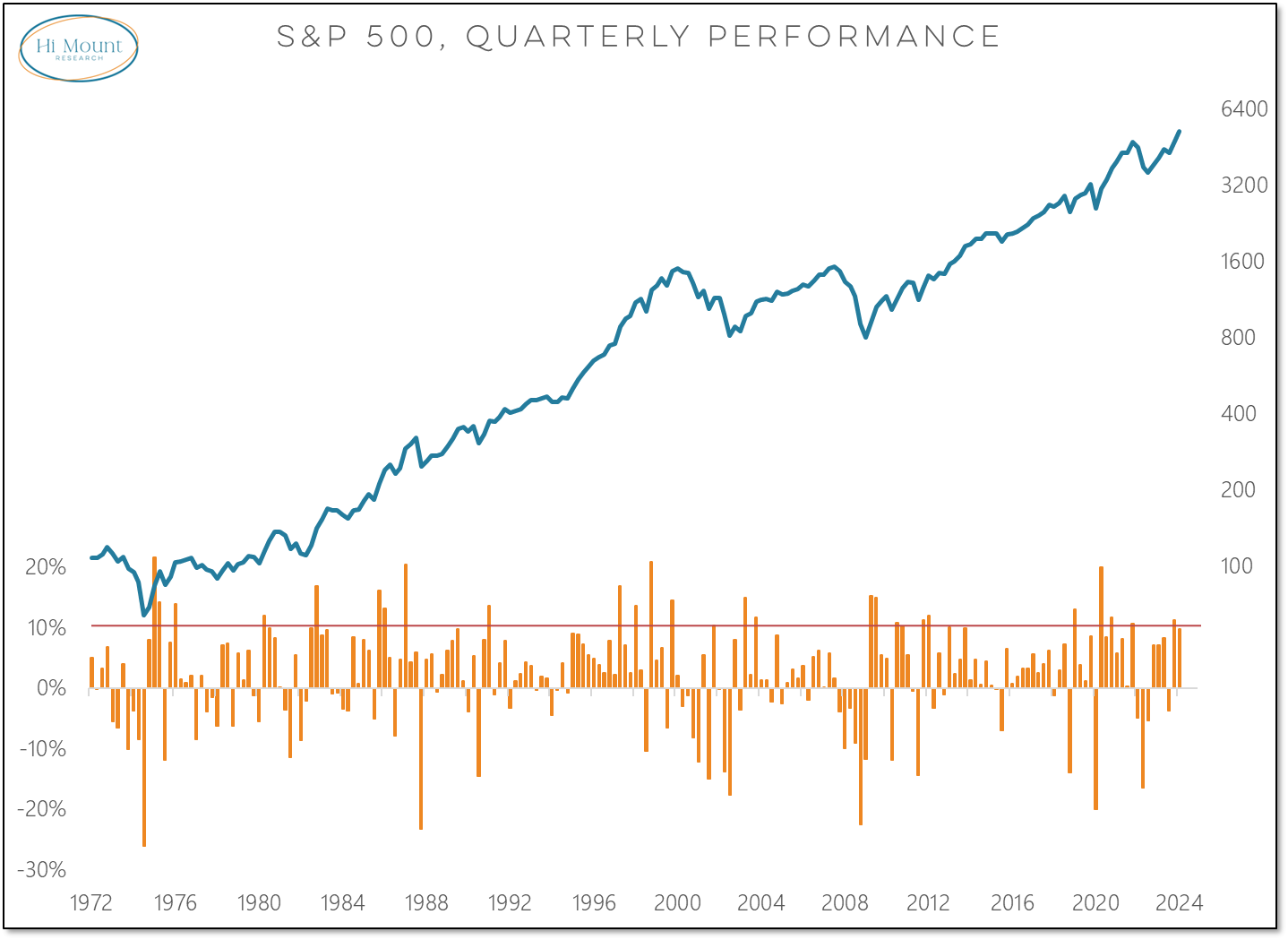

Now, after posting its best weekly gain of the year, the S&P 500 enters this holiday-shortened week (markets will be closed for Good Friday) with a good chance to do something it has not done in over a decade (and has only been achieved 5 times in the past 50 years): post back-to-back double-digit quarterly gains.

For that to happen we need to see 5250 before shutting down to celebrate Easter.

Subscribers can keep reading to see a summary of our latest Relative Strength Rankings report, which shows small-caps breaking down relative to large-caps and Energy & Industrials at the top of our relative strength rankings.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.