Sputtering Economy Raises Pressure On The Fed

Weight of the evidence tilts positive but macro risks could test market resiliency heading into Q4.

Paid subscribers can download the latest Weight of the Evidence and Relative Strength Ranking updates directly from our website.

Key Takeaway: The market has gotten noisier this month, but bullish behavior remains largely intact. Further volatility, however, could weigh on investor sentiment and have bulls putting their money to work elsewhere (hint: bonds). Given that valuations are in the sky and real activity in the economy is sputtering toward recession, macro risks could test market resiliency as we move toward Q4. If that is the case, expected rate cuts from the Fed could be seen as reactionary rather than precautionary by the market.

Housing market activity is back to levels seen during the COVID lows. Housing construction activity (starts and permits) is in a 30% drawdown from its peak while selling activity (new and existing) is 40% of its highs.

Investors and pundits alike applauded the new high retail sales data, overlooking the reality that when adjusted for inflation, sales peaked 3 years ago. Consumers have been spending more and more, but bringing home less and less.

Data revisions this week could leave payroll employment (from the Establishment Survey) looking more like the full-time employment data (from the Household Survey). Full-time employment peaked months again and has been falling on a year-over-year basis.

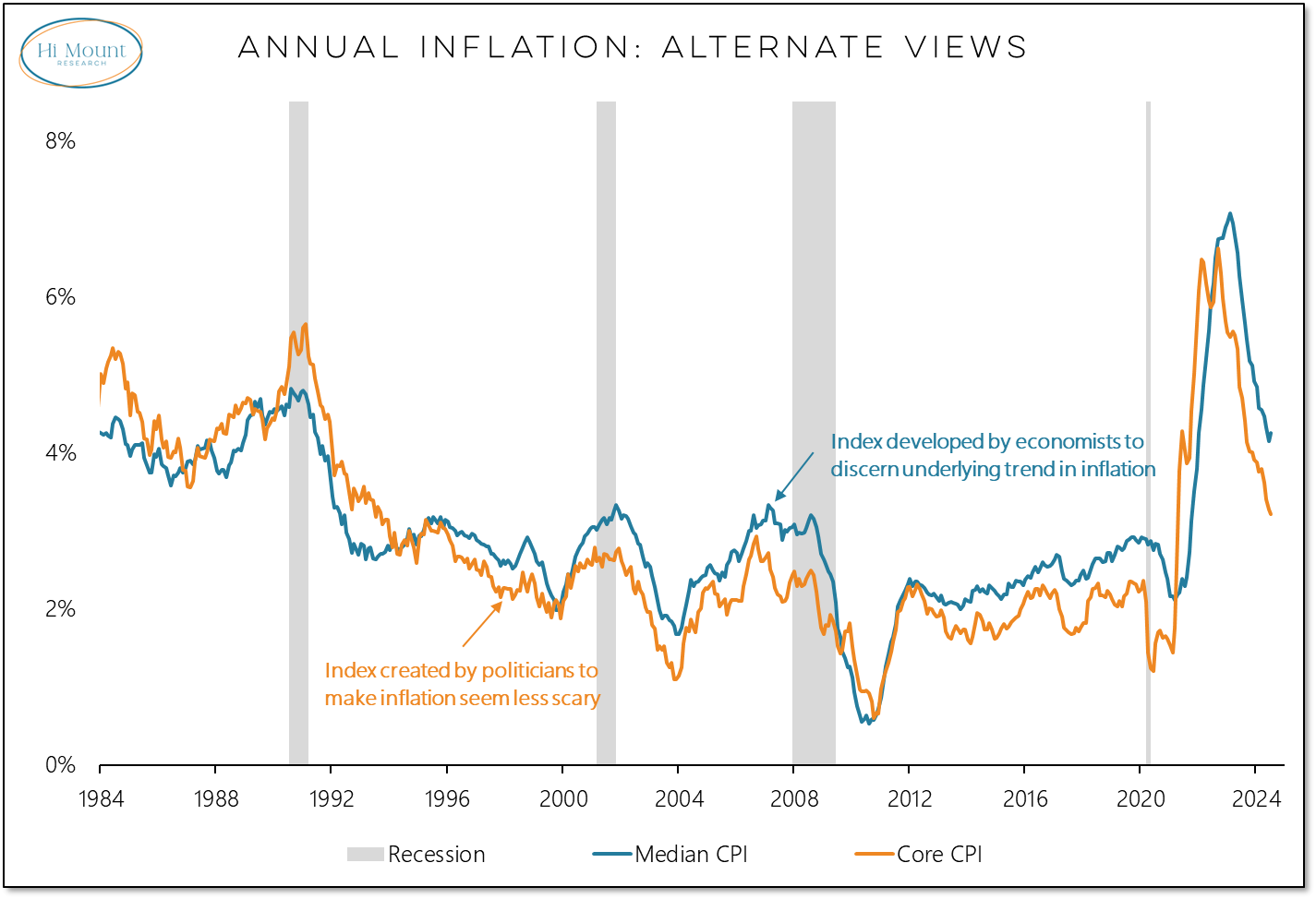

The inflation indicators created to make inflation look less scary continue to improve, while the indicators developed to show the underlying trend in inflation actually turned higher last month. Powell & company will need to convince the market that rate cuts make sense from an inflation perspective and are proactive from a growth perspective.

We work through the overall weight of the evidence below:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.