Small-Caps Wake From Their Slumber

Near-term consolidation would be perfectly normal after an historic move from small-caps, but ultimately, strength begets strength

Portfolio Applications update: We have published updates to our Dynamic Strategic and Cyclical Portfolios. A summary of the current exposure for these portfolios is below.

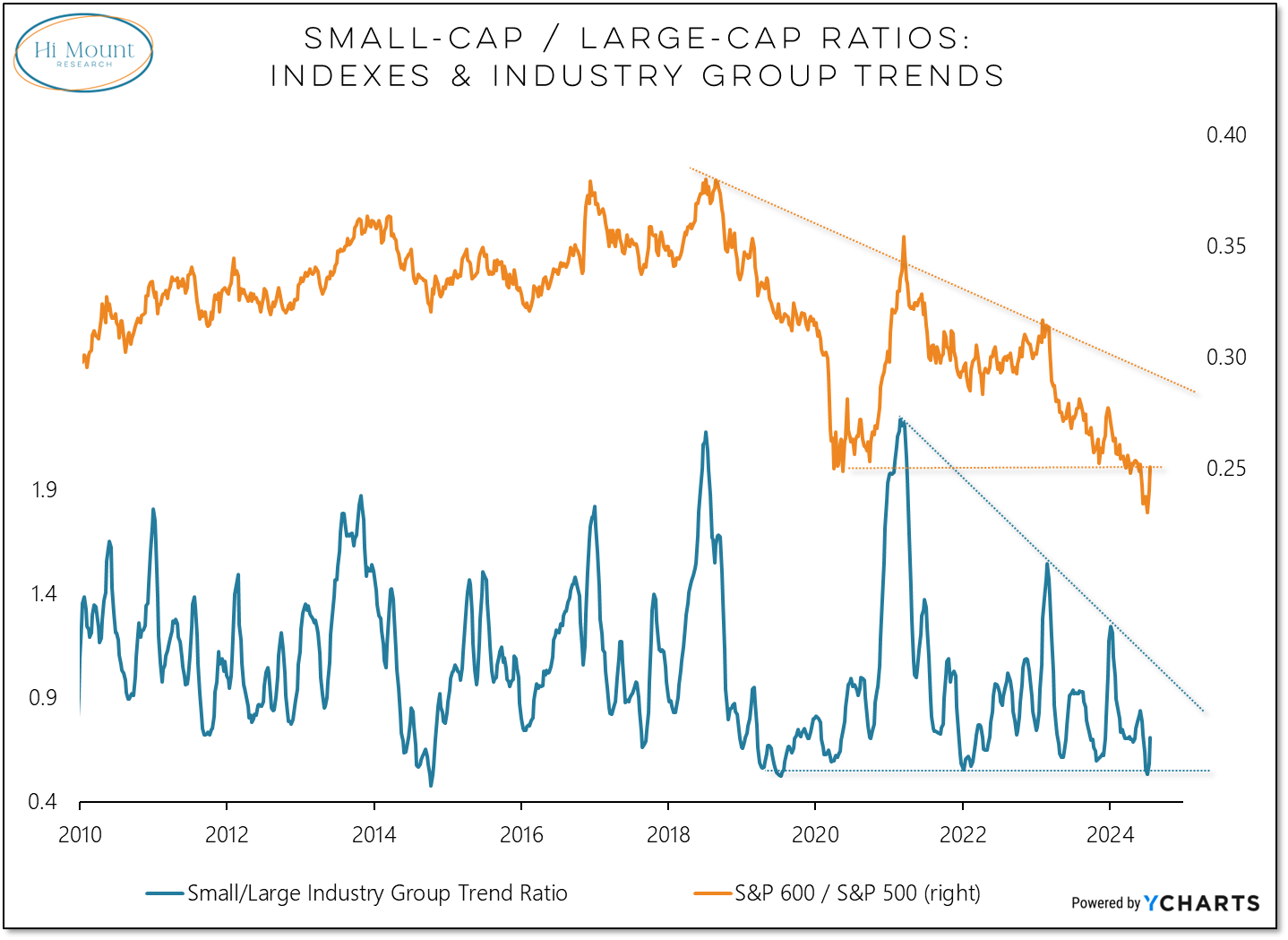

It was just a few weeks ago that small-caps were breaking down to multi-year lows versus large-caps at the index level while industry group trends for small-caps were as unfavorable as they have ever been.

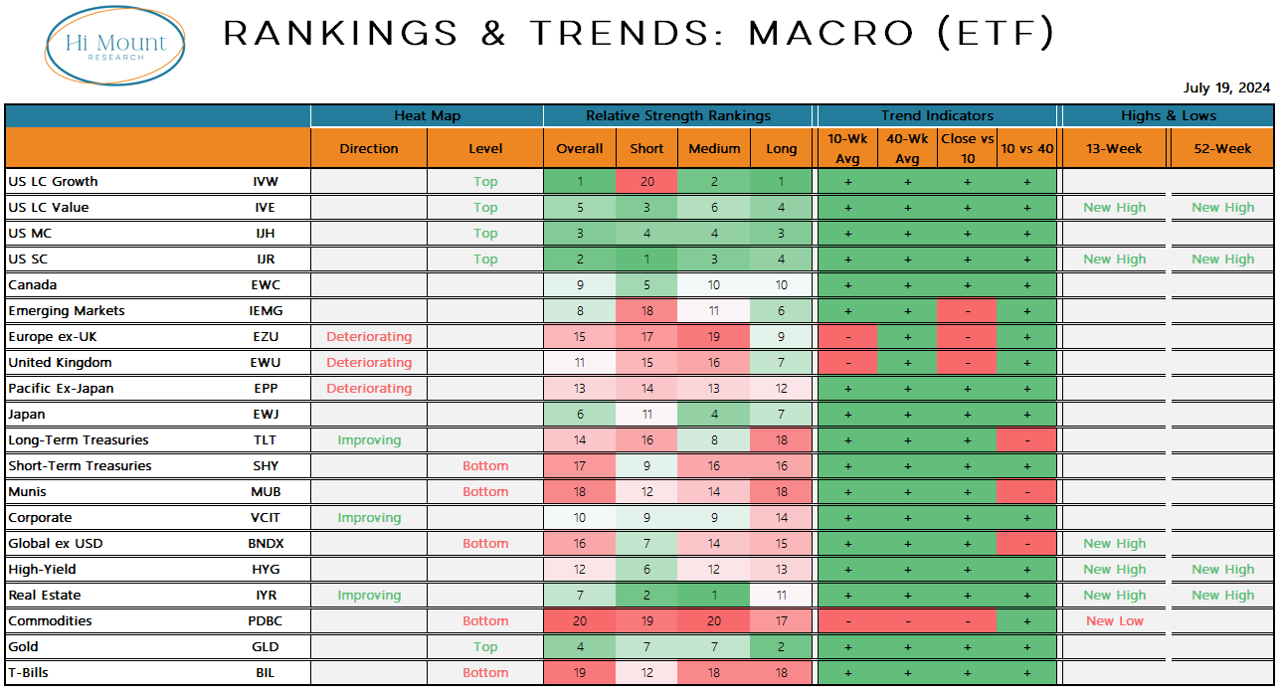

Following a 5-day 10%+ gain for small-caps, the future is looking decidedly brighter. Relative trends are bouncing as small-caps climb in the rankings and were one of just a handful of areas to make new highs last week.

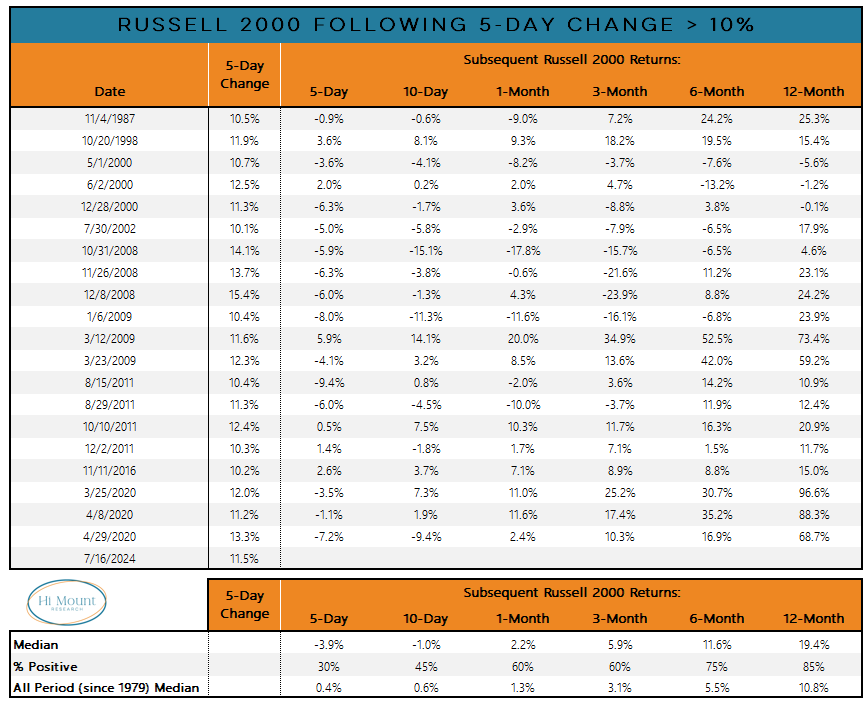

This isn’t the first time we’ve seen big short-term moves out of small-caps. Going back to 1979, we’ve seen 20 previous unique instances in which the Russell 2000 index has gained 10% or more over the course of 5 days. Two clear takeaways from the data:

Short-term consolidation is to be expected. Following previous 10% surges, the Russell 2000 experienced a median decline of 3.9% over the ensuing 5 days (versus an all-period median 5-day gain 0.4%).

Long-term strength is to be expected. There have been a few times in which the Russell 2000 was not higher a year later, but those are the exceptions. Usually strength begets strength and the median return a year after these price surges is twice the all-period median return.

Bottom Line: If history is our guide, investors should use near-term weakness to add to small-caps.

A couple other market developments to keep an eye on:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.