Secular Headwinds For Stocks

Equity exposure still historically high as investors ponder other alternatives

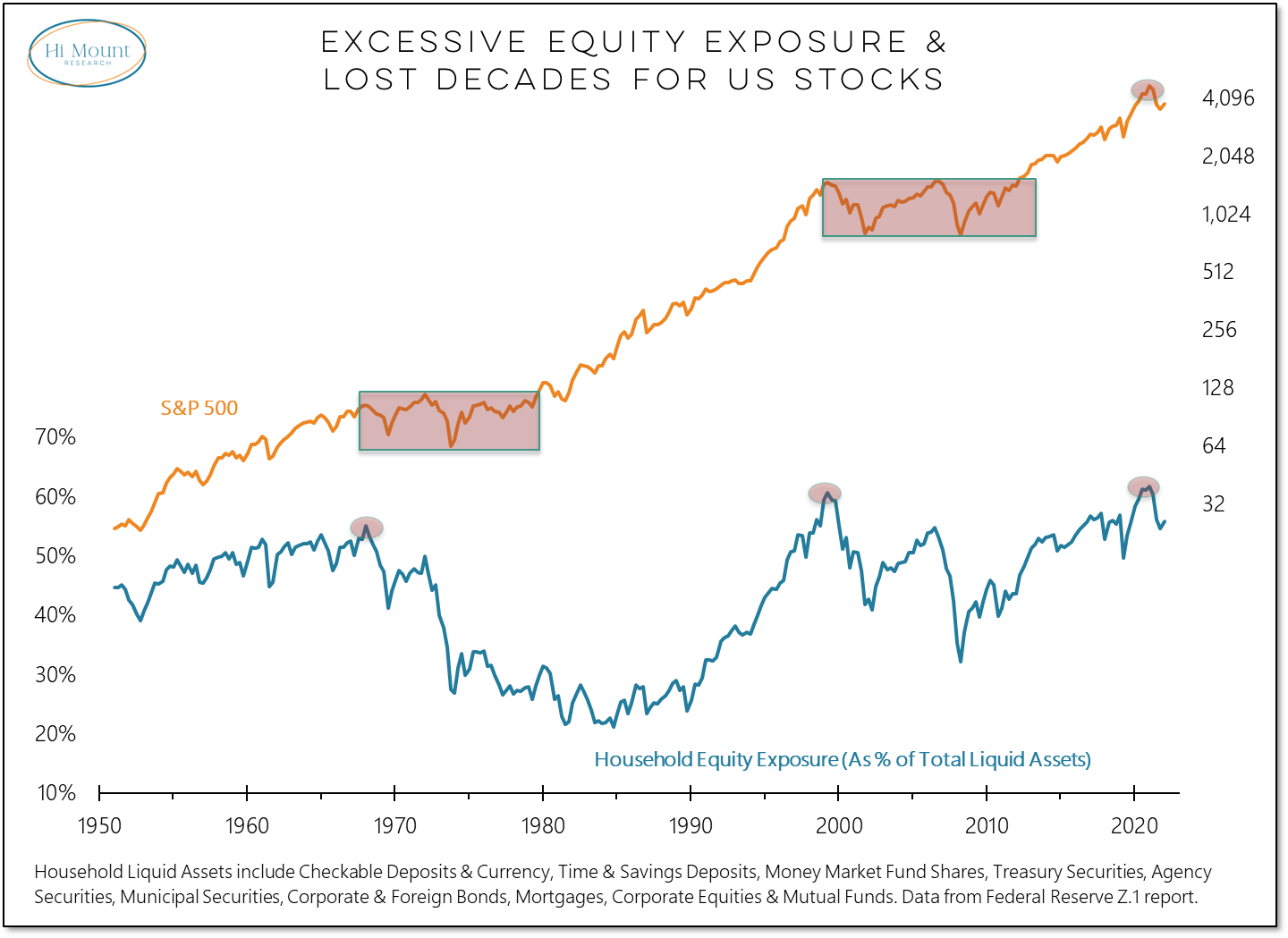

This week’s Market Insights video looks at the relationship between equity exposure, household liquidity and long-term trends in the stock market. With current household equity exposure in the top 10% of all time (going back to 1950), suggesting that stocks are a hated asset class is failing to see the forest for the trees.

Current positioning is consistent with minimal forward returns for equities and is similar to what preceded past lost decades for stocks.

With investor moods having soured and bonds offering their best alternative to stocks in decades, there are catalysts for change. We lay out our case below:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.