S&P 500 Struggling With Resistance But Bull Behavior Persists

Our indicators have not cracked, but hanging out beneath key levels is not a sign of strength

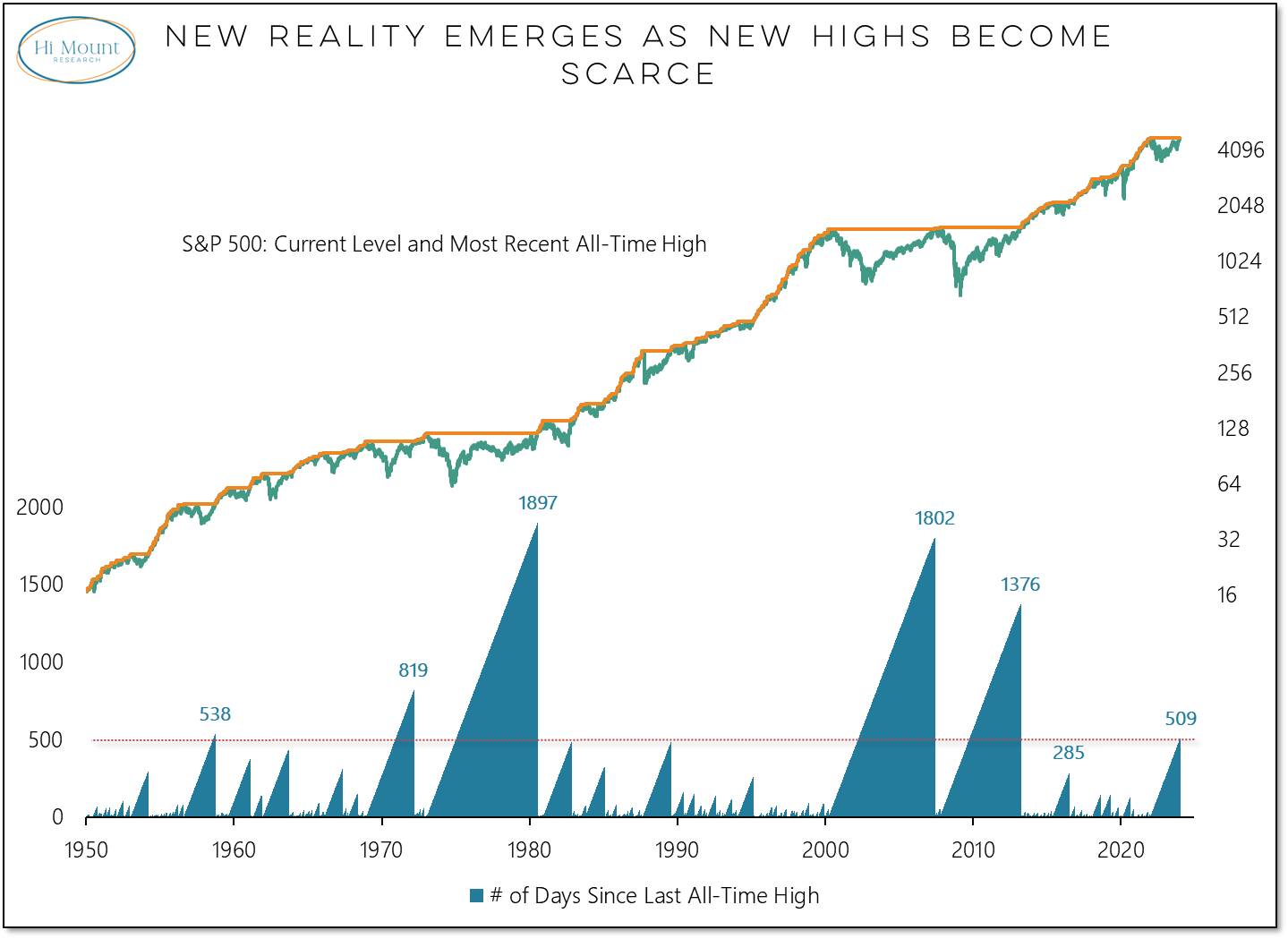

What: The S&P 500 has churned sideways since mid-December, keeping intact the 6th longest stretch in history without a new all-time high.

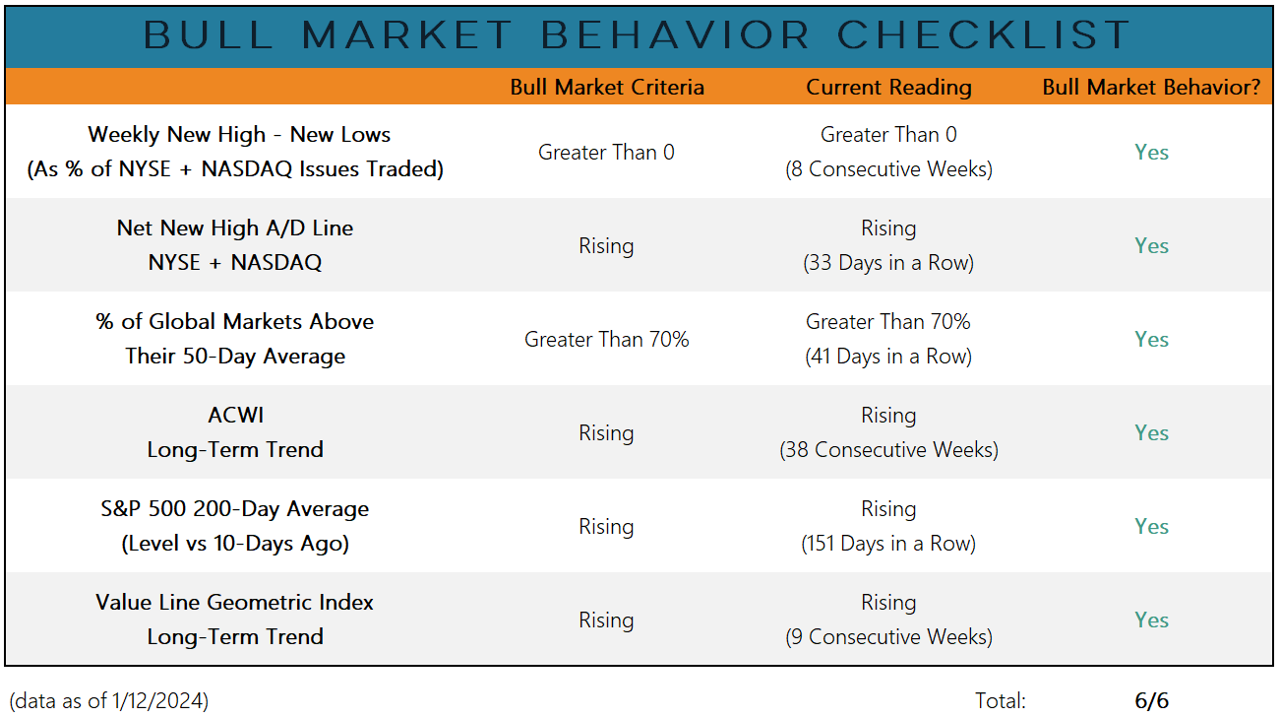

So What: While the index has stalled, weakness has not emerged on our Bull Market Behavior checklist. New highs are struggling to stay above new lows, but so far the net new high trend has not rolled over.

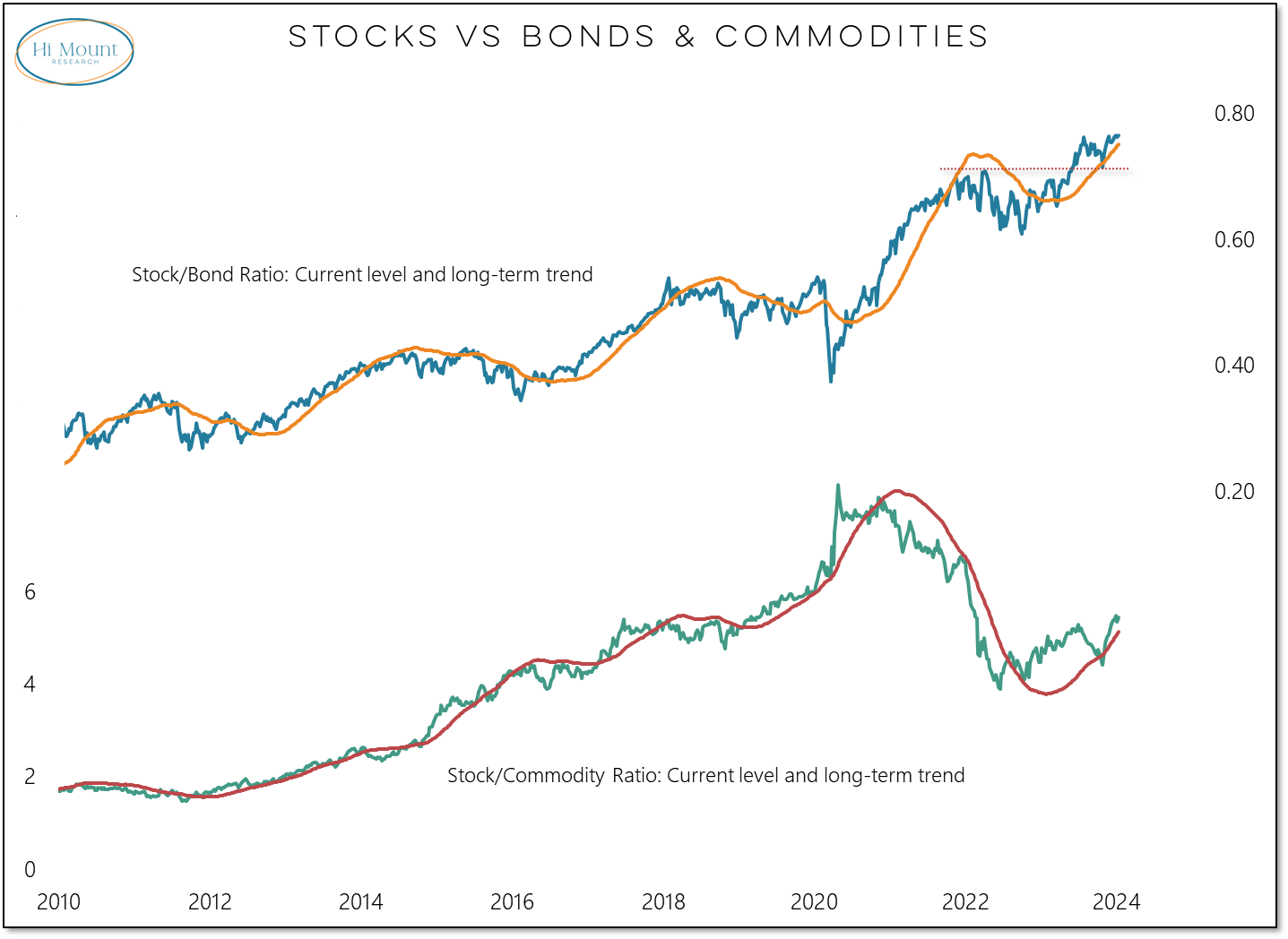

Now What: Price and breadth trends continue to favor the bullish case. Relative trends argue that investors should be tilting toward equities over both bonds and commodities.

Subscribers can download our latest Bull Market Behavior Checklist report and this week’s Relative Strength Rankings update.

When it comes to sector leadership trends, size matters:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.